Accepting credit and debit card payments is an essential part of running a successful business in today's digital age. However, setting up a merchant account for payment processing can be a complex and costly process. Luckily, there are alternative options available that allow businesses to accept credit card payments without the need for a traditional merchant account.

One such option is through the use of a payment gateway. A payment gateway acts as an intermediary between your customers' credit card information and your business's bank account. It securely captures and transfers the payment data, ensuring a seamless and efficient transaction process. By utilizing a payment gateway, businesses can accept credit card payments online without the need for a dedicated merchant account.

One of the key advantages of accepting credit cards without a merchant account is the elimination of the associated fees. Traditional merchant accounts often come with setup fees, monthly fees, processing fees, and other hidden costs. By opting for an alternative method, businesses can save on these financial burdens and allocate more resources towards growing their operations.

Another benefit of accepting credit cards without a merchant account is the convenience it offers to both businesses and customers. The online payment process becomes easier and more accessible, allowing customers to make purchases with just a few clicks. For businesses, this streamlined process leads to improved customer satisfaction and increased sales.

In conclusion, accepting credit cards without a merchant account is a viable option for businesses looking to simplify the payment acceptance process. Through the use of a payment gateway, businesses can eliminate the need for a traditional merchant account while enjoying the benefits of secure and efficient online transactions. By bypassing the complexities and fees associated with merchant accounts, businesses can focus on what matters most – growing their business and serving their customers.

Section 1: Understanding Alternative Payment Solutions

In the world of ecommerce, accepting credit and debit card payments is an essential part of the business process. However, traditional methods of credit card acceptance often require a merchant account, which can come with significant fees and financial commitments.

Fortunately, there are alternative payment solutions that allow businesses to accept credit and debit cards without the need for a merchant account. These solutions provide a convenient and cost-effective way to process online transactions and expand the customer base.

One such alternative is the use of a payment gateway. A payment gateway acts as a middleman between the business and the financial institutions involved in the payment process. It securely captures and encrypts customers' payment information and then sends it to the appropriate financial institution for processing.

By utilizing a payment gateway, businesses can accept credit card payments without the need for a merchant account. This means they can avoid the fees and financial commitments associated with traditional credit card acceptance methods.

Another alternative is the acceptance of payment through third-party platforms. These platforms, such as PayPal, Stripe, and Square, allow businesses to accept credit and debit card payments without the need for a merchant account. They provide a user-friendly interface and make the payment process seamless for both the business and the customer.

In conclusion, understanding alternative payment solutions is crucial for businesses looking to accept credit and debit card payments without the need for a merchant account. Whether through payment gateways or third-party platforms, these solutions provide a cost-effective and convenient way to accept and process online transactions. By utilizing these alternative payment solutions, businesses can expand their customer base and streamline their payment acceptance process.

What is a Merchant Account?

A merchant account is a type of financial account that allows businesses to accept credit and debit card payments from their customers. It serves as a point of acceptance for card transactions, whether they are made in person at a physical location or online through a payment gateway.

When a business wants to start accepting card payments, it needs to establish a merchant account with a merchant service provider or a bank. This account is necessary for the payment processing process, where the funds from the customer's card are transferred to the business's bank account.

The merchant account acts as an intermediary between the business, the customer, and the financial institutions involved in the transaction. It enables the seamless acceptance of credit and debit cards, allowing businesses to accept a wide range of payment methods.

By having a merchant account, businesses can process payments from customers using their credit or debit cards without the need to personally contact the customer's bank for authorization. The merchant account gateway handles this authorization process and securely facilitates the transfer of funds.

However, it's important to note that merchant accounts come with fees for processing transactions. These fees vary depending on the volume of transactions and the types of cards accepted. Nevertheless, the benefits of accepting credit and debit cards make a merchant account an essential tool for modern businesses.

Exploring Alternatives to Merchant Accounts

When it comes to accepting credit card payments for your online business, traditional merchant accounts may not always be the best option. Fortunately, there are alternative methods available that can be more convenient and cost-effective.

One alternative is to use a payment gateway service. A payment gateway acts as an intermediary between your business and the customer's bank, securely processing their credit card transactions. This eliminates the need for a separate merchant account, as the payment gateway handles all aspects of the payment process.

