When it comes to small and medium businesses, managing finances and keeping track of expenses, taxes, and bookkeeping is essential. This is where accounting software comes into play, providing business owners with the tools and features they need to efficiently handle their financial management.

Two popular choices for accounting software are Odoo Accounting and QuickBooks. These platforms offer a range of features and integration options to help users streamline their financial processes. By comparing these two software solutions, businesses can determine which one is the best fit for their specific needs and requirements.

Odoo Accounting is a cloud-based platform that provides a comprehensive suite of accounting tools and features. It offers seamless integration with other Odoo modules, allowing businesses to easily manage payroll, expenses, and invoices in one centralized system. The platform also provides robust reporting capabilities, giving users real-time insights into their financial performance.

On the other hand, QuickBooks is a widely recognized accounting software that is known for its user-friendly interface and ease of use. It offers a range of features for small businesses, including invoicing, payments, and tax management. QuickBooks also provides integration with other third-party apps and services, making it a versatile and flexible option for businesses of all sizes.

In conclusion, both Odoo Accounting and QuickBooks have their own strengths and advantages. The best accounting software for your business will depend on your specific needs, budget, and preferences. Whether you prioritize integration options, reporting capabilities, or ease of use, there is a solution out there that can help you efficiently manage your financials and take your business to the next level.

Comparing Odoo Accounting and QuickBooks: Which is the Better Accounting Software?

When it comes to choosing the best accounting software for your business, it is important to consider the features and capabilities of different platforms. Two popular accounting software options are Odoo Accounting and QuickBooks. Both offer a range of features and tools to help with financial management, bookkeeping, and payroll. However, there are some key differences to consider.

One major difference between Odoo Accounting and QuickBooks is the target audience. QuickBooks is well-known for catering to small and medium-sized businesses, while Odoo Accounting offers solutions for businesses of all sizes, from small to enterprise-level. This means that Odoo Accounting may offer more scalability and flexibility for businesses as they grow.

Another important aspect to consider is the reporting capabilities of the accounting software. QuickBooks has a strong reputation for its robust reporting features, providing businesses with detailed insights into their financial performance. On the other hand, Odoo Accounting offers a customizable reporting tool that allows users to create tailored reports to suit their specific needs.

Integration is another crucial factor to consider. QuickBooks integrates seamlessly with a wide range of third-party apps and services, allowing for easy data syncing and automation. Odoo Accounting also offers integration options, but it may require more customization to achieve the same level of integration as QuickBooks.

When it comes to expenses management, QuickBooks has a dedicated feature for tracking and categorizing expenses, making it easier for businesses to stay on top of their spending. Odoo Accounting, on the other hand, offers a comprehensive expense management module that includes features such as expense tracking, reporting, and reimbursement.

For businesses that deal with taxes and invoicing, both Odoo Accounting and QuickBooks offer robust solutions. QuickBooks allows users to easily create and send invoices, track payments, and manage sales tax. Odoo Accounting also offers similar features, but it may require additional customization to meet specific tax requirements.

In conclusion, both Odoo Accounting and QuickBooks offer a range of features and tools for accounting and financial management. The best choice for your business depends on your specific needs and preferences. QuickBooks may be a better fit for small and medium-sized businesses looking for a user-friendly accounting platform with strong reporting capabilities. On the other hand, Odoo Accounting may be a better option for businesses of all sizes that require scalability, customization, and integration options.

Overview of Odoo Accounting

Odoo Accounting is a comprehensive financial management software that offers a range of features to help businesses of all sizes manage their accounting needs. Designed for small to medium enterprises (SMEs) as well as larger enterprises, Odoo Accounting provides an integrated platform for bookkeeping, invoicing, expenses, taxes, payroll, and reporting.

One of the key advantages of Odoo Accounting is its seamless integration with other Odoo applications. This allows for easy data sharing between different modules, such as inventory management, sales, and purchasing, creating a unified system for all business processes. This integration eliminates the need for manual data entry and reduces the risk of errors.

Odoo Accounting also offers powerful reporting and analysis capabilities. Users can generate customized financial reports, balance sheets, and profit and loss statements with just a few clicks. This helps businesses track their financial performance and make informed decisions based on real-time data.

Another noteworthy feature of Odoo Accounting is its support for multi-currency transactions. This is particularly useful for businesses operating in international markets, allowing them to manage their finances in different currencies and automatically calculate exchange rates.

In summary, Odoo Accounting is a comprehensive accounting software solution that offers a wide range of features to support the financial management needs of businesses. With its seamless integration, robust reporting capabilities, and support for multi-currency transactions, it is a powerful tool for businesses looking to streamline their accounting processes and gain better control over their finances.

Overview of QuickBooks

QuickBooks is a popular accounting software that is widely used by small and medium-sized businesses for financial management. It offers a wide range of features and tools that help businesses with their accounting and bookkeeping tasks.

One of the key features of QuickBooks is its ease of use. The software provides a user-friendly interface that allows even non-accounting users to navigate and perform various accounting tasks with ease. This makes it a great choice for businesses that do not have dedicated accounting personnel.

