The payment landscape is constantly evolving, and businesses are constantly exploring different ways to manage their financial transactions efficiently. Stripe has emerged as a leading payment platform, offering a range of features to streamline the payment process for businesses of all sizes. One such feature is the ability to use multiple payout accounts, providing businesses with enhanced flexibility and customization options.

With Stripe's dashboard, businesses can easily manage their financial accounts and track transactions in a centralized location. The platform offers automation and integration capabilities, allowing businesses to connect with various banking and financial management systems seamlessly. This ensures that businesses can streamline their payout processes and focus on other essential aspects of their operations.

Using multiple payout accounts with Stripe offers an added layer of security and control. By splitting funds across different accounts, businesses can mitigate risks and reduce the impact of potential security breaches. Furthermore, businesses can tailor their payout processes based on specific requirements or configurations, ensuring that funds are distributed efficiently and accurately.

Integration with Stripe's API enables businesses to fully customize their payout process. Organizations can define rules and conditions, automate reconciliation processes, and set up customized notifications. This level of customization empowers businesses to design a payout system that suits their unique needs and workflows, ultimately saving time and reducing operational costs.

Setting Up Multiple Payout Accounts with Stripe

Managing multiple payout accounts with Stripe is a simple and efficient process that allows businesses to customize their payment system according to their specific needs. With the extensive range of features available on the Stripe dashboard, businesses can easily set up and manage multiple payout accounts.

Customization is key when it comes to managing payments, and Stripe offers a variety of options to tailor the payout process to suit your business requirements. By utilizing the Stripe API, businesses can integrate their own platform with Stripe, ensuring a seamless and streamlined experience for both the business and its customers.

One of the main benefits of setting up multiple payout accounts with Stripe is the ability to have separate accounts for different banking or financial operations. This allows businesses to easily reconcile transactions and keep track of their funds across various accounts. Furthermore, Stripe provides in-depth reporting and analytics, giving businesses full visibility into their payout accounts and transactions.

When it comes to security, Stripe prioritizes protecting financial data and ensuring the safety of sensitive information. With industry-leading security measures in place, businesses can trust that their payout accounts and credentials are well-protected. Additionally, Stripe's system offers a high level of encryption, reducing the risk of unauthorized access to banking and financial information.

Overall, setting up multiple payout accounts with Stripe is a simple and effective way for businesses to manage their payments. With a comprehensive range of features and customization options, businesses can fully integrate Stripe into their operations, providing a seamless experience for both themselves and their customers.

Overview

The automation of transactions is an essential aspect of modern financial systems. With the increasing demand for customization and integration, platforms like Stripe provide a comprehensive solution for businesses to manage their payment processes efficiently. Stripe offers a secure and user-friendly dashboard that allows users to connect multiple payout accounts and streamline the reconciliation of transactions.

By enabling multiple payout accounts, businesses can easily allocate funds to different banking systems or financial institutions. This flexibility ensures efficient distribution of funds, while also enhancing security by allowing businesses to use separate credentials for each account. Stripe's API provides seamless integration with various platforms, enabling businesses to leverage the power of automation in their payment processes.

One of the benefits of using multiple payout accounts is the ability to customize reports according to specific business needs. With Stripe's reporting features, businesses can generate detailed insights and analytics for each account, helping them make informed decisions based on accurate financial data. This level of customization ensures that businesses have a clear overview of their payment activities across different accounts.

In summary, Stripe's support for multiple payout accounts offers businesses a powerful platform for managing their payment processes efficiently. By providing integration, customization, and reporting capabilities, Stripe empowers businesses to streamline their financial operations and enhance security in their banking systems.

Step 1: Create a Stripe Account

Creating a Stripe account is the first step towards setting up multiple payout accounts. Stripe is a popular payment platform that offers a wide range of customization options, reporting capabilities, and high-level security features.

With a Stripe account, you can easily manage and track your transactions, integrate with various systems and platforms through their API, and automate the payment process. Stripe also provides a user-friendly dashboard that allows you to monitor your payout system and access detailed information about your accounts.

