Welcome to our article on the best simple planning accounting software reviews. If you are a small business owner looking for efficient financial solutions, this guide is for you. In today's fast-paced world, managing your company's budget, tracking expenses, and staying on top of taxes and profits can be challenging. However, with the right accounting software, these tasks become much easier.

Accounting software helps automate bookkeeping, expense management, invoice creation, and even time tracking. With cloud-based solutions becoming increasingly popular, entrepreneurs can now access their financial data from anywhere, at any time. This convenience and ease of use are vital for small business owners who may not have the resources to hire a dedicated finance team.

Our reviews will cover some of the best accounting software options available, focusing on their simplicity, affordability, and overall effectiveness. By utilizing these tools, you can streamline your financial management processes, saving time and reducing the stress associated with bookkeeping, tax filing, and budget planning.

So, whether you are a freelancer, a startup owner, or an established small business, we have compiled a list of the top-rated accounting software solutions to help you find the perfect fit for your needs. With these tools by your side, you can take control of your company's finances and focus on what truly matters: growing your business.

Best Simple Planning Accounting Software Reviews Top Rated Tools Plan

When running a business, it is crucial to keep track of your finances to ensure profitability. With the multitude of accounting tasks that need to be managed, finding the right software can make all the difference. Simple planning accounting software provides an easy and efficient solution for small businesses.

Cloud-based accounting software allows you to access your financial data from anywhere at any time. This is particularly helpful for businesses with remote teams or multiple locations. With simple planning accounting software, you can easily manage your budget, track expenses, and generate invoices with just a few clicks.

The best simple planning accounting software provides user-friendly interfaces and intuitive features that make bookkeeping and financial management a breeze. You don't need to be a financial expert to navigate these tools. They simplify the process, allowing you to focus more time on growing your business.

Reviews from users consistently highlight the ease of use and effectiveness of simple planning accounting software. These tools enable businesses to streamline their financial processes, saving time and reducing the stress of tax season. With accurate and up-to-date financial data, you can make informed decisions to maximize profits.

Whether you are a small business owner, freelancer, or self-employed individual, simple planning accounting software is an essential tool for managing your finances. Don't let the complexities of bookkeeping and accounting hold your business back. Invest in the right software to simplify the financial side of your business and ensure its success.

Importance of Simplifying Accounting

The planning and management of financial matters is of utmost importance for any business, regardless of its size. Simple accounting solutions can make the process of tracking profit, expenses, and taxes much easier and more efficient.

By using user-friendly software, businesses can save valuable time that would otherwise be spent on complex bookkeeping tasks. These software solutions often come with features that allow for easy data entry, organization, and financial analysis.

In addition to simplifying financial management, simple accounting software can also help small businesses stay on budget. With clear visibility into their income and expenses, businesses can make better decisions regarding resource allocation and planning for growth.

Cloud-based accounting tools make it even easier for businesses to access their financial data from anywhere, at any time. This level of accessibility and flexibility is especially beneficial for business owners who are constantly on the go.

Another key aspect of simplifying accounting is the ease of use and user-friendly interface. Non-financial professionals should be able to navigate the software without getting overwhelmed. This allows business owners to take control of their finances and make informed decisions without needing to hire additional staff.

In conclusion, simple accounting software can greatly benefit businesses by providing easy-to-use solutions for financial management. From budgeting and expense tracking to tax preparation and financial analysis, these tools make it possible for small businesses to streamline their accounting processes and focus on their core operations.

Benefits of Using Simple Planning Accounting Software

Efficient Planning: Simple planning accounting software provides businesses with the tools they need to effectively plan and budget their financial resources. It allows businesses to set financial goals, track their progress, and make informed decisions about their expenses and investments.

Cloud Solutions: With simple planning accounting software, businesses can access their financial information from anywhere, as long as they have an internet connection. This cloud-based feature makes it easy for businesses to manage their finances on the go and collaborate with their team members in real-time.

Track Financial Records: Simple planning accounting software enables businesses to keep track of their financial records in one central location. This eliminates the need for paper-based bookkeeping and reduces the chances of errors and misplacements. It also allows businesses to easily generate financial reports for analysis and auditing purposes.

Faster and Easier Tax Management: By using simple planning accounting software, businesses can streamline their tax management processes. The software automatically calculates taxes based on the entered financial data, reducing the chances of errors and penalties. It also provides businesses with a clear overview of their tax liabilities and helps in timely tax filing.

