In order to effectively manage the financial operations of a nonprofit organization, it is essential to establish a well-structured chart of accounts. A chart of accounts is a systematic arrangement of all the financial transactions that an organization conducts. It provides a clear and organized framework for recording and categorizing various sources of income, expenses, assets, and liabilities.

One of the key components of a nonprofit chart of accounts is the categorization of cash and expenses. Cash accounts include all the transactions related to cash flow, such as cash receipts, disbursements, and transfers. Expenses accounts, on the other hand, include all the costs associated with the daily operations of the organization, such as salaries, rent, utilities, and supplies.

Another important aspect of a nonprofit chart of accounts is the tracking and categorization of grants. Grants are a major source of revenue for many nonprofit organizations and need to be properly recorded and monitored. By having separate accounts for each grant, organizations can accurately track the income and expenses associated with specific funding sources.

The chart of accounts also helps in the preparation of financial statements, such as the balance sheet and income statement. The balance sheet provides a snapshot of the organization's financial position at a specific point in time, including its assets, liabilities, and net worth. The income statement, on the other hand, summarizes the organization's revenue, expenses, and profit or loss over a specific period of time.

Furthermore, a well-designed chart of accounts is crucial for budgeting and financial management. It allows organizations to allocate funds effectively, monitor spending, and make informed financial decisions. Additionally, a well-organized chart of accounts makes the financial audit process smoother and more efficient, as it provides a clear record of all financial transactions.

In conclusion, a comprehensive nonprofit chart of accounts is an essential tool for effective financial management. It helps in tracking and categorizing cash, expenses, grants, and other financial transactions, as well as in preparing financial statements and managing budgets. By establishing a well-structured chart of accounts, nonprofit organizations can ensure transparency, accuracy, and accountability in their financial operations.

Understanding the Nonprofit Chart of Accounts

The nonprofit chart of accounts is a financial tool that helps organizations track and categorize their financial transactions. It provides a systematic way to organize and analyze the flow of money within a nonprofit organization. This chart is essential for accurate financial reporting, budgeting, and decision-making.

One important component of the nonprofit chart of accounts is the categorization of assets, liabilities, and equity. Assets include cash, investments, and any physical property owned by the organization. Liabilities represent any outstanding debts or obligations, such as loans or accounts payable. Equity represents the organization's net worth or financial position, calculated by subtracting liabilities from assets.

Another key element of the nonprofit chart of accounts is the categorization of revenue and expenses. Revenue includes any income earned by the organization from fundraising activities, grants, donations, and program fees. Expenses represent the costs incurred by the organization in running its programs and operations, such as staff salaries, rent, utilities, and supplies.

The nonprofit chart of accounts also includes other categories for tracking specific types of transactions, such as restricted funds, grants, and contracts. These categories help ensure accurate accounting and reporting of funds that are designated for specific purposes or have restrictions on their use.

An effective nonprofit chart of accounts is crucial for financial management and oversight. It enables organizations to generate accurate financial statements, such as the balance sheet and income statement, which provide a snapshot of the organization's financial health. It also helps in budgeting and forecasting, as it allows organizations to track income and expenses and make informed decisions about resource allocation.

Furthermore, having a well-organized and properly labeled nonprofit chart of accounts is essential during an audit or review of the organization's financial records. It allows auditors to easily follow the flow of money and verify the accuracy and completeness of financial transactions.

In conclusion, the nonprofit chart of accounts is a vital tool for financial management in nonprofit organizations. It ensures accurate tracking and reporting of financial transactions, facilitates budgeting and decision-making, and enhances transparency and accountability. By understanding and effectively utilizing the chart of accounts, nonprofits can achieve their financial goals and fulfill their mission.

What is a Chart of Accounts?

A Chart of Accounts is a statement that categorizes and organizes the financial transactions of a nonprofit organization. It provides a systematic framework for tracking and reporting the organization's income, expenses, assets, and liabilities.

In a nonprofit example, the Chart of Accounts includes specific categories for revenue sources such as grants, donations, and program fees. It also includes expense categories such as salaries, utilities, and program expenses.

