In response to the economic impact caused by the COVID-19 pandemic, the U.S. government introduced the Employee Retention Credit (ERC) as part of the Coronavirus Aid, Relief, and Economic Security (CARES) Act. This tax incentive program was designed to help eligible employers keep their workforce employed during the crisis by providing a refundable tax credit.

Accounting for the ERC at KPMG involves understanding the qualifications and provisions of the program, as well as the guidelines set forth by the Internal Revenue Service (IRS). The credit is available to employers who experience a significant decline in gross receipts or suspend business operations due to government orders, with certain exceptions and limitations. It is essential for businesses to determine their eligibility and ensure compliance with the necessary criteria.

Calculations for the ERC involve various factors, including qualified wages and eligible health plan expenses. KPMG's accounting services provide guidance on understanding the wage and employment thresholds, as well as the specific calculations required to claim the credit accurately. By following these guidelines, employers can maximize their potential savings and ensure proper reporting of the credit on their tax returns.

KPMG offers comprehensive services to assist employers in navigating the complexities of the ERC. Our team of experts is knowledgeable about the latest updates and changes to the program, ensuring that our clients receive accurate and up-to-date guidance. With our support, businesses can effectively account for the Employee Retention Credit, taking advantage of this valuable tax incentive to help mitigate the financial challenges caused by the pandemic.

Understanding the Employee Retention Credit

The Employee Retention Credit (ERC) is an incentive program established by the CARES Act to provide financial support to employers who have been affected by the COVID-19 pandemic. This credit is designed to help organizations retain employees by providing a financial incentive to keep them on the payroll, even during times of reduced operations or closures.

The IRS has provided guidelines and eligibility criteria for employers to determine if they qualify for the ERC. To be eligible, employers must demonstrate a significant decline in revenue due to the pandemic or have been subject to a government order that limited their operations. Once eligibility is established, employers can calculate the credit based on qualified wages paid to employees during the designated timeframes.

KPMG is a leading accounting firm that provides services to help clients navigate the complexities of the ERC. Their comprehensive guide offers insights into the qualifications, calculations, and provisions of the credit, ensuring that employers can take full advantage of the savings and benefits provided by the program.

Understanding the ERC is crucial for employers who are looking to maximize their financial resources during challenging times. By partnering with KPMG, organizations can receive expert guidance and support in determining their eligibility, calculating the credit, and ensuring compliance with IRS guidelines. This valuable service from KPMG helps businesses make informed decisions and optimize their use of the Employee Retention Credit.

Overview of the Employee Retention Credit

The Employee Retention Credit is an incentive provided to eligible employers under the CARES Act, a federal legislation passed in response to the COVID-19 pandemic. The credit is meant to encourage employers to keep their employees on payroll despite economic challenges, by providing a tax credit for a portion of qualified wages paid by the employer.

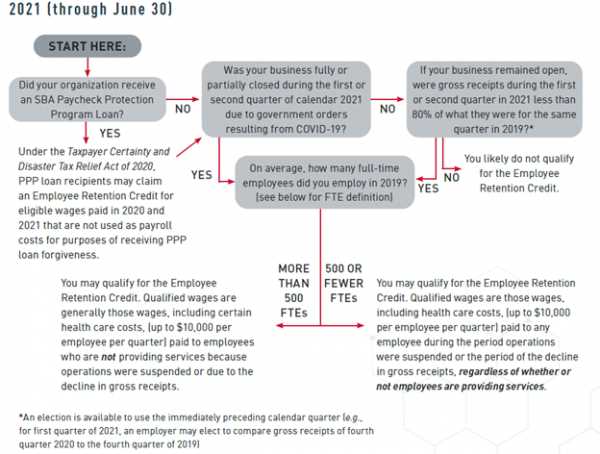

To qualify for the Employee Retention Credit, an employer must meet certain eligibility requirements outlined in the CARES Act and subsequent IRS guidelines. These requirements include having operations partially or fully suspended due to government orders related to COVID-19, or experiencing a significant decline in gross receipts compared to the same quarter in the previous year.

