Managing financial data and ensuring the accuracy of account balances is crucial for any business. With the multitude of tools and platforms available, finding the best account reconciliation software can be a challenging task.

Account reconciliation software vendors offer a variety of software solutions that automate the process of matching and analyzing data from different sources. These tools provide financial management capabilities to streamline the account reconciliation process and improve efficiency.

When comparing different account reconciliation software options, it's important to consider the data integration and analysis capabilities. Look for software that can handle large volumes of data and provide real-time reporting and analysis. The ability to integrate with other financial systems is also essential for seamless data flow and accurate reporting.

Accuracy and efficiency are key considerations when selecting account reconciliation software. Look for software that can automate the matching process and identify discrepancies with high accuracy. The software should also provide advanced reporting features, such as customizable dashboards and automated balance calculations, to help with financial analysis and decision-making.

By comparing different account reconciliation software vendors, businesses can find the best solution that meets their specific needs. Consider the capabilities and features offered by each vendor, as well as the ease of use and customer support. With the right account reconciliation software, businesses can save time and improve the accuracy of their financial data analysis.

Overview of Account Reconciliation Software

Account reconciliation software is an essential tool for businesses to streamline their financial processes and ensure accuracy in their accounting records. This automated software integrates with various financial platforms and provides efficient analysis and reporting capabilities.

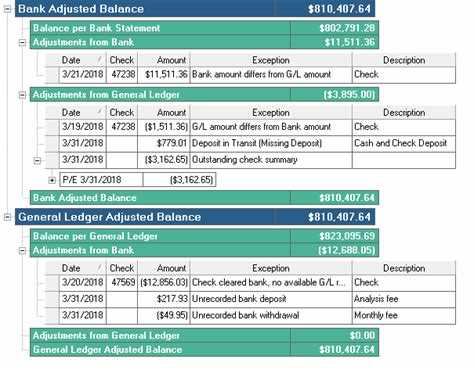

One of the main features of account reconciliation software is its ability to reconcile accounts and balance them accurately. It compares the data from different sources and identifies any discrepancies, making it easier for businesses to identify and resolve any issues. This significantly improves the efficiency of the reconciliation process and reduces the risk of errors.

Account reconciliation software also provides robust reporting capabilities. It generates detailed reports that highlight the financial health of the business and provide insights into any potential areas of concern. These reports can be customized to meet the specific needs of the business, allowing for a comprehensive analysis of the data.

Furthermore, account reconciliation software ensures the accuracy of financial data. By automating the reconciliation process, businesses can eliminate manual errors and reduce the risk of fraud. This not only saves time but also improves overall data integrity and facilitates better decision-making.

There are several vendors that offer account reconciliation software, each with their own unique set of features and functionalities. Businesses can compare these vendors to find the best software solution that meets their specific needs. It is important to consider factors such as ease of use, integration capabilities, and customer support when evaluating different software options.

In summary, account reconciliation software is a powerful tool that enhances the efficiency and accuracy of financial processes. Its automated features, integration capabilities, analysis, and reporting tools make it an essential component of any business's financial management system.

What is Account Reconciliation?

Account reconciliation is the process of comparing and matching financial records to ensure accuracy and consistency. It involves the identification and resolution of any discrepancies between different sets of data, such as bank statements and transaction records.

Account reconciliation software plays a critical role in this process, providing automated tools and capabilities for efficient and accurate reconciliation. These software platforms integrate with various financial and data management systems, allowing for seamless data transfer and analysis.

With account reconciliation software, businesses can automate the matching of transactions, perform balance checks, and generate comprehensive reports. This software also enables efficient data management, allowing for the identification and resolution of discrepancies in a timely manner.

The software's reporting capabilities are particularly valuable, providing detailed analysis and insights into the financial health of a business. By automating the reconciliation process, businesses can save time, improve accuracy, and enhance overall efficiency in their financial operations.

Account reconciliation software should be chosen carefully, as the needs and requirements of businesses may vary. Comparing different software solutions can help businesses find the best fit for their specific needs, ensuring seamless integration, accurate reconciliation, and efficient financial management.

Importance of Account Reconciliation Software

Account reconciliation is a critical financial management process that ensures the accuracy of financial data and the integrity of the balance sheet. Manual reconciliation of accounts can be time-consuming, error-prone, and inefficient. In today's fast-paced business environment, it is essential for organizations to adopt account reconciliation software to streamline and automate this process.

Account reconciliation software offers various capabilities that enhance efficiency and accuracy. These tools provide automated reconciliation processes, eliminating the need for manual data entry and reducing the risk of human error. By integrating with other financial systems, such as ERP platforms, the software enables seamless data flow and ensures the consistency of financial information.