By using a Chart of Accounts, nonprofit organizations can effectively track their financial transactions and generate accurate financial statements, including the balance sheet, income statement, and cash flow statement. It serves as a tool for financial management and budget planning, providing a comprehensive view of the organization's financial health.

The Chart of Accounts enables the organization to easily track grants and their associated expenses, ensuring proper allocation of funds and transparency in financial reporting. It also helps in the process of audit, simplifying the identification and verification of financial transactions.

In summary, a Chart of Accounts is an essential financial management tool for nonprofit organizations. It allows for effective tracking, reporting, and analysis of the organization's income, expenses, and assets, serving as a foundation for sound financial decision-making and ensuring accountability and transparency in financial operations.

Importance of a Chart of Accounts for Nonprofits

The chart of accounts is an essential tool for nonprofits to effectively manage their financial statements and ensure accurate financial reporting. It serves as a consistent framework that helps the organization categorize and track its financial activities, providing a clear understanding of its assets, expenses, and income.

By using a chart of accounts, a nonprofit can easily identify and track its cash flow, which is crucial for budgeting and making informed financial decisions. It allows the organization to monitor its revenue and expenses, ensuring that resources are allocated appropriately and in line with its mission and goals.

The chart of accounts also plays a vital role in facilitating financial audits. By providing a structured framework for recording financial transactions, a nonprofit can easily generate reports and supporting documentation needed for an audit. This helps ensure transparency and accountability, giving stakeholders confidence in the organization's financial management.

Furthermore, a well-designed chart of accounts enables a nonprofit to effectively analyze and report on its financial performance. It provides the foundation for generating financial statements, such as the balance sheet and income statement, which are essential for assessing the organization's financial health and making informed strategic decisions.

In summary, a chart of accounts is crucial for nonprofit organizations as it provides a clear and organized structure for recording and tracking financial transactions. It enables effective financial management, budgeting, and reporting, while also ensuring transparency and accountability. By utilizing a comprehensive chart of accounts, nonprofit organizations can better fulfill their mission and drive positive impact in their communities.

Elements of a Nonprofit Chart of Accounts

A nonprofit organization's chart of accounts is a financial management tool that helps track and categorize the organization's financial transactions. It plays a critical role in budgeting, reporting, and decision-making processes. The elements of a nonprofit chart of accounts include:

- Assets: These are the tangible and intangible resources owned by the organization, such as cash, investments, property, and equipment.

- Liabilities: These are the organization's obligations and debts that need to be repaid, like loans and accounts payable.

- Income: This category includes all the revenue the nonprofit receives, such as donations, grants, and program fees.

- Expenses: These are the costs incurred by the organization in carrying out its mission, including personnel expenses, program expenses, and administrative costs.

- Equity: Also known as net assets or fund balance, this category represents the organization's total value after deducting liabilities from assets.

- Grants: Nonprofits often receive grants from government agencies, foundations, and other organizations to fund specific projects or programs. This category helps track the funds received and expended through grants.

- Cash Flow: This section tracks the organization's inflows and outflows of cash, helping to monitor liquidity and cash management.

- Budget: The budget category includes the planned financial activities and anticipated inflows and outflows for a given period, helping the organization set financial goals and measure performance.

- Balance Sheet: This is a summary of the organization's assets, liabilities, and net assets at a specific point in time, providing a snapshot of its financial position.

- Audit: Some nonprofit organizations are required to undergo external audits to ensure compliance with financial regulations and provide stakeholders with assurance about the accuracy of financial statements.

A well-structured nonprofit chart of accounts not only helps the organization manage its finances efficiently but also provides valuable financial information to stakeholders, donors, and funding agencies. It enables accurate reporting, informed decision-making, and accountability in the financial management of the organization.

Setting Up a Nonprofit Chart of Accounts

A nonprofit organization needs a well-organized and comprehensive chart of accounts to effectively manage its financial resources. The chart of accounts serves as a roadmap for the organization's financial statements and helps ensure accurate tracking of cash flow, revenue, and expenses.