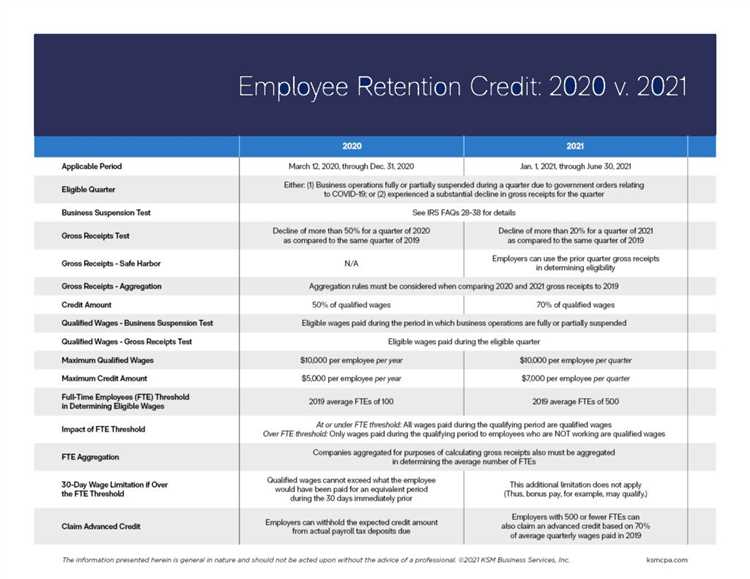

The credit amount is calculated based on qualified wages paid by the employer during the eligible period. The credit is equal to 50% of qualified wages paid up to a maximum of $10,000 per employee. Qualified wages include both cash compensation and certain employer-provided benefits, such as healthcare coverage.

Accounting for the Employee Retention Credit involves understanding the provisions of the CARES Act, determining eligibility, and accurately calculating the credit amount. KPMG, a leading provider of professional services, offers comprehensive accounting services to assist employers in navigating the complexities of the credit, ensuring compliance with guidelines, and maximizing the potential savings.

It is important for employers to carefully evaluate their eligibility and diligently follow the guidance provided by the IRS when claiming the Employee Retention Credit. Proper documentation and record-keeping are crucial in substantiating the credit, as well as being prepared for potential future audits. KPMG can provide expert advice and assistance in these areas, helping employers take full advantage of this valuable tax incentive while ensuring compliance with all relevant regulations.

Eligibility Criteria for the Employee Retention Credit

The Employee Retention Credit (ERC) is a tax incentive program introduced under the CARES Act, which provides eligible employers with a refundable tax credit. To qualify for the credit, employers must meet certain eligibility criteria set by the IRS. These criteria include:

- Business Operations: To be eligible for the ERC, an employer must be conducting a trade or business during the calendar year 2020 or 2021.

- Operations Suspended or Partially Suspended: The employer must have experienced either a full or partial suspension of operations due to government orders related to the COVID-19 pandemic, or a significant decline in gross receipts.

- Size of Business: The ERC is available to employers of all sizes, including tax-exempt organizations. However, different rules apply depending on the number of employees the employer had in 2019.

- Gross Receipts: Employers must meet certain gross receipts thresholds to be eligible for the credit. These thresholds vary depending on whether the employer had a significant decline in gross receipts.

- Qualified Wages: The ERC is calculated based on qualified wages paid to employees. Qualified wages include both cash compensation and certain health plan expenses paid by the employer.

It is important for employers to carefully review the eligibility criteria and consult with their accounting or tax services provider to ensure they meet all the qualifications for claiming the Employee Retention Credit. The guidelines for the ERC are complex and subject to change, so staying up to date with the latest IRS guidance is crucial.

Calculation and Limitations of the Employee Retention Credit

The Employee Retention Credit (ERC) is a tax incentive program established under the CARES Act by the IRS. This credit is intended to provide financial support to eligible employers who have been impacted by the COVID-19 pandemic and have experienced a significant decline in revenue. The ERC allows employers to qualify for a tax credit based on the wages paid to employees.

The calculation of the ERC involves several provisions and guidelines set forth by the IRS. To determine the credit amount, eligible employers must calculate the qualified wages paid to employees during the eligible period. Qualified wages include wages and certain health plan expenses paid to employees, subject to certain limitations.

