When it comes to managing the financial aspects of a small or medium-sized business, choosing the right accounting software is crucial. Peachtree Accounting and QuickBooks are two popular options that offer a range of features and solutions to help business owners with their bookkeeping and financial management needs.

One of the key factors to consider when comparing the two is their approach to handling finances. Peachtree Accounting is known for its robust financial management capabilities, offering advanced features for tracking and analyzing data such as payroll, expenses, invoices, and taxes. On the other hand, QuickBooks is well-regarded for its user-friendly interface and cloud-based solution, making it easy for business owners to access and manage their financial information from anywhere.

In addition to financial management, both Peachtree Accounting and QuickBooks offer additional features to support small business operations. Peachtree Accounting is known for its strong inventory management capabilities, helping businesses keep track of their stock levels and streamline the ordering process. QuickBooks, on the other hand, offers a wide range of reports and analytics tools, giving business owners valuable insights into their company's financial health and performance.

At the end of the day, the choice between Peachtree Accounting and QuickBooks depends on the specific needs and preferences of your business. If you're looking for a comprehensive financial management solution with advanced features, Peachtree Accounting may be the right choice for you. However, if ease of use and accessibility are your top priorities, QuickBooks might be the better option. It's important to carefully evaluate your business requirements and compare the features and functionalities of both software before making a decision.

In summary, Peachtree Accounting and QuickBooks are both powerful small business accounting software options that offer a range of tools for financial management, bookkeeping, and reporting. Whether you prioritize advanced financial features or user-friendly interface and accessibility, conducting a thorough evaluation of both solutions will help you determine which one is the best fit for your business.

Overview of Peachtree Accounting

Peachtree Accounting is a popular accounting software solution for small and medium-sized businesses. It offers a comprehensive set of tools for bookkeeping and financial management, making it a reliable choice for companies looking to streamline their accounting tasks.

With Peachtree Accounting, businesses can easily manage their invoices, track expenses, and generate detailed reports to gain insights into their financial performance. The software also includes features for inventory management, payroll processing, and tax preparation, making it a complete solution for all accounting needs.

One of the key benefits of Peachtree Accounting is its user-friendly interface, which allows even non-accounting professionals to easily navigate and utilize the software. It offers a cloud-based option, allowing businesses to access their financial data from anywhere, anytime, making it convenient for remote teams or those on the go.

Peachtree Accounting also offers robust security features to ensure the confidentiality and integrity of financial data. It provides data encryption, user permissions, and audit trails to protect sensitive information and prevent unauthorized access.

In conclusion, Peachtree Accounting is a reliable and efficient accounting software solution for small and medium-sized businesses. Its comprehensive features, user-friendly interface, and cloud-based capabilities make it an ideal choice for streamlining bookkeeping, financial management, and tax preparation processes.

Overview of QuickBooks

QuickBooks is a popular accounting software solution that is specifically designed for small and medium-sized businesses. It offers a wide range of features and tools to help companies manage their finances effectively and efficiently.

One of the main advantages of QuickBooks is its user-friendly interface, which makes it easy for small business owners to navigate and use the software. It provides a comprehensive set of tools for bookkeeping, such as tracking expenses, creating invoices, and managing payroll. This allows companies to stay organized and keep accurate records of their financial transactions.

QuickBooks also offers powerful reporting capabilities, allowing businesses to generate various financial reports that provide valuable insights into their performance. These reports can help business owners make informed decisions and plan for the future.

In addition, QuickBooks also provides a cloud-based solution, which allows companies to access their financial data from anywhere, at any time. This is particularly useful for businesses with multiple locations or remote workers, as it enables them to collaborate and share information seamlessly.

Another key feature of QuickBooks is its ability to handle inventory management. Companies can easily track their inventory levels, set reorder points, and generate purchase orders to ensure that they always have the right amount of stock on hand.

QuickBooks also offers integration with other software and tools, such as third-party payment processors and tax preparation software. This makes it easy for companies to manage their taxes and streamline their financial processes.

In conclusion, QuickBooks is a comprehensive accounting software solution that provides small and medium-sized businesses with a wide range of tools to manage their finances effectively. Whether it's handling payroll, tracking expenses, or generating financial reports, QuickBooks offers a user-friendly interface and robust features that make it an ideal choice for small business owners.