To create a Stripe account, you will need to provide some basic information and complete a quick registration process. Once your account is set up, you can add multiple banking accounts for payouts. These accounts can be customized based on your needs, allowing you to easily manage your funds and streamline the reconciliation process.

Stripe takes security seriously and provides robust security measures to protect your credentials and financial data. Their platform is PCI compliant and offers encryption for all transactions, ensuring that your payment information is safe and secure.

By creating a Stripe account, you gain access to a powerful payment platform that supports multiple payout accounts. This allows you to have more control over your financial management and streamline the payout process for your business.

Sign up for a Stripe Account

Signing up for a Stripe account is the first step to enable multiple payout accounts and access a wide range of features and services offered by the platform. Stripe is a powerful payment processing platform that provides secure and customizable online payment solutions.

To sign up for a Stripe account, visit the Stripe website and click on the "Sign up" button. You will be prompted to provide your basic information, such as your name, email address, and password. Once you have filled in the required fields, click on the "Create account" button to proceed.

After creating your account, Stripe will provide you with a set of API credentials. These credentials are important for integrating Stripe into your system and automating payment transactions. You can find your API credentials in the Dashboard under the "Developers" section.

Stripe's platform offers robust management and customization options for your multiple payout accounts. This allows you to easily set up and manage different bank accounts for your transactions. It also provides tools for financial reconciliation and security, ensuring that your payment processes are accurate and protected.

With Stripe, you can connect and manage multiple banking accounts for payouts. This means you can customize your payout process based on your business needs and preferences. Stripe's seamless integration with various banking systems ensures that your financial operations are efficient and streamlined.

Overall, signing up for a Stripe account allows you to access a comprehensive platform for payment processing, financial management, and customization. It provides the necessary tools and features to manage multiple payout accounts, automate transactions, and ensure the security of your financial data.

Verify Your Email

To ensure the security and financial integrity of your API integration with Stripe's multiple payout accounts system, it is essential to verify your email. Verification of your email is a crucial step in the setup process as it ensures that you are the authorized user and have access to the associated financial accounts.

Upon successful email verification, you will be able to access the full range of features and customization options offered by Stripe for managing multiple payout accounts. This includes automation of payment reconciliation, detailed reporting and analytics, and seamless integration with your existing banking and financial systems.

Verification of your email also enables you to have better control and security over your transactions. By confirming your email, you can protect your account from unauthorized access and ensure that all sensitive financial information is only accessible to authorized individuals.

Once your email is verified, you can easily navigate through the Stripe dashboard to manage and monitor all your accounts in one place. The intuitive interface allows for easy customization and configuration according to your specific requirements, making it a convenient and efficient platform for financial management.

In conclusion, the verification of your email is an essential step to ensure the security and effective usage of the multiple payout accounts system provided by Stripe. By verifying your email, you unlock a range of features and functionalities that will enable you to streamline your financial operations, enhance security, and gain better control over your transactions.

Step 2: Add Multiple Payout Accounts

To enable efficient banking and financial management, Stripe provides a seamless integration for adding multiple payout accounts to your platform. This feature allows you to have separate accounts designated for different purposes such as payment collection, reporting, or automation.

The Stripe dashboard provides a user-friendly interface where you can easily manage and customize these multiple payout accounts. You can view transaction details, set security settings, and reconcile payments with ease. Each account can have its own unique credentials and settings, ensuring the security and integrity of your financial operations.

With the Stripe platform's robust API, you can programmatically add and manage multiple payout accounts. This enables you to automate the account creation process, saving time and effort. Furthermore, you can integrate these accounts into your existing reporting and reconciliation systems, ensuring accurate and up-to-date financial information.

Adding multiple payout accounts with Stripe offers unparalleled flexibility and customization. You can create accounts for specific regions, currencies, or business units, streamlining your financial management. This feature simplifies the handling of complex payout scenarios and allows you to tailor your payment workflow to your unique business needs.