There are certain limitations and qualifications to be met in order to be eligible for the ERC. For example, eligible employers must have experienced a full or partial suspension of operations due to government orders or a significant decline in gross receipts. Additionally, eligible employers with more than 100 full-time employees need to meet certain criteria to qualify for the credit.

KPMG provides accounting services to assist employers in navigating the complex calculations and limitations of the Employee Retention Credit. Our team of professionals can help determine eligibility, calculate the credit amount, and ensure compliance with all IRS guidelines. By taking advantage of this credit, employers can realize significant tax savings and help support their workforce during these challenging times.

Importance of Accounting for the Employee Retention Credit

The Employee Retention Credit (ERC) is a key provision of the Coronavirus Aid, Relief, and Economic Security (CARES) Act that provides a significant incentive for employers to retain their employees during challenging economic times. As an employer, understanding and properly accounting for the ERC can result in substantial cost savings and financial benefits.

Accounting for the ERC involves following the guidelines and calculations provided by the Internal Revenue Service (IRS) to determine the eligibility and amount of credit you can claim. Complying with the accounting requirements ensures accurate financial reporting and enables you to take full advantage of the program.

Properly accounting for the ERC requires keeping track of eligible wages, which are the wages paid to qualifying employees during the designated periods. These calculations can be complex, as they involve the identification of eligible wages and the application of specific provisions outlined in the CARES Act.

By accounting for the ERC, employers can benefit from significant tax savings. The credit allows for a refundable tax credit of up to 50% of qualified wages, with a maximum credit of $5,000 per employee. This can result in substantial financial savings for businesses of all sizes.

KPMG offers comprehensive accounting services to help businesses navigate the complexities of the Employee Retention Credit. Our team of professionals can assist with determining eligibility, calculating the credit amount, and ensuring compliance with the program's qualifications. By partnering with KPMG, you can optimize your tax savings and confidently navigate the ERC program.

Impact on Financial Statements

The IRS Employee Retention Credit (ERC) program, implemented as part of the CARES Act, provides an incentive for eligible employers to retain their employees during the COVID-19 pandemic. The ERC is a tax credit that eligible employers can claim on their federal tax returns. In order to qualify for the credit, employers must meet certain eligibility and qualification provisions set forth by the IRS.

The accounting for the Employee Retention Credit involves understanding the guidelines provided by the IRS and applying them to the employer's financial statements. KPMG, as a leading provider of tax services, assists clients in understanding the impact of the credit on their financial statements and provides guidance on the proper accounting treatment.

When accounting for the Employee Retention Credit, employers need to consider the impact it has on their financial statements. The credit is recognized as a reduction in the employer's wage expense, which in turn affects the overall profitability of the company. The amount of the credit is based on qualified wages and certain other eligible expenses incurred during the eligible period. Employers must carefully calculate the credit amount and properly allocate it to the appropriate accounting periods.

The Employee Retention Credit can have a significant impact on the financial statements of eligible employers. It is important for companies to accurately account for the credit to ensure compliance with the IRS guidelines and to provide transparent and reliable financial information. KPMG's accounting professionals can assist employers in understanding and implementing the proper accounting treatment for the credit, ensuring accurate financial reporting.

Compliance with Tax Regulations

In order to ensure compliance with tax regulations regarding the Employee Retention Credit (ERC), employers must adhere to the provisions set forth in the CARES Act and the guidelines established by the IRS. KPMG offers comprehensive accounting services to assist employers in navigating these complex regulations and maximizing the benefits of the ERC.

KPMG helps employers determine their eligibility for the credit by conducting thorough calculations to assess whether they meet the qualifications outlined in the CARES Act. This includes evaluating factors such as a decline in gross receipts or a full or partial suspension of operations due to COVID-19.

Once an employer is determined to be eligible for the ERC, KPMG assists in calculating the maximum credit amount based on qualified wages and health plan expenses. These calculations take into account the wage limitations and the specific provisions outlined in the CARES Act.