Pricing and Packages

When it comes to choosing small business accounting software, pricing is an important factor to consider. Both Peachtree Accounting and QuickBooks offer various pricing packages that cater to the needs of different businesses.

QuickBooks provides a range of pricing options to suit small and medium-sized enterprises. The software offers a subscription-based pricing model, with different packages offering different features and functionalities. For small businesses, QuickBooks offers a self-employed plan which allows users to track income and expenses, calculate taxes, and create basic invoices. For medium-sized businesses, QuickBooks offers more advanced plans with features such as payroll, inventory management, and financial reporting.

Peachtree Accounting, on the other hand, offers a one-time purchase pricing model. Each package includes different features and functionalities, such as general ledger, accounts payable, accounts receivable, and financial reporting. Peachtree Accounting also offers add-on modules for specific needs, such as payroll and inventory management.

Both QuickBooks and Peachtree Accounting offer cloud-based solutions, allowing users to access their data from anywhere, at any time. This provides flexibility and convenience for businesses that require remote access to their accounting software.

In conclusion, when comparing the pricing and packages of Peachtree Accounting and QuickBooks, it is essential for small business owners to consider their individual needs. QuickBooks offers a subscription-based model with a range of features, while Peachtree Accounting offers a one-time purchase model with add-on modules. Both options provide small businesses with the necessary tools to effectively manage their financial data, accounting, taxes, payroll, inventory, and bookkeeping.

Pricing plans for Peachtree Accounting

Peachtree Accounting offers a range of pricing plans to suit the needs of small businesses. The software provides comprehensive bookkeeping and accounting solutions, allowing businesses to efficiently manage their financial data.

With Peachtree Accounting, users can easily create and send professional invoices, track expenses, and generate detailed financial reports. The software also offers features for inventory management, allowing businesses to keep track of stock levels and make informed purchasing decisions.

Peachtree Accounting offers cloud-based solutions, allowing users to access their data from anywhere, at any time. This makes it convenient for businesses with multiple locations or remote employees. Users can also easily sync their Peachtree Accounting data with popular third-party applications, such as QuickBooks, to streamline their business processes.

When it comes to pricing, Peachtree Accounting offers different packages to cater to businesses of varying sizes. The pricing plans are designed to be affordable for small businesses, offering the necessary features without breaking the bank. The software also provides options for add-ons, such as payroll management, to further enhance the functionality of the accounting software.

In conclusion, Peachtree Accounting offers a comprehensive and affordable solution for small businesses looking to streamline their accounting and financial management processes. With its robust features, cloud-based accessibility, and competitive pricing plans, Peachtree Accounting is a strong contender in the small business accounting software market.

Pricing plans for QuickBooks

QuickBooks offers a range of pricing plans suitable for small and medium-sized businesses. The pricing options are designed to cater to different business needs and budgets, ensuring that businesses can choose the plan that best fits their requirements.

QuickBooks' pricing plans offer a variety of features, including expense tracking, accounting management, cloud-based storage, payroll and tax calculations, and invoicing solutions. Businesses can easily manage their financial data, generate reports, and track inventory with QuickBooks' user-friendly software.

The pricing plans for QuickBooks are flexible and scalable, allowing businesses to upgrade or downgrade their plan as per their changing needs. QuickBooks offers affordable options for businesses of all sizes, ensuring that even small businesses or startups can benefit from its comprehensive bookkeeping and accounting solutions.

With QuickBooks' pricing plans, businesses can streamline their financial processes, automate tasks, and save time and effort in managing their finances. The cloud-based solution also allows businesses to access their data from anywhere, making it convenient for business owners and their teams to stay updated on their financials at all times.

In conclusion, QuickBooks offers a range of pricing plans that cater to the diverse needs of small and medium-sized businesses. With its comprehensive accounting and bookkeeping features, cloud-based accessibility, and flexible pricing options, QuickBooks is an ideal choice for businesses looking for an efficient and cost-effective financial management solution.

Features and Functionality

Peachtree and QuickBooks are both popular accounting software solutions for small and medium-sized businesses. They offer a range of features and functionality to help businesses manage their financials effectively.