In conclusion, Stripe provides a comprehensive solution for managing multiple payout accounts. With its seamless integration, robust API, and customizable features, you can efficiently handle complex financial operations and ensure the security and accuracy of your transactions.

Go to your Stripe Dashboard

To set up and manage multiple payout accounts with Stripe, you need to access your Stripe Dashboard. The Stripe Dashboard is a comprehensive platform that allows you to have a full overview of your multiple payment accounts, transactions, and financial reporting. It serves as the central hub for all your payment and payout management needs.

With the Stripe Dashboard, you can easily integrate and reconcile transactions from multiple payment sources, streamlining your financial operations and automating your payout system. It provides a secure and reliable platform for banking and payment management, ensuring the utmost security for your financial information.

The Stripe Dashboard also offers customization options, allowing you to tailor the platform according to your specific needs. You can configure your payout accounts, set up different banking details for each account, and customize the reporting and reconciliation features. This level of flexibility and customization ensures that you have full control over your financial operations.

Additionally, the Stripe Dashboard provides a user-friendly interface and intuitive navigation, making it easy to manage and monitor your multiple payout accounts. You can access detailed financial reports, track transaction histories, and analyze payment trends. This comprehensive set of features enables efficient financial management and decision-making.

Furthermore, the Stripe API integration allows you to seamlessly connect your payout accounts to other systems or platforms, enhancing automation and streamlining your financial processes. This integration capability enables you to integrate with existing systems, such as accounting software or ERP systems, for seamless financial data transfer and synchronization.

Add a New Payout Account

When it comes to managing multiple payout accounts, Stripe provides a secure and robust system that allows you to easily add new accounts to your platform. Adding a new payout account is a straightforward process that ensures the security of your financial transactions.

To add a new payout account, start by logging into your Stripe dashboard. From there, navigate to the "Payouts" section and select the option to add a new account. Stripe integrates seamlessly with various banking institutions, allowing you to connect different accounts to your platform without any hassle.

During the setup process, you will be prompted to provide the necessary credentials for the new payout account. This includes essential details such as the account name, account number, and routing number. Stripe maintains a high level of security to protect your sensitive financial information, ensuring that only authorized individuals have access to it.

Once you have entered the required information, Stripe will verify the details provided and establish a connection with the new payout account. This process typically takes a few business days to complete to ensure the accuracy and integrity of the account information.

Once the new payout account is successfully added, you can leverage Stripe's powerful reporting and reconciliation tools to track and manage transactions made through this account. This includes customizable reporting options and automation features that streamline your financial management processes.

With Stripe's multiple payout account management capabilities, you have full control over your banking and financial operations. Whether you need to separate funds for different departments, locations, or business segments, Stripe offers a flexible and secure solution for payout account management.

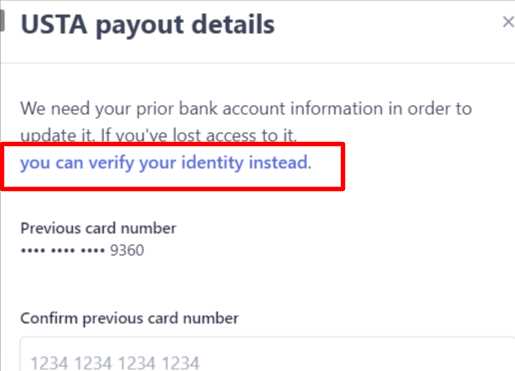

Verify the added Payout Account

Once you have added multiple payout accounts to your Stripe account, it is important to verify each account to ensure that transactions can be successfully processed.

To verify the added payout account, you will need to follow the verification process provided by your chosen financial institution or banking partner. This may involve submitting certain documentation or completing additional authentication steps.

Once the verification process is complete, you can proceed with using the multiple payout accounts for transaction management in your Stripe integration. This integration allows you to automate the payment and reporting processes, enhancing the efficiency and security of your financial system.

