In today's fast-paced technological world, managing financial transactions and asset valuation in the real estate industry is becoming increasingly complex. Real estate professionals are seeking innovative solutions to streamline their trust accounting processes, ensuring accurate and efficient bookkeeping. The advent of cloud-based accounting software has revolutionized the way trust accounting is done, offering flexible and comprehensive solutions for real estate management.

Trust Accounting Solutions provide the ideal software for real estate professionals looking to optimize their financial management processes. This software offers a wide range of features, including transaction recording, portfolio analysis, and cashflow management, all specifically tailored for the unique needs of the real estate industry. With Trust Accounting Solutions, users can easily track and manage their investment portfolio, ensuring accurate valuation of assets and seamless tax accounting.

One of the key advantages of Trust Accounting Solutions is its ability to integrate with other real estate management software. This seamless integration allows users to synchronize data across various platforms, ensuring a holistic approach to property management. Additionally, Trust Accounting Solutions offers customizable dashboards and reporting features, allowing users to visualize and analyze financial data in a clear and concise manner.

With Trust Accounting Solutions, real estate professionals can rest assured that their trust accounting needs are met with a reliable and efficient software solution. Say goodbye to the tedious and error-prone manual bookkeeping processes and embrace the benefits of cutting-edge technology. Experience the ease and convenience of Trust Accounting Solutions and unlock the full potential of your real estate business.

What is Real Estate Trust Accounting Software?

Real Estate Trust Accounting Software is a specialized financial solution designed for managing and tracking trust accounts in the real estate industry. It provides a comprehensive set of tools for bookkeeping, reporting, and transaction management, tailored specifically to the unique needs of real estate investment and asset management firms.

The software enables efficient management of a portfolio of real estate assets, allowing users to track and analyze the financial performance of each property in the trust. It facilitates accurate valuation and tax reporting by automating the calculation of property values and generating relevant financial reports for tax purposes.

With Real Estate Trust Accounting Software, users can easily manage trust transactions, such as rent collection, bill payments, and disbursements. The software also provides features for tracking and managing property repairs and maintenance, ensuring that all expenses are properly accounted for.

One of the key benefits of Real Estate Trust Accounting Software is its ability to securely store and manage sensitive financial data in the cloud. This allows multiple users to access and update information in real time, ensuring that all stakeholders have the most up-to-date information at their fingertips.

Overall, Real Estate Trust Accounting Software is an essential tool for professionals in the real estate industry, providing a centralized solution for managing trust accounts, financial reporting, and transaction management. It streamlines the complex processes involved in real estate investment and asset management, improving efficiency and accuracy in financial operations.+

Why is Real Estate Trust Accounting Software Important?

Real estate trust accounting software is a crucial tool for the efficient management of real estate transactions. Whether you are a real estate investor, a property manager, or an accountant, having the right software is essential for accurate bookkeeping and financial reporting.

Trust accounting is a specialized branch of accounting that deals with the tracking, recording, and reporting of financial transactions related to trust funds. In the real estate industry, trust accounting software is particularly important as it helps manage complex financial operations associated with property transactions and investments.

The software enables efficient tracking and management of income and expenses, ensuring accurate taxation and financial reporting. It simplifies the process of recording and reconciling financial transactions, allowing real estate professionals to maintain an accurate record of their assets and liabilities.

Furthermore, real estate trust accounting software provides essential tools for asset valuation and investment analysis. It enables users to track the performance of their real estate portfolio, assess the profitability of different properties, and make informed investment decisions.

Cloud-based trust accounting solutions offer the additional advantage of remote access and collaboration. Users can access their financial data from anywhere and collaborate with their team members in real-time. This flexibility is especially beneficial for property managers and accountants who often need to access financial data while on the go.

In conclusion, real estate trust accounting software plays a vital role in ensuring accurate financial management and reporting in the real estate industry. Its features and capabilities facilitate efficient bookkeeping, asset valuation, investment analysis, and financial reporting. Investing in a reliable software solution can have a significant impact on the success of your real estate business.

