When it comes to financial compliance, government contractors must adhere to a set of stringent requirements and regulations. As part of this process, the Defense Contract Audit Agency (DCAA) conducts audits to review contractors' accounting systems for compliance with federal policies and procedures.

An essential aspect of this audit is the verification of the contractor's internal accounting system. The DCAA uses a comprehensive checklist to assess the adequacy and reliability of the contractor's accounting controls, processes, and documentation.

The checklist covers various aspects of the contractor's accounting system, including general ledger review, financial statement review, timekeeping controls, contract pricing procedures, and indirect cost rates. The DCAA also examines the contractor's compliance with government reporting requirements, such as the submission of incurred cost proposals and the accuracy of financial data.

During the audit, the DCAA evaluates the contractor's financial and accounting policies, procedures, and internal controls to ensure they are in line with government regulations. This includes assessing the contractor's ability to maintain accurate financial records, properly allocate costs, and provide adequate supporting documentation.

Ultimately, the DCAA accounting system audit checklist serves as a crucial tool for both the government and contractors to ensure compliance and accountability. By thoroughly reviewing and assessing the contractor's accounting system, the DCAA helps maintain the integrity of the government's financial reporting while providing contractors with valuable insights into areas for improvement.

DCAA Accounting System Audit Checklist: A Comprehensive Guide

In order to ensure compliance with federal government regulations and financial reporting requirements, it is essential for government contractors to undergo an accounting system audit. The Defense Contract Audit Agency (DCAA) is responsible for conducting these audits to verify the reliability of a company's accounting system.

The DCAA Accounting System Audit Checklist acts as a comprehensive guide for auditors to review the internal controls, processes, procedures, and policies of a company's accounting system. The checklist covers various aspects of the accounting system, including general ledger, accounts payable, accounts receivable, payroll, and indirect costs.

During the audit, the DCAA will carefully review the company's accounting software, documentation, and records to ensure compliance with government regulations and reporting requirements. They will verify the accuracy and completeness of financial data, assess the effectiveness of internal controls, and evaluate the company's ability to provide reliable financial information.

The checklist includes a thorough examination of the company's compliance with government regulations, such as the Federal Acquisition Regulation (FAR) and Cost Accounting Standards (CAS). The auditors will review the company's policies and procedures to determine if they align with these regulations and ensure proper financial management.

Additionally, the DCAA will evaluate the company's system for tracking and allocating costs to various contracts. This includes verifying that costs are properly segregated and allocated in accordance with contract terms, as well as ensuring accurate and timely reporting of indirect costs.

Overall, the DCAA Accounting System Audit Checklist is an essential tool for government contractors to prepare for and successfully navigate the audit process. By following this comprehensive guide, companies can ensure that their accounting systems are compliant with government regulations and capable of providing accurate financial information for federal contracts.

What is DCAA?

The Defense Contract Audit Agency (DCAA) is a federal agency responsible for conducting audits of government contracts and providing accounting and financial advisory services to the Department of Defense (DoD) and other federal agencies. The DCAA ensures that contractors comply with government reporting and accounting procedures to maintain the integrity of the procurement process.

The DCAA's main role is to conduct audits of government contractors' financial statements, systems, and internal controls to ensure compliance with federal regulations, government policies, and contractual requirements. These audits are conducted to verify the accuracy and reliability of the contractors' financial and accounting systems, as well as to detect any potential fraud or mismanagement of government funds.

The DCAA's audit process includes a comprehensive review of the contractor's accounting system, which involves assessing the adequacy of internal controls, evaluating the effectiveness of financial reporting and disclosure practices, and examining compliance with specific government regulations and contract terms. This audit is essential to ensure that contractors are accurately reporting costs, allocating expenses, and maintaining proper documentation.