When setting up a nonprofit chart of accounts, it is essential to consider the specific needs and requirements of the organization. The chart should be tailored to capture all the necessary financial information and provide a clear representation of the organization's financial health.

The chart of accounts typically includes categories such as cash accounts, revenue sources, expenses, grants, and assets. These categories help organize the financial data into meaningful groups and make it easier for financial management and reporting purposes.

For example, cash accounts category would include subcategories for different bank accounts, petty cash, and other cash holdings. Revenue sources category would include subcategories for donations, membership fees, program fees, and other sources of income. Expenses category would include subcategories for salaries and wages, rent, utilities, supplies, and other expenditure items.

In addition to categorizing financial data, a nonprofit chart of accounts should also include budget columns to track actual income and expenses against the budgeted amounts. This allows the organization to monitor its financial performance and make adjustments as needed.

Furthermore, a nonprofit chart of accounts should be designed to facilitate financial audits. It should provide a clear and transparent view of the organization's financial transactions, making it easier for auditors to review and assess the accuracy and completeness of financial records.

Overall, a well-structured nonprofit chart of accounts is vital for financial management and reporting. It provides the foundation for budget planning, financial analysis, and decision-making within the organization. By accurately tracking income, expenses, and other financial metrics, a nonprofit can maintain a strong financial position and effectively fulfill its mission.

Determining your Nonprofit's Financial Structure

Creating and maintaining a solid financial structure is essential for the success and sustainability of any nonprofit organization. A well-designed financial structure ensures that all financial activities, such as cash flow, income, and expenses, are managed efficiently and transparently.

The first step in determining your nonprofit's financial structure is to establish a comprehensive chart of accounts. This chart provides a framework for organizing and categorizing financial transactions, such as revenue from grants or donations, expenses for programs or administrative costs, and assets or liabilities.

One crucial component of your nonprofit's financial structure is the balance sheet. This statement provides an overview of your organization's assets, liabilities, and net assets at a specific point in time. It reveals the financial health of your organization and helps in decision-making and budget planning.

Another vital element is the income statement, which shows the revenue and expenses incurred by your nonprofit during a specific period. This statement helps in tracking the financial performance of your organization, identifying areas of success or concern, and determining the overall financial stability.

Audits play a crucial role in determining the accuracy and reliability of your nonprofit's financial structure. Conducting regular audits ensures that your organization's financial records are accurate, complete, and comply with relevant regulations and accounting standards.

Grants and other sources of revenue are integral to the financial structure of many nonprofits. Tracking and managing grants effectively, ensuring compliance with grant requirements, and accurately reporting on the use of grant funds are essential tasks for maintaining a strong financial position.

Overall, a well-defined financial structure is essential for the long-term success and sustainability of your nonprofit organization. It provides the framework for managing financial resources, tracking income and expenses, and making informed financial decisions. By establishing a comprehensive chart of accounts and regularly reviewing and updating your financial statements, you can ensure the financial stability and transparency of your nonprofit organization.

Defining Account Categories

When it comes to managing the finances of a nonprofit organization, having a well-defined chart of accounts is essential. This allows for clear organization and tracking of financial transactions, ensuring that the organization's funds are properly managed and accounted for.

One important aspect of creating a comprehensive chart of accounts is defining account categories. These categories help to categorize and classify various types of financial transactions and activities within the organization.

For example, the management category may include accounts such as salaries, benefits, and training expenses. These accounts give insight into the organization's spending on personnel and development.

The balance sheet category includes accounts that track the organization's assets, liabilities, and equity. This provides a snapshot of the organization's financial position at a given point in time.

Grants and income accounts are crucial for nonprofits as they track funds received from donors and other sources. These accounts help to measure the organization's ability to generate revenue and funds for its mission.

Expenses play a significant role in the financial management of a nonprofit. Accounts such as rent, utilities, and supplies fall into this category and are essential for budgeting and monitoring spending.

Financial statements and audit accounts are used to compile the organization's financial performance and ensure compliance with regulations. These accounts track the flow of funds and provide an accurate representation of the organization's financial health.