Benefits of Real Estate Trust Accounting Software

1. Efficient Portfolio Management: Real estate trust accounting software allows for efficient management of the portfolio by providing tools for tracking and analyzing property performance. It enables real estate professionals to easily track and evaluate investments, cashflow, and transaction history.

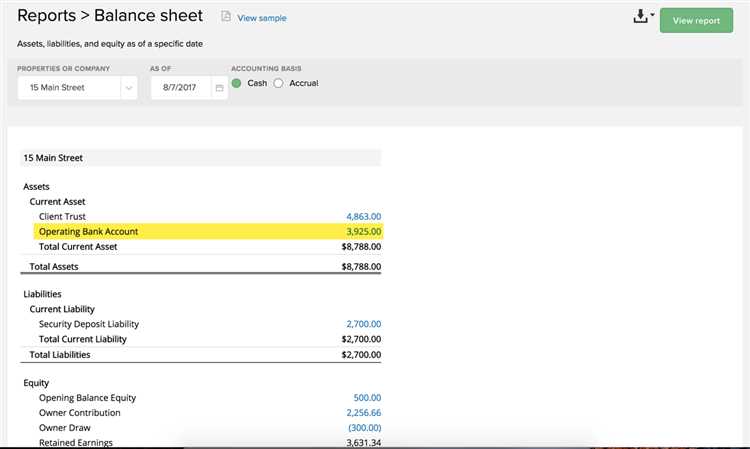

2. Accurate Financial Reporting: The software provides accurate and detailed financial reporting, ensuring compliance with accounting standards and regulations. It allows for easy generation of reports such as balance sheets, profit and loss statements, and tax reports.

3. Improved Tax Management: Real estate trust accounting software streamlines the tax management process by automating tasks such as tracking expenses, deductibles, and generating tax documentation. It helps ensure tax compliance and reduces the risk of errors.

4. Comprehensive Analysis and Valuation: The software offers tools for comprehensive analysis and valuation of real estate assets. It allows for accurate property valuation, investment analysis, and provides insights into the performance of individual properties or the entire portfolio.

5. Cloud-Based Access: Many real estate trust accounting software solutions are cloud-based, providing users with the convenience of accessing their financial data and reports from anywhere, anytime. This enables real estate professionals to stay connected and make informed decisions on the go.

6. Efficient Trust Accounting: The software automates trust accounting processes, such as managing trust accounts, reconciling transactions, and tracking disbursements. It reduces the manual effort involved in bookkeeping and ensures accurate and up-to-date trust accounting records.

7. Streamlined Property Management: Real estate trust accounting software integrates with property management systems, enabling seamless data exchange and streamlining property management tasks. It allows for easy tracking of property-related expenses, rent collection, and tenant management.

8. Enhanced Data Security: Trust accounting software offers enhanced data security measures to protect sensitive financial information. It helps prevent unauthorized access, ensures data integrity, and provides reliable backups for disaster recovery.

9. Scalable Solution: Real estate trust accounting software is designed to accommodate the needs of growing portfolios and can efficiently handle a large volume of financial transactions. It provides scalability to support the growth and expansion of real estate businesses.

10. Time and Cost Savings: By automating various accounting and financial management tasks, real estate trust accounting software saves time and reduces operational costs. It eliminates the need for manual data entry, reduces errors, and increases overall efficiency.

Streamlined Trust Accounting Processes

Trust accounting involves managing a variety of financial transactions and records associated with trust properties. To ensure accurate reporting, accounting, and valuation of trust assets, it is essential to streamline the trust accounting processes.

Efficient Property Management

A streamlined trust accounting software enables efficient property management by automating tasks related to trust assets. The software allows property managers to easily track property details, such as location, current valuation, and rental income. It also provides tools for managing property-related transactions, including purchase, sale, and lease agreements.