QuickBooks also offers seamless integration with other business platforms and applications. It allows users to connect their bank accounts, credit cards, and other financial accounts directly to the software, making it easier to track and manage expenses. Additionally, it has an invoicing feature that allows businesses to create and send professional-looking invoices to their customers.

Another important aspect of QuickBooks is its ability to handle payroll processing. The software provides a payroll management feature that enables businesses to calculate and process employee salaries, deductions, and taxes accurately. This helps businesses save time and reduce errors in their payroll processes.

QuickBooks operates on a cloud-based platform, which makes it accessible from anywhere and at any time. This allows users to access their financial data and reports from any device with an internet connection. The software also offers robust reporting capabilities, allowing businesses to generate various financial reports, such as balance sheets, profit and loss statements, and cash flow statements.

In conclusion, QuickBooks is a comprehensive and user-friendly accounting software that offers a wide range of features and tools for small and medium-sized businesses. Its integration capabilities, payroll management feature, cloud-based platform, and reporting functionalities make it a top choice for businesses looking for efficient and effective financial management software.

Features and Functionality

When it comes to features and functionality, Odoo Accounting and QuickBooks both offer a range of tools and options to streamline business financial management.

Odoo Accounting is an all-in-one platform that caters to the needs of businesses of all sizes. It includes comprehensive features for payroll, invoicing, expense management, and financial reporting. The software also offers integration with other Odoo modules, such as inventory management and CRM, allowing for seamless data flow across different departments.

On the other hand, QuickBooks is a well-established accounting software that is widely used by small and medium-sized enterprises. It offers a user-friendly interface and provides essential features for bookkeeping, invoicing, expense tracking, and financial reporting. QuickBooks also has a cloud-based version, which allows users to access their financial data from anywhere, anytime.

In terms of reporting capabilities, both Odoo Accounting and QuickBooks offer robust reporting functionalities. Users can generate financial reports, such as balance sheets, income statements, and cash flow statements, to gain insights into their business's financial health. They can also customize reports to meet specific requirements.

Furthermore, Odoo Accounting and QuickBooks provide options for managing expenses. Users can easily track and categorize expenses, such as office supplies, travel expenses, and vendor payments. This helps businesses stay on top of their spending and make informed financial decisions.

In conclusion, both Odoo Accounting and QuickBooks offer a range of features and functionality to meet the accounting needs of businesses. Odoo Accounting is suitable for medium to large enterprises due to its comprehensive features and integration capabilities. QuickBooks, on the other hand, is an excellent choice for small and medium-sized businesses looking for a user-friendly and cloud-based accounting software.

Odoo Accounting's Key Features

Bookkeeping: Odoo Accounting provides comprehensive bookkeeping capabilities, allowing small and medium-sized businesses to effectively manage their financial records.

Expense and Invoicing Management: With Odoo Accounting, users can easily track and manage expenses and create professional invoices for their business.

Integration: Odoo Accounting seamlessly integrates with other Odoo modules, such as inventory management and sales, providing a unified platform for all business operations.

Cloud-Based Software: Odoo Accounting is a cloud-based solution, enabling users to access their financial data from anywhere, at any time, and on any device.

Reporting and Analytics: The software offers advanced reporting and analytics capabilities, allowing users to gain valuable insights into their business's financial performance.

Payroll Management: Odoo Accounting includes payroll management features, enabling businesses to easily calculate and process employee salaries.

Enterprise-Grade Features: Odoo Accounting provides enterprise-grade features, such as multi-company support, multi-currency handling, and international tax compliance.

User-Friendly Interface: The software offers a user-friendly interface, making it easy for users to navigate and use the various accounting features.

| Odoo Accounting's Key Features |

|---|

| Bookkeeping |

| Expense and Invoicing Management |

| Integration |

| Cloud-Based Software |

| Reporting and Analytics |

| Payroll Management |

| Enterprise-Grade Features |

| User-Friendly Interface |

QuickBooks' Key Features

QuickBooks is a powerful accounting software that offers a wide range of features to help businesses manage their financials effectively. Whether you are a small enterprise or a medium-sized business, QuickBooks provides the necessary tools to streamline your bookkeeping, tax filing, and expense tracking processes.

One of the key features of QuickBooks is its user-friendly interface and easy navigation. It is designed to simplify financial management tasks, making it accessible for users with varying levels of accounting knowledge. With its simple and intuitive platform, users can easily track income and expenses, create invoices, manage payroll, and generate financial reports.

QuickBooks also offers integration with other business applications, allowing for seamless data transfer and collaboration. Whether you need to connect your accounting software with your CRM system or project management tool, QuickBooks provides integration options to enhance your business processes.

The cloud-based nature of QuickBooks is another standout feature. With cloud accounting, users can access their financial data anytime, anywhere, as long as they have an internet connection. This enables real-time collaboration with team members and gives business owners the flexibility to manage their finances on the go.

In addition to basic accounting functions, QuickBooks also offers advanced features such as inventory management, multi-currency support, and job costing. These features cater to the needs of businesses that require more robust financial management capabilities.

Furthermore, QuickBooks provides comprehensive reporting tools that give businesses insights into their financial performance. Users can generate various reports, such as profit and loss statements, balance sheets, and cash flow statements, to monitor their business's financial health.

