In today’s fast-paced retail environment, efficient management of business finances is crucial to success. One of the key components of this process is having a reliable retail shop accounting software that can handle various financial tasks seamlessly. From generating invoices and managing expenses to tracking inventory and calculating profit, a good accounting software can significantly streamline your store’s financial operations.

With the advancement of technology, there are now numerous retail shop accounting software options available in the market. These software solutions not only simplify the process of bookkeeping and accounting but also provide a range of features that can help improve the overall efficiency of your business management.

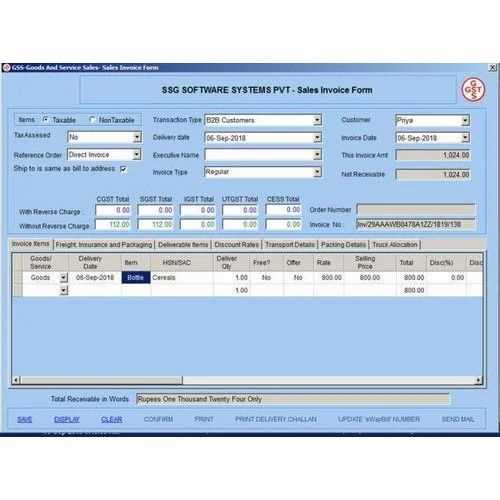

One of the primary features of retail shop accounting software is its point-of-sale (POS) capabilities. By integrating the sale and inventory data, these software solutions provide real-time information on sales, tax, and expenses. This not only saves time but also eliminates the need for manual data entry, reducing the chances of errors and improving accuracy. Additionally, the software can generate detailed sales reports, helping you analyze sales performance and make informed business decisions.

Why Retail Shop Accounting Software is Essential for Your Business

Retail shop accounting software has become an essential tool for businesses in the modern market. With the rapid advancement of technology, manual bookkeeping systems are becoming obsolete, and businesses are turning to software solutions to streamline their financial processes.

One of the key benefits of retail shop accounting software is its ability to integrate with a point of sale (POS) system. This integration allows for seamless tracking of sales and inventory, as well as the automatic generation of invoices and receipts. With a software that is specifically designed for retail shops, businesses can easily manage their cashiers, track their sales, and generate accurate invoices, ultimately improving efficiency and customer service.

In addition to sales and inventory management, retail shop accounting software also helps businesses effectively track and analyze their expenses. By recording and categorizing expenses, businesses can gain valuable insight into their spending patterns and identify areas where they can reduce costs. This level of financial transparency allows businesses to make informed decisions that will ultimately improve their profitability.

Furthermore, retail shop accounting software simplifies the process of tax preparation. With built-in tax calculation features, businesses can easily calculate and file their taxes, ensuring compliance with tax regulations. This eliminates the need for manual calculations and reduces the risk of errors, saving businesses time and resources.

Overall, retail shop accounting software is essential for small businesses to effectively manage their finances. From sales and inventory management to expense tracking and tax preparation, this software provides businesses with the necessary tools to streamline their operations, optimize their profitability, and ensure long-term financial success.

Choosing the Right Retail Shop Accounting Software

When running a retail store, managing finances is crucial to the success of your business. Effective accounting software can help streamline your financial processes, allowing you to focus on growing your store and maximizing profits. The right retail shop accounting software can automate tasks such as point-of-sale (POS) transactions, expense tracking, inventory management, tax reporting, and invoice management.

One of the key considerations when choosing retail shop accounting software is the size of your business. Small retail stores may benefit from software that is simple and easy to use, while larger stores may require more advanced features and capabilities. It is important to assess your specific needs and find software that is scalable and can grow with your business.

Accounting software should also have robust reporting capabilities, allowing you to generate detailed sales and financial reports. This can provide valuable insights into your store's performance, helping you make informed decisions and identify areas for improvement. Look for software that offers customizable reporting options, so you can tailor reports to suit your specific requirements.

Another important feature to consider is integration with other systems. The retail shop accounting software should be able to seamlessly integrate with your POS system, inventory management software, and other systems you use to run your store. This integration can help ensure accurate and up-to-date financial data, as well as streamline workflow and reduce the risk of errors.