Comprehensive Investment Analysis

Trust accounting software offers comprehensive investment analysis features that help in making informed financial decisions. It provides tools for evaluating the performance of trust assets, assessing the risk associated with different investments, and predicting future cashflow. With this information, trustees can optimize the trust portfolio and maximize returns.

Seamless Financial Reporting

Trust accounting software simplifies the process of generating financial reports for trust properties. It automatically tracks income, expenses, and tax liabilities, allowing for accurate and timely reporting. Trustees can easily generate custom reports, including income statements, balance sheets, and cashflow statements, to gain a clear understanding of the financial health of the trust.

Efficient Bookkeeping and Management

With trust accounting software, bookkeeping and management become more efficient. The software automates routine accounting tasks, such as recording transactions, reconciling accounts, and generating invoices. It also provides a centralized platform for storing and managing important trust documents, ensuring easy access and organization.

Cloud-Based Accessibility

Cloud-based trust accounting software offers the advantage of accessibility from anywhere and at any time. Trustees can access the software from their preferred devices, allowing for remote management of trust properties. This cloud-based approach also ensures data security and backup, so trustees never have to worry about losing valuable financial information.

In conclusion, streamlining trust accounting processes with the help of dedicated software can significantly improve the efficiency and accuracy of managing trust assets. With features like efficient property management, comprehensive investment analysis, seamless financial reporting, efficient bookkeeping and management, and cloud-based accessibility, trust accounting software provides the necessary tools to ensure effective financial management for real estate trusts.

Accurate and Timely Financial Reporting

Accurate and timely financial reporting is a crucial aspect of managing real estate trust accounting. Without a reliable solution, financial reporting can become a challenging and time-consuming task for property management companies and real estate investment firms.

A trusted accounting software can streamline the entire process of financial reporting, allowing for accurate and up-to-date information to be easily accessed and analyzed. This software can handle various accounting tasks such as bookkeeping, asset management, investment valuation, and tax reporting.

With the help of advanced trust accounting software, property managers can efficiently track financial transactions related to real estate investments. This includes rent collection, property expenses, mortgage payments, and more. The software can also provide detailed financial analysis and reporting, ensuring accurate portfolio valuation and investment performance tracking.

Cloud-based trust accounting solutions offer the added advantage of being accessible from anywhere, at any time. This allows property managers and investors to have real-time access to financial reports, ensuring that they are always informed about the financial health of their real estate portfolio.

In summary, accurate and timely financial reporting is essential for effective real estate trust accounting. By using reliable accounting software, property management companies and real estate investment firms can streamline their financial processes, ensuring accurate bookkeeping, analysis, and reporting of their property transactions. This, in turn, allows for better decision-making and overall portfolio management.

Improved Compliance and Transparency

With the advancement of technology, real estate trust accounting software has become an essential tool for ensuring improved compliance and transparency in financial reporting. This software enables estate managers to efficiently track and manage their portfolio of properties, investments, and transactions, ensuring accurate and up-to-date financial records.

By utilizing trust accounting software, estate managers can easily calculate and file accurate tax returns, ensuring compliance with regulatory requirements. Automated features such as automatic cash flow analysis, asset valuation, and real-time reporting enable managers to make informed decisions about their investments and effectively manage their finances.

Additionally, trust accounting software provides a cloud-based solution that allows for secure and convenient access to financial information from anywhere, at any time. This feature enhances transparency and ensures that all stakeholders have access to the necessary information for decision-making and auditing purposes.

The software also facilitates easy collaboration and communication among different departments and stakeholders, further improving transparency in financial reporting. With centralized access to financial data, estate managers can provide accurate and timely reports to investors, shareholders, and regulatory authorities.