Cloud-based: QuickBooks offers a cloud-based solution, allowing users to access their data from anywhere with an internet connection. This makes it convenient for businesses with remote employees or multiple locations.

Data organization: Both Peachtree and QuickBooks provide tools to organize and track financial data. Users can easily manage invoices, expenses, payroll, and taxes, ensuring accurate and up-to-date bookkeeping.

Inventory management: QuickBooks offers robust inventory management functionality, allowing businesses to track their stock levels, create purchase orders, and generate reports on inventory profitability.

Financial reporting: Peachtree and QuickBooks both offer a wide range of financial reports, such as profit and loss statements, balance sheets, and cash flow statements. These reports provide insights into the financial health of the business and help in making informed decisions.

Customizability: QuickBooks allows users to customize the software to match their business needs. Users can add industry-specific features or integrate third-party apps to extend the functionality of the software.

Security and data protection: Both Peachtree and QuickBooks prioritize the security of their users' data. They have built-in security measures and follow industry-best practices to protect against data breaches and ensure the privacy of sensitive financial information.

User-friendly interface: QuickBooks is known for its user-friendly interface, making it easy for non-accounting professionals to navigate and use. Peachtree also offers an intuitive interface but may have a steeper learning curve for beginners.

Scalability: Both Peachtree and QuickBooks can accommodate the needs of small and medium-sized businesses. They offer features and functionality that can scale with the growth of the company, ensuring that the software remains suitable as the business expands.

Overall, both Peachtree and QuickBooks offer a comprehensive set of features and functionality for small and medium-sized businesses. The choice between the two ultimately depends on the specific needs and preferences of the company. It is advisable to try out demos or free trials of both software to determine which one best fits the business's accounting and financial management requirements.

Key features of Peachtree Accounting

Peachtree Accounting offers a comprehensive set of features that make it an ideal bookkeeping solution for small and medium-sized businesses. With this software, businesses can easily manage their financial data and streamline their accounting processes.

Invoices and expenses: Peachtree Accounting allows businesses to create and manage invoices, track payments, and easily generate financial reports. It also enables businesses to track and categorize expenses, ensuring accurate financial records and effective expense management.

Inventory management: With Peachtree Accounting, businesses can efficiently manage their inventory by tracking stock levels, setting up reorder points, and generating inventory reports. This feature helps businesses optimize their inventory and avoid stockouts or overstocking.

Tax management: Peachtree Accounting simplifies tax management by automatically calculating and tracking taxes based on set tax rates and regulations. Businesses can also generate tax reports, making it easier to file both state and federal taxes.

Payroll management: Businesses can streamline their payroll processes with Peachtree Accounting. It allows businesses to easily calculate employee wages, process paychecks, and generate reports for payroll tax purposes. This feature saves time and ensures accurate and timely payroll management.

Business reports: Peachtree Accounting provides businesses with a variety of customizable reports that offer insights into the company's financial health. Businesses can generate profit and loss statements, balance sheets, cash flow reports, and more, allowing for informed financial decision-making.

Data security: Peachtree Accounting ensures the security of sensitive financial data by providing password protection and user access controls. It also offers data backup options, allowing businesses to restore their data in case of data loss or system failures.

Key features of QuickBooks

Taxes: QuickBooks offers a comprehensive tax management solution that helps small and medium-sized businesses stay on top of their tax obligations. The software allows users to organize and track their business expenses, income, and deductions, making tax filing easier and more efficient.

Bookkeeping: QuickBooks provides robust bookkeeping capabilities, allowing businesses to easily track their financial transactions, reconcile bank accounts, and generate detailed financial reports. With features like customizable charts of accounts and automated transaction categorization, QuickBooks simplifies the bookkeeping process.

Invoices and Payments: QuickBooks allows users to create and send professional-looking invoices to their clients, as well as track invoice status and payment due dates. The software also enables businesses to accept online payments, making it easier for customers to pay invoices and improving cash flow.

Financial Management: QuickBooks provides a suite of financial management tools, including cash flow forecasting, budgeting, and financial analysis. These features help businesses gain a deeper understanding of their financial health and make informed decisions about their future.