One of the key benefits of account reconciliation software is its analysis and reporting capabilities. The software allows for in-depth analysis of financial transactions, identifying discrepancies and anomalies in a timely manner. This enables financial management to make informed decisions and take appropriate actions to rectify any issues that may arise.

By automating the account reconciliation process, organizations can also improve their reporting capabilities. The software generates comprehensive reports, providing a clear picture of the financial health of the organization. These reports can be customized to meet specific requirements and shared with stakeholders, such as auditors and investors.

Furthermore, account reconciliation software offers a comparison feature that allows for easy identification of differences between account statements. This helps organizations promptly identify errors or discrepancies that need to be addressed, ensuring the accuracy of financial records and preventing fraudulent activities.

When selecting account reconciliation software, organizations should consider vendor reputation, customer reviews, and the specific needs of their business. It is important to choose a software solution that is user-friendly, customizable, and scalable to accommodate future growth. With the right account reconciliation software in place, organizations can streamline their financial operations, improve accuracy, and make well-informed decisions based on reliable data.

Benefits of Using Account Reconciliation Software

Account reconciliation software offers a wide range of benefits for businesses, making it a valuable tool in financial management. Here are some of the key advantages:

- Improved Efficiency: With the use of account reconciliation software, businesses can streamline their reconciliation process, saving time and reducing the risk of errors. The software automates the comparison of financial data between different platforms, eliminating manual data entry and tedious reconciliation tasks.

- Enhanced Accuracy: Account reconciliation software ensures accuracy in financial reporting by minimizing human errors. The software matches transactions, identifies discrepancies, and highlights any inconsistencies, enabling businesses to promptly resolve discrepancies and maintain accurate financial records.

- Enhanced Financial Analysis: Account reconciliation software provides valuable tools for financial analysis. The software generates comprehensive reports and insightful analytics based on the reconciled data, enabling businesses to gain deeper insights into their financial performance and make informed decisions.

- Seamless Integration: Account reconciliation software can integrate with various financial management systems, allowing businesses to effortlessly import data from multiple sources. This integration enhances data accessibility and eliminates the need for manual data transfer, enabling real-time monitoring and analysis.

- Vendor Comparison: With the help of account reconciliation software, businesses can easily compare vendors and their financial performance. The software can track vendor payments, analyze transaction history, and generate reports for vendor evaluation, helping businesses make informed decisions and optimize vendor relationships.

- Automated Balance Monitoring: Account reconciliation software enables businesses to automate balance monitoring. The software can set up alerts and notifications for balance discrepancies, ensuring timely action and preventing fraudulent activities.

In conclusion, account reconciliation software offers numerous benefits, including improved efficiency, enhanced accuracy, enhanced financial analysis, seamless integration, vendor comparison capabilities, and automated balance monitoring. By implementing this software, businesses can streamline their financial management processes, save time, and make more informed decisions based on accurate and reliable data.

Key Features to Consider

When comparing account reconciliation software, there are several key features to consider. These features will help determine which platform is the best fit for your business:

- Reconciliation Capabilities: Look for software that offers advanced reconciliation capabilities, such as matching and comparing data from multiple sources.

- Data Accuracy: Accuracy is crucial in account reconciliation. Choose a software that is known for its high accuracy in data matching and reconciliation.

- Integration: Consider software that easily integrates with your existing financial management systems, such as ERP or CRM platforms.

- Automated Reconciliation: Look for software that automates the reconciliation process, saving time and reducing the risk of errors.

- Reporting and Analysis: Choose a software that offers robust reporting and analysis capabilities, allowing you to gain insights into your financial data.

- Vendor Support: Consider the level of support provided by the software vendor, including training, implementation assistance, and ongoing technical support.

- Efficiency: Look for software that streamlines the reconciliation process, reducing manual effort and improving overall efficiency.

- Balance Confirmation: Choose software that provides the ability to confirm balances with external parties, ensuring accuracy and transparency.

Considering these key features will help you choose the right account reconciliation software for your business. Remember to evaluate your specific needs and priorities to find the best solution.

Data Import and Integration

The management of financial data is crucial for the efficiency of any business. When it comes to account reconciliation, data import and integration play a vital role in ensuring the accuracy of financial reporting and analysis.

Account reconciliation software offers various tools and features to import data from different sources, including accounting platforms, bank statements, and other financial systems. The software allows for automated data import, saving time and effort for businesses.

Comparison of different software vendors is necessary to find the best solution for your business needs. Look for software that offers seamless integration with your existing accounting platforms and other financial systems. This will allow for easy transfer of data between different platforms and ensure accuracy in the reconciliation process.

The ability to import data from various sources and integrate it within the software enables businesses to have a comprehensive view of their financial data. The software provides a seamless flow of data, making it easier to match transactions, identify discrepancies, and reconcile account balances.