In conclusion, trust accounting software plays a crucial role in improving compliance and transparency in estate management. With its advanced features and cloud-based solution, it enables accurate financial reporting and fosters better communication and collaboration. By implementing trust accounting software, estate managers can streamline their processes, enhance compliance, and provide stakeholders with reliable and transparent financial information.

Key Features to Look for in Real Estate Trust Accounting Software

When it comes to managing the financial aspect of real estate transactions and investments, having the right trust accounting software is crucial. Here are some key features to look for in real estate trust accounting software:

1. Cashflow Management

Real estate trust accounting software should provide robust cashflow management capabilities. This includes features such as tracking income and expenses, generating cashflow reports, and forecasting future cashflows. With a comprehensive cashflow management tool, you can easily monitor your financial position and make informed decisions.

2. Property and Asset Management

The software should offer property and asset management features that allow you to track and manage your real estate portfolio effectively. This includes features such as property valuation, lease management, maintenance tracking, and tenant management. Having a centralized platform to manage all your properties and assets simplifies your operations and ensures efficient management.

3. Transaction and Financial Analysis

A crucial feature to look for in real estate trust accounting software is the ability to perform transaction and financial analysis. This includes features such as investment analysis, ROI calculations, and portfolio performance tracking. With these tools, you can evaluate the profitability of your investments and identify areas for improvement.

4. Cloud-Based Solution

Opt for a cloud-based real estate trust accounting software as it provides flexibility and accessibility. With a cloud-based solution, you can access your financial data and reports anytime, anywhere, as long as you have an internet connection. This ensures that you can stay on top of your real estate finances even when you're on the go.

5. Trust Accounting and Bookkeeping

Of course, a key feature to look for in real estate trust accounting software is trust accounting and bookkeeping capabilities. This includes features such as trust account reconciliation, general ledger management, and financial reporting. These tools ensure accurate and compliant financial records, which is crucial for real estate businesses.

By considering these key features when choosing real estate trust accounting software, you can find a solution that meets your specific needs and helps you streamline your financial management processes. Investing in the right software can save you time, reduce errors, and provide valuable insights to make informed decisions.

Integration with Real Estate Management Systems

When it comes to managing your real estate investments, having an integrated trust accounting solution is essential. Integration with real estate management systems allows you to streamline your financial and operational processes, improving efficiency and accuracy.

By integrating your trust accounting software with your real estate management system, you can easily analyze and report on your investment portfolio. This integration enables you to track cashflow, property valuation, and asset management in one centralized solution.

With integrated trust accounting, you can efficiently manage all your financial transactions, including lease management, sales, and acquisitions. The system automatically tracks and records these transactions, providing accurate and up-to-date financial data for bookkeeping and reporting purposes.

Furthermore, integration with real estate management systems enables seamless integration with other financial tools, such as tax software. This integration ensures that your trust accounting system is always in sync with the latest tax regulations and reporting requirements.

Cloud-based integration allows you to access your trust accounting solution from anywhere, at any time. This flexibility is especially valuable for real estate professionals who frequently work remotely or manage properties in different locations.

In conclusion, integration with real estate management systems is crucial for effective trust accounting. It allows for comprehensive financial analysis, accurate reporting, and streamlined operations. With a fully integrated solution, you can confidently manage your real estate investments and stay ahead in the ever-changing financial landscape.

Automation of Trust Accounting Transactions

Trust accounting involves the bookkeeping and financial management of trust funds, ensuring accurate and efficient handling of cashflow, investments, valuations, assets, and portfolios. With the automation of trust accounting transactions, real estate professionals can streamline their processes, saving time and improving accuracy.

Trust accounting software provides a comprehensive solution for managing the complex transactions associated with trust accounting. It allows for seamless recording, tracking, and reconciliation of transactions, ensuring that all financial activities are accurately recorded and organized.

One of the key benefits of automating trust accounting transactions is the ability to generate detailed reports and analysis. Trust accounting software can generate financial statements, tax reports, and transaction reports with ease, providing real estate professionals with the necessary information for effective financial planning and decision-making.