Lastly, consider the level of customer support and training provided by the software provider. It is important to choose a software company that offers comprehensive support and training resources, so you can easily learn and make the most of the software's features. Look for software providers that offer phone, email, and live chat support, as well as documentation and tutorials to help you navigate the software.

In conclusion, choosing the right retail shop accounting software is essential for managing your store's finances effectively. Consider the size of your business, reporting capabilities, integration with other systems, and customer support when evaluating different software options. By making the right choice, you can streamline your financial processes, improve efficiency, and ultimately boost your store's profitability.

Key Features to Consider

When choosing retail shop accounting software, it is important to consider a few key features that will help streamline your business finances and improve efficiency. Here are some important features to look for:

- Point-of-Sale Integration: Look for software that seamlessly integrates with your point-of-sale system. This will allow for real-time tracking of sales and inventory, ensuring accurate financial records.

- Expense Tracking: The software should have robust expense tracking capabilities, allowing you to easily record and categorize all expenses related to your retail store. This will help you monitor and control your expenses, ultimately maximizing your profit.

- Bookkeeping and Accounting: The software should have comprehensive bookkeeping and accounting features, including the ability to generate invoices, track accounts receivable and payable, and reconcile bank statements. This will enable you to maintain accurate financial records and make informed business decisions.

- Inventory Management: Look for software that offers inventory management capabilities. This will help you track and manage your retail store's inventory, ensuring optimal stock levels and minimizing the risk of stockouts or overstocking.

- Tax Compliance: The software should have built-in features to help you stay compliant with tax regulations. Look for software that can automatically calculate and generate tax reports, making tax filing easier and less time-consuming.

- Sales Reporting: The ability to generate detailed sales reports is crucial for monitoring the performance of your retail store. Look for software that provides customizable sales reports, allowing you to analyze sales trends, identify top-selling products, and make data-driven decisions to improve your business.

By considering these key features, you can choose retail shop accounting software that meets the specific needs of your business and helps you streamline your finances for greater success.

Comparison of Top Retail Shop Accounting Software Solutions

When it comes to managing the finances of your retail shop, having the right accounting software can make all the difference. With the right software, you can effectively track and manage your expenses, taxes, and bookkeeping, allowing you to streamline your business finances.

One top choice for small retail shops is point-of-sale (POS) software that offers integrated accounting features. This type of software not only helps you track sales and manage inventory but also handles all your accounting needs. It allows you to easily generate invoices, track expenses, and even calculate profit margins.

Another popular option is dedicated accounting software specifically designed for retail shops. This software offers a comprehensive suite of features, including expense management, tax reporting, and financial analysis. With the ability to integrate with your point-of-sale system, it provides a seamless solution for all your accounting needs.

For those retail shops with multiple locations, cloud-based accounting software is often the best choice. This software allows you to access your financial information from anywhere, making it easy to manage your store's finances even when you're on the go. It also offers features such as cash management, cashier tracking, and sales reporting.

Ultimately, the best retail shop accounting software for your business will depend on your specific needs and budget. Consider factors such as the size of your store, the complexity of your finances, and any specific features or integrations you require. By choosing the right software, you can streamline your business finances and focus on what you do best - running your shop.

Implementing Retail Shop Accounting Software in Your Business

Implementing retail shop accounting software can bring numerous benefits to your business, helping you streamline your finance management and improve your overall profitability. With the right software in place, you can efficiently manage your inventory, track your sales, and take care of your bookkeeping tasks.

One of the key advantages of using retail shop accounting software is the ability to create and manage invoices with ease. Instead of manually writing invoices, the software allows you to generate them automatically, saving you time and reducing the chances of errors. This feature enables you to promptly send invoices to your customers, ensuring a smooth and efficient payment process.

Another crucial aspect of implementing retail shop accounting software is the ability to track and manage your inventory effectively. The software provides you with real-time information about your stock levels, allowing you to make informed decisions regarding your purchasing and sales strategies. With accurate inventory management, you can avoid stockouts and overstock situations, ensuring optimal efficiency in your store's operations.

Furthermore, retail shop accounting software can greatly simplify your bookkeeping tasks. It automates the recording and categorization of your sales, expenses, and other financial transactions, eliminating the need for manual data entry. This streamlines your bookkeeping processes and provides you with accurate and up-to-date financial information, which is essential for making informed business decisions.