QuickBooks also simplifies tax filing by automating tax calculations and generating necessary forms. This helps businesses save time and ensures accuracy in their tax filings.

Overall, QuickBooks is a top choice for small and medium-sized businesses looking for a reliable accounting software. Its extensive list of features, user-friendly interface, integration capabilities, and cloud accessibility make it a powerful tool for managing financials and growing your business.

User Interface and Ease of Use

When it comes to user interface and ease of use, both Odoo Accounting and QuickBooks offer cloud-based software that is designed to be user-friendly and intuitive. Both platforms provide a clean and organized layout, making it easy for users to navigate and find the features they need.

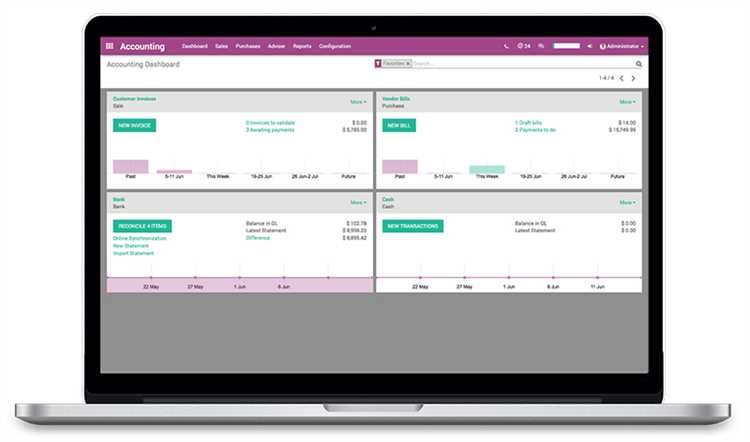

Odoo Accounting has a user interface that is visually appealing and modern, with a dashboard that provides a clear overview of financial information. The platform allows users to easily create and manage invoices, track expenses, and reconcile accounts. It also offers seamless integration with other Odoo modules, such as payroll and taxes, providing a comprehensive financial management solution for businesses of all sizes.

On the other hand, QuickBooks has a user interface that is simple and straightforward, making it ideal for small and medium-sized businesses. The platform offers a variety of features for accounting and bookkeeping, including invoicing, expense tracking, and financial reporting. QuickBooks also provides integration with third-party apps, allowing users to streamline their business processes and manage all aspects of their financials in one place.

In comparison, Odoo Accounting offers a more robust accounting platform with additional features and customization options, making it suitable for larger enterprises. QuickBooks, on the other hand, is best suited for small to medium-sized businesses that are looking for a user-friendly and affordable accounting solution.

Overall, both Odoo Accounting and QuickBooks offer user-friendly interfaces and ease of use, making it easy for businesses to manage their finances efficiently. The choice between the two platforms ultimately depends on the specific needs and preferences of the users.

Odoo Accounting's User Interface

Odoo Accounting offers a user-friendly and intuitive platform for managing all aspects of accounting. Its user interface is designed to streamline accounting processes and provide users with a clear and organized view of their financial data.

One of the key advantages of Odoo Accounting's user interface is its comprehensive and easy-to-use comparison features. Users can easily compare financial data across different periods, allowing them to track their business' performance and identify any trends or anomalies. This helps businesses make informed decisions and adapt their strategies accordingly.

Another highlight of Odoo Accounting's user interface is its efficient invoicing management system. Users can easily create and send professional-looking invoices, track payments, and manage overdue invoices. With its integration with other Odoo modules, such as the CRM and Sales modules, businesses can seamlessly link their sales orders with invoices and streamline their invoicing process.

Odoo Accounting's user interface also provides a comprehensive view of the business' financial health. Users can easily monitor their expenses, track revenue, and manage their taxes. The platform generates accurate and real-time financial reports, allowing businesses to get a clear picture of their financial performance and make data-driven decisions.

For small businesses, Odoo Accounting's user interface offers a cloud-based solution that eliminates the need for complex installations and IT support. The software can be accessed from anywhere, and users can collaborate in real-time, making it convenient for remote work or team collaboration.

In conclusion, Odoo Accounting's user interface is designed to simplify and streamline accounting tasks for businesses of all sizes. Its features, such as comparison tools, invoicing management, and real-time reporting, provide users with the tools they need to effectively manage their financials and make informed decisions.

QuickBooks' User Interface

QuickBooks is a popular accounting software designed for small and medium-sized businesses. One of its key strengths is its user-friendly interface that makes it easy for users with minimal accounting knowledge to navigate and utilize its features.

The cloud-based platform allows users to access their financial data from anywhere, making it convenient for businesses with multiple locations or remote employees. QuickBooks provides a clear and intuitive dashboard where users can easily manage their bookkeeping tasks, such as creating and tracking invoices, managing expenses, and generating financial reports.

With QuickBooks, users can also integrate their bank accounts and credit cards, providing real-time updates on their financial transactions. This integration simplifies the reconciliation process and ensures accuracy in recording income and expenses.