Cloud-based trust accounting software offers additional advantages by providing remote access and real-time updates. This allows real estate professionals to access their trust accounting information from any location and collaborate with team members. Additionally, cloud-based software ensures data security and backup, protecting sensitive financial information.

Automation of trust accounting transactions also simplifies property management. With trust accounting software, real estate professionals can easily track rental income, expenses, and property valuation, allowing for efficient management of their real estate portfolio. They can also automate various processes, such as fee calculations and fund distributions, reducing administrative tasks and freeing up time for more strategic activities.

In conclusion, automation of trust accounting transactions is essential for real estate professionals to streamline their financial management processes. Trust accounting software provides a real-time, cloud-based solution for recording, tracking, and analyzing trust transactions, offering improved efficiency, accuracy, and collaboration. By utilizing such software, real estate professionals can focus on their core business activities and make informed financial decisions based on accurate and up-to-date information.

Customizable Reporting and Analytics

When it comes to real estate trust accounting, accurate and timely reporting is crucial. With a customizable reporting and analytics software, you can easily generate detailed reports and analysis to gain insights into the financial health of your real estate trust.

This software allows you to track various financial metrics such as cashflow, asset valuation, tax liabilities, and portfolio performance. You can create custom reports tailored to your specific needs, whether it's for internal bookkeeping or external reporting to stakeholders and investors.

With customizable reporting and analytics, you have the flexibility to analyze your real estate trust's financial data in various ways. You can generate reports based on different time periods, property types, or investment strategies. This allows you to gain a comprehensive understanding of your trust's performance and make informed decisions for future investment opportunities.

Furthermore, the software provides real-time updates and dashboards, which enable you to closely monitor the financial health of your trust. You can easily track incoming and outgoing cashflows, identify potential risks, and assess the profitability of different properties within your portfolio.

By utilizing a customizable reporting and analytics software, you can streamline your real estate trust accounting processes and ensure accurate financial reporting. This solution not only saves you time but also helps you make data-driven decisions for optimal trust management and investment strategies.

Choosing the Right Real Estate Trust Accounting Software

When it comes to managing financial assets in the real estate industry, having the right software solution is crucial. Real estate trust accounting software provides analysis, tax reporting, and bookkeeping capabilities that are specific to the needs of trust managers and property investors.

One of the key features to consider when choosing real estate trust accounting software is its ability to handle cashflow management. The software should allow users to track income and expenses, generate financial statements, and provide real-time updates on the financial health of the trust.

Another important aspect to consider is the software's valuation capabilities. A good trust accounting solution should be able to accurately value real estate assets and provide detailed reports on their performance. This is especially important for investors who rely on accurate asset valuation for decision-making.

The software should also provide transaction management functionality, allowing users to easily record and track all financial transactions related to the trust. This includes recording property sales, acquisitions, and rental income. The ability to generate comprehensive reports on these transactions is crucial for tax reporting and audit purposes.

Cloud-based solutions are becoming increasingly popular in the real estate industry, and trust accounting software is no exception. Cloud-based software offers the advantage of easy access from any device with an internet connection, as well as automatic updates and backups. This ensures that trust managers have access to the most up-to-date information at all times.

In conclusion, when choosing real estate trust accounting software, it is essential to consider its cashflow management, asset valuation, transaction management, and cloud-based capabilities. By selecting the right software solution, trust managers and property investors can streamline their financial operations and make informed decisions based on accurate and up-to-date data.

Evaluating Your Trust Accounting Needs

When evaluating your trust accounting needs, it is important to consider the specific requirements of your real estate portfolio and financial management. Trust accounting software should be able to handle various types of transactions, such as property acquisitions and sales, rent payments, and expense tracking. It should also have robust reporting capabilities to provide a comprehensive view of your trust's financial performance and cashflow.