In addition to the core accounting features, retail shop accounting software often includes point-of-sale (POS) capabilities, enabling you to manage your sales and cashiers efficiently. The software can help you track cash register activity, monitor cashier performance, and generate detailed sales reports. This functionality allows you to identify sales trends, measure your store's performance, and identify opportunities for growth.

By implementing retail shop accounting software in your business, you can gain better control over your finances, improve your store's efficiency, and ultimately increase your profitability. Whether you run a small shop or manage a chain of retail stores, investing in the right accounting software is a crucial step towards achieving your financial goals.

Steps to Successfully Implement Retail Shop Accounting Software

1. Assess your business needs: Before implementing retail shop accounting software, it is important to assess your business needs and determine what features and functionalities are essential for your store. Consider factors such as sales volume, inventory management, expenses tracking, and tax processing.

2. Research and choose the right software: Conduct thorough research on different accounting software options available in the market. Look for software that specifically caters to retail businesses and offers features such as point-of-sale integration, inventory tracking, expense management, and financial reporting. Compare prices, read reviews, and choose the software that best fits your requirements and budget.

3. Plan for data migration: If you are transitioning from manual bookkeeping or switching from another accounting software, you need to plan for data migration. Create a backup of your existing financial data and ensure a smooth transfer to the new retail shop accounting software. This may involve importing sales data, inventory records, and expense details.

4. Train your staff: Proper training is crucial to successfully implement retail shop accounting software. Train your employees, especially cashiers and managers, on how to effectively use the software. Ensure they understand how to process sales, manage inventory, generate financial reports, and track expenses. This will help streamline your business operations and ensure accurate financial management.

5. Customize and set up: Configure the accounting software according to your retail shop's specific needs. Set up your chart of accounts, tax rates, and payment methods. Customize invoices, receipts, and other financial documents with your store's logo and branding. This will help create a professional and consistent image for your business.

6. Test and troubleshoot: Before fully integrating the accounting software into your daily operations, conduct thorough testing to ensure everything is functioning properly. Test different scenarios such as sales transactions, inventory updates, and expense tracking. Identify and resolve any issues or errors to prevent future disruptions in your business finance management.

7. Monitor and review: Once the retail shop accounting software is implemented, regularly monitor and review your financial data. Use the software's reporting capabilities to analyze sales trends, track inventory levels, and review profit and loss statements. This will provide valuable insights and help you make informed decisions to improve your business's financial health.

8. Seek professional assistance if needed: If you find it challenging to implement the accounting software on your own, consider seeking professional assistance. Hire an accountant or bookkeeper with experience in retail shop accounting to help you with the initial setup and provide ongoing support and advice.

By following these steps, you can successfully implement retail shop accounting software and streamline your business finances. Effective management of sales, expenses, and inventory will help you make informed decisions, maximize profit, and ensure the overall success of your retail store.

Training and Support for Your Retail Shop Accounting Software

When it comes to managing your shop's finances, having the right accounting software is crucial. It not only helps you keep track of your sales, expenses, and profits, but also enables you to handle important tasks such as tax filings, bookkeeping, and inventory management. However, using such software effectively requires proper training and support.

Most retail shop accounting software providers offer comprehensive training programs to help you get started. These programs are designed to familiarize you with the software's features and functionalities, ensuring that you can navigate through the system with ease. From setting up your store's POS system to managing expenses and generating financial reports, the training covers all aspects of using the software.

Along with training, reputable software providers also offer ongoing customer support. This means that whenever you encounter a technical issue or have a question about the software, you can reach out to their support team for assistance. They can guide you through troubleshooting steps, answer your queries, and even provide custom solutions to address your unique business needs.

Having access to training and support for your retail shop accounting software is essential for the smooth operation of your business. It allows you to optimize the use of the software, ensuring accurate financial management and improved efficiency. With proper training and support, you can confidently handle your shop's finances without any hassle or confusion.

Benefits of Retail Shop Accounting Software

Retail shop accounting software offers numerous benefits for store owners and managers. It helps streamline the accounting processes in a shop and makes it easier to manage finances.

One of the key advantages of using accounting software for retail shops is that it automates the cashier and bookkeeping tasks. The software can automatically record sales transactions, generate invoices, and track inventory levels. This not only saves time but also reduces the chances of errors and discrepancies in financial records.