Payroll: QuickBooks offers integrated payroll functionality that simplifies the payroll process for businesses. Users can easily calculate salaries, generate pay stubs, and file payroll taxes. The software also supports direct deposit, making it convenient for both employers and employees.

Inventory Management: QuickBooks allows businesses to track and manage their inventory in real-time. Users can easily create and update inventory records, track sales and stock levels, and generate detailed inventory reports. The software also supports barcode scanning, making it efficient to process incoming and outgoing inventory.

Cloud-based Solution: QuickBooks offers a cloud-based accounting solution that allows users to access their data from anywhere, at any time. The software automatically syncs data across devices, ensuring that users always have the most up-to-date information.

User Interface and Ease of Use

Both Peachtree and QuickBooks offer user-friendly interfaces that make it easy for small and medium-sized businesses to manage their accounting and financial data. Peachtree provides a clean and intuitive interface, with a navigation menu that allows users to access different modules such as sales, purchases, inventory, and payroll.

On the other hand, QuickBooks has a simple and straightforward interface that is designed for small businesses. The software provides a step-by-step setup wizard that helps users with the initial setup process, making it easy for them to get started. QuickBooks also offers a customizable dashboard that displays key financial data, such as income and expenses, in a clear and visually appealing format.

Both Peachtree and QuickBooks allow users to easily generate reports and invoices, track expenses, and manage payroll. Peachtree offers a variety of pre-built reports that provide users with insights into their company's financial performance. QuickBooks, on the other hand, allows users to easily customize reports and invoices to meet their specific business needs.

Furthermore, both software solutions offer built-in tools for inventory management, making it easy for businesses to track their inventory levels and automate the ordering process. Peachtree has a comprehensive inventory management module that allows users to track inventory levels, record stock transfers, and generate purchase orders. QuickBooks also offers inventory management features, allowing users to easily create and track purchase orders and manage their inventory levels.

In terms of ease of use, QuickBooks has a slight advantage. The software is known for its user-friendly interface and intuitive design, making it easy for even non-accounting professionals to navigate and use effectively. Peachtree, while still user-friendly, may have a steeper learning curve for users who are not familiar with accounting software.

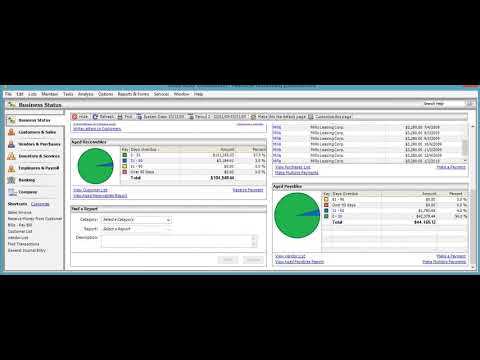

User interface of Peachtree Accounting

The user interface of Peachtree Accounting is designed to simplify the financial management process for small and medium-sized businesses. The software offers a user-friendly interface that allows users to easily navigate through the different features and functions.

One of the key features of Peachtree Accounting is its data entry capabilities. Users can easily input data related to expenses, payroll, inventory, and invoices, among others. The software also allows users to generate reports and analyze their financial data.

Peachtree Accounting provides a comprehensive solution for small business accounting. The software includes features for bookkeeping, tax management, and inventory management. Users can easily track their company's financial performance and make informed decisions based on the data provided by the software.

The user interface of Peachtree Accounting also offers a variety of customization options. Users can personalize their dashboard and choose the specific features they want to access. This allows users to tailor the software to their specific needs and preferences.

In summary, the user interface of Peachtree Accounting is intuitive and user-friendly. The software provides small and medium-sized businesses with a complete solution for their financial management needs. With its data entry capabilities, customizable dashboard, and comprehensive features, Peachtree Accounting is a reliable choice for businesses looking for efficient accounting software.

User interface of QuickBooks

QuickBooks provides a user-friendly and intuitive interface that makes bookkeeping and financial management tasks a breeze. The software offers a well-organized dashboard where users can easily access all the important features and tools.

The user interface of QuickBooks is designed to be simple and straightforward, allowing even non-accounting professionals to navigate through the software with ease. The main menu provides quick access to essential features such as invoicing, expenses management, payroll, and reports.