In addition to providing accurate calculations, KPMG helps employers ensure compliance by assisting in the documentation and record-keeping requirements associated with the ERC. This includes maintaining records of qualified wages, eligible employees, and the necessary documentation to support the eligibility and amount of the credit claimed.

By partnering with KPMG, employers can benefit from expert guidance and support in navigating the complexities of the ERC program while ensuring compliance with tax regulations. KPMG's comprehensive accounting services help employers maximize their savings through the Employee Retention Credit while minimizing the risk of non-compliance with tax laws and regulations.

Accounting Treatment for the Employee Retention Credit at KPMG

At KPMG, the accounting treatment for the Employee Retention Credit (ERC) involves various calculations and guidelines to ensure accurate reporting and compliance with the program's provisions. The ERC is an incentive provided by the IRS to eligible employers for retaining employees during the COVID-19 pandemic.

The accounting team at KPMG closely follows the IRS guidelines to determine the eligibility of employers for the ERC. They assess the employer's qualification based on factors such as the impact of COVID-19 on the business, the type of business entity, and the specific provisions of the program.

Once an employer qualifies for the ERC, KPMG's accounting professionals calculate the amount of the credit based on eligible wages paid to employees. This involves determining the qualified wages for each employee and the applicable percentage of wages that can be claimed as a credit.

KPMG also assists clients in managing the accounting treatment for the ERC savings. This includes documenting and tracking any wage reductions, suspension of operations, or other factors that may affect the calculation of the credit. It is crucial for employers to maintain accurate records to support their claim for the ERC and to comply with tax regulations.

In summary, the accounting treatment for the Employee Retention Credit at KPMG involves careful calculations, adherence to IRS guidelines, and documentation to accurately report the credit and ensure compliance. By providing these accounting services, KPMG helps employers navigate the complexities of the ERC program and maximize their potential savings.

Recording the Employee Retention Credit on Balance Sheet

The Employee Retention Credit (ERC) is a provision under the CARES Act that offers eligible employers a tax credit for keeping their employees on payroll during the COVID-19 pandemic. KPMG provides comprehensive accounting services to help businesses navigate the complexities of this program and maximize their savings.

When recording the Employee Retention Credit on the balance sheet, KPMG follows specific guidelines provided by the IRS. The credit amount is calculated based on eligible wages paid to qualifying employees, and it can be applied against the employer's share of Social Security taxes. It is important to accurately calculate the credit to ensure compliance with IRS regulations.

KPMG's accounting team works closely with employers to determine eligibility for the Employee Retention Credit. This involves reviewing the provisions of the CARES Act and analyzing the employer's wage expenses to identify qualifying wages. In some cases, KPMG may need to communicate with the employer's HR department to gather necessary data.

Once the eligibility and qualifying wages are determined, KPMG records the Employee Retention Credit as a liability on the employer's balance sheet. This allows for the accurate tracking of the credit and ensures that it is properly accounted for in the financial statements.

As the Employee Retention Credit is a tax credit, the amount recorded on the balance sheet represents a potential reduction in the employer's future tax liability. KPMG helps employers understand the impact of this credit on their overall tax position and advises them on how to optimize their financial planning.

Recognizing the Employee Retention Credit in Income Statement

The Employee Retention Credit (ERC) is an incentive program implemented by the IRS as part of the CARES Act. It allows eligible employers to claim a tax credit for a percentage of qualified wages paid to employees during the qualifying period. Properly accounting for the ERC in the income statement is crucial to fully reflect the potential savings and benefits of this tax credit.

To recognize the ERC in the income statement, employers need to follow specific guidelines and calculations provided by the IRS. First, they must determine their eligibility for the credit based on various provisions such as business size, revenue decline, and government shutdown orders. If an employer meets the eligibility criteria, they can move forward with calculating the qualifying wages for each employee.

The qualifying wages considered for the ERC are generally limited to $10,000 per employee per calendar quarter. This wage limit includes both cash compensation and certain qualified health plan expenses. However, the IRS provides additional qualifications and exceptions for certain employees, such as those with an ownership stake in the business or relatives of business owners.