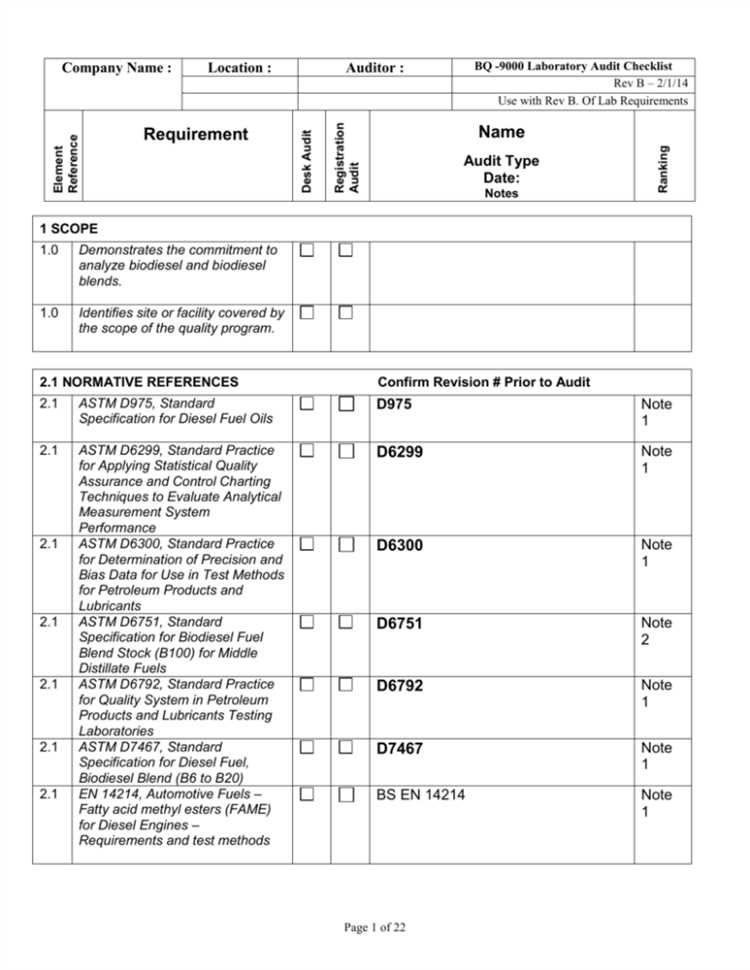

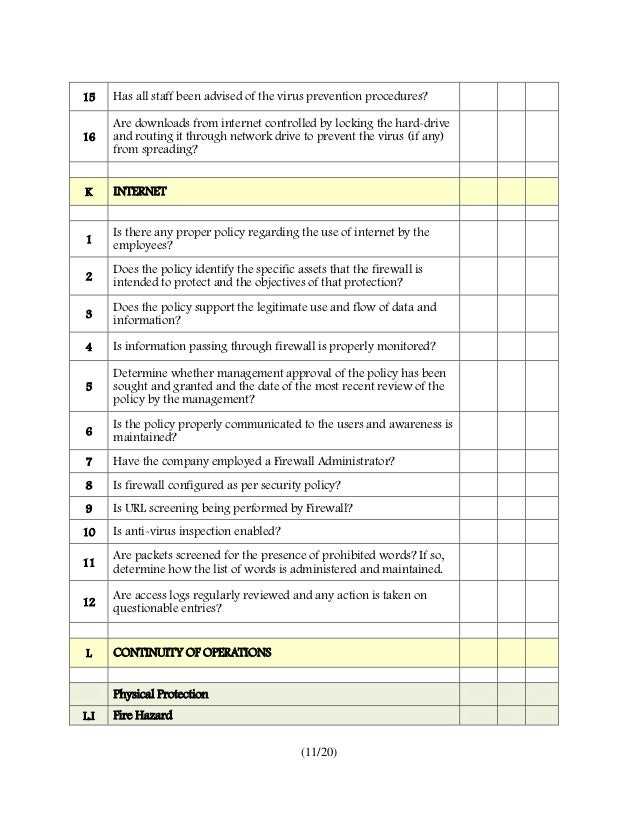

The DCAA's accounting system audit checklist serves as a guide for auditors to review the contractor's accounting system for compliance with applicable regulations and to identify any potential weaknesses or areas of non-compliance. It covers various aspects of the accounting system, such as general ledger maintenance, timekeeping procedures, cost accumulation methodologies, contract cost reporting, and cost estimating practices. The checklist helps auditors to systematically review and evaluate the contractor's accounting system, ensuring its reliability and compliance with established standards.

Overall, the DCAA plays a critical role in ensuring the financial accountability and transparency of government contracts. Its audits and reviews help to safeguard taxpayer dollars, promote fair competition, and maintain the integrity of the procurement process.

Importance of DCAA Accounting System Audit

An accounting system audit conducted by the Defense Contract Audit Agency (DCAA) is of utmost importance for any business that has contracts with the federal government. This audit ensures that the company's accounting system is in compliance with the financial reporting requirements and regulations set by the government.

The DCAA accounting system audit serves as an external review of the company's accounting practices, controls, and procedures. It aims to verify the accuracy, reliability, and integrity of financial data and ensure that the company's accounting system is capable of producing reliable financial reports.

By conducting this audit, the DCAA helps the government to ensure that taxpayer dollars are being used appropriately and that contractors are not mismanaging funds. The audit process includes a thorough examination of the company's accounting system documentation, internal controls, policies, and procedures to ensure they are in line with federal regulations.

The DCAA accounting system audit checklist is a valuable tool in guiding the audit process. It provides a comprehensive list of requirements that need to be addressed and verified during the audit. This checklist ensures that the auditors cover all necessary areas and helps identify any potential areas of non-compliance or weakness in the company's accounting system.