Another option is to accept debit card payments. Debit card acceptance can be a great way to expand your customer base, as many individuals prefer to use their debit cards for online purchases. With the right payment processor, you can easily accept debit card payments without the need for a traditional merchant account.

A popular alternative is to use a third-party payment processor. These processors act as an intermediary, handling the financial transactions on behalf of your business. They often have lower fees than traditional merchant accounts and can be easier to set up and manage.

In addition to these alternatives, some businesses may benefit from using online payment platforms such as PayPal or Stripe. These platforms allow businesses to accept credit card payments without the need for a merchant account, making it easier for small businesses or individuals to start accepting online payments.

Overall, there are many alternatives to merchant accounts that can make accepting credit card payments more accessible and cost-effective for your business. By exploring these options and selecting the solution that best fits your needs, you can streamline your payment process and provide a convenient experience for your customers.

Section 2: Benefits of Accepting Credit Cards Without a Merchant Account

Accepting credit cards without a merchant account offers numerous benefits for businesses. Here are some key advantages:

- Lower Fees: By accepting credit cards without a merchant account, businesses can avoid the high fees typically associated with setting up and maintaining a traditional merchant account. This can result in significant cost savings for the business.

- No Account Approval Process: Unlike traditional merchant accounts that require a lengthy approval process, accepting credit cards without a merchant account allows businesses to start accepting card payments immediately. This can save valuable time and expedite the payment acceptance process.

- Expanded Payment Acceptance: Accepting credit cards without a merchant account enables businesses to accept a wide variety of payment methods, including credit cards, debit cards, and online payments. This increases convenience for customers and enhances the overall payment experience.

- Financial Security: Processing credit card transactions without a merchant account offers a higher level of financial security. It eliminates the need for businesses to store sensitive customer payment information, reducing the risk of data breaches and fraud.

- No Bank Involvement: With credit card acceptance without a merchant account, businesses can bypass the involvement of traditional banks in the payment processing process. This can simplify the payment flow and eliminate potential complications associated with banking relationships.

- Faster Payment Processing: Utilizing a payment gateway for credit card acceptance allows for faster processing of payments. Transactions can be authorized and completed in real-time, ensuring timely availability of funds for the business.

In summary, accepting credit cards without a merchant account offers businesses the benefits of lower fees, streamlined payment processing, expanded payment acceptance, and enhanced financial security. These advantages make it an attractive option for businesses seeking a convenient and cost-effective way to accept credit card payments.

Lower Costs and Fees

The acceptance of credit and debit card payments without a merchant account can help lower costs and fees for businesses. When using a traditional merchant account, businesses typically have to pay various fees, including monthly fees, transaction fees, and even cancellation fees. However, by using a payment gateway that does not require a merchant account, businesses can avoid these additional expenses.

Without a merchant account, businesses can save on monthly fees that are usually associated with maintaining the account. These fees can add up over time and cut into a business's bottom line. By choosing to accept credit and debit cards without a merchant account, businesses can eliminate this ongoing expense and allocate these funds towards other areas of their business.

In addition, businesses can also reduce transaction fees by using a payment gateway that does not require a merchant account. Traditional merchant accounts often charge a percentage of each transaction as a fee. However, without a merchant account, businesses can find alternative payment gateways that offer lower transaction fees or even flat-rate fees for processing each payment.

Furthermore, businesses can avoid cancellation fees that are sometimes associated with terminating a merchant account. These fees can be substantial and can be a burden for businesses that may want to switch to a different payment processing solution. By not having a merchant account, businesses have the flexibility to choose different payment gateways without incurring any additional fees.

In summary, accepting credit and debit card payments without a merchant account can provide businesses with the opportunity to lower costs and fees. By avoiding monthly fees, reducing transaction fees, and eliminating cancellation fees, businesses can save money and allocate these funds towards growing their business.

Simplified Setup and Maintenance

Accepting credit and debit card payments online can be a complex process, requiring a merchant account and various financial services. However, with the availability of payment gateways, businesses can simplify their setup and maintenance.

By using a payment gateway, businesses can accept credit and debit card payments without the need for a merchant account. This eliminates the time and effort required to set up and maintain a traditional merchant account, including the application process, credit checks, and fees.