Once the qualifying wages for all eligible employees are determined, the employer can calculate the actual amount of the ERC. The credit is equal to a percentage (determined by the applicable quarter) of the qualifying wages paid during specific periods, up to the maximum limit. The exact percentage may vary depending on the time period and the revenue decline experienced by the employer.

Finally, when recognizing the ERC in the income statement, employers should clearly indicate the credit as a separate line item. This allows for transparency in financial reporting and demonstrates the impact of the credit on the company's bottom line. Proper accounting for the ERC ensures that the employer accurately reflects the potential tax savings and incentivizes employee retention while complying with the IRS guidelines.

Disclosure Requirements for the Employee Retention Credit

The Employee Retention Credit (ERC) is a tax incentive program established under the provisions of the Coronavirus Aid, Relief, and Economic Security (CARES) Act. As part of this program, eligible employers can claim a credit against certain employment taxes for wages paid to qualified employees.

When accounting for the ERC, it is important for employers to understand and comply with the disclosure requirements set forth by the Internal Revenue Service (IRS). These requirements are designed to ensure transparency and accuracy in reporting and claiming the credit.

Under the guidelines provided by the IRS, employers must disclose specific information related to their eligibility for the credit, such as the number of qualified employees, the total amount of qualified wages paid, and the amount of the credit claimed. This information must be reported on Form 941, the employer's quarterly federal tax return.

In addition to the general disclosure requirements, employers may also need to provide additional documentation and calculations to support their claims for the credit. This may include records of eligible wages, documentation of qualified employee classifications, and evidence of any other eligibility criteria outlined by the IRS.

By ensuring compliance with these disclosure requirements, employers can not only avoid potential penalties and audits but also demonstrate their commitment to transparency and accountability in utilizing the Employee Retention Credit. Proper accounting and disclosure of the credit can also result in significant tax savings for eligible employers.

Reporting Considerations for the Employee Retention Credit

When it comes to reporting the Employee Retention Credit, there are several important considerations that employers need to keep in mind. The provisions of the CARES Act provide an incentive for employers to retain their employees during the COVID-19 pandemic, and reporting accurately is crucial to receive the full benefits of this program.

Firstly, it is important to understand the guidelines and qualifications for the Employee Retention Credit. The IRS has provided detailed information on eligibility and calculation methods, and employers should ensure that they meet all the necessary criteria to claim the credit. KPMG, a leading accounting firm, offers specialized services to assist businesses in navigating the complexities of the program.

Employers must accurately report their eligible wages when claiming the Employee Retention Credit. This includes considering any changes in employee compensation or working hours that may affect their eligibility for the credit. Additionally, employers should keep thorough records of all relevant documentation to support their claims.

It is also important to note that the Employee Retention Credit is a refundable tax credit, which means that any excess credit can be refunded to the employer. This can have significant savings implications for businesses, especially during this challenging economic period.

Overall, reporting considerations for the Employee Retention Credit require employers to have a clear understanding of the program, careful record-keeping, and attention to detail. By working with accounting professionals, such as KPMG, businesses can ensure that they receive the full benefits of this valuable incentive and accurately report their eligibility for the credit.

Reporting the Employee Retention Credit in Financial Statements

The Employee Retention Credit (ERC) is a tax credit provided by the CARES Act, which was enacted in response to the COVID-19 pandemic. This credit is designed to provide financial incentives for eligible employers to retain their employees during periods of economic uncertainty. KPMG, as a reputed accounting firm, offers services to help businesses navigate the qualifications, calculations, and reporting requirements related to the ERC.

According to the guidelines provided by the IRS, employers can claim the ERC on their quarterly employment tax returns. However, it's important for businesses to accurately account for this credit in their financial statements. Proper accounting of the ERC ensures transparency and compliance with relevant accounting standards.

KPMG's comprehensive guide on accounting for the ERC in financial statements provides detailed instructions on how to record and report this credit. The guide includes information on the recognition and measurement of the credit, as well as any necessary disclosures. It also addresses the impact of the ERC on the income statement, balance sheet, and cash flow statement.