Effective management of finances is crucial for the success of any retail business. Accounting software provides a comprehensive view of the shop's financial health, including information about sales, expenses, and profit margins. This helps store owners make informed decisions and identify areas for improvement.

Retail shop accounting software also simplifies tax preparation. It can generate accurate tax reports, calculate the amount of tax owed, and even facilitate electronic filing. This saves the shop time and effort during tax season and helps ensure compliance with tax regulations.

In addition, accounting software allows for better expense management. It enables store owners to track and categorize expenses, such as rent, utilities, and supplier payments. By having a clear overview of expenses, retailers can identify cost-saving opportunities and reduce unnecessary expenditures.

Furthermore, retail shop accounting software provides real-time visibility into inventory levels. Store owners can easily track stock movements, identify popular products, and make informed purchasing decisions. This helps optimize inventory management and prevent stockouts or overstocking situations.

In summary, retail shop accounting software offers various benefits, including streamlined cashier and bookkeeping tasks, improved financial management, simplified tax preparation, enhanced expense management, and optimized inventory control. By leveraging these features, retailers can effectively manage their shop's finances and focus on growing their business.

Improved Financial Management and Reporting

The right accounting software can greatly improve the management of your retail business's finances, making it easier and more efficient to keep track of your income, expenses, and overall profitability. With the help of this software, you can automate many tasks related to tax calculation and reporting, ensuring compliance with all relevant laws and regulations.

Effective financial management is especially crucial for retail businesses, which often deal with high volumes of inventory and numerous sales transactions. Accounting software designed for retail can integrate with your point of sale (POS) system, allowing for real-time tracking of sales and inventory levels. This gives you a clear understanding of your store's financial health and helps you make informed decisions about inventory management and pricing.

In addition to managing sales and inventory, retail accounting software can also streamline other important financial tasks. You can easily generate and send invoices to customers, track outstanding payments, and reconcile your bank accounts. This makes it easier to stay on top of your cash flow and ensure that your receivables are collected in a timely manner.

Furthermore, retail accounting software often comes with built-in tools for expense tracking and bookkeeping. You can categorize your expenses and generate reports that provide a clear overview of your business's financial performance. This information is invaluable when it comes to making informed decisions and identifying areas where you can reduce expenses or increase profitability.

Overall, investing in the right accounting software can greatly benefit small retail businesses by providing them with the tools and insights needed to effectively manage their finances. By automating tasks, streamlining processes, and generating accurate reports, this software can save time and effort, allowing business owners to focus on growing their business and maximizing profits.

Increased Efficiency and Productivity

Implementing retail shop accounting software can significantly increase the efficiency and productivity of your business. With a point-of-sale (POS) system integrated into the software, you can easily manage sales transactions and track inventory levels in real time. This eliminates the need for manual data entry, reducing errors and saving time for your staff.

The software provides comprehensive financial management tools, including invoice and expense management, tax calculations, and bookkeeping features. By automating these processes, you can focus more on running your store and serving your customers, instead of spending hours on paperwork and calculations.

With the ability to generate detailed reports on sales, profits, and expenses, you can gain valuable insights into your business performance and make data-driven decisions. The software also allows you to manage multiple stores from a centralized platform, enabling you to streamline operations and share inventory across locations.

In addition, the software can simplify cashier tasks by providing easy-to-use interfaces and secure payment processing capabilities. This not only speeds up the checkout process but also ensures accuracy in transactions, reducing the risk of costly errors.

Overall, investing in retail shop accounting software can revolutionize the way you manage your business finances. By eliminating manual processes, automating tasks, and providing real-time insights, the software empowers you to run a more efficient and productive operation, ultimately driving growth and success.

Tips for Effective Use of Retail Shop Accounting Software

1. Automate tasks: Take advantage of retail shop accounting software to automate repetitive tasks, such as generating invoices or updating inventory. This will save you time and ensure accuracy in your financial records.

2. Track sales and expenses: Use the software to track your retail shop's sales and expenses. This will give you a clear picture of your business's financial health and help you make informed decisions to improve profitability.

3. Streamline inventory management: Utilize the inventory management features of the software to keep track of your store's stock levels. This will help you avoid overstocking or running out of popular items, ensuring satisfied customers and minimizing losses.

4. Integrate with POS systems: If you have a point-of-sale (POS) system, choose retail shop accounting software that integrates seamlessly with it. This integration will provide a holistic view of your sales and inventory, making it easier to reconcile transactions and manage cash flow.