Furthermore, the software should be able to handle both real estate and non-real estate investments, allowing you to accurately track the value and performance of your entire asset portfolio. This includes conducting investment analysis and valuation, as well as generating tax reports and statements. A comprehensive trust accounting solution should also have integrated bookkeeping features, ensuring accurate and up-to-date financial records for tax and regulatory compliance.

In addition to these core functionalities, it is important to evaluate the scalability and flexibility of the trust accounting software. As your real estate portfolio grows, you may need a solution that can handle a larger number of properties and transactions. Likewise, if you diversify your investment strategy, the software should be able to accommodate different asset types and investment structures.

Finally, consider the user interface and ease of use of the trust accounting software. It should provide an intuitive and user-friendly experience, allowing you to navigate and access the necessary information efficiently. Look for a software solution that offers training and support to ensure a smooth transition and implementation process.

Comparing Software Options

1. Trust Accounting Solutions

Trust Accounting Solutions offers a comprehensive software solution for real estate trust accounting. Their software provides accurate valuation and tracking of property assets, enabling users to effectively manage their financial portfolios. The software also helps streamline the accounting process by automating cashflow analysis, tax reporting, and bookkeeping tasks.

2. Cloud-based Accounting Software

Cloud-based accounting software is a popular choice for real estate investment firms. This type of software allows users to access their financial data from anywhere, making it ideal for remote teams or professionals who travel frequently. Additionally, cloud-based software often includes features such as real-time transaction tracking and portfolio analysis, providing users with up-to-date information on their investments and property transactions.

3. Financial Management Software

Financial management software is another option for real estate trust accounting. This type of software focuses on providing users with a holistic view of their financial situation, including asset valuation, cashflow management, and investment analysis. It often includes advanced reporting capabilities, allowing users to generate detailed financial reports for tax purposes or to share with stakeholders.

4. Property Management Software

Property management software can also be used for real estate trust accounting. While it primarily focuses on managing rental properties, some property management software includes trust accounting features. This type of software is especially useful for organizations that have a mix of trust and non-trust accounts, as it allows for centralized management of both types of financial transactions.

5. Custom-built Software Solutions

In some cases, organizations may opt for custom-built software solutions for their real estate trust accounting needs. These solutions are tailored to meet specific requirements and can be built from scratch or modified from existing software. Custom-built software offers the advantage of flexibility and scalability, as it can be adapted to the organization's unique needs and can grow with the business over time.

Overall, when comparing software options for real estate trust accounting, it's important to consider factors such as the specific needs of the organization, the complexity of the financial transactions, and the scalability of the software. Finding the right software solution is integral to efficient and accurate trust accounting in the real estate industry.

Reading User Reviews and Recommendations

When it comes to finding the best cloud-based financial software for trust accounting, reading user reviews and recommendations can provide valuable insights. Trust accounting software is designed to streamline the management of financial transactions related to trusts, estates, investments, and properties. By reading user reviews, you can gain a better understanding of the software's strengths and weaknesses and make an informed decision about which solution is right for your needs.

One aspect that users often comment on is the reporting capabilities of the trust accounting software. Reporting is an essential feature for tracking the performance and financial health of your trust. A good software should offer comprehensive reporting options, including real-time data, tax reporting, and investment portfolio analysis. User reviews can help you evaluate the reporting features of different software solutions and determine if they meet your specific reporting needs.

Another important aspect to consider when reading user reviews is the software's asset valuation and bookkeeping capabilities. Trust accounting software should enable accurate tracking and valuation of assets, whether it's real estate properties, cashflow, or other investment assets. Users may comment on the software's ability to track and record asset transactions, generate accurate financial statements, and streamline the bookkeeping process.

User reviews can also shed light on the overall user experience and ease of use of the trust accounting software. It's important to find a software solution that is user-friendly and intuitive, as this will save you time and effort when managing your trust's finances. Look for reviews that mention the software's user interface, navigation, and ease of entering and retrieving data.