The software also offers several tools for payroll management, including the ability to track employee time and calculate taxes. This helps businesses streamline their payroll process and ensures compliance with tax regulations.

QuickBooks' reporting capabilities allow users to generate comprehensive and customizable reports, providing insights into their business's financial health. They can track key performance indicators, monitor cash flow, and identify trends or areas that require improvement.

In comparison to Odoo Accounting, QuickBooks focuses primarily on accounting and financial management tasks, making it an ideal choice for businesses that prioritize bookkeeping functionality. Its user-friendly interface, cloud-based platform, and extensive features make it a powerful tool for small and medium-sized businesses.

Pricing and Packages

When it comes to pricing, both Odoo Accounting and QuickBooks offer different packages tailored to the needs of businesses of different sizes.

Odoo Accounting offers a flexible pricing model, with a variety of packages available to suit the needs of small, medium, and enterprise-level businesses. The pricing is based on the number of users and includes features such as financial management, bookkeeping, tax management, and cloud integration.

QuickBooks also offers various pricing plans for small, medium, and enterprise-level businesses. The plans include features such as accounting, financial management, invoicing, expenses, payroll, and tax management. The pricing is based on the level of functionality and the number of users.

Both Odoo Accounting and QuickBooks provide comprehensive accounting software solutions with a range of features to help businesses manage their finances effectively. However, the pricing and packages offered by Odoo Accounting may be more suitable for small and medium-sized businesses, while QuickBooks may be a better option for larger enterprises that require more advanced functionalities.

Ultimately, the choice between Odoo Accounting and QuickBooks will depend on the specific needs and budget of your business. It is recommended to compare the different packages and features offered by each platform to determine which one aligns best with your requirements.

Odoo Accounting's Pricing Options

Odoo Accounting offers various pricing options to accommodate the needs of different businesses, ranging from small to medium-sized enterprises. With its flexible and scalable pricing structure, users can choose a plan that best suits their accounting requirements.

For small businesses with basic accounting needs, Odoo Accounting offers a free plan that includes essential features such as expense tracking, invoicing, and financial reporting. This plan is perfect for startups and small businesses looking for a cost-effective solution.

For medium-sized businesses that require more advanced accounting features and management capabilities, Odoo Accounting offers a paid plan starting at a competitive price. This plan includes additional features such as payroll management, multi-currency support, and integration with third-party software.

Odoo Accounting also offers an enterprise plan for larger businesses that require robust accounting functionality and enhanced security measures. This plan provides additional features such as automated bank reconciliation, advanced analytics, and customizable reporting options.

All pricing options for Odoo Accounting are cloud-based, allowing users to access their financial data anytime and anywhere. The software also provides seamless integration with other Odoo modules, creating a comprehensive platform for business management.

In comparison to other accounting software options like QuickBooks, Odoo Accounting offers a more cost-effective solution while providing similar features and functionality. Its user-friendly interface and intuitive design make it easy for users to navigate and perform bookkeeping tasks efficiently.

Overall, Odoo Accounting's pricing options cater to the diverse needs of businesses, offering flexibility, scalability, and robust accounting features. Whether you are a small startup or a large enterprise, Odoo Accounting provides a comprehensive solution for all your accounting needs.

QuickBooks' Pricing Options

QuickBooks offers various pricing options to cater to the accounting needs of different businesses, whether small, medium, or enterprise-level.

For small businesses, QuickBooks Online offers three pricing plans: Simple Start, Essentials, and Plus. The Simple Start plan is suitable for businesses that need basic bookkeeping and invoicing features. The Essentials plan includes additional features like bill management and time tracking. The Plus plan offers advanced features such as inventory tracking and project profitability analysis.

Medium-sized businesses can opt for the QuickBooks Online Advanced plan, which provides features beyond what is offered in the small business plans. This plan includes additional features like enhanced reporting, batch invoicing, and customized user permissions.

Enterprise-level businesses can choose the QuickBooks Desktop Enterprise plan, which is designed to handle complex financial management needs. This plan allows for advanced inventory tracking, advanced reporting, and integration with other QuickBooks products like payroll and payments.

All of QuickBooks' pricing options offer cloud-based accounting, which means that businesses can access their financial data from any device with an internet connection. This allows for easy collaboration and ensures that businesses stay up to date with their financials.

When considering QuickBooks' pricing options, it is important for businesses to assess their accounting needs, budget, and the size of their user base. By choosing the right pricing plan, businesses can ensure that they have access to the necessary features and functionality to efficiently manage their finances, taxes, expenses, and reporting.

Integrations and Add-ons

When it comes to integrations and add-ons, both Odoo Accounting and QuickBooks offer a wide range of options to enhance their platforms. Both software have built-in features for handling taxes and accounting, but they also provide additional integrations to meet specific user needs.

Odoo Accounting has a robust ecosystem of apps and integrations that cater to various business requirements. Users can integrate the software with popular financial management tools like PayPal, Stripe, and Square to streamline payment processing and invoicing. Additionally, Odoo Accounting can also be integrated with e-commerce platforms like Shopify and Magento for seamless management of online sales and inventory.