In conclusion, the DCAA accounting system audit plays a crucial role in ensuring the financial integrity of government contracts. It helps verify that the company's accounting system is sound and that it complies with all federal regulations. This audit not only benefits the government but also provides assurance to the company's stakeholders that proper financial controls are in place.

Benefits of a Comprehensive Audit Checklist

A comprehensive audit checklist provides several benefits for businesses, both internal and external. It ensures compliance with government requirements, particularly for federal contracts, and helps maintain financial reporting accuracy.

Firstly, an audit checklist helps businesses identify and address any areas of non-compliance or potential risks. By reviewing internal policies, documentation, and accounting procedures, companies can ensure that all necessary controls are in place to meet government requirements.

Secondly, a comprehensive audit checklist allows for a systematic review and verification of accounting systems and processes. This helps identify weaknesses or inefficiencies in the system, enabling businesses to implement improvements and corrective actions.

Additionally, the use of a well-designed audit checklist helps establish consistent and standardized reporting procedures. This enhances the transparency and reliability of financial information, both for internal decision-making and external stakeholders.

Moreover, an audit checklist serves as a valuable tool during external audits conducted by government agencies or third-party auditors. It provides a clear framework for conducting the audit and ensures that all necessary information and documentation are readily available.

In summary, a comprehensive audit checklist is an essential tool for businesses to ensure compliance with government requirements, improve internal controls, enhance financial reporting accuracy, and facilitate external audits. It helps businesses identify and address areas of non-compliance and provides a systematic approach to reviewing and verifying accounting systems and processes. By implementing a well-designed audit checklist, companies can effectively meet their obligations and maintain the trust of the government and other external stakeholders.

Preparing for the DCAA Accounting System Audit

Preparing for a DCAA (Defense Contract Audit Agency) accounting system audit is essential for any company that wants to do business with the Federal Government. This comprehensive audit verifies that a company's accounting system is in compliance with the regulations and requirements set by the government.

One of the first steps in preparing for the audit is to establish internal controls within the accounting system. This includes implementing policies and processes that ensure accuracy, reliability, and compliance with federal financial reporting requirements. It is important to review these controls regularly to identify and address any potential weaknesses or gaps in the system.

Documentation also plays a vital role in preparing for the DCAA accounting system audit. Companies should maintain detailed and organized records of their financial transactions, policies, procedures, and any other relevant documentation. This documentation should be easily accessible and up to date in order to facilitate the audit process.

During the audit, the DCAA will thoroughly review the company's accounting system to ensure compliance with federal regulations. This includes evaluating the effectiveness of internal controls, reviewing financial statements and reports, and assessing the overall reliability of the system. Any discrepancies or non-compliance issues will be identified and addressed by the DCAA.

By diligently preparing for the DCAA accounting system audit, companies can ensure that their accounting systems are in compliance with federal regulations and capable of accurately reporting financial information to the government. This compliance not only allows them to do business with the Federal Government but also establishes a level of trust and reliability in their financial operations.

Gathering and Organizing Financial Records

To ensure proper controls and compliance with federal accounting regulations, the DCAA (Defense Contract Audit Agency) conducts audits of government contractors' accounting systems. One critical aspect of this audit is the review of the financial records and documentation. Therefore, it is imperative for organizations to have efficient processes in place for gathering and organizing financial records.

The first step in this process is to establish a comprehensive checklist of the required financial records and documentation. This checklist should cover all the necessary information that will be reviewed during the audit. It is crucial to consult the DCAA's guidance and the applicable government regulations to ensure that the checklist is complete and up to date.

Once the checklist is established, organizations should develop and implement internal procedures and policies to ensure the timely collection and organization of the financial records. These procedures should outline the responsibilities of different personnel involved in the process, as well as the specific timelines for gathering and organizing the records.

Organizations should also consider using electronic systems or software that can help streamline the gathering and organizing of financial records. These systems can provide a centralized database for storing financial information, making it easier to access and review when needed. Additionally, they can automate certain processes, such as data entry and record keeping, reducing the likelihood of errors and ensuring consistency.

It is important to note that external verification of the financial records may be required during the DCAA audit. Therefore, organizations should have processes in place to facilitate this verification, such as maintaining supporting documentation and providing access to external auditors when necessary.

In conclusion, gathering and organizing financial records is a crucial aspect of maintaining compliance with government accounting requirements. By implementing efficient processes and utilizing appropriate systems, organizations can ensure that their financial records are readily available for audit and that they meet the standards set by the DCAA.

Creating an Audit Trail

An audit trail is an essential component of a strong accounting system that helps ensure compliance with government regulations and requirements. It is a documented record of all processes, procedures, and controls implemented within an organization to track and verify financial transactions, making it easier to review and assess the accuracy and integrity of accounting data.