Moreover, data import and integration also improve the efficiency and effectiveness of the reconciliation process. Businesses can save time by eliminating the need for manual data entry and reduce the risk of errors that may occur during manual entry.

In conclusion, data import and integration are essential features of account reconciliation software. They enhance the accuracy, efficiency, and effectiveness of financial reporting and analysis. By choosing a software solution that offers seamless integration, businesses can streamline their reconciliation process and ensure the accuracy of their financial data.

Automated Reconciliation

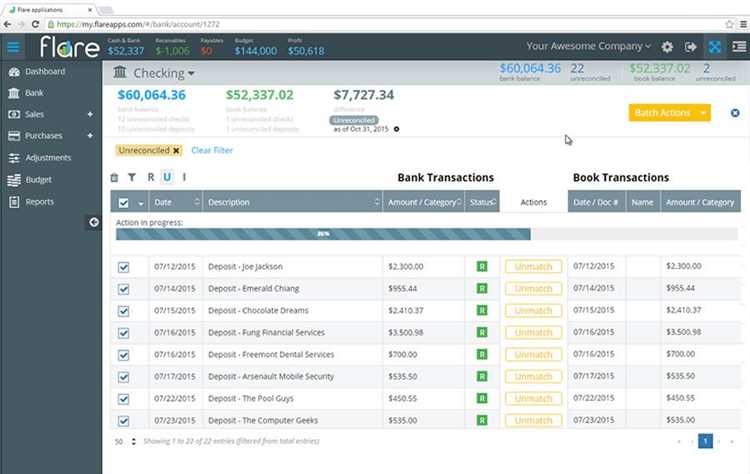

In the comparison of account reconciliation software tools, one key feature to consider is automated reconciliation. With automated reconciliation capabilities, financial management becomes more efficient and accurate.

Automated reconciliation software platforms utilize advanced algorithms and data analysis to match and reconcile account balances. This greatly reduces the manual effort required for reconciliation, saving time and reducing the risk of errors.

By automating the reconciliation process, financial data from various sources can be seamlessly integrated into the software. This integration ensures that all relevant data is captured and analyzed for accurate reconciliation.

Automated reconciliation software allows for faster identification of discrepancies and exceptions in account balances. This proactive approach enables quick resolution of issues, ensuring the accuracy of financial statements.

Furthermore, automated reconciliation software provides comprehensive reporting and audit trails, allowing for easy tracking and management of reconciliation activities. This enhances transparency and accountability in the financial reconciliation process.

With the capabilities of automated reconciliation, businesses can streamline their financial management processes, reduce costs, and improve overall efficiency. By choosing the right software from reputable vendors, businesses can ensure accurate and reliable reconciliation for their accounts.

Exception Handling

When it comes to account reconciliation, exception handling is a critical aspect that requires careful attention. Exception handling tools provided by account reconciliation software are designed to identify and resolve discrepancies and anomalies in financial data. These tools allow for in-depth analysis of account data to ensure accuracy and efficiency in the reconciliation process.

Account reconciliation software offers various features and capabilities for exception handling. One of the key functions is automated reporting, which allows users to generate customized reports highlighting discrepancies and exceptions detected during the reconciliation process. This reporting functionality not only saves time but also provides a comprehensive overview of the financial state of the accounts.

Vendors of account reconciliation software offer different exception handling capabilities, and it's crucial to compare these features when selecting a software solution. Some platforms provide real-time alerts for exceptions, allowing users to address them promptly. Others offer integration with other financial software, enabling seamless transfer of data for further analysis and resolution.

Exception handling in account reconciliation software can greatly improve the efficiency and accuracy of the reconciliation process. By quickly identifying and resolving discrepancies, businesses can maintain a balanced financial system and ensure the integrity of their financial data. This not only saves time and effort but also minimizes the risk of errors and potential financial losses.

Reporting and Analytics

When it comes to account reconciliation, accurate analysis and comparison of financial data are crucial for businesses. Reporting and analytics capabilities provided by various account reconciliation software vendors play a vital role in this process, ensuring efficiency and accuracy.

Account reconciliation software platforms offer a wide range of reporting tools, allowing users to generate customizable reports based on their specific needs. These reports provide insights into the financial health of the business by presenting data in an organized and easy-to-understand format.

Integration with other financial software and automated data reconciliation make reporting and analytics even more powerful. By seamlessly integrating with other tools, account reconciliation software enables businesses to retrieve and aggregate data from multiple sources, ensuring data accuracy and reliability.

The advanced analytics capabilities of account reconciliation software also enhance reporting. By utilizing data analysis techniques, businesses can gain a deeper understanding of their financial situation, identify trends, and make informed decisions based on the insights derived from the data.

Additionally, reporting and analytics features allow for the comparison of data across different periods, highlighting any discrepancies or imbalances in account balances. This helps businesses identify errors and discrepancies, ensuring the accuracy of financial reports and improving the reconciliation process.