By utilizing multiple payout accounts, you gain greater flexibility in managing your financial transactions. This enables you to customize your payout strategy and ensure efficient reconciliation of funds across various accounts.

During the verification process, it is important to maintain the integrity and security of your account credentials. This includes protecting sensitive information related to your banking accounts and ensuring that proper authentication mechanisms are in place.

By successfully verifying your added payout accounts, you can optimize your payment infrastructure and provide a seamless experience for your customers. This verification process helps to establish trust and confidence in your platform, while also streamlining the management of your financial operations.

Step 3: Configure Payout Settings

Once you have set up your multiple payout accounts with Stripe, it is important to configure the payout settings to ensure smooth financial transactions.

Reporting and automation are key aspects of any financial accounts payout system. With Stripe's dashboard, you can easily access and monitor payout transactions in real-time. This allows for efficient reconciliation and management of your multiple payout accounts.

Stripe provides customization options for your payout settings, giving you the flexibility to tailor it to your business needs. You can easily configure the frequency of payouts and set up automated transfers to your multiple banking accounts. This saves you time and effort, eliminating the need for manual intervention.

Security is of utmost importance when it comes to financial transactions. Stripe ensures the security of your payout accounts by providing a robust platform and implementing the latest security measures. Your API credentials and payment information are securely stored and encrypted, protecting you and your customers from unauthorized access.

With Stripe's comprehensive payout management system, you can streamline your financial operations by configuring payout settings for your multiple accounts. This helps you maintain accurate records, automate processes, and ensure the smooth flow of funds across your different payout accounts.

Set Default Payout Account

The ability to set a default payout account is an important feature when using multiple payout accounts with Stripe. This ensures that funds are automatically sent to the designated banking or financial institution without the need for manual intervention.

By setting a default payout account, businesses can streamline their payout processes and reduce the risk of misdirected funds or delays. This is particularly useful for platforms that handle a large volume of payouts, such as marketplace or crowdfunding platforms.

Setting a default payout account is easy and can be done through the Stripe API or the Dashboard. This customization allows businesses to choose the most convenient and secure method for managing their payout accounts.

For businesses that prefer to use the Dashboard, they can simply navigate to the "Payouts" section and select the desired payout account as the default. This can be done by entering the necessary banking credentials or selecting an existing account from the list of connected accounts.

Alternatively, businesses can use the Stripe API to set the default payout account programmatically. This provides further flexibility and automation in managing payout accounts. With the API, businesses can integrate their own systems or use third-party tools for reporting and reconciliation purposes.

Regardless of the method chosen, setting a default payout account is a crucial step in ensuring efficient management of multiple payout accounts. It enhances security, reduces manual errors, and streamlines the overall payment process.

Specify Payout Schedule

One of the key features of using multiple payout accounts with Stripe is the ability to specify a payout schedule tailored to your business needs. With automation and API integration, you can easily set up a customized schedule for each connected account through the Stripe dashboard.

By specifying the payout schedule, you have control over when and how frequently funds are transferred from the Stripe platform to the connected accounts. This empowers you to manage the financial flow efficiently and ensures seamless banking integration.

The flexibility of the payout schedule allows you to align the transfers with your business operations and optimize cash flow. Whether you prefer daily, weekly, bi-weekly, or monthly payouts, Stripe offers the necessary tools to configure your payout schedule accordingly.

Furthermore, the comprehensive reporting and management system provided by Stripe enables you to track and monitor the payment transactions and payouts across your multiple accounts. This enhances transparency and simplifies financial reconciliation.

Stripe also prioritizes security and ensures that sensitive banking credentials are securely stored and protected. With robust encryption and compliance measures, you can trust that your payout accounts are safe and your transactions are secured within the Stripe platform.

In conclusion, specifying a payout schedule with Stripe offers customization and flexibility for seamless financial management. By utilizing the automation and integration capabilities, you can streamline your payout processes, enhance cash flow, and have peace of mind knowing that your transactions are secure and conducted with the utmost professionalism.