To create an effective audit trail, organizations should follow a checklist that includes key steps and requirements. This checklist should cover aspects such as establishing clear policies and procedures, maintaining proper documentation of all financial transactions, and implementing internal controls to prevent fraud and errors.

One crucial aspect of creating an audit trail is the reporting process. Organizations should regularly generate comprehensive reports detailing all financial activities, including income, expenses, assets, and liabilities. These reports should be reviewed both internally and externally, ensuring transparency and accuracy in financial reporting.

Documentation plays a vital role in creating an audit trail. Proper documentation of financial transactions, such as invoices, receipts, and bank statements, helps to provide evidence and verification. This documentation should be organized and easily accessible, allowing for efficient audit reviews and inquiries.

In addition to internal controls, organizations should also consider external verification. This can involve having an independent accounting firm conduct periodic audits to ensure compliance with federal regulations and industry best practices. These external audits provide an unbiased review of the organization's accounting system, identifying areas for improvement and strengthening overall financial controls.

Overall, creating an audit trail is a critical part of maintaining accounting system compliance. It involves implementing processes, controls, and documentation to track and verify financial transactions. By adhering to a comprehensive checklist, organizations can establish a robust audit trail that meets government requirements and helps ensure the integrity of their financial reporting.

Ensuring Accuracy of Financial Data

In the context of government audits and compliance with federal regulations, it is imperative for organizations to have accurate financial data. This accuracy is not only important for the sake of transparency and accountability but also for the overall integrity of the organization's financial reporting.

One of the key aspects of ensuring the accuracy of financial data is through the conduct of regular internal audits. These audits involve a thorough review of the organization's financial processes, controls, and procedures. The use of an audit checklist can help in systematically reviewing and verifying the accuracy of financial data. This checklist should encompass various aspects such as the documentation of accounting policies, verification of financial transactions, and adherence to government regulations.

Additionally, organizations should also consider obtaining external audits from reputable auditing firms. These external audits can provide an unbiased and independent assessment of the organization's financial data. External audits can help identify any discrepancies or irregularities in the financial reporting, providing assurance to stakeholders and regulatory authorities.

Furthermore, the implementation of robust internal controls is crucial in ensuring the accuracy of financial data. These controls should include processes and procedures that are designed to prevent and detect errors or fraud. Regular monitoring and evaluation of these controls can help in identifying weaknesses and implementing necessary improvements to minimize the risk of inaccurate financial data.

Compliance with government regulations is another vital aspect of ensuring the accuracy of financial data. Organizations must stay updated with the latest regulations and ensure that their accounting systems and processes are in line with these requirements. This includes proper classification and recording of transactions, adherence to reporting standards, and the timely submission of required financial reports.

In conclusion, ensuring the accuracy of financial data involves a combination of internal and external reviews, adherence to regulations, and the implementation of robust controls and procedures. By conducting regular audits, continuously monitoring internal processes, and staying compliant with government regulations, organizations can maintain the accuracy and integrity of their financial data.

Reviewing Policies and Procedures

As part of the DCAA accounting system audit checklist, the review of policies and procedures is a crucial step in ensuring compliance with internal and federal requirements. The accounting system should have documented policies and procedures that outline the processes for financial reporting, accounting controls, and verification of compliance with regulations.

The review should assess whether these policies and procedures are comprehensive and address all necessary areas of the accounting system. This includes evaluating the documentation for clarity, completeness, and accuracy. It is important that the accounting system follows consistent processes and that the policies and procedures are communicated effectively to relevant personnel.

The review should also evaluate the effectiveness of the internal controls outlined in the policies and procedures. These controls help to ensure the accuracy and reliability of the financial information generated by the accounting system. The review should verify that these controls are being implemented and followed correctly.

In addition to internal requirements, the review should also assess the accounting system's compliance with external federal regulations. This includes ensuring that the policies and procedures align with relevant laws and regulations, such as the Federal Acquisition Regulation (FAR) and the Defense Federal Acquisition Regulation Supplement (DFARS).

Overall, the review of policies and procedures plays a crucial role in assessing the effectiveness and reliability of the accounting system. It helps to ensure that the system follows established processes, maintains proper documentation, and operates in compliance with internal and external requirements.

Evaluating Compliance with Federal Regulations

When evaluating compliance with federal regulations, it is crucial to thoroughly assess the documentation and controls within an accounting system. This involves a comprehensive review of the system's procedures, accounting policies, and financial processes. A checklist can be used to ensure that all necessary requirements are met.

The evaluation should include an examination of both internal and external verification processes. Internal controls should be in place to ensure that all transactions are accurately recorded and reported. This includes regular reviews of the accounting system to verify its accuracy and effectiveness. Additionally, external reporting requirements, such as those mandated by the government, should be carefully reviewed to ensure compliance.