Reporting the ERC in financial statements involves considering various factors such as its eligibility requirements, maximum credit amount, and limitations based on qualified wages. KPMG's expertise in analyzing the provisions of the CARES Act and understanding how they apply to different industries enables them to provide accurate and reliable advice on reporting the ERC.

By properly reporting the ERC in financial statements, businesses can demonstrate their compliance with the CARES Act and showcase the financial benefits they have received through this incentive. Moreover, transparent reporting allows stakeholders to evaluate the impact of the program on the company's financial performance and assess the potential savings achieved through the credit.

Disclosure Notes for the Employee Retention Credit

Eligibility for the Employee Retention Credit (ERC) is determined by various criteria set forth in the legislation and guidelines provided by the IRS. The credit is available to eligible employers who have experienced a significant decline in gross receipts or have been subject to a full or partial suspension of business operations due to COVID-19. It is important to note that certain services and governmental entities are not eligible for this credit.

Accounting for the Employee Retention Credit requires a thorough understanding of the provisions of the CARES Act and subsequent guidance issued by the IRS. Our team at KPMG has extensive experience in analyzing and implementing the necessary calculations to determine the credit amount for eligible employers. We ensure compliance with all relevant tax regulations and reporting requirements.

Under the Employee Retention Credit program, eligible employers can claim a credit against certain qualified wages paid to their employees. The credit is based on a percentage of qualified wages, including health plan expenses, up to a maximum amount per employee, per quarter. Employers must meet specific criteria and calculations to qualify for and claim the credit.

The Employee Retention Credit serves as a valuable incentive for employers to retain their workforce during challenging times. By providing a tax credit, the program aims to assist employers in sustaining their operations and minimizing employee layoffs. The credit can result in significant tax savings for eligible employers, helping to mitigate the financial strain caused by the COVID-19 pandemic.

To qualify for the Employee Retention Credit, employers must meet certain qualifications, including maintaining an average of 100 or fewer full-time employees in 2019. Additionally, employers must demonstrate a decline in gross receipts by comparing the current quarter's gross receipts to the same quarter in the previous year. Our team at KPMG can guide employers through the qualification process and help them navigate the complex requirements of the credit.

Audit and Assurance Procedures for the Employee Retention Credit

The Employee Retention Credit (ERC) is a key provision of the CARES Act that provides qualified employers with a significant incentive to retain employees during the COVID-19 pandemic. KPMG offers accounting services to help businesses navigate the complexities of the ERC program and ensure accurate calculations.

To determine eligibility and claim the ERC, KPMG's audit and assurance procedures involve a thorough examination of an employer's payroll and wage data. This includes evaluating whether the employer meets the qualifications outlined by the IRS and the specific provisions of the CARES Act.

During the audit process, KPMG employs various guidelines and procedures to verify the accuracy of the calculations and documentation provided by the employer. This includes reviewing the employer's records to ensure compliance with the wage and employment requirements set forth by the ERC program.

KPMG's experienced team of auditors also assesses the reliability and validity of the employer's documentation of eligible employee wages, including the calculation methods used. This helps ensure that the employer is accurately claiming the available ERC savings and following appropriate accounting principles.

In addition, KPMG's audit and assurance procedures include a review of any supporting documentation, such as payroll records and employee documents, to verify the eligibility of employees for the ERC. This helps ensure that the employer is accurately identifying and including eligible employees in their calculations for the credit.

Overall, KPMG's audit and assurance procedures for the Employee Retention Credit provide businesses with a comprehensive approach to ensuring compliance with the program's guidelines and maximizing the available credits. With KPMG's expertise and thorough examination of eligibility and documentation, employers can confidently navigate the complexities of the ERC and claim the incentives they are entitled to.

Review of Eligibility and Documentation

In order to qualify for the Employee Retention Credit (ERC) program under the CARES Act, there are certain eligibility requirements that businesses need to meet. KPMG provides comprehensive guidelines and assistance to ensure that businesses understand and comply with these requirements.

The first criterion for eligibility is that the business must have experienced a significant decline in gross receipts due to the COVID-19 pandemic. KPMG helps businesses calculate the decline in a manner that adheres to the guidelines provided by the Internal Revenue Service (IRS). This is crucial for determining the amount of credit that the business can avail.