In conclusion, reporting and analytics capabilities offered by account reconciliation software are essential for businesses in maintaining accurate financial records and making informed decisions. By leveraging these tools, businesses can enhance efficiency, ensure accuracy, and gain valuable insights into their financial performance.

Top Account Reconciliation Software Solutions

When it comes to account reconciliation, efficient and accurate processes are essential for financial analysis. Today, businesses have access to a wide range of software solutions that can streamline this important task. Here are some top account reconciliation software solutions:

- Vendor Comparison: Before choosing a software, it's important to compare different vendors and their offerings. Look for features like automated reconciliation, integration with existing platforms, and data management capabilities.

- Automated Reconciliation: The best software solutions offer automated reconciliation capabilities, saving time and improving efficiency. These platforms automatically match transactions, identify discrepancies, and provide real-time updates.

- Integration with Existing Platforms: Look for software that seamlessly integrates with your existing financial systems. This will ensure a smooth transition and efficient data transfer.

- Data Management Capabilities: Effective account reconciliation software should have robust data management capabilities. It should be able to handle large volumes of data, perform complex calculations, and generate detailed reports.

- Accuracy and Balance: Accuracy is crucial when it comes to account reconciliation. Look for software that provides accurate results and ensures that the balance is correctly maintained.

- Reporting and Analysis: Good software solutions should offer comprehensive reporting and analysis capabilities. This will allow you to gain insights into your financial data and make informed decisions.

Overall, the top account reconciliation software solutions offer a range of capabilities to streamline and enhance your financial processes. When choosing a software, consider factors like automation, integration, accuracy, and reporting to find the best solution for your business.

Solution A

Solution A is a comprehensive account reconciliation software platform that is specifically designed for financial management. It offers powerful reconciliation capabilities, allowing users to easily match and compare financial data from different sources. With its advanced data analysis tools, Solution A provides accurate and efficient reconciliation results.

One of the key features of Solution A is its integration capabilities. It seamlessly integrates with various financial systems to gather and consolidate data, providing a centralized platform for account reconciliation. This integration ensures that all financial transactions and balances are accurately recorded and matched.

With Solution A, users can easily manage their accounts and perform reconciliation tasks with ease. The software provides a user-friendly interface, allowing users to navigate through the platform effortlessly. It also offers customizable reporting tools, enabling users to generate comprehensive reports for analysis and auditing purposes.

Furthermore, Solution A offers advanced reconciliation tools that enhance efficiency and accuracy. It provides automated matching algorithms that streamline the reconciliation process and reduce manual errors. The software also offers exception management tools, allowing users to quickly resolve discrepancies and exceptions.

In addition, Solution A supports collaboration and communication among users. It allows multiple users to work on reconciliation tasks simultaneously and provides a secure platform for data sharing and communication. This promotes efficient collaboration and enables real-time updates on reconciliation progress.

Overall, Solution A is a powerful and efficient account reconciliation software that offers robust capabilities for financial management. Its integration, reporting, and analysis tools make it an ideal choice for companies looking to streamline their reconciliation processes and improve accuracy and efficiency in their financial operations.

Solution B

Solution B is a powerful account reconciliation software designed specifically for financial management. It offers a comprehensive suite of tools and features that enhance efficiency and streamline the reconciliation process.

With Solution B, businesses can benefit from automated data integration, eliminating the need for manual entry and reducing errors. The software also provides real-time reporting and analysis, allowing for quick and accurate insights into the financial health of the company.

One of the key advantages of Solution B is its advanced reconciliation capabilities. It can handle multiple accounts and platforms, making it ideal for businesses with complex financial structures. The software also offers detailed balance reconciliation for enhanced accuracy and control.

Another standout feature of Solution B is its vendor management functionality. It allows users to easily track and reconcile vendor accounts, ensuring timely payments and reducing the risk of discrepancies.

In summary, Solution B is a comprehensive and robust account reconciliation software that offers advanced features for efficient financial management. Its automated data integration, real-time reporting, and analysis capabilities make it a valuable tool for businesses looking to enhance their reconciliation processes.

Solution C

Solution C offers a comprehensive account reconciliation software with advanced capabilities for financial management. With its automated tools, this software simplifies the reconciliation process and ensures accuracy in balancing accounts.

One of the key strengths of Solution C is its analysis and reporting capabilities. It provides detailed reports on account discrepancies, enabling businesses to identify and address any issues promptly. The software also offers integration with other platforms, allowing for seamless data transfer and improved efficiency in reconciling accounts.

When comparing different vendors, Solution C stands out for its user-friendly interface and intuitive navigation. It makes the reconciliation process easy to understand and reduces the learning curve for new users. Additionally, it offers customizable features and settings to meet specific business needs.