Within the software, users can easily input and track data related to their company's financial transactions, including sales, purchases, and expenses. QuickBooks also allows users to generate various reports to gain insights into their business's financial health and make informed decisions.

One of the key features of QuickBooks is its ability to handle multiple aspects of a business's finances, such as taxes, payroll, and inventory management. The software offers customizable templates for invoices and allows users to track customer payments and send payment reminders.

In addition, the user interface of QuickBooks makes it easy for businesses to manage their inventory and track sales and purchases. The software provides a variety of tools to effectively monitor stock levels, create purchase orders, and generate reports on sales and inventory.

Overall, the user interface of QuickBooks is designed to be user-friendly and efficient for small and medium-sized businesses. It provides a comprehensive and easy-to-use solution for all accounting and financial management needs.

Customer Support and Resources

When it comes to customer support and resources, both Peachtree and QuickBooks offer a range of options to assist small businesses in managing their financial tasks effectively.

- Peachtree provides customer support through phone and email, ensuring that users have access to assistance when they need it. Additionally, Peachtree offers a comprehensive online knowledge base and community forums, where users can find answers to common questions and receive guidance on using the software.

- QuickBooks, on the other hand, offers 24/7 customer support via phone, chat, and email. This ensures that users can get assistance at any time, even outside of regular business hours. QuickBooks also provides an extensive online library of video tutorials, articles, and guides to help users with various aspects of bookkeeping, inventory management, payroll, invoices, and expenses.

Both Peachtree and QuickBooks understand the importance of helping small businesses navigate the complexities of accounting and provide them with the necessary tools to succeed. Whether it's answering technical questions, providing guidance on tax management, or offering training resources, both companies demonstrate a commitment to customer support. Additionally, both solutions have active user communities where individuals can engage with other users to share experiences, solve problems, and exchange best practices.

Customer support for Peachtree Accounting

Peachtree Accounting offers excellent customer support for businesses using their software. Their team is knowledgeable and responsive, ready to assist with any questions or issues that may arise in the course of managing your business finances.

One of the key advantages of Peachtree Accounting's customer support is their expertise in inventory management. They understand the importance of accurate and up-to-date inventory data for a business, and are able to guide you through the process of setting up and maintaining your inventory system within the software.

In addition to inventory, Peachtree Accounting's customer support team can assist with a wide range of other business-related topics. Whether you need help with bookkeeping, managing expenses, or processing payroll, they have the knowledge and experience to provide you with a solution.

Another area where Peachtree Accounting excels in customer support is in their ability to handle medium to large-sized companies. They understand the unique challenges that come with managing a company of this size, and can offer guidance on complex financial processes such as generating customized reports, managing taxes, and creating invoices.

Peachtree Accounting also offers various support options to cater to different business needs. They provide phone support, email support, and an online knowledge base, ensuring that you have access to the information and assistance you need whenever and wherever you need it.

Customer support for QuickBooks

QuickBooks, as a leading small business accounting software solution, provides excellent customer support to its users. Whether you are a small or medium-sized business owner, QuickBooks understands the importance of reliable customer support and offers various channels to assist its users.

When using QuickBooks, you may encounter questions or issues related to invoices, inventory management, data entry, taxes, expenses, or payroll. QuickBooks' customer support team is available to help you navigate through these challenges and ensure that your bookkeeping and financial management processes run smoothly.

One of the advantages of QuickBooks is its comprehensive customer support resources. Users can access a wealth of educational materials, including tutorials, user guides, and frequently asked questions, through the QuickBooks website. These resources provide step-by-step instructions and best practices for using the software effectively.

If you require personalized assistance, QuickBooks offers different support options, including live chat, phone support, and email support. The support team is knowledgeable and responsive, making it easy for you to get the help you need in a timely manner. They can guide you through troubleshooting common issues, answer questions about specific features, or provide guidance on generating reports for your business.

Additionally, QuickBooks also has an online community where users can connect with each other, exchange ideas, and seek advice. The community is an excellent platform for learning from other small business owners who may have faced similar challenges or have unique insights into using QuickBooks effectively.