5. Simplify bookkeeping: Use the software to simplify your bookkeeping processes. It should allow you to easily categorize expenses, reconcile bank statements, and generate financial reports. This will make tax preparation and financial analysis much more efficient.

6. Train your staff: Ensure that your employees are trained on how to use the retail shop accounting software effectively. This will help them understand their role in financial management and improve accuracy in handling transactions and recording data.

7. Regularly back up data: To avoid data loss, regularly back up your financial data using the software's built-in backup feature or an external storage solution. This will protect you from unforeseen events and allow for quick data recovery if needed.

8. Stay updated with tax regulations: Keep up-to-date with tax regulations that apply to your retail shop. Retail shop accounting software should have features to help you stay compliant, such as automatic tax calculations and the ability to generate tax reports.

9. Analyze profitability: Leverage the software to analyze the profitability of your retail shop. Look for features that allow you to track profit margins, compare expenses to sales, and identify areas for improvement. This will help you make strategic business decisions to maximize profits.

10. Seek professional support: If you are unsure about using retail shop accounting software or need guidance, consider seeking professional support, such as consulting with an accountant or attending training sessions. They can provide valuable insights and ensure you are getting the most out of the software for your business.

Regularly Update and Reconcile Your Financial Data

As a small retail shop owner, it is crucial to regularly update and reconcile your financial data to ensure the accuracy and integrity of your records. This process involves keeping track of all sales, expenses, and cash transactions that occur in your store. By regularly updating your financial data, you can have an up-to-date and accurate picture of your business's financial health.

One important aspect of updating your financial data is to record all sales transactions accurately. This includes capturing every sale made at the point-of-sale (POS) system or cash register. By doing so, you can accurately track your store's sales and monitor your inventory levels. This information is essential for effective inventory management and can help you identify sales trends and forecast future demand.

Additionally, you should also record all expenses incurred by your retail shop, such as rent, utilities, salaries, and inventory purchases. Tracking your expenses allows you to monitor your business's cash flow and identify areas where you can potentially cut costs or negotiate better deals with suppliers. By regularly reconciling your expenses, you can ensure that your financial records accurately reflect the true costs of running your store.

Reconciling your financial data also involves matching your sales and expense records with your bank statements. This process helps identify any discrepancies or errors in your records, enabling you to correct them promptly. Reconciling your bank statements with your financial data can help you identify any missing transactions, detect fraudulent activity, and ensure that your records align with your actual bank balance.

In addition to maintaining accurate records, updating and reconciling your financial data also plays a crucial role in tax preparation. By having up-to-date and accurate financial information, you can easily generate reports and statements required for tax filing. This reduces the time and effort needed to complete your business's tax obligations and can help you avoid penalties or audits by tax authorities.

By regularly updating and reconciling your financial data, you can streamline your business's accounting and bookkeeping processes, improve the accuracy of your financial records, and make informed decisions based on reliable data. Investing in retail shop accounting software can provide you with the tools and features necessary for efficient financial management, ultimately helping you maximize your store's profit and success.

Utilize Advanced Features and Integrations

When choosing a retail shop accounting software, it is important to look for advanced features and integrations that can streamline your business finances. These advanced features can help you manage your expenses, track your inventory, and automate your bookkeeping processes.

One of the key features you should look for is an integrated point-of-sale (POS) system. With a POS system, you can easily process sales transactions, generate invoices, and track your sales and revenue in real-time. This not only saves you time but also provides you with accurate and up-to-date financial data.

In addition to a POS system, you should also consider software that integrates with other essential business tools. For example, look for accounting software that integrates with your inventory management system. This integration allows you to track your inventory levels, manage reordering, and monitor stock movements directly from your accounting software.

Another important integration to consider is with your payment processors. This ensures that your sales transactions are automatically recorded in your accounting software, saving you the hassle of manual data entry.

Furthermore, advanced accounting software often provides features like tax management and reporting. These features help you stay compliant with tax regulations and generate accurate financial reports for your business. By automating the tax calculation and reporting processes, you can save time and avoid costly errors.

In summary, utilizing advanced features and integrations in your retail shop accounting software can greatly simplify your business finances. Features like a comprehensive POS system, integration with inventory management and payment processing tools, and tax management capabilities can help you streamline your operations, improve your financial accuracy, and ultimately drive more profit for your business.