Organizing Accounts within Categories

When it comes to organizing accounts within categories for a nonprofit, it is important to create a clear and logical statement of accounts that reflects the flow of revenue and expenses within the organization. This helps to ensure that all transactions are properly recorded and can be easily tracked and audited.

The categories within the chart of accounts should include both revenue and expense accounts. Revenue accounts include income from donations, grants, and other sources, while expense accounts include items such as salaries, rent, and other operating costs. By categorizing accounts in this way, the financial statement can provide a comprehensive view of the organization's financial position.

In addition to the main revenue and expense categories, it is also important to include other accounts that are specific to the nonprofit organization. For example, grants may have their own category to track the funding received and the expenses associated with fulfilling the requirements of each grant. This allows for better budget management and ensures that all funds are being allocated appropriately.

Another important aspect of organizing accounts within categories is to group them in a way that reflects the different areas of the organization. For example, accounts related to cash flow, such as cash on hand and cash receipts, may be grouped together. Accounts related to asset management, such as property and equipment, may also be grouped together. This helps to provide a clear and organized financial statement that allows for easier analysis and decision-making.

In conclusion, organizing accounts within categories is a crucial part of nonprofit financial management. By creating a well-structured chart of accounts, the organization can effectively track its revenue and expenses, properly manage its budget, and ensure that all financial transactions are accurately recorded and audited. This ultimately leads to better financial management and a stronger and more transparent organization.

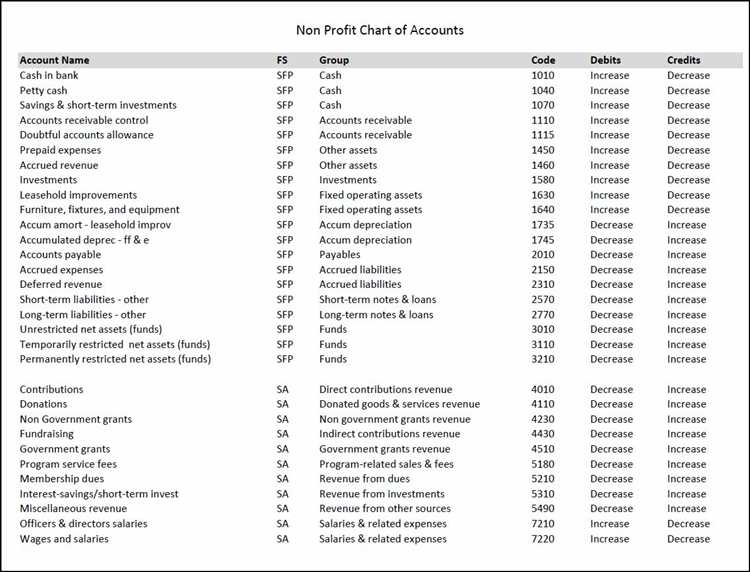

Nonprofit Chart of Accounts Example

A nonprofit organization's chart of accounts is a key financial management tool that helps track the flow of funds and ensure accurate record keeping. It provides a systematic framework for organizing financial data, such as grants, transactions, expenses, and revenue.

The chart of accounts typically includes categories such as assets, liabilities, equity, revenue, and expenses. These categories are further broken down into subcategories to provide a detailed view of the organization's financial activities.

For example, the revenue category may include subcategories for individual donations, corporate sponsorships, grants, and program fees. Each subcategory allows for easy tracking of income from various sources and enables the organization to analyze its revenue streams.

The expense category may include subcategories for salaries and benefits, program expenses, fundraising costs, and administrative expenses. By tracking expenses in this detailed manner, the organization can understand where its funds are being allocated and make informed budget decisions.

Additionally, the chart of accounts includes balance sheet accounts, such as cash, accounts receivable, and accounts payable, which provide a snapshot of the organization's financial position at a given point in time. This information is crucial for financial reporting, audits, and compliance with regulatory requirements.