With Solution C, businesses can benefit from efficient account reconciliation management. The software streamlines the entire process and eliminates manual tasks, saving time and reducing errors. Its automated features enable businesses to reconcile accounts more quickly and consistently.

In conclusion, Solution C is a powerful account reconciliation software that combines accuracy, efficiency, and management capabilities. Its integration with other platforms, automated tools, and comprehensive reporting make it a valuable solution for businesses looking to streamline their financial processes.

Comparison of Pricing and Licensing

When evaluating account reconciliation software, one important factor to consider is the pricing and licensing options offered by different vendors. Pricing models can vary significantly, so it's crucial to understand the cost structure and choose a solution that aligns with your budget and needs.

Some software vendors offer tiered pricing plans that are based on the number of data or transactions processed. This can be useful for businesses of different sizes, as it allows for scalability and cost optimization. Others may offer a fixed pricing model, which can be beneficial if you have a consistent volume of transactions.

Another aspect to consider is the licensing type. Some vendors offer a one-time purchase option, where you buy the software and own it indefinitely. Others offer a subscription-based model, where you pay a monthly or yearly fee for access to the software. Monthly subscriptions can be beneficial for businesses looking for flexibility, while one-time purchases may be more cost-effective for long-term use.

Integration capabilities and additional tools can also affect pricing. Some software platforms offer integration with other financial reporting and management systems, which can enhance efficiency and accuracy but may come at an additional cost. Additionally, certain vendors may offer advanced automated reconciliation tools or features, such as intelligent matching algorithms or exception handling, which can increase the software's capabilities but may be reflected in the pricing.

Before making a decision, it's important to evaluate your business's specific needs and compare pricing and licensing options from different vendors. Balancing cost, functionality, and integration can help ensure you choose the right account reconciliation software for your organization.

Pricing Models

When comparing account reconciliation software, it is important to carefully consider the pricing models offered by different solutions. The cost of the software is a critical factor in determining its suitability for your business.

Some software platforms offer a subscription-based pricing model, where you pay a monthly or annual fee for access to the software. This model is often preferred by businesses because it provides predictable costs and allows for scalability.

Other software tools may offer a usage-based pricing model, where you are billed based on the volume of transactions or the number of users. This model can be beneficial for businesses with fluctuating transaction volumes or those that require access for multiple employees.

Additionally, it is important to consider the accuracy, efficiency, and reporting capabilities of the software when evaluating its pricing. Look for tools that offer automated reconciliation, real-time data analysis, and comprehensive reporting options. Integration with existing financial management systems should also be considered to ensure seamless data flow and accurate balance reconciliation.

In conclusion, comparing the pricing models of different account reconciliation software solutions is crucial in finding the best fit for your business. Consider the capabilities, integration options, and reporting functionalities offered by the software to determine its value for your financial management needs.

Licensing Options

When considering account reconciliation software, it is important to evaluate the licensing options offered by different vendors. The right licensing option can greatly impact the financial efficiency and accuracy of your business.

Automated reconciliation software typically offers different licensing models, such as perpetual licenses or subscription-based licenses. Perpetual licenses grant users unlimited access to the software for a one-time fee, while subscription-based licenses require recurring payments for ongoing usage.

Analysis of your business requirements is essential to determine which licensing option will best meet your needs. Consider factors like the number of users, level of integration with other financial management tools, and the volume of data that needs to be reconciled regularly.

Some software vendors offer tiered licensing options based on the capabilities of the software. These tiers may range from basic account reconciliation to more advanced features like automated reporting and analysis. Assessing the specific needs of your business will help you better understand whether a basic license or a more advanced license is necessary.

Integration capabilities should also be considered. Some software vendors offer integration with third-party systems, such as ERP or accounting software, to streamline the reconciliation process. If your business relies heavily on these systems, choosing a software that offers integration can enhance overall efficiency and accuracy.

Additionally, consider the vendor's support and maintenance policies. Some vendors offer ongoing support and regular software updates as part of the licensing package, while others may charge additional fees for these services. Evaluating support and maintenance costs is crucial in order to accurately compare different vendors and make an informed decision.

In conclusion, when evaluating account reconciliation software, take into account the different licensing options offered by vendors. Analyze your business needs, consider integration capabilities, and assess support and maintenance policies. Making the right licensing choice will help you achieve efficient and accurate financial reconciliation for your business.

Customer Reviews and Ratings

When it comes to choosing the right account reconciliation software, one of the best ways to make an informed decision is by considering customer reviews and ratings. These insights can provide valuable information about the software's performance, reliability, and features.

Customer reviews and ratings can give you a glimpse into how well the software meets the needs of other businesses. Users often highlight the software's ability to streamline the account reconciliation process, providing accurate and detailed reporting.