Easy Invoicing and Expense Tracking: Simple planning accounting software makes it easy for businesses to generate professional invoices and track their expenses. It allows businesses to create and send invoices to clients, track payment status, and automate reminders for overdue payments. It also enables businesses to track their expenses, categorize them, and generate expense reports for better financial management.

Improved Profit Margins: By utilizing simple planning accounting software, businesses can gain better insights into their financial performance. The software provides businesses with detailed reports and analysis on their revenue, expenses, and profitability. This helps businesses identify areas of improvement, reduce unnecessary expenses, and maximize their profit margins.

Overall, using simple planning accounting software offers numerous benefits for businesses, including efficient planning, cloud solutions, streamlined financial records, faster tax management, easy invoicing and expense tracking, and improved profit margins. It is an essential tool for businesses of all sizes to effectively manage their finances and make informed business decisions.

Top Rated Accounting Tools

When it comes to managing your financials, it's important to have easy and efficient solutions in place. Thankfully, there are plenty of top-rated accounting tools available to help you streamline your bookkeeping, taxes, and overall financial management.

One of the key features users look for in accounting software is simplicity. The best tools offer simple interfaces and easy-to-use features, making it a breeze to track expenses, create invoices, and manage budgets. This is especially important for small businesses that may not have dedicated accounting staff.

Cloud-based software is becoming increasingly popular for accounting purposes. These tools allow you to access your financial information from anywhere, and they often offer real-time updates and collaboration features. With cloud-based accounting software, you can stay on top of your finances no matter where you are.

Another factor to consider when choosing accounting software is the ability to track and analyze financial data. The best tools provide robust reporting capabilities, allowing you to monitor your profit and loss, generate cash flow statements, and analyze trends over time. This data is crucial for making informed business decisions and planning for the future.

Finally, reading reviews and researching different accounting tools is essential before making a decision. User reviews can provide valuable insights into the strengths and weaknesses of each software, helping you find the best fit for your specific needs and preferences. Take the time to evaluate different options and consider the features and functionalities that are most important to you.

Overall, these top-rated accounting tools offer a range of features and functionalities to simplify your financial management. From easy-to-use interfaces and cloud-based accessibility to robust reporting capabilities and user-friendly features, these tools can help you stay on top of your finances and make informed business decisions.

Tool A - Features and Reviews

Invoices: Tool A offers a simple and efficient way to create and manage invoices. You can easily generate professional-looking invoices and send them to your clients with just a few clicks.

Reviews: User reviews consistently praise Tool A for its user-friendly interface and intuitive design. Many small business owners appreciate the ease of use and the time-saving features it provides.

Expenses: With Tool A, you can easily track and categorize your business expenses. This allows you to keep a close eye on your spending and make informed financial decisions.

Financial Planning: Tool A provides robust financial planning tools that enable you to create budgets, forecast revenue, and track your progress towards financial goals. It helps you stay organized and make smarter financial decisions for your business.

Profit Tracking: With Tool A, you can easily monitor your business's profitability. It provides detailed reports that allow you to analyze your income and expenses, helping you identify areas for improvement and make adjustments to increase your profits.

Bookkeeping: Tool A simplifies your bookkeeping process by automating many repetitive tasks. It enables you to efficiently manage your financial records and ensure accuracy in your accounting operations.

Cloud Solutions: Tool A offers cloud-based solutions, allowing you to access your financial data from anywhere, anytime. This flexibility is especially beneficial for small businesses that need to manage their finances on the go.

Tax Management: Tool A provides features specifically designed to help you manage your business taxes. It helps you stay organized and compliant, minimizing the risk of errors and penalties.

Easy Management: Tool A's user-friendly interface makes it easy to manage your finances, even if you don't have a background in accounting. It simplifies complex financial tasks and provides step-by-step guidance.

Track Your Time: Tool A allows you to track the time you and your team spend on different projects. This helps you accurately bill your clients and ensures that you are allocating your resources effectively.

Key Features of Tool A

Planning: Tool A provides efficient planning features that allow you to manage your business finances effectively. You can create budgets and track your expenses, ensuring that you stay on top of your financial goals and make well-informed decisions.

Easy to Use: With its simple interface and intuitive design, Tool A is easy to navigate, making it ideal for small business owners who may not have a background in accounting. You can quickly input and manage your financial data without any complexity.

Cloud-based: Tool A is cloud-based, meaning that you can access your financial data from anywhere and at any time. All your information is securely stored in the cloud, providing you with convenience and peace of mind.