On the other hand, QuickBooks also offers a range of integrations and add-ons that extend its functionality. Users can integrate with popular payroll software like Gusto and ADP to simplify payroll management and compliance. QuickBooks also has integrations with project management tools like TSheets and Trello, allowing businesses to track time and expenses more efficiently.

Both Odoo Accounting and QuickBooks provide cloud-based solutions, enabling users to access their financial data from anywhere, at any time. They also offer robust reporting features that allow users to generate comprehensive financial reports for analysis and decision-making. Moreover, both platforms support multi-currency and multi-language capabilities, making them suitable for businesses operating in a global market.

In conclusion, both Odoo Accounting and QuickBooks offer a range of integrations and add-ons to enhance their accounting software. The choice between the two depends on the specific needs of the business, such as the size of the enterprise, desired features, and budget. Whether you are a small business owner or a medium-sized enterprise, it is crucial to consider these factors and compare the offerings of both platforms to make an informed decision.

Odoo Accounting's Integrations

Odoo Accounting offers a wide range of integrations that enhance the bookkeeping capabilities of businesses, both small and medium-sized. These integrations allow users to streamline their accounting processes and ensure accurate and efficient management of financial data.

One of the key integrations offered by Odoo Accounting is tax management software integration. With this integration, businesses can easily calculate and track taxes, ensuring compliance with tax laws and regulations. This feature is especially beneficial for companies operating in multiple jurisdictions or dealing with complex tax structures.

Another important integration provided by Odoo Accounting is enterprise resource planning (ERP) system integration. With this integration, businesses can seamlessly transfer financial data between the accounting software and other ERP modules, such as inventory management or sales. This allows for a comprehensive overview of the business's finances and streamlines the overall management process.

Expense management integration is another valuable feature of Odoo Accounting. With this integration, businesses can easily track and categorize expenses, ensuring accurate reporting and analysis. This integration is particularly beneficial for businesses with high volume or complex expense structures.

Furthermore, Odoo Accounting offers cloud-based integrations that allow for easy access to financial data from anywhere, at any time. This cloud integration ensures that businesses can easily collaborate and share information, improving overall efficiency and productivity.

Lastly, Odoo Accounting provides payroll integration, allowing businesses to easily manage employee salaries and other related financial transactions. This integration streamlines the payroll process, reducing manual entry and ensuring accurate and timely payments.

In conclusion, Odoo Accounting's integrations offer a comprehensive suite of features that enhance the bookkeeping and financial management capabilities of businesses. From tax management to enterprise resource planning system integration, these integrations provide businesses with the tools they need to efficiently manage their financial data.

QuickBooks' Integrations

QuickBooks is a powerful accounting software that offers a wide range of integrations to help businesses streamline their financial management. These integrations provide users with additional tools and features to enhance their accounting processes and increase efficiency.

One of the key integrations offered by QuickBooks is its payroll management integration. This integration allows users to easily manage employee payroll, track hours worked, and generate accurate paychecks. With this integration, businesses can ensure that their employees are paid on time and that all tax deductions are accurately calculated.

QuickBooks also offers integrations with popular e-commerce platforms, such as Shopify and WooCommerce. This allows businesses to seamlessly sync their sales data with QuickBooks, making it easier to track and manage invoices, expenses, and inventory. The integration also provides real-time updates, ensuring that businesses have accurate and up-to-date financial information.

In addition to these integrations, QuickBooks offers integrations with various other business management tools. These integrations include customer relationship management (CRM) software, project management software, and reporting tools. By integrating these tools, businesses can centralize their data and streamline their operations, making it easier to track and manage their financial transactions.

Overall, QuickBooks' integrations make it a versatile and comprehensive accounting software for businesses of all sizes. Whether you are a small or medium-sized enterprise, QuickBooks offers a range of integrations to suit your needs and help you efficiently manage your finances.

Support and Customer Service

When it comes to support and customer service, both Odoo Accounting and QuickBooks offer a range of options to assist their users in managing their financial needs effectively.

QuickBooks has a reputation for providing excellent customer support, with various channels available for users to seek assistance. They offer phone support, live chat, and email support. Additionally, QuickBooks has an extensive knowledge base and community forums where users can find answers to their questions or troubleshoot issues.

On the other hand, Odoo Accounting also provides robust support and customer service options. They offer a ticketing system where users can submit their queries and receive prompt responses. In addition, Odoo Accounting has a vast community of users who actively contribute to forums and offer assistance to fellow users. Their community-driven support system ensures that users can find answers to their questions quickly and efficiently.

Both Odoo Accounting and QuickBooks provide comprehensive documentation and training resources to help users navigate their software effectively. They offer online tutorials, webinars, and user guides to familiarize users with the features and functionality of their respective platforms.

In terms of customer service, both Odoo Accounting and QuickBooks prioritize their users' needs and strive to provide timely and helpful assistance. Ultimately, the support and customer service options offered by both platforms ensure that users can effectively manage their bookkeeping, payroll, expenses, invoices, taxes, and other financial aspects of their businesses.

Odoo Accounting's Support Options

Odoo Accounting provides a comprehensive set of support options for its cloud-based accounting software, catering to the needs of both small and medium-sized businesses.