Furthermore, user reviews can provide insight into the level of customer support and satisfaction with the software provider. Trust accounting software is an important financial tool, and it's crucial to have a reliable support team that can assist you with any technical issues or questions that arise. Reviews that mention responsive customer support and positive experiences with the software provider can give you confidence in choosing a trustworthy solution.

In summary, reading user reviews and recommendations is an essential step in finding the best trust accounting software. Look for reviews that cover reporting capabilities, asset valuation and bookkeeping features, user experience, and customer support. By considering the experiences of other users, you can make an informed decision and find a trust accounting software that meets your specific needs and preferences.

Top Real Estate Trust Accounting Software Solutions

Managing trust accounting for real estate transactions can be a complex task. Fortunately, there are many software solutions available to help streamline the process and ensure accurate and efficient financial management. Here are some of the top real estate trust accounting software solutions:

1. Reporting and Analysis Software

Real estate trust accounting software with advanced reporting and analysis features can provide valuable insights into financial performance. These solutions can generate customizable reports that allow users to track cashflow, analyze portfolio performance, and evaluate property valuations. This information can be crucial for making informed financial decisions and optimizing asset management.

2. Cloud-based Trust Accounting Solution

A cloud-based trust accounting solution offers a convenient and secure way to manage real estate trust accounting. With cloud software, users can access their accounts and financial data from anywhere, at any time. This flexibility is especially beneficial for real estate professionals who need to work remotely or collaborate with team members in different locations.

3. Transaction Management Software

Real estate trust accounting software with transaction management capabilities can streamline the process of handling trust transactions. These solutions often include tools for tracking and reconciling incoming and outgoing funds, managing trust accounts, and automating bookkeeping tasks. This can help minimize errors and ensure accurate and timely financial records.

4. Tax and Compliance Management Tools

Trust accounting software that integrates tax and compliance management features can simplify the process of fulfilling tax obligations and adhering to regulatory requirements. These tools can automate calculations, generate tax forms, and provide guidance on compliance issues. This helps real estate professionals stay on top of their financial responsibilities and avoid costly penalties.

5. Asset and Portfolio Management Software

Real estate trust accounting software with asset and portfolio management capabilities can help real estate professionals effectively manage their investments. These solutions offer tools for tracking and analyzing property performance, assessing risk, and monitoring market trends. This information is crucial for making informed investment decisions and optimizing portfolio performance.

Choosing the right real estate trust accounting software solution is important for ensuring accurate and efficient financial management. Consider your specific needs and requirements, and compare different options to find the software that best suits your business. With the right software in place, you can streamline your trust accounting processes and focus on growing your real estate portfolio.

Software A

Software A is a comprehensive trust accounting solution designed for real estate professionals. With its advanced reporting and transaction tracking capabilities, it simplifies the management of trust accounts, ensuring accurate and timely financial information for both trustors and beneficiaries.

One of the key features of Software A is its trust property valuation module. This allows users to accurately calculate the value of trust assets, taking into account factors such as market conditions, property condition, and recent sales in the area. This information is crucial for making informed investment decisions and for tax compliance purposes.

The software also includes robust bookkeeping functionality, allowing users to easily track income and expenses related to trust accounts. This includes features such as automated bank reconciliation, expense categorization, and tax preparation tools. By automating these processes, Software A reduces the risk of errors and saves valuable time for real estate professionals.

Furthermore, Software A provides users with detailed analysis and reporting capabilities. Users can generate financial reports, cashflow statements, and portfolio performance reports, providing a comprehensive view of the financial health of trust accounts. With its cloud-based architecture, these reports can be accessed from anywhere, ensuring real-time visibility into trust account performance.

In conclusion, Software A is a powerful and versatile trust accounting software solution for real estate professionals. Its robust features, including trust accounting, property valuation, bookkeeping, and financial reporting, make it an essential tool for managing trust accounts and ensuring compliance with tax regulations. By streamlining accounting processes and providing valuable insights, Software A enables real estate professionals to make informed investment decisions and effectively manage their trust portfolios.