Manage Multiple Payout Accounts

Managing multiple payout accounts is a crucial aspect of any business operating on Stripe's platform. With the ability to have multiple accounts, businesses can easily organize their financial transactions, streamline reporting, and prioritize banking reconciliation.

Stripe provides a robust dashboard that allows users to customize their payout account management. Through the dashboard, businesses can view and access all their payout accounts, add new accounts, or delete existing ones. The user-friendly interface allows for efficient navigation and seamless integration with other payment systems.

Security is a top priority when it comes to managing multiple payout accounts. Stripe ensures data protection through encryption techniques and secure API integration. Users have the peace of mind that their financial information and credentials are safeguarded, minimizing the risk of fraud or unauthorized access.

In addition to security, Stripe offers comprehensive reporting and analytics tools. This enables businesses to gain insights into their payment transactions across all their payout accounts. Detailed reports provide information on revenue, fees, and refunds, allowing for better financial analysis and decision-making.

The management of multiple payout accounts also brings the advantage of customization. Businesses can personalize each account's settings based on their specific needs and requirements. Customizable options include currency selection, automatic transfers, and payout schedules, giving businesses full control over their banking arrangements.

With Stripe's platform for managing multiple payout accounts, businesses can efficiently handle their financial operations in a centralized and organized manner. The intuitive dashboard, coupled with extensive security measures, ensures a seamless experience for users. Whether it's reconciliation, reporting, or customization, Stripe's solution offers businesses the tools they need for effective payout account management.

Step 4: Receive Payouts

Once you have set up your multiple payout accounts with Stripe, you can start receiving payouts from your customers. Stripe provides a seamless banking and payment infrastructure to ensure smooth transaction processes.

With Stripe's advanced payment management system, you can easily track and manage your payouts. You can access all your financial data, including transactions and reconciliation reports, through Stripe's user-friendly dashboard.

To receive payouts, all you need to do is provide your banking credentials to Stripe. This enables them to securely transfer funds to your multiple payout accounts. Stripe's robust security measures ensure the safety of your financial information, giving you peace of mind.

Stripe's powerful API integration allows you to customize your payout process according to your specific business needs. You can set up automatic payouts, schedule payouts at specific intervals, or manually initiate payouts with just a few clicks.

By using multiple payout accounts, you can effectively manage and organize your financials. You can easily track the payouts associated with different branches or departments within your organization. This level of reporting and customization optimizes your financial operations.

Whether you operate an e-commerce platform, subscription-based service, or any other type of business, Stripe's multiple payout accounts feature provides a flexible and efficient solution for managing your finances. Start using Stripe today and streamline your payout processes.

Monitor Payouts

Monitoring payouts is a crucial part of managing your payment operations. With the Stripe API integration, you can easily track and monitor all your financial transactions in real time.

Stripe provides a comprehensive dashboard that allows you to view and analyze your payouts from multiple accounts in one place. The dashboard provides detailed reporting and analytics, giving you insights into your banking and financial operations.

You can set up custom alerts and notifications to ensure you stay informed about any important changes or issues with your payouts. This adds an extra layer of security and helps you proactively manage any potential risks.

With the Stripe payout monitoring system, you can easily access all your payout data, view transaction history, and monitor the status of each payout. This level of transparency and visibility enables efficient payout management and troubleshooting.

In addition to the dashboard, you can also use the Stripe API to further customize and automate your payout monitoring. With the API, you can fetch and analyze payout data programmatically, allowing you to integrate it seamlessly with your existing systems and applications.

To access the Stripe payout monitoring system, you'll need to have the appropriate credentials and permissions. This ensures that only authorized personnel can access and manage your payout accounts, adding an extra layer of security to your financial operations.

Overall, monitoring payouts with Stripe provides a powerful and efficient way to manage your payment operations. The platform offers a robust set of tools and features that enable you to track, analyze, and customize your payout processes, giving you full control over your financial transactions.