With a payment gateway, the acceptance of cards is streamlined, allowing businesses to quickly and easily process financial transactions. This simplified setup and maintenance saves businesses time and effort, allowing them to focus on running their online business more efficiently.

Additionally, payment gateways offer a range of features and services to manage payment processing. They provide secure and reliable payment processing, ensuring the safety of customers' financial information. Payment gateways also offer customizable options for businesses, such as recurring billing and invoice management.

Overall, by utilizing a payment gateway, businesses can accept credit and debit card payments online without the need for a merchant account, simplifying the setup and maintenance process. This enables businesses to offer convenient and secure online payment options to their customers, while saving time and minimizing fees associated with traditional merchant accounts.

Increased Payment Options for Customers

In today's online business environment, offering multiple payment options is crucial for attracting and retaining customers. By implementing a payment gateway, businesses can process online transactions and accept credit, debit, and bank payments. This increased acceptance of various payment methods allows customers to choose the option that is most convenient for them, resulting in a better user experience.

A payment gateway acts as a bridge between the customer, the merchant, and the financial institutions involved in the transaction. It securely captures and encrypts payment data, ensuring the confidentiality and integrity of sensitive information. With a payment gateway in place, businesses can expand their customer base by accepting credit card payments without the need for a traditional merchant account.

By providing customers with the flexibility to pay through various channels, such as online, in-store, or through mobile devices, businesses can cater to different preferences and behaviors. This increases the likelihood of completing a sale and encourages repeat business. Additionally, accepting credit and debit card payments without the need for a merchant account means businesses can avoid costly fees and long approval processes associated with setting up and maintaining such accounts.

Furthermore, offering multiple payment options can help businesses gain a competitive edge in the market. Customers today expect convenience and flexibility when it comes to making payments, and businesses that fail to provide these options may lose out to competitors who do. By embracing the latest payment processing technologies and accepting credit cards without a merchant account, businesses can stay ahead of the curve and enhance their reputation as customer-focused organizations.

In conclusion, by implementing a payment gateway and accepting credit cards without a merchant account, businesses can significantly increase payment options for their customers. This not only improves the overall customer experience but also opens up new opportunities for growth and success in the ever-evolving online marketplace.

Section 3: Types of Alternative Payment Solutions

When it comes to accepting credit card payments without a traditional merchant account, there are several alternative payment solutions available for businesses. These solutions offer a way to accept credit card transactions online or in person without the need for a merchant account or the associated fees.

One popular alternative payment solution is a payment gateway. A payment gateway allows businesses to accept credit card payments online by securely processing the payment information and transferring the funds to the business's bank account. With a payment gateway, businesses can accept credit and debit card payments from customers without the need for a traditional merchant account.

Another type of alternative payment solution is a point of sale (POS) system. POS systems are often used by businesses that have a physical location where customers can make purchases. These systems allow businesses to accept credit card payments in person, without the need for a merchant account. The POS system securely processes the payment information and completes the transaction, making it easy for businesses to accept payments in-store.

Additionally, some alternative payment solutions offer mobile payment options. These solutions allow businesses to accept credit card payments using a smartphone or tablet, making it convenient for businesses that operate on-the-go or at events. Mobile payment solutions typically use an app or handheld device to securely process the payment information and complete the transaction.

Overall, alternative payment solutions provide businesses with a way to accept credit card payments without the need for a traditional merchant account. Whether businesses choose a payment gateway, a point of sale system, or a mobile payment solution, these options offer a convenient and cost-effective way to process transactions and increase payment acceptance.

Third-Party Payment Processors

When it comes to accepting credit card payments online without a merchant account, third-party payment processors are an excellent option. These processors offer a convenient and cost-effective way for businesses to accept credit and debit card transactions without the need for a traditional merchant account.

One of the main advantages of using a third-party payment processor is that they handle all the payment processing on behalf of the business. This means that the business does not need to set up its own payment gateway or have a direct relationship with a bank or financial institution.

Third-party payment processors typically charge fees for their services, but these fees are usually lower than what a merchant account would cost. Additionally, many processors offer flexible pricing plans that can be tailored to the specific needs of the business.