The evaluation should also consider whether the accounting system meets the specific regulations and requirements set forth by the federal government. This includes assessing whether the system has the necessary features and functionality to accurately capture and report financial information. Compliance with federal regulations is essential to avoid penalties and maintain the organization's integrity.

Identifying Weaknesses and Areas for Improvement

When conducting a DCAA accounting system audit, it is crucial to identify weaknesses and areas for improvement in order to ensure compliance with federal requirements. One of the main goals of the audit is to evaluate the efficiency and effectiveness of the accounting system. This includes assessing the internal controls, financial reporting processes, and documentation verification.

During the audit, the DCAA reviews the company's accounting policies and procedures to determine if they comply with government regulations. This involves examining the adequacy of the company's financial reporting systems, as well as the accuracy and completeness of the financial records. Any discrepancies or deficiencies in the accounting system can be identified through this process.

The DCAA audit checklist provides a comprehensive framework for evaluating the company's accounting system. It outlines the specific requirements and standards that the company must meet in order to be in compliance with federal regulations. By following this checklist, the DCAA can identify any gaps or weaknesses in the company's accounting system.

Once weaknesses and areas for improvement are identified, the company can take steps to address them. This may involve implementing new internal controls, improving documentation procedures, or enhancing financial reporting processes. By doing so, the company can strengthen its accounting system and ensure compliance with federal requirements.

It is important to note that the DCAA accounting system audit is not only an internal process. The results of the audit can also be used by external parties, such as government agencies or potential investors, to assess the company's financial integrity. Therefore, identifying weaknesses and areas for improvement is not only crucial for compliance, but also for maintaining the company's reputation and credibility.

Implementing Best Practices for the DCAA Audit

In order to successfully pass a DCAA audit, it is crucial for government contractors to implement best practices for their accounting systems. The Defense Contract Audit Agency (DCAA) conducts audits to ensure that contractors meet the necessary requirements for financial compliance and reporting. By following the proper procedures and guidelines, contractors can improve their chances of passing the audit and maintaining a good relationship with the government.

One of the first steps in implementing best practices for the DCAA audit is to review and understand the applicable regulations and requirements. This includes familiarizing oneself with the Federal Acquisition Regulations (FAR) and the DCAA's audit manual. By having a clear understanding of the regulations, contractors can ensure that their accounting system documentation and processes are in line with the government's expectations.

It is also important for contractors to establish strong internal controls and policies. This involves implementing procedures that provide verification, review, and oversight of financial transactions. Contractors should have documented processes for capturing and recording financial data, as well as a system for monitoring and detecting errors or irregularities.

External audits can be stressful, but by implementing best practices, contractors can streamline the DCAA audit process and minimize potential issues. Contractors should ensure that their accounting system and documentation comply with the DCAA's checklist and that they have appropriate controls and policies in place. By staying organized and prepared, contractors can establish a strong foundation for a successful audit and build trust with the government.

In conclusion, implementing best practices for the DCAA audit is essential for government contractors. By understanding the regulations and requirements, establishing strong internal controls and policies, and staying organized and prepared, contractors can improve their chances of passing the audit and maintaining a positive relationship with the government. By following these guidelines, contractors can ensure that their accounting system meets the necessary standards for financial compliance and reporting.

Establishing Internal Controls

Establishing strong internal controls is essential for organizations to ensure compliance with government regulations, particularly in the realm of federal accounting. These controls encompass a set of requirements and procedures that aim to safeguard financial transactions, prevent fraud, and maintain the accuracy of financial reporting.

As part of the DCAA accounting system audit checklist, organizations must have proper documentation in place to demonstrate the implementation and effectiveness of their internal controls. This documentation may include policies, procedures, and other supporting materials that outline the organization's processes and controls.

One key element of internal controls is the establishment of clear and well-defined accounting processes. This includes defining roles and responsibilities, segregating duties, and implementing checks and balances to minimize the risk of errors or fraudulent activities. Internal controls should also ensure that all financial transactions and reporting adhere to relevant accounting regulations and guidelines.

In addition, internal controls should include mechanisms for ongoing monitoring and verification. This can involve regular internal audits to assess the effectiveness of controls and identify areas for improvement. These audits may be conducted by internal staff or external auditors to provide independent verification of the organization's compliance with accounting and financial regulations.

A comprehensive internal controls checklist may include items such as conducting regular reconciliations, maintaining proper documentation for all financial transactions, implementing secure IT systems, enforcing a segregation of duties policy, and regularly reviewing and updating internal control procedures.

Establishing strong internal controls is crucial for organizations to ensure compliance with government regulations and maintain the integrity of their financial systems. By implementing effective controls and regularly reviewing and updating them, organizations can minimize the risk of errors, fraud, and non-compliance, and enhance the overall reliability and accuracy of their financial reporting.