In summary, QuickBooks not only offers robust accounting and financial management features but also backs it up with exceptional customer support. Their commitment to assisting small and medium-sized businesses sets them apart and makes them a preferred choice for many companies.

Integration and Compatibility

When it comes to integration and compatibility, both Peachtree Accounting and QuickBooks offer a wide range of features to ensure seamless operations within a business. However, there are some key differences between the two software.

Peachtree Accounting provides integration with various inventory management systems, allowing businesses to effectively track and manage their inventory. This integration ensures that accurate and up-to-date data is being recorded in the accounting software, making it easier to generate financial reports and manage expenses.

On the other hand, QuickBooks offers extensive integration options with other popular small business software solutions. It seamlessly connects with payroll management systems, allowing businesses to easily track and manage employee wages and benefits. Additionally, QuickBooks integrates with tax software, simplifying the process of filing taxes and generating accurate tax reports.

Moreover, QuickBooks also offers cloud-based solutions, making it easier for businesses to access their accounting data from anywhere, at any time. This flexibility ensures that businesses can manage their bookkeeping and financial tasks on-the-go, without being tied down to a specific location or device.

In summary, both Peachtree Accounting and QuickBooks offer integration and compatibility features that cater to the specific needs of small and medium-sized businesses. While Peachtree focuses more on inventory management integration, QuickBooks offers a wide range of integration options, including payroll and tax software. The cloud-based solution offered by QuickBooks also provides added convenience and flexibility in accessing and managing accounting data.

Integration options for Peachtree Accounting

Peachtree Accounting offers several integration options to streamline and optimize your small or medium-sized business's financial management processes. With these integration options, you can efficiently handle tasks such as payroll management, cloud storage, data reporting, and inventory management.

1. Payroll Integration: Peachtree Accounting allows you to integrate with various payroll systems, enabling you to easily process and manage employee payroll. This integration ensures accurate and timely payment for your staff, saving you time and reducing the risk of errors.

2. Cloud Integration: Peachtree Accounting provides integration with cloud-based platforms, allowing you to access your financial data from anywhere, at any time. By leveraging cloud technology, you can securely store and manage your company's financial information, ensuring data accessibility and easy collaboration.

3. Inventory Management Integration: Peachtree Accounting integrates with inventory management systems, helping you efficiently track and manage your company's inventory. This integration streamlines the process of monitoring and replenishing stock, reducing the risk of stockouts and ensuring accurate financial reporting.

4. Expense Tracking Integration: With Peachtree Accounting's expense tracking integration, you can easily monitor and categorize business expenses. This integration simplifies the process of tracking and reconciling expenses, enabling you to accurately calculate tax deductions and generate comprehensive financial reports.

5. Invoicing Integration: Peachtree Accounting offers integration with invoicing solutions, allowing you to create and send professional invoices to your clients. This integration automates the invoicing process, ensuring timely payment and improving cash flow management.

Overall, Peachtree Accounting's integration options provide small and medium-sized businesses with a comprehensive financial management solution. By seamlessly integrating with various systems and applications, Peachtree Accounting helps streamline your bookkeeping processes, optimize data management, and ensure accurate financial reporting.

Integration options for QuickBooks

When it comes to integrating with other financial and management software, QuickBooks offers a wide range of options for small and medium-sized businesses. These integration options allow businesses to streamline their bookkeeping processes and consolidate their financial data.

One of the key integration options for QuickBooks is the ability to generate detailed financial reports. By integrating with reporting software, businesses can easily pull data from QuickBooks to create comprehensive reports on their financial performance. This can be extremely beneficial for strategic decision-making and monitoring the overall health of the business.

QuickBooks also offers integration with invoicing software, allowing businesses to easily generate and send invoices to their clients. By synchronizing invoicing data with QuickBooks, businesses can streamline their billing processes and ensure that all sales and receipts are accurately recorded.

Another important integration option for QuickBooks is tax management software. By integrating with tax software, businesses can automate the calculation and reporting of their taxes, saving time and reducing the risk of errors. This is especially crucial during tax season when businesses need to accurately file their tax returns.