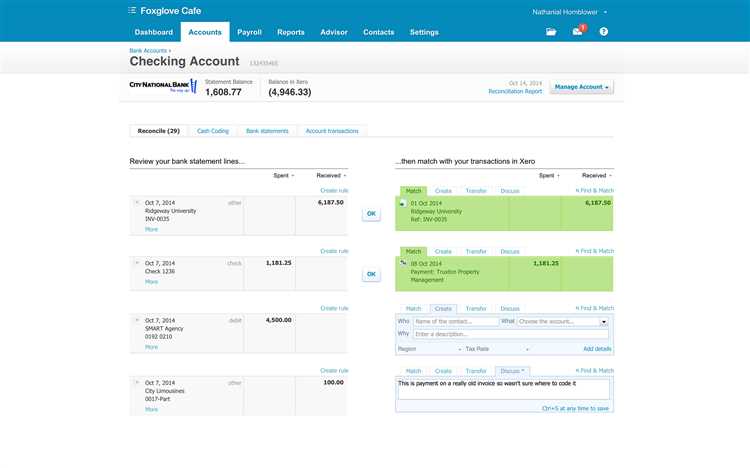

Bookkeeping and Accounting: This software offers robust bookkeeping and accounting features, helping you maintain accurate and up-to-date financial records. You can easily reconcile transactions, generate financial reports, and handle tasks such as invoicing and payroll.

Tax Management: Tool A simplifies tax management by providing features that help you track and organize your tax-related information. You can calculate and record your taxes effortlessly, ensuring compliance with tax regulations.

Profit and Loss Analysis: The software enables you to analyze the profitability of your business by generating detailed profit and loss reports. This feature allows you to identify areas of improvement and make informed decisions to optimize your business's financial performance.

Time Management: Tool A offers time management features that help you save time by automating repetitive tasks. You can set up recurring transactions, schedule payments, and generate invoices, allowing you to focus on other aspects of your business.

Financial Management Solutions: As a comprehensive financial management tool, Tool A provides solutions for various financial tasks. You can manage your cash flow, track accounts receivable and payable, and handle other financial processes efficiently.

Customer Reviews: Users have positively reviewed Tool A for its simplicity, reliability, and effectiveness in managing their business finances. They appreciate the ease of use and the accuracy of the software, making it a top choice in the market.

Secure and Reliable: Tool A ensures the security and reliability of your financial data. With frequent data backups and robust security measures, you can trust that your information is safe and protected from any potential threats.

User Reviews for Tool A

Solution for Small Businesses

Tool A is a fantastic accounting software for small businesses. It offers a variety of features that help track and manage finances efficiently. The cloud-based platform makes it easy to access your financial information anywhere, anytime. With this software, you can easily handle bookkeeping, expenses, invoices, and taxes, making it a comprehensive solution for small business owners.

Easy to Use and Simple

One of the best things about Tool A is its user-friendly interface. Even if you're not an accounting expert, you can navigate through the software with ease. It's designed to simplify financial management, allowing you to focus on other aspects of your business. The software offers step-by-step guides and tutorials, making it a breeze to set up and use.

Time and Profit Management

Tool A offers powerful time and profit management features. You can easily track the time spent on different projects or tasks, enabling you to bill accurately and optimize your resources. The software also provides detailed reports and analysis of your business's financial performance, helping you make informed decisions to improve profitability.

Exceptional Customer Reviews

Many users have left positive reviews of Tool A, praising its simplicity and ease of use. They appreciate the software's ability to streamline accounting processes, save time, and reduce errors. Users also note the excellent customer support provided by the Tool A team, ensuring their questions and concerns are promptly addressed.

Extensive Budget and Financial Management

With Tool A, you can create and manage budgets effortlessly. The software allows you to set financial goals, track expenses, and monitor your progress in real-time. This helps you stay on top of your budget and make data-driven decisions for the growth of your business. From cash flow management to financial forecasting, Tool A covers all aspects of financial management.

Highly Recommended Accounting Software

Overall, Tool A is highly recommended for small businesses in need of an efficient and user-friendly accounting software. It provides the necessary tools to effectively manage finances, track expenses, create budgets, and analyze profit. The positive user reviews and excellent customer support make Tool A a reliable choice for businesses of all sizes.

Tool B - Features and Reviews

Tool B is a simple and efficient financial accounting software designed for small businesses. With its user-friendly interface, it provides a range of features to help businesses budget, track expenses, and manage invoices.

One of the standout features of Tool B is its invoicing management system. Users can easily create and customize professional-looking invoices, track payments, and send reminders to clients. This makes it easier for businesses to stay on top of their finances and ensure they are getting paid on time.