Many customers appreciate the automation capabilities of the software, as it eliminates the need for manual data entry and reduces human error. The software's integration capabilities with other financial management platforms also receive positive feedback, allowing for seamless data transfer and analysis.

Efficiency and time-saving features are often praised by customers, as the software can quickly reconcile accounts and identify any discrepancies. The software's ability to generate comprehensive reports and provide real-time insights into the financial health of the business is also highly valued.

Customers also appreciate the software's user-friendly interface and intuitive navigation, which makes it easy to navigate and utilize the various reconciliation tools. Additionally, the software's customer support and vendor responsiveness receive positive ratings, as these factors are crucial for smooth implementation and ongoing support.

Overall, customer reviews and ratings provide a valuable resource for businesses looking to find the best account reconciliation software. By considering the experiences of others, you can make a more informed decision and choose a software that aligns with your specific needs and requirements.

Review A

When it comes to financial management, accurate and efficient data reconciliation is crucial for any business. In our analysis of account reconciliation software, we have identified Review A as one of the top solutions for businesses looking to streamline their financial processes.

Review A offers a wide range of features and capabilities that make it a standout choice for businesses of all sizes. With its user-friendly interface and powerful tools, this software allows users to easily integrate data from various sources and vendors, ensuring comprehensive analysis and reporting.

One of the key strengths of Review A is its automated reconciliation capabilities. By automating the reconciliation process, businesses can significantly reduce errors and improve efficiency. The software also provides real-time balance updates, allowing users to quickly identify any discrepancies and take necessary actions.

Another notable feature of Review A is its strong emphasis on accuracy. The software utilizes advanced algorithms and data matching techniques to ensure that every transaction is accurately reconciled. This not only helps businesses maintain financial integrity but also contributes to overall compliance with regulatory requirements.

When comparing different account reconciliation software options, it is essential to consider integration capabilities. Review A seamlessly integrates with existing financial systems and platforms, allowing for smooth data transfer and synchronization. This eliminates the need for manual data entry and enables real-time reporting and analysis.

In summary, Review A stands out as a top choice for businesses seeking an efficient and reliable account reconciliation software. Its automated reconciliation capabilities, emphasis on accuracy, and integration capabilities make it a valuable tool for streamlining financial processes and maintaining data integrity.

Review B

Review B focuses on comparing the account reconciliation software capabilities offered by various vendors in terms of accuracy and efficiency. These tools play a crucial role in financial management, ensuring that the accounts are accurate and up to date.

One of the key features that Review B examines is the software's integration capabilities with different platforms. Integration allows seamless data transfer between various systems, making the reconciliation process faster and more efficient. In addition, it enables automated analysis and balance adjustments, saving valuable time and resources.

Another important aspect of account reconciliation software is its ability to handle large volumes of data. Review B evaluates the software's data management capabilities, looking for features like advanced filtering options and customizable reports that enable users to easily analyze and interpret financial information.

Review B also considers the level of automation offered by the software. Automated reconciliation processes reduce the risk of human error and improve overall accuracy. The software should provide intuitive workflows and intelligent matching algorithms to expedite the reconciliation process and ensure data consistency.

In summary, Review B provides a comprehensive comparison of various account reconciliation software solutions, emphasizing their accuracy, efficiency, integration capabilities, data management features, and automation. Choosing the right software can greatly enhance a company's financial management processes and ensure the accuracy of its accounts.

Review C

When it comes to financial reconciliation, accuracy and efficiency are key factors for any business. Review C is an automated account reconciliation software that offers comprehensive reporting and analysis capabilities.

One of the standout features of Review C is its advanced data integration capabilities. This software can easily integrate with your existing financial management tools, allowing for seamless and accurate reconciliation of your balance sheets and accounts.

With Review C, vendors can benefit from its automated reconciliation processes, reducing the time and effort required for manual reconciliation. This leads to increased efficiency and improved financial reporting accuracy.

The software also provides robust reporting and analysis features, allowing you to gain better insights into your financial data. Review C offers customizable reporting options, allowing you to generate detailed reports tailored to your specific needs.

Additionally, Review C offers a user-friendly interface and intuitive navigation, making it easy for users to navigate through the software and access the necessary functions. This ensures that even users with limited technical expertise can effectively use the software.

In summary, Review C is a powerful account reconciliation software that provides financial reporting efficiency, automated reconciliation processes, advanced data integration, and comprehensive reporting and analysis capabilities. It is an ideal solution for businesses looking to streamline their financial reconciliation processes and improve accuracy in their reporting.

Implementation and Support

When considering account reconciliation software, it is important to evaluate the implementation process and the level of support provided by the vendors. A smooth implementation is crucial for the successful adoption of the software and its integration with your existing financial systems. Look for vendors that offer a dedicated implementation team to guide you through the setup process and provide training to your staff.