For users who require assistance with tax-related matters, Odoo Accounting offers a dedicated tax support feature. This feature ensures that businesses can easily manage their tax obligations, including generating tax reports and calculating tax liabilities accurately.

In addition to tax support, Odoo Accounting provides robust support for expense management. Users can easily track and categorize their expenses, ensuring accurate bookkeeping and allowing businesses to stay on top of their financials.

Odoo Accounting also offers a range of support options for invoice management. The software allows users to create and send professional invoices, track payment statuses, and generate reports for a clear overview of their business's invoicing activities.

Furthermore, Odoo Accounting's support extends to payroll management. The software provides features for managing employee salaries, taxation, and deductions, making it easier for businesses to handle their payroll responsibilities.

Integration and platform compatibility are also strengths of Odoo Accounting's support options. The software seamlessly integrates with other Odoo modules, allowing for efficient data exchange between different aspects of a business. Additionally, Odoo Accounting is compatible with various platforms, enabling users to access and manage their financial data from anywhere, at any time.

Overall, Odoo Accounting's support options cater to the diverse needs of accounting and financial management. The software offers a comprehensive set of features that make it a reliable choice for businesses of all sizes, providing the necessary tools to streamline accounting processes and support informed decision-making.

QuickBooks' Support Options

When it comes to accounting software, QuickBooks offers a wide range of support options to meet the needs of business users of all sizes. Whether you're a small business owner or a medium-sized enterprise, QuickBooks provides various avenues for assistance and guidance.

One of the key support options offered by QuickBooks is their extensive knowledge base. This online resource provides users with access to detailed articles, guides, and tutorials on various accounting and bookkeeping topics. Users can search for specific topics or browse through the different categories to find answers to their questions.

QuickBooks also offers phone support for users who prefer to speak with a representative directly. Their customer support team is available during regular business hours to help with any technical issues, software troubleshooting, or general inquiries. This option allows users to get personalized assistance and resolve any problems they may encounter quickly.

For users who prefer self-paced learning, QuickBooks provides interactive training courses and webinars. These sessions cover a wide range of topics, including basic accounting principles, payroll management, and tax reporting. Users can participate in these training sessions at their own convenience, allowing them to learn at their own pace and obtain the necessary skills to effectively use the software.

In addition to these support options, QuickBooks also has a community forum where users can interact with each other, ask questions, and share best practices. This platform serves as a valuable resource for users to connect with other QuickBooks users, exchange ideas, and get advice from experienced professionals.

Overall, QuickBooks' support options cater to the diverse needs of business users, providing them with the tools and resources they need for successful financial management. Whether it's through their knowledge base, phone support, training courses, or community forum, QuickBooks ensures that users have access to the necessary support to make the most of their accounting software.

Security and Data Privacy

When it comes to choosing accounting software, security and data privacy are crucial concerns for businesses. Both Odoo Accounting and QuickBooks offer features and integrations that prioritize the safeguarding of financial information.

For small and medium-sized enterprises (SMEs), Odoo Accounting provides a secure platform for managing and storing financial data. It offers cloud-based storage, ensuring that data is backed up and protected against loss or damage. Additionally, Odoo's robust security measures, such as encryption and two-factor authentication, protect against unauthorized access to sensitive information.

QuickBooks, on the other hand, has a long-standing reputation for its security features. It offers bank-level security and uses encryption to protect data during transmission and storage. QuickBooks also provides multiple layers of user authentication, allowing businesses to control access to financial records and information.

Both software options offer secure ways to handle sensitive financial tasks, such as reporting, expenses, taxes, and payroll. With Odoo Accounting, users can generate detailed financial reports, track expenses, manage taxes, and process payroll with confidence, knowing that their data is protected.

Similarly, QuickBooks provides customizable reports, tax management tools, and payroll features that prioritize data security. QuickBooks also integrates with third-party applications, allowing businesses to securely share financial information across platforms.

In summary, when comparing Odoo Accounting and QuickBooks, businesses can feel confident in the security and data privacy measures offered by both platforms. Whether managing bookkeeping for a small business or handling enterprise-level accounting needs, both software options prioritize the protection of financial data.

Odoo Accounting's Security Measures

When it comes to enterprise cloud accounting platforms, security is a top priority. Odoo Accounting understands the importance of ensuring the safety and privacy of its users' financial data.

One of the key security features of Odoo Accounting is its integration with secure cloud servers. This means that all accounting data, including invoices, expenses, taxes, and payroll information, is stored on protected servers that meet industry standards. This ensures that users can access their financial information securely from any device with an internet connection.

Odoo Accounting also provides robust user access management, allowing businesses to control who can view, edit, and manage their financial data. This ensures that only authorized personnel have access to sensitive financial information, reducing the risk of data breaches or unauthorized access.

In addition, Odoo Accounting offers advanced reporting and auditing features that enable businesses to keep track of all financial activities and transactions. This helps businesses detect any potential fraudulent activities and ensures the accuracy and integrity of their financial records.

Furthermore, Odoo Accounting's software is regularly updated with the latest security patches and enhancements, providing businesses with the most up-to-date security measures. This helps protect against emerging threats and vulnerabilities.