Another key feature of Tool B is its time and expense tracking capabilities. This allows businesses to keep track of how much time and money they are spending on different projects or clients. The software also helps with tax preparation by generating detailed expense reports and providing insights into deductible expenses.

Tool B is a cloud-based software, which means businesses can access their financial data from anywhere at any time. This makes it convenient for entrepreneurs who are always on the go. The software also offers integration with other popular cloud solutions, such as QuickBooks and Xero, making it easy to sync data between different platforms.

Overall, Tool B has received positive reviews from users. Many praise its simplicity and ease of use, making it suitable for businesses that don't have a dedicated accounting team. The software's intuitive interface and comprehensive financial management features have helped numerous small businesses streamline their bookkeeping processes and maximize their profits.

In conclusion, Tool B is a reliable and efficient financial accounting software that offers a range of features to help small businesses manage their finances. From invoicing and expense tracking to tax preparation and budgeting, Tool B provides a comprehensive solution for businesses of all sizes.

Key Features of Tool B

1. Cloud-based Financial Management: Tool B offers cloud-based solutions for small businesses to manage their financials easily. This allows you to access your accounting software from anywhere, at any time, without the need for installation or updates.

2. Easy Budget Planning: With Tool B, you can easily create and manage budgets for your business. This feature helps you track your expenses and stay within your financial limits. It also allows you to set goals and monitor your progress towards those goals.

3. Efficient Bookkeeping: Tool B provides efficient bookkeeping solutions, making it easy for you to keep track of your business transactions. You can easily record invoices, expenses, and payments, ensuring accurate financial records and simplifying tax preparation.

4. Streamlined Invoicing: The software offers streamlined invoicing options, allowing you to create and send professional invoices to your clients. You can easily customize the invoices with your business logo and details, and track the payment status of each invoice.

5. Tax Management: Tool B simplifies the management of taxes for your business. It helps you track tax liabilities, calculate taxes accurately, and generate tax reports to aid in tax preparation. This feature ensures compliance with tax regulations and minimizes the risk of errors.

6. Profit Tracking: The software allows you to track your business's profitability by generating income statements and profit reports. You can easily monitor your revenue and expenses, identify areas of improvement, and make informed financial decisions.

7. Time Tracking: Tool B offers time tracking features that allow you to record and monitor the time spent on different projects. This helps you accurately allocate resources, track project costs, and manage your team's productivity.

8. Simple Expense Management: With Tool B, you can easily manage and track your business expenses. You can categorize expenses, add receipts, and generate expense reports, providing you with a clear overview of your business expenditures.

9. User-friendly Interface: The software has a user-friendly interface that makes it easy to navigate and use all its features. Even non-accounting professionals can quickly learn and effectively utilize the software for their financial management needs.

10. Data Security: Tool B ensures the security of your financial data. It uses encryption and secure servers to protect your information from unauthorized access or loss, providing you with peace of mind.

User Reviews for Tool B

1. Easy to Use and Budget-Friendly

Tool B is an excellent piece of software for small businesses looking to simplify their financial management. Users praise its ease of use and affordability, making it a popular choice for startups and solopreneurs. With its simple interface and intuitive features, Tool B helps users stay on top of their budget and track expenses effectively.

2. Streamline Your Bookkeeping Process

One of the greatest strengths of Tool B is its bookkeeping solutions. Users appreciate how the software automates the tedious tasks of creating invoices, recording transactions, and generating financial reports. By streamlining these processes, Tool B frees up valuable time, allowing users to focus on growing their business.

3. Efficient Planning and Tracking

Tool B provides efficient planning and tracking capabilities, enabling users to stay organized and make better financial decisions. With features like budgeting tools and expense tracking, users can easily monitor their cash flow and identify areas for improvement. This level of financial visibility is highly valued by entrepreneurs looking to optimize their profit margins.

4. Cloud-Based Convenience

Users appreciate the cloud-based nature of Tool B, as it allows for easy access to financial data from anywhere and any device. Gone are the days of sifting through piles of paper receipts or being tied down to a single computer. With Tool B, you can manage your business finances on the go and stay in control of your financials no matter where you are.

5. Reliable Customer Support

Tool B has received positive reviews for its customer support. Users appreciate the prompt and helpful assistance provided by the team whenever they encounter any issues or have questions about the software. Reliable and responsive customer support ensures that users can rely on Tool B to effectively manage their accounting and tax-related tasks.