Segregation of Duties

The segregation of duties is an important aspect of a DCAA accounting system audit. It refers to the distribution of financial processes and responsibilities among different individuals to reduce the risk of fraud, error, or misuse of resources. Effective segregation of duties helps ensure compliance with federal regulations and provides reliable financial reporting for external review.

In order to achieve proper segregation of duties, companies should establish clear policies and procedures that outline the specific roles and responsibilities of each employee involved in the accounting system. This documentation should include information on who has access to financial information, who can authorize transactions, and who is responsible for recording and reconciling financial data.

Furthermore, it is crucial to implement internal controls and processes that enforce segregation of duties. This can be achieved by implementing checks and balances, such as requiring multiple approvals for certain transactions, segregating duties between those who authorize and those who execute transactions, and conducting periodic reviews to ensure compliance.

- Develop and enforce policies and procedures that clearly define the roles and responsibilities of employees within the accounting system.

- Implement internal controls and processes that enforce segregation of duties, such as requiring multiple approvals for certain transactions.

- Assign different individuals to handle key functions of the accounting system, such as recording transactions, reconciling accounts, and preparing financial reports.

- Regularly review and update documentation to ensure it aligns with current regulations and requirements.

- Perform periodic audits to assess the effectiveness of segregation of duties and identify any potential weaknesses or areas for improvement.

By following these guidelines and ensuring proper segregation of duties, companies can establish a robust accounting system that meets DCAA requirements and provides accurate and reliable financial reporting.

Documenting Policies and Procedures

Having well-documented policies and procedures is crucial for government contractors to ensure compliance with federal regulations and requirements. These documents outline the processes and controls in place for financial reporting and internal auditing.

A comprehensive checklist should be created to review and verify that all necessary policies and procedures are in place. This checklist should cover various areas such as accounting processes, internal controls, external audits, and reporting requirements.

Policies and procedures should be clear and specific, detailing the steps and guidelines to be followed. They should address all relevant regulations and compliance requirements to ensure accuracy and transparency in financial reporting.

Internal controls play a crucial role in maintaining the integrity of the accounting system. Policies and procedures should clearly outline the internal control measures in place, including segregation of duties, authorization procedures, and reconciliation processes.

An effective accounting system should also have procedures for external audit reviews. These procedures should outline the steps to be taken during an external audit and address any potential issues that may arise.

Regular review and update of policies and procedures are essential to ensure ongoing compliance with government regulations. This review process should involve all relevant stakeholders and should be documented to demonstrate the organization's commitment to maintaining a strong accounting system.

By documenting policies and procedures, government contractors can establish a framework for financial accountability and provide a clear roadmap for compliance with federal regulations. This documentation serves as a foundation for maintaining controls, ensuring accurate reporting, and ultimately protecting the integrity of the accounting system.

Training Employees on DCAA Requirements

Training employees on DCAA (Defense Contract Audit Agency) requirements is essential for ensuring proper accounting and reporting procedures in federally funded contracts. The DCAA has established specific guidelines for contractors to follow in order to maintain compliance with government regulations.

During the training process, employees should be educated on the necessary procedures and processes required for accurate financial reporting. This includes understanding the verification and documentation process, as well as the importance of thorough review and adherence to DCAA regulations.

Employees should also be trained on how to effectively utilize the accounting system, including the use of appropriate policies and controls. They should understand the significance of maintaining accurate and reliable financial data, as this will be subject to external audits by the DCAA.

The training should emphasize the significance of internal controls in ensuring compliance with DCAA requirements. Employees should be familiarized with the various controls and procedures necessary to protect the integrity of financial data and ensure its accuracy.

Furthermore, employees should be educated on the specific checklist used by the DCAA during their audits. This checklist outlines the specific requirements and documentation that will be reviewed by the agency. Familiarity with this checklist will help employees in understanding the areas that may be subject to scrutiny during an audit.

In summary, training employees on DCAA requirements is crucial for maintaining compliance with government regulations in federal contracts. By ensuring that employees understand the necessary procedures, controls, and documentation, contractors can minimize the risk of non-compliance and successfully navigate the audit process.

Ensuring Proper Timekeeping and Labor Distribution

Proper timekeeping and labor distribution are critical aspects of accounting for government contracts in compliance with federal regulations. These processes ensure accurate and reliable financial reporting and help maintain transparency and accountability in the use of government funds.

To ensure proper timekeeping and labor distribution, it is essential to have well-defined accounting policies and procedures in place. These policies should outline the requirements and expectations for recording and allocating employee time and labor costs to specific projects or cost objectives. They should also address any government-specific regulations and reporting requirements, such as the Defense Contract Audit Agency (DCAA) guidelines.