Overall, Odoo Accounting provides a secure and reliable accounting platform for businesses of all sizes, from small to medium enterprises. Its robust security measures, integration capabilities, and comprehensive financial management features make it a preferable choice for businesses looking for a secure accounting solution.

QuickBooks' Security Measures

When it comes to the security of your financial data, QuickBooks offers a range of measures to ensure that your information is safe and protected. These security features make it an ideal choice for small and medium-sized businesses that want reliable accounting software.

One of the key security features in QuickBooks is user access control. This allows you to set different levels of access for different users, ensuring that only authorized individuals can view or modify sensitive financial data.

QuickBooks also offers secure cloud storage for your financial information. This means that your data is stored on remote servers, protected by advanced encryption techniques. As a result, you can access your financial data from anywhere, at any time, without worrying about its security.

In addition to these measures, QuickBooks provides regular security updates and patches to protect your data from the latest threats. This ensures that your software is always up to date with the latest security measures.

Furthermore, QuickBooks offers secure integration with other business tools and software. This allows you to easily manage your business's finances, payroll, and expenses in one centralized platform.

Overall, QuickBooks' security measures provide peace of mind for businesses, allowing them to focus on their core operations while leaving the financial bookkeeping and reporting to a trustworthy and secure software platform.

Pros and Cons

Cloud-based Financial Management: Both Odoo Accounting and QuickBooks offer cloud-based solutions, allowing users to access their financial information from anywhere with an internet connection. This enables real-time access to important data and facilitates collaboration among team members.

Reporting and Invoicing: Odoo Accounting provides customizable reporting features, giving users the ability to generate detailed financial reports to track business performance. QuickBooks also offers robust reporting capabilities, allowing users to create professional invoices and track payments.

Expense and Integration: QuickBooks has a dedicated module for managing expenses, making it easy to track and categorize business expenses. Odoo Accounting, on the other hand, offers seamless integration with other Odoo modules, such as inventory and sales, providing a holistic view of the business.

Comparison for Payroll Management: QuickBooks has built-in payroll processing functionality, streamlining the process of managing employee salaries and taxes. Odoo Accounting, however, lacks this feature and requires third-party integrations or manual calculations for payroll management.

Bookkeeping for Small and Medium-sized Enterprises: Odoo Accounting is a comprehensive platform suitable for small and medium-sized enterprises (SMEs), offering essential bookkeeping features such as journal entries, bank reconciliation, and general ledger management. QuickBooks is also popular among SMEs for its user-friendly interface and intuitive workflows.

Easy Tax Management: QuickBooks simplifies tax management with its tax calculation and reporting capabilities. It offers automated calculations for sales tax, VAT, and other taxes, helping businesses stay compliant. While Odoo Accounting provides basic tax management features, it may require additional customization or third-party apps for complex tax scenarios.

User-Friendly Software: QuickBooks is known for its user-friendly interface and ease of use, making it ideal for businesses that require minimal accounting knowledge. Odoo Accounting, on the other hand, may require a learning curve for users unfamiliar with the Odoo platform, but offers more advanced functionalities for comprehensive financial management.

In conclusion, both Odoo Accounting and QuickBooks have their own pros and cons. While QuickBooks offers a more user-friendly experience and comprehensive payroll management, Odoo Accounting excels in seamless integration with other Odoo modules and customizable reporting capabilities. Businesses should evaluate their specific needs and budget to choose the accounting software that best suits their requirements.

Odoo Accounting: Pros and Cons

Odoo Accounting is a popular accounting software platform that offers a range of features and capabilities for small and medium-sized businesses. Like any software, it has its pros and cons.

Pros:

- Integration: Odoo Accounting seamlessly integrates with other Odoo modules, allowing for easy management of financial processes within a unified platform.

- Cloud-based: The software is cloud-based, which means that users can access their financial data from anywhere with an internet connection.

- Reporting and Analytics: Odoo Accounting provides robust reporting and analytics tools, offering insights into a business's financial performance and helping with decision-making.

- Invoicing and Expenses: The software allows for easy creation and management of invoices, as well as tracking and categorizing expenses.

- Payroll Management: Odoo Accounting includes a payroll management feature, which streamlines the process of paying employees and managing payroll taxes.

Cons:

- Complexity: Some users may find Odoo Accounting complex to set up and use, especially those who are not familiar with accounting principles and software.

- Limited Tax Support: While Odoo Accounting supports basic tax calculations, it may not have the extensive tax functionality required for businesses operating in complex tax environments.

- Bookkeeping: Although the software automates many bookkeeping tasks, users still need to have a good understanding of accounting principles to ensure accurate and reliable financial records.

- Scalability: While suitable for small and medium-sized businesses, Odoo Accounting may not have all the features and capabilities required by larger enterprises.

In conclusion, Odoo Accounting offers a range of valuable features for small and medium-sized businesses, including integration with other Odoo modules, cloud-based access, powerful reporting and analytics tools, and convenient invoicing and expense management. However, it may not be suitable for businesses with complex tax requirements or those that require highly scalable accounting software.

QuickBooks: Pros and Cons

Pros:

- QuickBooks is a popular choice for small and medium-sized businesses.