In summary, Tool B offers small businesses an easy-to-use and budget-friendly accounting software solution that streamlines bookkeeping processes, provides efficient planning and tracking capabilities, offers cloud-based convenience, and includes reliable customer support.

Comparison of Simple Planning Accounting Tools

In the world of business, accounting is a crucial aspect for small businesses to manage their finances. With the wide range of accounting software available, it can be overwhelming to choose the best one that suits your needs. To help you make an informed decision, we have reviewed and compared some of the top-rated simple planning accounting tools.

When it comes to budget planning and bookkeeping, one of the key factors to consider is ease of use. The software should provide an intuitive interface that allows businesses to easily manage their financial transactions. Additionally, it should have features such as expense tracking, invoice management, and tax solutions to help businesses stay on top of their financial obligations.

Another important aspect to consider is the software's ability to generate accurate financial reports. Small businesses rely on these reports to analyze their profit and loss, track expenses, and make informed financial decisions. It is essential that the software has robust reporting capabilities that provide comprehensive and real-time financial insights.

Time management is another crucial factor to consider when comparing simple planning accounting tools. The software should offer time-saving features such as automation of recurring tasks, easy data entry, and efficient data synchronization. This way, businesses can focus on running their operations instead of spending excessive time on manual accounting tasks.

Lastly, cost is an important consideration for small businesses. The software should have affordable pricing plans that align with the needs of the business. It should also provide value for money by offering a wide range of features and functionalities that cater to the specific requirements of the business.

In conclusion, when comparing simple planning accounting tools, it is essential to consider factors such as ease of use, accurate financial reporting, time-saving features, and cost-effectiveness. By carefully evaluating these aspects, businesses can choose the best software solution that meets their accounting needs and helps them effectively manage their finances.

Key Factors to Consider in Choosing an Accounting Tool

When selecting an accounting tool for your small business, there are several key factors to consider. Choosing the right software is crucial for efficient bookkeeping and financial management. Here are some important considerations you should keep in mind:

- Type of Business: Consider the specific needs of your business and choose an accounting software that caters to those needs. Different industries may have different requirements when it comes to tracking expenses, managing invoices, and analyzing profit margins.

- Features and Functionality: Look for software solutions that offer the features and functionalities that are important to you. This may include options for tracking time and expenses, budgeting, generating financial reports, and managing taxes.

- User-Friendliness: Ensure that the accounting tool you choose is intuitive and easy to use. It should have a user-friendly interface that allows you to navigate and perform tasks efficiently, even if you don't have a background in accounting.

- Cloud-Based: Consider opting for a cloud-based accounting software. This allows you to access your financial data from anywhere and at any time, as long as you have an internet connection. Cloud-based solutions also offer data backup and automatic updates.

- Security: Ensure that the software you choose has robust security measures in place to protect your financial data. Look for features such as encryption, data backup, and secure user authentication to safeguard sensitive information.

- Integration: Check if the accounting tool integrates with other software or apps that you currently use. Integration can streamline your business processes by allowing data to flow seamlessly between different systems, such as your CRM or e-commerce platform.

- Support and Training: Consider the level of support and training provided by the software provider. Look for resources such as online tutorials, documentation, and customer support channels to ensure that you can effectively use the software and troubleshoot any issues that may arise.

- Reviews and Recommendations: Before making a decision, read reviews and seek recommendations from other small business owners or professionals in your industry. Their insights and experiences can provide valuable guidance when choosing the best accounting tool for your business.

By carefully considering these key factors, you can select an accounting tool that meets your business's specific needs and enables efficient financial management and planning.

Comparison of Tool A and Tool B

When it comes to simple and easy-to-use solutions for small business bookkeeping and accounting, Tool A and Tool B are among the top choices. Both tools aim to help businesses track their expenses, manage their budget, and plan for future financial needs.

One key difference between Tool A and Tool B is their approach to cloud-based accounting. Tool A offers a cloud-based platform, allowing users to access their financial data from anywhere and at any time. This can be especially beneficial for businesses with remote teams or multiple locations. On the other hand, Tool B is a desktop-based software, which can provide an added layer of security for businesses concerned about cloud-based data storage.

Another important consideration is the ease of use. Tool A prides itself on its user-friendly interface, making it easy for even non-accounting professionals to navigate and understand. It offers features like easy-to-create invoices, tracking of financial transactions, and the ability to generate accurate profit and loss statements. Tool B also offers similar features, however, some users may find it slightly more complex to navigate compared to Tool A.