Support is also a critical factor to consider, as it ensures that any technical issues or questions that arise during the use of the software can be addressed promptly. The software should come with a reliable support system, whether it's through phone, email, or live chat. The support team should be knowledgeable and responsive to ensure that your business doesn't experience any downtime due to software issues.

Furthermore, the software should have robust reporting and analysis capabilities. This enables you to generate detailed financial reports and perform analysis on your account balances with ease. You should be able to access and analyze your financial data in a format that is both accurate and easy to understand.

Efficiency is another important aspect of implementation and support. The software should streamline your account reconciliation processes, automate repetitive tasks, and reduce manual errors. Look for software that offers advanced reconciliation features, such as automated matching algorithms, to save time and improve accuracy.

Integration with your existing financial management systems is also key. The account reconciliation software should be compatible with your current software tools and platforms, allowing seamless data transfer between systems. This ensures that all your financial data is up to date and accurate across different platforms.

In conclusion, when comparing account reconciliation software, it is crucial to evaluate the implementation process and level of support provided by the vendors. Look for software that offers a smooth implementation, robust support, efficient reporting and analysis capabilities, integration with your existing systems, and automated reconciliation tools to enhance accuracy and efficiency in your financial processes.

Implementation Process

When it comes to implementing account reconciliation software, businesses should carefully consider various factors to ensure a smooth integration into their existing systems. The implementation process involves several steps, which include selecting the right tools and platforms, ensuring efficient data analysis and reconciliation, and maintaining accuracy in financial reporting.

First, businesses need to compare different vendors and their software capabilities to find the best fit for their specific needs. This involves evaluating features such as automated data management, reconciliation capabilities, and reporting functionalities. By conducting a thorough comparison, businesses can make an informed decision and select the most suitable software for their account reconciliation process.

Once a software solution has been chosen, the next step is to integrate it into the existing systems. This may involve working with IT teams to ensure compatibility with other software and data sources. The implementation team should also ensure that the software can seamlessly retrieve and analyze relevant financial data from multiple platforms, such as ERP systems and bank statements.

Efficiency is a key aspect of the implementation process. The software should be able to streamline the reconciliation process, allowing businesses to save time and resources. This can include features such as automated matching algorithms and intelligent reconciliation rules that expedite the identification of discrepancies and ensure accurate balance calculations.

Throughout the implementation process, it is crucial to ensure the accuracy of the account reconciliation. This can be achieved by regularly validating and verifying the data inputs and outputs. Testing and quality control measures should be implemented to identify any errors or discrepancies in the reconciliation process and promptly resolve them.

In conclusion, the implementation process of account reconciliation software involves careful evaluation, efficient integration, and continuous monitoring to ensure accurate and streamlined financial reporting. By selecting the right software, businesses can optimize their reconciliation process, improve efficiency, and maintain accurate account balance information.

Training and Support

When choosing an account reconciliation software, it is important to consider the training and support provided by the vendors. A comprehensive training program can help ensure that your team is equipped with the necessary knowledge and skills to effectively use the software. Look for vendors that offer on-site or online training sessions, user manuals, video tutorials, and other educational resources.

Integration with existing data systems is another crucial aspect to consider. The software should be able to seamlessly integrate with your existing financial platforms, such as ERP or accounting software, to ensure the accuracy and efficiency of data transfer. This integration capability will minimize the risk of errors and discrepancies in your account reconciliation process.

An important feature to look for in account reconciliation software is robust reporting capabilities. The software should be able to generate detailed reports that provide insights into your account balances, financial analysis, and reconciliation status. These reports can help you identify discrepancies, track trends, and make informed decisions regarding your accounts.

Furthermore, automated reconciliation tools can greatly improve the efficiency of your reconciliation process. The software should have advanced matching algorithms and exception handling capabilities to quickly identify and resolve discrepancies. Automated management of reconciliation tasks can save time and effort, allowing your team to focus on more strategic activities.

Lastly, consider the level of support provided by the software vendor. Look for providers that offer timely and responsive customer support. This can be in the form of phone, email, or chat support, as well as access to an online community or knowledge base. Having access to a dedicated support team can ensure that any issues or questions are addressed promptly, minimizing downtime and maximizing the effectiveness of the software.

Case Studies

Account reconciliation software has proven to be instrumental in improving the financial management of businesses. Through the analysis and comparison of data, these platforms enable companies to achieve balance and accuracy in their financial accounts.

One case study demonstrated the capabilities of automated reconciliation tools in enhancing efficiency. By integrating the software with the company's existing systems, the reconciliation process was streamlined, reducing the time and effort required for manual data entry.