Another benefit of using a third-party payment processor is the ease and speed of the setup process. Businesses can start accepting payments online within a short period of time, often within a few days or even hours. This is especially beneficial for small businesses or startups that need to start accepting payments quickly.

Overall, third-party payment processors provide an efficient and hassle-free way for businesses to accept credit card payments without the need for a merchant account. They offer affordable fees, easy setup process, and handle all the payment processing on behalf of the business. For businesses looking to accept credit cards online, using a third-party payment processor is a great option to consider.

Mobile Payment Solutions

In today's fast-paced and digital world, mobile payment solutions have become an essential part of the financial landscape for businesses. These solutions offer a convenient and efficient way to process financial transactions, accept payments, and manage fees.

Mobile payment solutions provide a seamless process for businesses to accept debit and credit card payments without the need for a traditional merchant account. This allows businesses to widen their customer base and offer more flexibility in payment options. Whether it's in-store, online, or on-the-go, mobile payment solutions provide a point of sale gateway for easy and secure transactions.

By using mobile payment solutions, businesses can ensure quick and secure payment processing, with the ability to accept payments from customers using their smartphones or other mobile devices. These solutions eliminate the need for bulky and expensive hardware, as the payment process can be conducted directly through a mobile app or website.

Mobile payment solutions also offer businesses the benefit of lower fees compared to traditional merchant account acceptance. With the elimination of the need for physical equipment and the streamlined process, businesses can save on transaction fees and enjoy more cost-effective payment processing.

Overall, mobile payment solutions provide a convenient, efficient, and cost-effective way for businesses to accept credit and debit card payments without the need for a traditional merchant account. With the ability to accept payments online, in-store, and on-the-go, businesses can cater to a wider range of customers and provide a seamless payment experience. Implementing mobile payment solutions can greatly enhance a business's financial operations and customer satisfaction.

Peer-to-Peer Payment Platforms

Peer-to-peer payment platforms have revolutionized the way people accept and make payments. These platforms provide a convenient and efficient way to accept credit and debit card payments without the need for a traditional merchant account. Instead, they act as an intermediary, connecting buyers and sellers through their online platforms.

One of the key benefits of using peer-to-peer payment platforms is that they simplify the acceptance process for businesses. They eliminate the need for a separate payment gateway and streamline the transaction process, making it easier for businesses to accept credit and debit card payments online without incurring hefty fees.

Unlike traditional payment processing methods, peer-to-peer payment platforms do not require a business to have a bank account or go through a lengthy application and approval process. This makes it an ideal solution for small businesses or individuals who want to accept payments quickly and easily without the hassle and financial burden of setting up a merchant account.

Through these platforms, businesses can securely accept payments from customers using their credit or debit cards. The platforms handle the entire payment process, from authorization to settlement, ensuring that businesses receive their funds in a timely manner.

Peer-to-peer payment platforms also offer added convenience for both businesses and customers. They allow for seamless integration into existing websites or online stores, making it easy for businesses to accept payments without disrupting their current operations. Customers can make payments using their preferred credit or debit cards, giving them the flexibility to choose the payment method that works best for them.

In conclusion, peer-to-peer payment platforms have revolutionized the way businesses accept credit and debit card payments. They offer a simple and efficient way to process payments online without the need for a traditional merchant account. By eliminating the fees and lengthy approval processes associated with a merchant account, these platforms provide a cost-effective solution for businesses of all sizes.

Section 4: Factors to Consider when Choosing an Alternative Payment Solution

When choosing an alternative payment solution that allows you to accept credit and debit cards without a traditional merchant account, there are several important factors to consider.

1. Payment Acceptance:

Ensure that the alternative payment solution you choose supports the acceptance of major credit and debit cards. This is crucial for catering to a wide range of customer preferences and maximizing your sales potential.

2. Financial Stability:

Research the financial stability of the payment solution provider. You want to ensure that they have a solid financial foundation and are well-established in the industry to avoid any potential disruptions to your business's payment processing.

3. Integration with your Business:

Consider how easily the alternative payment solution can integrate with your existing online business processes. Look for options that offer seamless integration with your website or online store, ensuring a smooth payment experience for your customers.