When it comes to reviews, both Tool A and Tool B have received positive feedback from users. Many users appreciate the simplicity and efficiency of Tool A, praising its ability to help them save time and stay organized. Tool B, on the other hand, has been praised for its comprehensive reporting capabilities and advanced features, making it a popular choice for businesses with more complex financial needs.

Finally, let's talk about taxes. Tool A offers built-in tax calculators and tax preparation features, making it easier for businesses to stay compliant with tax regulations. Tool B also offers tax-related features, but some users may find it necessary to integrate it with other tax software to get a more comprehensive solution.

In conclusion, both Tool A and Tool B offer simple and effective accounting solutions for small businesses. The choice between the two will depend on factors such as cloud-based preferences, ease of use, specific business requirements, and the need for tax-related features. It's advisable to consider these factors and read more reviews to determine which tool is the best fit for your business.

Features Comparison

When choosing the best simple planning accounting software for your small business, it is important to compare the features offered by different solutions. Here are some key features to consider:

- Expenses Tracking: Look for software that allows you to easily track your business expenses and categorize them for accurate bookkeeping.

- Invoicing: Check if the software provides easy invoice creation and management tools, allowing you to send professional invoices to your clients.

- Cloud-Based: Consider cloud-based solutions that offer convenient access to your financial data from anywhere, ensuring seamless business management.

- Budget Planning: Look for software that helps you create and monitor your business budget, allowing you to make informed financial decisions.

- Profit Analysis: Check if the software provides tools to track and analyze your business's profit margins, helping you identify areas for improvement.

- Time Management: Consider software that allows you to efficiently manage your time by automating repetitive accounting tasks.

- Easy to Use: Look for software that offers a user-friendly interface and requires minimal training to get started.

- Financial Reporting: Check if the software provides customizable financial reports, enabling you to gain insights into your business's financial performance.

By comparing the features of different accounting software based on your business needs, you can find the best solution that meets your requirements, streamlines your financial management, and helps your business thrive.

Pricing Comparison

When it comes to financial and business solutions, finding the right software at the right price is crucial. As small businesses strive to keep track of their expenses, taxes, and profit, having a simple and easy-to-use accounting software is essential. There are several options available in the market that offer various pricing plans, ensuring that businesses of all sizes can find a solution that suits their budget.

One popular choice for small businesses is cloud-based accounting software. These solutions offer affordable monthly subscription plans, allowing businesses to access their financial data anytime, anywhere. With features like budget management, time tracking, and expense tracking, these software solutions provide all the tools necessary for efficient bookkeeping.

For businesses looking for more advanced features and customization options, there are also on-premises accounting software solutions available. These often come with a higher upfront cost but can be more cost-effective in the long run for businesses with specific needs. These solutions provide comprehensive financial management capabilities, making it easier to handle complex financial tasks.

When comparing pricing plans, it's essential to consider the features included in each package. Some software solutions offer additional modules or add-ons for an extra cost, allowing businesses to tailor their accounting software to their specific requirements. Reviewing the pricing structures, customer reviews, and ratings can help businesses make an informed decision and find the best accounting software within their budget.

Ultimately, choosing the right accounting software is crucial for small businesses to streamline their financial management processes. By considering the pricing options, features, and customer reviews, businesses can find an accounting software that offers the best value for money and meets their unique business requirements.

Final Thoughts on Simple Planning Accounting Software

In conclusion, when it comes to managing your small business's finances, having a reliable and easy-to-use accounting software is crucial. Simple Planning Accounting Software is a top-rated tool that has received positive reviews for its cloud-based features and user-friendly interface. It provides a simple and efficient way to track your expenses, create invoices, and manage your budget.

With Simple Planning Accounting Software, you can easily keep track of your income and expenses, allowing you to stay organized and make informed financial decisions for your business. The software also offers helpful features for bookkeeping, making it easier to manage your financial records and ensure accurate tax filings.

One of the standout features of Simple Planning Accounting Software is its ability to generate detailed financial reports. These reports provide you with a comprehensive overview of your business's financial health, including information on your profit, expenses, and taxes. This can be extremely beneficial for planning and forecasting future growth.

Another advantage of Simple Planning Accounting Software is its simplicity. The software is designed to be intuitive and easy to use, even for those with limited accounting knowledge. This means that you don't need to spend a lot of time or effort to get started and can focus more on running your business.

In conclusion, if you're looking for a simple and effective accounting software to manage your small business's finances, Simple Planning Accounting Software is an excellent choice. Its user-friendly interface, cloud-based features, and efficient financial management tools make it a top-rated option for businesses of all sizes.