Overall, a well-structured chart of accounts is essential for effective financial management in nonprofit organizations. It enables accurate tracking and reporting of financial activities, supports budget planning, and facilitates strategic decision-making for the organization's long-term sustainability.

Revenue Accounts

Revenue accounts are an essential part of a nonprofit organization's financial management. These accounts track the flow of cash and income into the organization, providing valuable information for budgeting, financial statement preparation, and decision-making.

Revenue accounts include various sources of income for the nonprofit organization, such as donations, grants, program fees, membership fees, and fundraising events. Each source of revenue is recorded separately in the chart of accounts, allowing for easy tracking and analysis.

When creating revenue accounts, it is essential to categorize them properly to ensure accurate financial reporting. This categorization helps in generating income statements and determining the organization's financial health. Examples of revenue accounts may include "Donations and Contributions," "Grants and Contracts," "Program Income," "Membership Dues," and "Fundraising Events."

Revenue accounts also play a crucial role in the organization's budgeting process. By tracking income from different sources, the organization can better plan for future expenses and allocate resources effectively. This helps in maintaining a positive cash flow and achieving financial stability.

In addition to budgeting, revenue accounts are essential for auditing purposes. Recording revenue transactions accurately and transparently is crucial for demonstrating the organization's financial integrity and compliance with regulations. Auditors rely on revenue accounts to assess the organization's financial performance and ensure that funds are being used as intended by donors and grantors.

The balance of revenue accounts is reflected on the organization's balance sheet as assets. This provides a clear picture of the financial position and shows the organization's capacity to carry out its mission effectively.

In summary, revenue accounts are essential for a nonprofit organization's financial management. They track the flow of cash and income into the organization, provide valuable information for budgeting and decision-making, and play a crucial role in financial reporting, auditing, and demonstrating the organization's financial health. By accurately recording and categorizing revenue accounts, nonprofits can effectively manage their resources and achieve their mission.

Expense Accounts

In a nonprofit organization, expense accounts are essential for tracking the various expenses incurred by the organization. These accounts help to ensure that the organization's resources are properly allocated and managed.

Expense accounts include categories such as grants, revenue, and assets. Grants are financial resources provided to the organization by external entities for specific projects or programs. Revenue refers to the income generated by the organization through donations, fundraising activities, or other sources. Assets represent the organization's tangible and intangible resources, such as property, equipment, and intellectual property.

Expense accounts are crucial for budget planning and management. By monitoring the flow of expenses, the organization can ensure that its financial resources are used effectively to achieve its goals and objectives. The expense accounts provide a detailed breakdown of the organization's spending, allowing for better financial decision-making.

Expense accounts are recorded in the organization's financial statements, such as the income statement, balance sheet, and cash flow statement. These statements provide a comprehensive overview of the organization's financial position and help stakeholders understand the financial health of the organization.

Proper management of expense accounts is essential for a nonprofit organization to fulfill its mission effectively. By accurately tracking and categorizing expenses, the organization can demonstrate transparency and accountability to its donors, board members, and other stakeholders.

Overall, expense accounts play a crucial role in the financial management of a nonprofit organization. They provide a detailed record of the organization's financial transactions, ensuring that resources are allocated efficiently and that the organization can achieve its goals while maintaining a sustainable financial position.

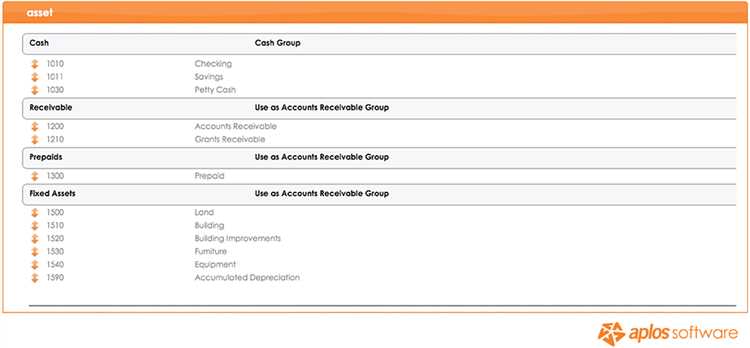

Asset Accounts

In the financial management of a nonprofit organization, asset accounts play a crucial role in tracking the flow of funds and ensuring the organization's financial stability. These accounts represent the tangible and intangible assets owned by the nonprofit, which contribute to its overall value and ability to carry out its mission.