Another important factor in qualifying for the ERC is the size of the business. KPMG helps businesses determine whether they fall under the category of large employers or small employers, as this determines the specific provisions and qualifications they need to meet.

Documenting the eligibility and meeting the requirements of the program is essential for claiming the tax credit. KPMG assists businesses in gathering and organizing the necessary documentation, such as payroll records, employee count, and calculation of qualified wages. This ensures that businesses are able to accurately demonstrate their eligibility and maximize their savings through the ERC program.

KPMG's accounting services for the Employee Retention Credit provide businesses with the expertise and support needed to navigate the complex requirements of the program. By reviewing eligibility and documentation in detail, KPMG ensures that businesses can take full advantage of the tax credit and optimize their financial benefits during these challenging times.

Testing the Calculation of the Employee Retention Credit

As outlined by the IRS, the Employee Retention Credit is a tax incentive provided by the CARES Act to encourage employers to retain their employees during the COVID-19 pandemic. The credit allows eligible employers to claim a percentage of qualified wages paid to employees as a tax credit, which can result in significant savings for businesses.

Testing the calculation of the Employee Retention Credit is crucial to ensure that employers are accurately determining their eligibility and the amount of credit they can claim. KPMG provides comprehensive guidelines and services to assist employers in properly accounting for this credit.

When testing the calculation of the Employee Retention Credit, it is essential to understand and apply the eligibility provisions and program guidelines established by the IRS. This includes determining if an employer meets the eligibility criteria based on factors such as the impact of COVID-19 on their operations, the size of the employer, and whether they received certain government assistance.

Additionally, the wage calculations for the credit should be carefully reviewed and tested, taking into account the specific requirements outlined in the CARES Act and related IRS guidance. This includes considering the maximum amount of eligible wages per employee, any limitations on the credit based on the number of full-time equivalent employees, and any applicable caps or exclusions for certain employee compensation.

KPMG's accounting services can assist employers in testing the calculation of the Employee Retention Credit, ensuring compliance with IRS guidelines and maximizing the potential benefits of this incentive. By accurately determining the eligibility and calculating the credit, employers can take advantage of valuable tax savings while supporting their workforce during these challenging times.

Addressing Risks and Internal Controls

The Employee Retention Credit (ERC) is a tax incentive provided under the CARES Act by the IRS to encourage employers to retain their employees during the COVID-19 pandemic. As such, it is crucial for accounting firms like KPMG to have appropriate internal controls in place to address the risks associated with the program.

One of the main risks that need to be addressed is ensuring accurate and compliant calculations of the credit. KPMG must establish procedures and controls to ensure that the ERC calculations are done in accordance with the guidelines provided by the IRS. This includes verifying the eligibility of the employer, the employee, and the wages qualified for the credit.

Another important aspect is maintaining documentation and records to support the claimed credits. KPMG should establish a robust system to track and retain all relevant documentation, such as payroll records, tax forms, and certifications, to ensure compliance with IRS requirements. This documentation will also be crucial for any potential audits or inquiries from the IRS.

Additionally, KPMG should have controls in place to ensure that only qualified employees are included in the calculations. This may involve reviewing employee qualifications, such as their work status, wage rates, and hours worked, to ensure that they meet the requirements for the credit. Non-compliance in this area could lead to incorrect credit calculations and potential financial repercussions.

The risks associated with the ERC program also extend to data security and confidentiality. KPMG should implement appropriate controls to protect sensitive employee information during the credit calculation process. This may include measures such as restricted access to data, encryption of sensitive information, and regular monitoring to detect any potential breaches.

Overall, addressing risks and implementing effective internal controls is essential for accounting firms like KPMG when dealing with the Employee Retention Credit program. By doing so, they can ensure accurate accounting for the credit, maintain compliance with IRS guidelines, and mitigate potential risks and financial implications for both the firm and its clients.

Future Updates and Changes to the Employee Retention Credit

In the coming months, there may be future updates and changes to the Employee Retention Credit program at KPMG. As the coronavirus pandemic continues to evolve, the government may implement new legislation or modify existing ones to provide additional relief to employers and businesses.