A comprehensive internal control system should be implemented to enforce these policies and procedures. This may include measures such as timekeeping software or systems, training programs, and regular review and verification of recorded time and labor distribution. Regular audits should be conducted to ensure compliance with internal controls and identify any areas of improvement or non-compliance.

Documentation and record-keeping are crucial components of the timekeeping and labor distribution process. The system should maintain accurate and up-to-date records of employee timesheets, project codes or cost objectives, and the associated labor costs. These records should be easily accessible for internal or external audits and must be retained for the required period as per government regulations.

By following a thorough checklist for timekeeping and labor distribution, organizations can establish a robust accounting system that meets government compliance requirements. This will not only ensure accurate financial reporting but also help build trust and credibility with government agencies and stakeholders.

Maintaining Accurate and Timely Cost Accumulation

Accurate and timely cost accumulation is crucial for a company's compliance with government regulations, specifically with the requirements set by the DCAA (Defense Contract Audit Agency). To ensure compliance, companies must establish and follow proper procedures for internal accounting and reporting.

Internally, companies should maintain a well-documented accounting system that adheres to the federal regulations and controls. This system should include clear processes for recording and accumulating costs, as well as policies for verification and review. It is important to have strong internal controls in place to prevent errors and discrepancies in cost accumulation.

Government audits and external reviews may be conducted to assess the accuracy and reliability of a company's cost accumulation. During these audits, the DCAA will review the accounting system and its documentation to ensure that it meets the required standards. Companies should be prepared to provide evidence of compliance with the DCAA's checklist to avoid any penalties or legal issues.

Accurate and timely cost accumulation is essential for proper government contract management. It allows companies to track their expenses and allocate costs appropriately, ensuring that they are properly compensated for the work performed. Furthermore, accurate cost accumulation helps companies identify any potential cost overruns or inefficiencies, allowing them to take corrective actions in a timely manner.

In conclusion, maintaining accurate and timely cost accumulation requires companies to have a robust accounting system that aligns with government regulations and controls. By following proper procedures and documentation, companies can ensure compliance with the DCAA's checklist and avoid any potential audit issues. Accurate cost accumulation is not only crucial for compliance but also for effective contract management and financial decision-making within the organization.

Conducting a Mock DCAA Audit

Conducting a mock DCAA audit can help federal contractors prepare for the real audit process and ensure their accounting systems meet the requirements set forth by the Defense Contract Audit Agency (DCAA). This type of audit simulates the external review of a company's accounting controls, processes, and documentation to assess compliance with government regulations and policies.

The first step in conducting a mock DCAA audit is to review the DCAA accounting system checklist. This checklist outlines the specific requirements and areas that will be evaluated during the audit. It includes a comprehensive list of financial controls, reporting procedures, and internal processes that must be in place to ensure compliance.

During the mock audit, the company's accounting system will be assessed for compliance with these requirements. This will involve a thorough examination of the company's financial records, documentation, and policies to verify that they align with the DCAA's guidelines. The audit team will review the company's internal controls, procedures, and reporting practices to ensure they meet the necessary standards.

Any deficiencies or areas of non-compliance that are identified during the mock audit can be addressed before the actual DCAA audit takes place. This provides an opportunity for the company to correct any issues and make necessary improvements to their accounting system. It allows the company to identify any potential weaknesses or gaps in their financial processes and take proactive measures to address them.

Conducting a mock DCAA audit is an essential step for federal contractors to ensure they are prepared for the actual audit process. By identifying any areas of non-compliance or deficiencies in their accounting system, companies can improve their internal controls and processes to meet the DCAA's requirements. This readiness will help them pass the actual audit with confidence and maintain compliance with government regulations.

Testing the Effectiveness of Internal Controls

Testing the effectiveness of internal controls is an essential step in ensuring compliance with external requirements, especially when it comes to federal regulations for government contractors. The verification of the adequacy and reliability of a company's accounting system is crucial to demonstrate compliance and maintain proper financial reporting.

An internal control system encompasses a range of processes, documentation, and procedures designed to maintain accurate financial records and prevent fraud. To assess the effectiveness of these controls, a thorough review and audit must be conducted, focusing on various aspects such as segregation of duties, authorization processes, and access controls.

A comprehensive checklist can guide auditors in conducting an in-depth examination of internal controls. The checklist should include a series of questions and objectives aimed at verifying compliance with relevant regulations and identifying any weaknesses in the system. It may cover areas such as cash management, inventory control, accounts receivable and payable, and financial statement reconciliations.

During the testing process, auditors may perform procedures such as walkthroughs, testing of transactions, and sample reviews to evaluate the effectiveness of internal controls. This may involve requesting documentation, assessing the adequacy of segregation of duties, and performing data analysis to identify any irregularities or inconsistencies.