One of the primary asset accounts for a nonprofit organization is cash, which includes the funds the organization holds in its bank accounts and other liquid assets. This account reflects the immediate financial resources available to the organization for day-to-day operations, such as paying bills, salaries, and expenses.

Nonprofit organizations also have accounts for grants and receivables, which represent the funds or assets that the organization is eligible to receive from external sources. These accounts track the income generated from grants, donations, and other forms of revenue, and are essential for budget planning and financial reporting.

Fixed assets, such as buildings, equipment, and vehicles, are other significant asset accounts for nonprofits. These assets have a longer lifespan and are typically recorded at their original cost. Managing and tracking the value of fixed assets is crucial for an organization's financial statement and audit processes.

The balance sheet of a nonprofit organization provides a snapshot of its assets, liabilities, and equity, and asset accounts play a central role in this financial statement. By accurately recording and categorizing the various asset accounts, nonprofit organizations can effectively assess their financial health and make informed management decisions.

Overall, asset accounts are vital components of a nonprofit organization's financial chart of accounts. They provide insights into the organization's financial resources, help in budgeting and managing expenses, and ensure transparency in financial reporting and auditing processes.

Best Practices for Maintaining a Nonprofit Chart of Accounts

Managing the financial aspects of a nonprofit organization requires a comprehensive and well-maintained chart of accounts. This crucial tool helps track grants, expenses, and revenue, allowing for a clear understanding of the flow and balance of financial resources.

One best practice for maintaining a nonprofit chart of accounts is to use a well-defined and organized structure. This structure should reflect the specific needs of the organization and allow for easy categorization and analysis of financial transactions. For example, a nonprofit may choose to divide its chart of accounts into categories such as income, expenses, assets, and liabilities.

Another important best practice is to regularly review and update the chart of accounts. Financial management needs change over time, and the chart of accounts should reflect these changes. Regular reviews can help identify any outdated or unnecessary accounts and ensure that the chart is aligned with the nonprofit's current financial goals and objectives.

It is also advisable to maintain a separate chart of accounts for each grant or funding source. This allows for better tracking and transparency of funds associated with specific grants. It ensures accurate reporting of financial information to donors and regulatory agencies, as well as enhances accountability and compliance.

An effective nonprofit chart of accounts should provide a clear and accurate view of the organization's financial health. It should support budgeting, cash management, and financial statement preparation. Regular reconciliations should be performed to ensure the accuracy of accounts and to identify any discrepancies or errors.

Lastly, having a well-maintained chart of accounts is critical during an audit. Auditors rely on the chart to understand the organization's financial history and make informed decisions about its financial integrity. Therefore, keeping the chart of accounts accurate and up to date is essential for successful financial management in a nonprofit organization.

In conclusion, maintaining a well-organized and up-to-date nonprofit chart of accounts is crucial for effective financial management. By following best practices such as using a clear structure, regularly reviewing and updating the chart, separating accounts for each grant, and conducting regular reconciliations, nonprofits can ensure accurate reporting, efficient budgeting, and strong financial accountability.

Regular Review and Updates

Regular review and updates of a nonprofit's chart of accounts are crucial for effective financial management. The chart of accounts is a comprehensive list of all the organization's financial transactions, including cash flows, expenses, grants, and revenue.

By reviewing and updating the chart of accounts regularly, the organization can ensure that it accurately reflects its financial activities and helps in budgeting and decision-making processes. This review also helps in identifying any discrepancies or errors in the financial records that may require further investigation.

Additionally, regular updates to the chart of accounts allow the nonprofit to align its financial management practices with industry standards and best practices. It ensures that the organization is using relevant and up-to-date categories for recording transactions, classifying expenses, and reporting on financial performance.