4. Fees and Pricing:

Compare the fees and pricing structures of different payment solutions. Look for transparent pricing models with no hidden costs or excessive transaction fees. Consider what payment methods are covered by the fees and ensure they align with your business needs.

5. Security:

Security is paramount when it comes to processing online payments. Ensure that the alternative payment solution you choose employs industry-standard security measures like encryption and tokenization to protect sensitive customer data.

6. Customer Support:

Consider the level of customer support provided by the payment solution provider. Look for options that offer 24/7 customer support, as you may encounter issues with payment processing at any time, and prompt resolution is essential for a seamless payment experience.

7. International Support:

If your business operates globally or plans to expand internationally, make sure the alternative payment solution supports international payments and can handle multiple currencies. This will allow you to reach a broader customer base and simplify your financial operations.

8. Mobile Payment Capabilities:

In today's digital landscape, mobile payments are becoming increasingly important. Look for an alternative payment solution that offers mobile payment capabilities, allowing your customers to easily make payments through their smartphones or tablets.

By considering these factors when choosing an alternative payment solution, you can ensure that you find a reliable solution that meets your business's needs and allows you to accept credit and debit card payments without a traditional merchant account.

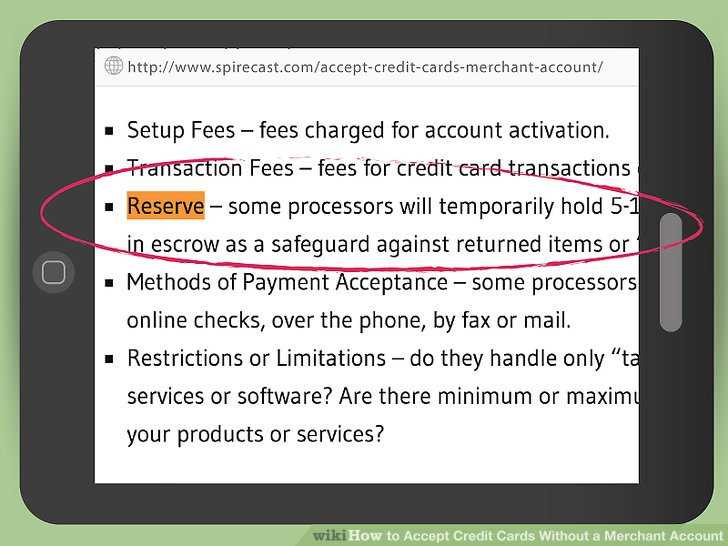

Transaction Fees and Pricing Models

When it comes to accepting credit and debit card payments online, there are various transaction fees and pricing models to consider. These fees and models can greatly impact the financial aspects of your business, so it's important to understand them.

One of the key components of online payment acceptance is the payment gateway, which acts as a bridge between your online store and the customer's bank. The gateway securely processes the transaction and sends the payment information to the bank for authorization and processing.

Without a merchant account, your business may rely on a third-party processor to handle the payment processing. In this case, you will typically be charged a transaction fee for each payment processed. This fee is often a percentage of the transaction amount, with a minimum fee per transaction.

Some pricing models may also include additional fees, such as monthly fees, setup fees, and chargeback fees. It's important to carefully review the pricing structure and terms offered by different payment processors to ensure you are getting the best deal for your business.

Another factor to consider is the type of cards your business will be accepting. Different card types, such as credit cards and debit cards, may have different transaction fees associated with them. For example, credit cards may have higher transaction fees due to the higher risk of fraud compared to debit cards.

Overall, understanding the transaction fees and pricing models associated with accepting credit and debit cards online is crucial for any business. It allows you to make informed decisions about which payment processors to partner with and ensures you are optimizing your financial processes.

Integration with eCommerce Platforms

When it comes to running an online business and accepting payments, having a seamless integration with eCommerce platforms is crucial. By integrating your payment processing system with your chosen eCommerce platform, you can easily accept credit and debit card payments without the need for a merchant account.

By using a payment gateway, you can securely process online transactions and eliminate the need for a traditional merchant account. A payment gateway acts as the middleman between your online store and your customer's bank, securely transmitting the necessary financial information to complete the payment process. This allows your business to accept all major credit and debit cards without the need for a merchant account from a bank.