The overall goal of testing internal controls is to ensure that the accounting system accurately records transactions, provides reliable financial information, and protects against potential risks. By identifying weaknesses or gaps, companies can implement necessary improvements and strengthen their internal control environment to ensure compliance and maintain the integrity of financial reporting.

Identifying Areas for Improvement

When conducting an audit of a DCAA accounting system, it is important to identify areas for improvement to ensure compliance with government regulations and requirements. This involves evaluating the organization's policies, processes, and internal controls to pinpoint any weaknesses or gaps that could impact its financial reporting and overall compliance.

The audit checklist serves as a tool for the auditor to review documentation and verify the organization's adherence to federal accounting standards. By conducting a thorough review of the accounting system, auditors can identify areas where the organization may need to make improvements to ensure proper financial reporting and compliance with government regulations.

One area that may require improvement is the organization's internal controls. The audit checklist will help identify any control deficiencies or weaknesses that could lead to misstatements in financial reporting. By addressing these issues, the organization can strengthen its internal controls and minimize the risk of non-compliance.

Additionally, the audit may uncover areas where the organization's accounting processes can be streamlined or enhanced. This could involve automating certain tasks, implementing better record-keeping practices, or improving the accuracy and timeliness of financial reporting.

The organization should also assess its compliance with government accounting regulations and requirements. The audit checklist will highlight any areas where the organization may be falling short of these standards, providing an opportunity for corrective action.

In conclusion, the DCAA accounting system audit checklist is a comprehensive tool for identifying areas where an organization may need to make improvements in its policies, processes, reporting, and internal controls. By addressing these areas, the organization can ensure compliance with federal regulations and improve its overall financial reporting and accountability.

Reviewing Compliance with DCAA Policies

During an accounting system audit, it is crucial to review the documentation and processes to ensure compliance with DCAA policies and regulations. This review involves examining the internal controls, accounting procedures, and reporting processes in place to verify that they meet the requirements set forth by the government.

One key aspect of reviewing compliance is to assess whether the accounting system adequately captures and records all financial transactions according to DCAA guidelines. This includes verifying that the system has proper controls and procedures in place to prevent errors, inaccuracies, or fraud.

Additionally, the audit checklist should include an evaluation of the system's ability to produce accurate and reliable financial reports. This involves examining the reporting processes and ensuring that they align with federal reporting requirements. The auditor should also verify that the system can generate the specific reports necessary to demonstrate compliance with government policies.

The review should extend beyond the internal documentation and processes to include an examination of any external verification or oversight. This may involve assessing how the accounting system interacts with external auditors or agencies, such as the DCAA. The goal is to ensure that the system has the necessary mechanisms in place to support external audit reviews and to facilitate the sharing of relevant information.

In conclusion, reviewing compliance with DCAA policies during an accounting system audit requires a comprehensive assessment of the documentation, controls, procedures, and reporting processes in place. This evaluation is essential to ensure that the system meets the government's requirements and can accurately demonstrate compliance with applicable regulations.

Addressing Noncompliance Issues

Addressing noncompliance issues is crucial for organizations to maintain regulatory compliance and ensure the accuracy and integrity of their financial reporting. Noncompliance can occur when requirements, policies, or procedures are not followed, resulting in inadequate controls or inaccurate accounting practices. It is essential to promptly address any noncompliance issues and take appropriate corrective actions to avoid potential financial and legal consequences.

One key aspect of addressing noncompliance issues is through verification and review processes. Organizations need to establish robust internal controls and regularly monitor and review their accounting systems to identify any deviations from regulatory requirements or internal policies. External audits may also be conducted by government agencies or independent auditors to assess compliance with federal regulations and identify any noncompliance issues.

When noncompliance issues are identified, organizations should thoroughly investigate the root causes and develop corrective action plans. This may involve revising accounting procedures, strengthening internal controls, or providing additional training to employees to ensure future compliance. Clear documentation of these corrective actions is essential for demonstrating to auditors or regulatory agencies that appropriate measures have been taken.

In some cases, noncompliance issues may extend beyond internal practices and require collaboration with external stakeholders. Organizations may need to communicate with government agencies or regulatory bodies to address noncompliance issues and provide necessary documentation or reports. This collaborative approach helps to ensure transparency and accountability in addressing noncompliance and establishes trust between the organization and the governing authorities.

To prevent future noncompliance issues, organizations should regularly review and update their accounting systems, procedures, and controls to align with changing regulations and industry best practices. Conducting periodic internal audits can help identify any potential noncompliance issues and allow for timely corrective actions. Additionally, organizations should promote a culture of compliance through training programs, communication channels, and clear reporting mechanisms to encourage employees to report any potential noncompliance concerns.