Furthermore, regular review and updates to the chart of accounts are essential for maintaining compliance with auditing and reporting requirements. Auditors rely on the chart of accounts to assess the accuracy and completeness of the organization's financial records during the audit process, and a well-maintained chart of accounts can streamline this process.

In conclusion, regular review and updates to a nonprofit's chart of accounts are critical for accurate financial management, proper budgeting, and efficient reporting. It helps the organization to track its income, expenses, grants, and assets, maintain a balance sheet, and ensure compliance with auditing requirements. By keeping the chart of accounts up-to-date, the nonprofit can make informed financial decisions and demonstrate transparency and accountability to its stakeholders.

Ensuring Consistency and Accuracy

Ensuring consistency and accuracy in a nonprofit organization's financial management is crucial for maintaining a healthy financial balance. An organized chart of accounts provides a structured framework for categorizing revenue and expenses, allowing for accurate tracking and reporting.

With a well-designed chart of accounts, the organization can effectively manage its budget and cash flow, ensuring that transactions are recorded correctly and in a timely manner. This helps to maintain an accurate picture of the organization's income and expenses, allowing for better financial decision-making.

Consistency in recording revenue and expenses is particularly important when dealing with grants and other sources of funding. By accurately categorizing these transactions, the organization can easily track the use of funds and ensure that they are being allocated according to the terms of the grants. This is essential for maintaining the trust of donors and funding organizations.

Furthermore, a comprehensive chart of accounts plays a critical role during audits. By providing a clear and organized record of financial transactions, the organization can demonstrate its adherence to accounting principles and compliance with regulatory requirements. It also simplifies the auditing process, saving time and resources.

Regularly reviewing and reconciling the nonprofit's financial statements, including the balance sheet and income statement, is another important step in ensuring accuracy. This involves comparing the recorded financial data with bank statements and other supporting documents to identify any discrepancies or errors. By promptly addressing these issues, the organization can maintain accurate financial records and make informed financial decisions based on reliable data.

In conclusion, an accurate and consistent chart of accounts is vital for nonprofit organizations to effectively manage their finances. It provides a foundation for budgeting, tracking revenue and expenses, and ensures compliance with auditing standards. By prioritizing accuracy and consistency in financial management practices, nonprofits can build trust, make informed decisions, and ultimately achieve their mission more effectively.

Utilizing Accounting Software for Efficiency

Accounting software can greatly benefit nonprofit organizations by increasing efficiency and accuracy in financial management. By automating tasks such as data entry, generating financial reports, and tracking transactions, nonprofits can streamline their operations and focus more on their core mission.

One of the key advantages of using accounting software for nonprofits is the ability to create custom chart of accounts. This allows the organization to categorize income, expenses, and assets in a way that aligns with their specific needs and goals. A well-designed chart of accounts provides a clear and organized structure for financial reporting, making it easier for auditors to review and for management to assess the financial health of the organization.

Furthermore, accounting software facilitates the management of grants and other sources of revenue for nonprofits. It allows organizations to track and report on grant funds separately, ensuring compliance with specific funding requirements and providing transparency to donors and regulatory bodies. This level of detail and accuracy can help nonprofits maximize their grants and effectively manage the resources they receive.

In addition to grant management, accounting software also enables nonprofits to track and manage their expenses. By categorizing expenses and assigning them to specific projects or programs, organizations can easily monitor spending and track the impact of their initiatives. This level of visibility is essential for effective financial management and strategic decision-making.

The ability to generate financial statements, such as balance sheets and income statements, is another valuable feature of accounting software. These statements provide a snapshot of the nonprofit's financial position and performance, allowing stakeholders to gain insights into the organization's financial health. Additionally, software can help streamline the process of preparing cash flow statements, which provide an overview of the organization's cash inflows and outflows.

Overall, utilizing accounting software can greatly benefit nonprofit organizations by increasing efficiency, improving financial management, and providing transparency to stakeholders. By automating tasks, tracking transactions, managing grants and expenses, and generating financial statements, nonprofits can focus on their mission and make informed decisions to drive their impact.