One of the key benefits of integrating with eCommerce platforms is the ease of use and the ability to manage your online sales and transactions in one central location. With the integration, you can keep track of your sales, inventory, and revenue, making it easier to monitor your business's financial health. Additionally, integrating with eCommerce platforms often provides access to additional features such as fraud protection, order management, and customer support, further enhancing the overall shopping experience for your customers.

By integrating your payment processing system with eCommerce platforms, you can also streamline the payment process for your customers. With a seamless checkout process, customers can easily enter their payment information without being redirected to an external payment page. This improves the overall user experience and reduces the chances of cart abandonment, ultimately leading to higher conversion rates and increased sales for your business.

In conclusion, integrating your payment processing system with eCommerce platforms allows your business to accept credit and debit card payments without the need for a traditional merchant account. This streamlines the payment process, provides access to additional features, and enhances the overall shopping experience for your customers. As a result, your business can efficiently process online transactions, increase sales, and grow without the hassle of merchant account fees or complex processes.

Security and Fraud Protection

When running an online business, it is crucial to ensure the security and protection of financial transactions. Accepting credit and debit cards without a merchant account requires a robust security system to safeguard your business and customers' sensitive information.

One of the key components of security is using a trusted payment gateway. A payment gateway acts as the intermediary between your online store and the bank, securely transmitting transaction data. It encrypts sensitive information, such as credit card numbers, to prevent unauthorized access and fraud.

Furthermore, partnering with a reputable bank that specializes in online payment processing can provide an additional layer of security. These banks have sophisticated fraud detection systems in place, which automatically monitor and analyze transactions for any suspicious activity.

Implementing a multi-step verification process is also essential to prevent fraudulent transactions. This can include verifying the customer's identity through their card information, billing address, and CVV code. Additionally, implementing a secure customer authentication system, such as 3D Secure, can further protect against unauthorized use of credit cards.

Regular monitoring of transactions and account activity is crucial to quickly identify and respond to any suspicious activity. This can be done by regularly reviewing transaction reports, monitoring chargebacks, and implementing real-time notification systems for any abnormal activity.

Overall, while accepting credit cards without a merchant account offers convenience and flexibility, it is important to prioritize the security and protection of your business and customers' financial information. By implementing robust security measures and partnering with trusted payment gateways and banks, you can confidently process online transactions without compromising security.

Section 5: Setting Up Credit Card Payments Without a Merchant Account

Accepting credit card payments is crucial for any business to stay competitive in today's financial landscape. However, setting up a merchant account can be a complicated and time-consuming process. Luckily, there are alternative options for businesses to accept credit card payments without having to go through the traditional merchant account route.

One popular method is to use a payment gateway that allows businesses to process credit card transactions without the need for a merchant account. These payment gateways act as a middleman between the business and the bank, facilitating the acceptance and processing of credit card payments.

When choosing a payment gateway, it is important to consider factors such as fees, ease of use, and security. While some payment gateways may charge a fee for their services, they often provide a cost-effective solution compared to the fees associated with setting up and maintaining a traditional merchant account.

By using a payment gateway, businesses can access a range of features and functionalities that enhance the payment process. These may include the ability to accept various payment methods, such as credit cards and debit cards, as well as providing customers with a seamless checkout experience.

In addition to payment gateways, businesses can also explore options such as mobile payment solutions and peer-to-peer payment platforms. These innovative solutions allow businesses to accept credit card payments through mobile devices, offering convenience and flexibility to both the business and the customer.

However, it is important for businesses to consider the financial implications of accepting credit card payments without a merchant account. While the flexibility and convenience may be appealing, there may be higher transaction fees or limitations on the volume of transactions that can be processed. It is crucial to carefully review the terms and conditions of any payment processing solution to ensure it aligns with the needs and goals of the business.

In conclusion, setting up credit card payments without a merchant account is a viable option for businesses looking to accept payments without the hassle and cost associated with traditional merchant accounts. By exploring alternative payment solutions such as payment gateways, mobile payment options, and peer-to-peer platforms, businesses can streamline their payment processes and provide a seamless payment experience to their customers.

Creating an Account with a Third-Party Payment Processor

Accepting credit and debit card payments is essential for any online business. However, setting up a merchant account with a bank can be time-consuming and comes with various fees. Luckily, there is an alternative: using a third-party payment processor.