In another case study, the software's reporting and analysis capabilities were highlighted. The platform provided comprehensive financial reports, allowing the management to gain valuable insights into the company's financial health. This data-driven approach facilitated informed decision-making and strategic planning.

Additionally, account reconciliation software was found to improve data accuracy. By automating the reconciliation process, potential human errors were minimized, ensuring that the financial accounts were error-free and up-to-date.

Overall, these case studies illustrate the significant benefits of using account reconciliation software. The integration of automated tools, efficiency in reconciliation processes, accurate data management, and robust reporting capabilities all contribute to improving the financial management of businesses.

Company A: How They Streamlined their Reconciliation Process

Company A, a leading financial institution, was struggling with inefficiencies in their account reconciliation process. With numerous financial systems and data sources, their manual reconciliation efforts were time-consuming and prone to errors. This led to delays in financial reporting and a lack of accuracy in their balance sheets.

In order to improve their reconciliation process, Company A decided to implement account reconciliation software. After careful evaluation and a thorough comparison of various vendors and their software capabilities, they selected a solution that offered seamless integration with their existing financial platforms.

The selected software provided advanced reconciliation and reporting tools, enabling Company A to automate much of the reconciliation process. By leveraging the software's data analysis capabilities, they were able to quickly identify discrepancies and reconcile accounts in a more efficient manner.

With the implementation of the new software, Company A experienced a significant increase in efficiency and accuracy. The software allowed them to streamline their reconciliation process, reducing the time spent on manual tasks and minimizing the risk of errors. They were also able to generate more reliable financial reports, providing management with real-time insights into their financial performance.

In addition to improving their reconciliation process, the software also offered enhanced data management capabilities. Company A could easily import and export data from multiple sources, ensuring that all relevant information was captured and reconciled. This streamlined approach not only saved time but also improved the overall accuracy of their financial records.

Overall, the implementation of account reconciliation software has greatly benefited Company A. By leveraging the integration, financial capabilities, and reporting tools provided by the software, they have been able to streamline their reconciliation process, improve efficiency, and ensure the accuracy of their financial data.

Company B: Achieving Greater Accuracy with Account Reconciliation Software

Company B recognized the need for improved accuracy in their account reconciliation processes and decided to invest in account reconciliation software. By leveraging the capabilities of this software, they were able to streamline their reconciliation process and achieve greater accuracy in their financial management.

The software enabled Company B to automate the reconciliation process, reducing the dependency on manual data entry and minimizing the risk of human error. With automated data integration from various sources, including vendors and financial platforms, the software ensured that all the necessary data was captured and reconciled accurately.

With real-time reporting and analysis capabilities, the software provided Company B with a comprehensive view of their financial position at any given time. This enabled them to identify discrepancies and resolve them quickly, ensuring the accuracy of their account balances. The software also supported integration with other financial management platforms, allowing for seamless data transfer and further enhancing efficiency.

In addition to improving accuracy, the software also increased the efficiency of Company B's account reconciliation process. By automating repetitive tasks and providing intuitive reconciliation workflows, the software reduced the time and effort required for each reconciliation. This allowed Company B to allocate resources to more value-added activities, such as data analysis and strategic financial planning.

In conclusion, by implementing account reconciliation software, Company B was able to achieve greater accuracy in their account balances, streamline their reconciliation processes, and improve overall financial management efficiency. The software's integration capabilities, automated reconciliation workflows, and real-time reporting and analysis features were instrumental in helping Company B meet their accounting and compliance requirements with precision and efficiency.

Company C: Cost Savings and Efficiency Gains with Reconciliation Software

Company C has experienced significant cost savings and efficiency gains since implementing account reconciliation software. The software has revolutionized their financial management processes by providing automated tools for data analysis and integration.

One of the key benefits of the software is its ability to reconcile accounts and ensure the accuracy of financial data. Company C has multiple vendors and platforms that they work with, and the software's reconciliation capabilities streamline the process of balancing accounts across these different sources. With the software, discrepancies and errors are quickly identified and resolved, saving the company time and resources.

Additionally, the software's automated reporting features have improved efficiency in financial reporting. Company C no longer has to manually compile and analyze data from various sources, as the software generates comprehensive reports with just a few clicks. This enables the company to make informed decisions more quickly and allocate resources more effectively.

Furthermore, the integration capabilities of the software have enhanced overall efficiency in the company's financial management. The software seamlessly integrates with existing systems and databases, eliminating the need for manual data entry and reducing the risk of human error. This integration also facilitates real-time data updates, ensuring that all financial information is up-to-date and accurate.

In conclusion, Company C has experienced significant cost savings and efficiency gains with the implementation of account reconciliation software. The software's tools for data analysis, integration, and automated reporting have improved accuracy, streamlined processes, and enabled the company to make more informed financial decisions. Overall, the software has proven to be an invaluable asset in optimizing financial management for Company C.