- It offers a cloud-based platform, allowing users to access their financial data from anywhere.

- QuickBooks provides easy and intuitive bookkeeping and accounting features.

- It offers a wide range of reporting options, allowing businesses to better analyze their financial data.

- QuickBooks offers services for both self-employed individuals and larger enterprises.

- It provides integration with other business management and payroll software.

- QuickBooks is known for its strong customer support and resources.

Cons:

- While QuickBooks is suitable for small and medium-sized businesses, it may not be as ideal for larger enterprises with more complex accounting needs.

- The software can be expensive, especially for businesses that require additional features and services.

- QuickBooks may lack some advanced accounting features that are available in other accounting software.

- Some users find the interface and navigation of QuickBooks to be complex and not as user-friendly as they would like.

- The tax features in QuickBooks may not be as robust as those offered by specialized tax software.

- There have been occasional reports of data security issues with QuickBooks, although Intuit, the company behind QuickBooks, has taken steps to address these concerns.

Overall, QuickBooks is a popular and widely-used accounting software that offers a range of features and benefits for small and medium-sized businesses. However, businesses should carefully compare its features, pricing, and integration capabilities with other accounting software options to ensure it meets their specific needs.

User Reviews and Ratings

When it comes to user reviews and ratings, both Odoo Accounting and QuickBooks receive positive feedback from businesses of various sizes.

Medium-sized businesses especially appreciate the comprehensive features offered by both platforms. Odoo Accounting offers advanced reporting capabilities, allowing users to generate detailed financial reports that are essential for tax management and financial analysis. QuickBooks, on the other hand, provides easy-to-use tools for invoicing, expense tracking, and payroll management, making it a popular choice for small and medium-sized businesses.

Users also highlight the ease of use and intuitive interface of both Odoo Accounting and QuickBooks. With cloud-based platforms, users can access their accounting software anytime and anywhere. The user-friendly interfaces make it easier for businesses to manage their finances and keep track of expenses.

Another aspect that users appreciate is the integration capabilities. Both Odoo Accounting and QuickBooks allow users to connect with other software and platforms, making it easier for businesses to manage their finances and streamline their operations.

Overall, businesses praise Odoo Accounting and QuickBooks for their user-friendly interfaces, wide range of features, and robust reporting capabilities. While Odoo Accounting is more popular among medium and enterprise-level businesses, QuickBooks is widely used by small and medium-sized businesses due to its simplicity and affordability. The choice between the two ultimately depends on the specific needs and preferences of the business.

User Reviews of Odoo Accounting

Odoo Accounting is a powerful accounting software with a wide range of features that make it a popular choice for businesses of all sizes. Users appreciate the comprehensive comparison between Odoo Accounting and other accounting software options, which helps them make informed decisions about which platform to choose.

One of the standout features of Odoo Accounting is its robust reporting capabilities. Users praise the software for its ability to generate detailed financial reports that provide valuable insights into their business's financial health. The platform's reporting features make it easy to track income, expenses, and taxes, making it a valuable tool for effective financial management.

Another advantage of Odoo Accounting is its seamless integration with other Odoo modules. Users appreciate how the software seamlessly integrates with other Odoo modules, such as payroll and inventory management, allowing them to streamline their business processes and improve overall efficiency.

Small and medium-sized businesses, in particular, find Odoo Accounting to be a cost-effective solution for their bookkeeping and accounting needs. The software offers essential features like invoicing and expense tracking, making it a valuable tool for managing the financial aspects of their business.

Overall, users are highly satisfied with Odoo Accounting's user-friendly interface, robust feature set, and cloud-based platform. They praise the software for its ability to simplify financial tasks and automate tedious processes, allowing them to focus on running their business efficiently.

User Reviews of QuickBooks

QuickBooks is highly regarded by its users for its user-friendly interface and comprehensive financial management features. Many users appreciate how easy it is to navigate through the software and perform various bookkeeping tasks, such as tracking expenses, generating invoices, and managing taxes.

The cloud-based accounting platform offered by QuickBooks allows users to access their financial data from anywhere, making it convenient for small and medium-sized businesses. Users also appreciate the seamless integration with other business software, such as payroll management systems and customer relationship management (CRM) platforms.

One of the standout features of QuickBooks is its robust reporting capabilities. Users can generate various reports, including profit and loss statements, balance sheets, and cash flow statements, which provide valuable insights into the financial health of their businesses. The ability to customize these reports according to their specific needs is also highly praised by users.

QuickBooks also offers excellent support and customer service, with many users reporting prompt and helpful assistance from the support team. This is especially important for business owners who may not have a background in accounting and need guidance in navigating the software.

In terms of pricing, QuickBooks offers different plans to cater to the needs of different businesses, from small enterprises to medium-sized companies. Users appreciate the flexibility in pricing options, allowing them to choose a plan that best suits their budget and requirements.

In conclusion, QuickBooks is highly recommended by its users for its user-friendly interface, comprehensive features, and excellent customer support. Whether you are a small business owner or a medium-sized enterprise, QuickBooks provides powerful accounting software that meets the needs of your business.