When you create an account with a third-party payment processor, you can start accepting card payments without the need for a traditional merchant account. These payment processors act as intermediaries between your business and your customers' financial institutions, handling the entire payment process.

The process of setting up an account with a third-party payment processor is usually straightforward and can be done online. Once you have chosen a payment processor that suits your business needs, you will need to provide some basic information about your company and banking details.

After creating your account, you will receive access to a payment gateway that allows you to accept card payments on your website. The payment processor handles the secure transmission of the transaction data, ensuring that your customers' financial information is protected.

Using a third-party payment processor offers several advantages for online businesses. Firstly, it eliminates the need for a merchant account, saving you time and money. Additionally, payment processors often offer competitive transaction fees, especially for businesses with a high volume of transactions.

Overall, creating an account with a third-party payment processor is a convenient and cost-effective way to accept credit and debit card payments. By leveraging the services of these processors, you can streamline your payment acceptance process, provide a seamless checkout experience for your customers, and focus on growing your business.

Integrating Payment Gateway APIs for Online Stores

When running an online business, accepting credit and debit cards is crucial for the success of your financial transactions. However, it can be challenging to accept payments without a merchant account. That's where payment gateway APIs come in.

A payment gateway is a financial service provider that acts as a bridge between your online store and your bank account. By integrating payment gateway APIs into your website, you can process card payments without the need for a merchant account.

Payment gateways enable secure and efficient processing of online transactions. They encrypt sensitive customer data, such as credit card details, to ensure the safety of your customers' information. This encryption helps build trust with your customers and protects your business from potential fraud.

By integrating payment gateway APIs, you can accept a wide range of credit and debit cards, including Visa, Mastercard, American Express, and more. This allows your customers to make purchases using their preferred payment methods, enhancing their shopping experience on your online store.

One of the main advantages of integrating payment gateway APIs is that you can accept online payments without having to pay hefty merchant account fees. Payment gateways often charge a flat rate or a small percentage of the transaction amount, making it a cost-effective solution for small businesses.

Integrating payment gateway APIs into your online store is a straightforward process. Most payment gateways provide comprehensive documentation and support to help you through the integration process. Depending on your technical skills, you can choose from various integration methods, such as using hosted payment pages, direct API integration, or using a shopping cart plugin that supports your chosen payment gateway.

To summarize, integrating payment gateway APIs into your online store is a convenient and secure way to accept credit and debit card payments without the need for a merchant account. It expands your customer base by accepting a wide range of payment methods and eliminates the need for costly merchant account fees. By providing a seamless payment process, you can enhance your customers' shopping experience and boost your online business.

Configuring POS Systems for In-Person Transactions

When it comes to accepting credit and debit card payments in-person, businesses need to configure their point of sale (POS) systems correctly. A POS system enables a business to accept card payments from customers by securely communicating with the payment gateway, merchant account, and the customer's bank.

To begin accepting in-person transactions, businesses must first set up a merchant account with a bank or a payment service provider. This account acts as a central hub for all card transactions and payment processing. It enables businesses to accept and deposit funds, monitor transaction history, and manage fees and chargebacks.

Once the merchant account is set up, businesses need to integrate their POS system with a payment gateway. The payment gateway acts as a bridge between the business's POS system and the customer's bank. It securely transmits the transaction information, authorizes the payment, and settles the funds into the merchant account. Additionally, the payment gateway provides security measures, such as encryption and fraud detection, to protect both the business and the customer.

Configuring the POS system involves connecting it to the merchant account and setting up payment acceptance options. Businesses can configure their POS systems to accept a range of payment methods, including credit cards, debit cards, contactless payments, and mobile wallets. They can also customize the settings to include additional features like tipping, customer loyalty programs, and invoice management.

During the configuration process, businesses should also consider the fees associated with accepting card payments. These may include transaction fees, monthly fees, chargeback fees, and interchange fees. By understanding these fees upfront, businesses can better manage their costs and optimize their payment acceptance strategy.

Configuring a POS system for in-person transactions is a crucial step for any business that wants to accept credit and debit cards. With the right setup, businesses can provide a seamless payment experience for their customers, increase sales, and streamline their payment process.