Software B

Software B is a comprehensive real estate trust accounting solution that offers a range of features to help manage your cashflow and financial transactions for real estate investments. With its intuitive interface and powerful functionality, this software is designed to streamline your bookkeeping processes and provide detailed insights into your real estate portfolio.

This software is capable of handling all types of real estate assets, including both residential and commercial properties. Whether you own a single property or a large investment portfolio, Software B can effectively track and manage your financial transactions, taking into account various factors such as rental income, expenses, and tax implications.

One of the key benefits of Software B is its cloud-based nature, allowing you to access and manage your trust accounting data from anywhere, at any time. This ensures that you are always up-to-date with your financial information and can make informed decisions about your real estate investments.

In addition to its robust accounting capabilities, Software B also provides valuable reporting and analysis tools. You can generate comprehensive financial reports, track the performance of your assets, and even perform valuation analysis to determine the value of your real estate investments.

Overall, Software B offers a complete solution for real estate trust accounting. Its powerful features, user-friendly interface, and cloud-based functionality make it an ideal choice for real estate professionals looking to streamline their financial management processes and maximize their investment returns.

Software C

Software C is a versatile and efficient real estate trust accounting software that provides a comprehensive solution for asset and trust management. With advanced accounting features, it offers seamless cashflow management, investment tracking, and portfolio analysis.

With Software C, users can easily handle trust accounting tasks such as transaction recording, bookkeeping, and financial reporting. Its user-friendly interface allows for efficient data entry and ensures accurate calculations.

In addition, Software C offers robust reporting capabilities, including tax reporting and valuation analysis. Users can generate detailed reports on property transactions, income, expenses, and trust distributions. This helps users maintain compliance with financial regulations and facilitates informed decision-making.

Software C also provides cloud-based access, allowing users to securely access their trust accounting information from any device with an internet connection. This ensures real-time collaboration and data synchronization among team members.

Overall, Software C is a powerful tool for real estate trust accounting, offering a solution that streamlines financial management and provides comprehensive reporting and analysis capabilities.

Selecting the Best Real Estate Trust Accounting Software for Your Needs

When it comes to managing the financial aspects of real estate trusts, having the right accounting software is essential. With numerous options available on the market, it can be overwhelming to choose the best software for your specific needs. Here are some key factors to consider when selecting real estate trust accounting software.

Cashflow and Reporting:

One of the most important features of trust accounting software is its ability to track and manage cashflow. Look for software that offers comprehensive reporting capabilities, allowing you to analyze income and expenses, generate financial statements, and monitor the overall financial health of your trusts.

Accounting and Tax Compliance:

Trust accounting software should have robust accounting functionalities, including the ability to handle complex transactions and maintain accurate records. It should also have built-in tax compliance features, ensuring that your trusts remain in line with the applicable tax laws and regulations.

Investment and Portfolio Management:

If you have multiple real estate assets held within your trusts, it's important to choose software that can handle portfolio management. Look for features such as asset valuation, investment analysis, and performance tracking to effectively manage your real estate investments.

Trust and Property Management:

The ideal real estate trust accounting software should also offer functionalities for trust and property management. This includes features such as lease management, rental tracking, maintenance scheduling, and tenant communication. These tools help streamline property management tasks and ensure smooth operations.

User-Friendly Interface and Integration:

An intuitive and user-friendly interface is crucial for easy navigation and efficient use of the software. Additionally, consider the software's compatibility with other systems you currently use. Integration with existing software, such as CRM or property management tools, can streamline processes and enhance overall efficiency.

By carefully considering these factors, you can select the best real estate trust accounting software that meets your specific needs. Remember to assess your requirements, compare different solutions, and choose a software that aligns with your goals and objectives.