KPMG is closely monitoring any updates or changes to the provisions, eligibility requirements, and guidelines of the Employee Retention Credit. Our team of accounting professionals is committed to staying up-to-date with the latest information and ensuring that our clients are aware of any new incentives or savings opportunities.

The Internal Revenue Service (IRS) is expected to issue further guidance on the Employee Retention Credit, potentially clarifying certain calculations and providing additional instructions for employers to accurately claim the credit on their tax returns. KPMG will promptly review and analyze any new information issued by the IRS to ensure that our clients are in compliance with the latest regulations.

Employers who have claimed the Employee Retention Credit under the Coronavirus Aid, Relief, and Economic Security (CARES) Act should be aware that future updates or changes to the program may require adjustments to their accounting and tax records. KPMG's team of experts is ready to assist in assessing the impact of any changes and providing guidance on how to remain compliant with the updated regulations.

We encourage employers to stay informed about any future updates or changes to the Employee Retention Credit by regularly checking KPMG's website and consulting with our dedicated team of professionals. By staying proactive and knowledgeable about the latest developments, businesses can ensure they are maximizing their eligibility for the Employee Retention Credit and taking advantage of the available tax savings.

Potential Legislative and Regulatory Changes

As the tax landscape continues to evolve, there have been discussions and proposals for potential legislative and regulatory changes to the employee retention credit program. These changes aim to improve the effectiveness of the program, provide additional savings for employers, and ensure that it aligns with current economic conditions.

One potential change includes the expansion of eligibility criteria for employers. Currently, certain businesses, such as governmental entities, are not eligible for the credit. However, there are discussions about modifying these qualifications to include a broader range of employers, providing them with the opportunity to participate in the program and take advantage of the financial incentives it offers.

Another potential change involves the calculation of the credit. The IRS has provided guidelines on how to calculate the credit based on eligible wages, but there have been discussions about simplifying these calculations and providing more clarity to employers. This would not only streamline the accounting process for employers but also ensure that the credit is utilized accurately and efficiently.

Furthermore, there have been discussions about extending the duration of the employee retention credit. The current provisions of the CARES Act stipulate that the program covers wages paid between March 13, 2020, and December 31, 2020. However, there are proposals to extend this period to provide additional support for employers and encourage employee retention beyond the initial timeline.

In summary, potential legislative and regulatory changes to the employee retention credit program could bring about expanded eligibility for employers, simplified calculations for the credit, and an extended duration of the program. These changes would aim to provide additional support for businesses, increase savings, and ensure that the program remains a viable incentive for employee retention.

Impact of Accounting Updates on the Employee Retention Credit

The Employee Retention Credit (ERC) is a tax incentive program provided by the CARES Act to encourage eligible employers to retain their employees during the economic downturn caused by the COVID-19 pandemic. The ERC allows qualifying businesses to claim a tax credit for a portion of qualified wages paid to employees.

However, recent accounting updates have introduced changes to how the ERC is accounted for and recognized in financial statements. These updates affect the timing and presentation of the credit, potentially impacting a company's financial position and performance.

KPMG, a leading provider of accounting services, is at the forefront of helping businesses navigate these accounting updates and understand the implications for the ERC. By keeping abreast of the latest guidelines issued by the IRS and other regulatory bodies, KPMG can assist businesses in assessing their eligibility for the credit, determining the amount of credit they can claim, and providing necessary calculations and documentation.

Some of the key accounting updates to consider include the treatment of the ERC as a reduction of wage expenses in the income statement, the recognition of the credit as an income tax benefit in the balance sheet, and the disclosure requirements in the footnotes of financial statements. These updates aim to provide transparency and consistency in the reporting of the ERC across different industries.

It is essential for businesses to understand the accounting provisions related to the ERC to accurately reflect the financial impact of the credit on their savings, cash flow, and overall financial performance. KPMG's expertise in accounting and tax services enables businesses to navigate these complexities and ensure compliance with the latest regulations while maximizing the benefits of the ERC.