Case Studies: How Retail Shop Accounting Software Transformed Businesses

Running a retail shop comes with its fair share of challenges, from managing inventory and sales to keeping track of expenses and bookkeeping. In the past, many small retail businesses relied on manual methods of tracking their finances, which often led to errors and inefficiencies. However, with the advent of retail shop accounting software, these businesses have been able to streamline their financial processes and transform the way they operate.

One such case study is a small retail store that used to struggle with keeping track of its sales and inventory. The store owner would spend hours manually inputting sales data and reconciling inventory. This tedious process often resulted in mistakes and inconsistencies, causing the business to lose profit. After implementing retail shop accounting software, the store was able to automate its point-of-sale system, allowing cashiers to easily generate invoices and track sales in real time. The software also integrated with the store's inventory management system, ensuring accurate inventory tracking and reducing the risk of stockouts.

Another case study involves a retail business that was struggling with its bookkeeping and tax filing. The business owner found it difficult and time-consuming to keep track of expenses and reconcile them with sales. This led to delays in preparing financial statements and filing taxes, which incurred penalties. With the use of retail shop accounting software, the business was able to automate its expense tracking process. The software streamlined the capture of expenses and categorized them accordingly, making it easy to generate accurate financial reports and file tax returns on time.

In both of these examples, retail shop accounting software has played a crucial role in transforming the way these businesses manage their finances. By automating processes such as sales tracking, inventory management, and expense categorization, these businesses have been able to save time, minimize errors, and improve the overall efficiency of their operations. Whether it's a small retail store or a larger chain, investing in the right accounting software can be a game-changer for any retail business.

Case Study 1: Retail Shop XYZ

Retail Shop XYZ is a small retail store that specializes in selling clothing and accessories. As the business grew, it became increasingly difficult for the shop owner to manage sales and track profits manually. The shop owner decided to implement a retail shop accounting software to streamline their business finances.

The retail shop accounting software helped Retail Shop XYZ automate their bookkeeping tasks, such as recording sales, tracking expenses, and generating invoices. It also provided a point-of-sale (POS) system that integrated seamlessly with the cashier's workflow, making transaction processing quick and efficient.

With the software's built-in expense management feature, Retail Shop XYZ was able to easily track their store's expenses. This helped them identify areas where they could reduce costs and improve profitability. Additionally, the software provided detailed reports and analytics, allowing the shop owner to analyze sales data and make informed business decisions.

The retail shop accounting software also simplified the process of managing taxes. It automatically calculated the tax amount on each sale, reducing the risk of errors and ensuring compliance with tax regulations. This saved the shop owner significant time and effort during tax season.

Overall, the implementation of the retail shop accounting software greatly improved Retail Shop XYZ's financial management. The shop owner no longer had to spend hours manually reconciling accounts and tracking sales. Instead, they were able to focus on growing their business and providing a better shopping experience for their customers.

Case Study 2: Retail Shop ABC

Retail Shop ABC, a small retail store specializing in clothing and accessories, was struggling with managing their business finances efficiently. With a high volume of sales and inventory, the shop needed a reliable system to track their expenses and profits accurately.

After evaluating several options, Retail Shop ABC decided to implement a point-of-sale (POS) software for their store. This software not only helped them streamline their sales management process but also provided features for bookkeeping and accounting.

The POS software allowed Retail Shop ABC to generate invoices instantly, making it easier for their cashier to manage transactions efficiently. The software also provided a comprehensive inventory management system, helping the shop keep track of all their products and ensure they never ran out of stock.

With the implementation of the new software, Retail Shop ABC was able to maintain accurate records of their expenses, sales, and profits. The software also automated their tax calculations, saving them significant time and effort.

Furthermore, the accounting features of the software allowed Retail Shop ABC to generate financial reports, providing valuable insights into their business performance. This helped them make informed decisions and identify areas for improvement.

In conclusion, the implementation of a point-of-sale software with integrated accounting capabilities has greatly benefited Retail Shop ABC. The software has streamlined their business finances, improved their invoice and bookkeeping processes, and provided them with better control over their inventory and sales management. With these improvements, Retail Shop ABC can focus on growing their business and enhancing their customer experience.