QuickBooks also offers integration options for payroll management. By syncing payroll data with QuickBooks, businesses can efficiently manage employee salaries, deductions, and tax withholdings. This simplifies the payroll process and ensures that all financial data is accurately recorded.

In addition to these integration options, QuickBooks also allows businesses to integrate with inventory management software. By syncing inventory data with QuickBooks, businesses can effectively track their stock levels, streamline their order fulfillment process, and ensure accurate financial reporting.

Overall, the integration options available for QuickBooks make it a comprehensive financial management solution for small and medium-sized businesses. Whether it's generating financial reports, managing invoices, handling taxes, processing payroll, or tracking inventory, QuickBooks can seamlessly integrate with other software to provide an all-in-one accounting solution.

Security and Data Protection

When it comes to security and data protection, both Peachtree Accounting and QuickBooks offer robust features to ensure the safety of your company's financial information.

Peachtree Accounting provides a cloud-based system that allows you to securely store and access your data from anywhere, while also offering encryption and user authentication to prevent unauthorized access. Additionally, Peachtree Accounting has built-in security measures to protect against data breaches and cyber attacks, ensuring that your financial information remains safe.

Similarly, QuickBooks also prioritizes data protection by offering cloud-based storage and encryption to keep your data secure. QuickBooks uses advanced security protocols to protect your company's financial information, including bank-level encryption for transactions and data security measures to prevent unauthorized access.

In terms of data backup and recovery, both Peachtree Accounting and QuickBooks provide options to regularly backup your company's financial data. This ensures that your data is protected in case of accidental loss or system failures.

Overall, both Peachtree Accounting and QuickBooks offer strong security features to protect your business's financial data. However, it is important to regularly update and maintain the software, as well as implement good security practices, to further enhance the security and data protection for your small or medium-sized business.

Security measures of Peachtree Accounting

Peachtree Accounting understands the importance of security when it comes to managing a small business's financial data. With its robust security measures, this software provides reliable protection for your bookkeeping, inventory, and financial information.

Peachtree Accounting offers a medium-sized business a secure solution for managing expenses, inventory, and payroll. The software employs encryption technology to safeguard sensitive data from unauthorized access. This ensures that your company's financial information and payroll details remain confidential.

Peachtree Accounting also provides cloud accounting capabilities, allowing you to securely access your data from anywhere, without the risk of losing it. With built-in data backup and recovery features, you can have peace of mind knowing that your data is protected even in the event of hardware failure or natural disasters.

In addition, Peachtree Accounting allows you to create secure user access controls, ensuring that only authorized individuals have access to specific financial information. This minimizes the risk of internal data breaches and unauthorized alterations to crucial business data.

The software also offers robust reporting functionalities, enabling you to generate detailed reports on financial statements, invoices, and taxes. These reports can be securely shared with key stakeholders, such as accountants or business partners, providing transparency and accountability.

Overall, Peachtree Accounting prioritizes the security of your small business's accounting data. With its comprehensive security measures and user-friendly interface, it offers a reliable and secure solution for managing your business's financial information.

Security measures of QuickBooks

When it comes to accounting software, security is of utmost importance. QuickBooks, a popular small business accounting software, offers a range of security measures to protect the sensitive financial data of businesses.

Data encryption: QuickBooks uses advanced encryption technologies to encrypt the data transmitted between the user's computer and the QuickBooks server, ensuring that the financial information is secure.

Access controls: QuickBooks allows business owners to restrict access to sensitive financial information, ensuring that only authorized personnel can view and modify the data.

Cloud storage: QuickBooks offers a cloud-based solution, enabling businesses to store their financial data securely in the cloud. This eliminates the risk of data loss due to hardware failure or theft.

Multi-factor authentication: QuickBooks implements multi-factor authentication, requiring users to verify their identity through multiple steps, such as a password and a unique code sent to their mobile device. This adds an extra layer of security to prevent unauthorized access.

Regular backups: QuickBooks automatically creates regular backups of business data, ensuring that in the event of data loss or corruption, businesses can quickly restore their financial information.

Secure online banking integration: QuickBooks enables businesses to securely connect their accounts with various financial institutions, allowing for seamless syncing of transactions while ensuring the security of sensitive banking information.

Overall, QuickBooks offers robust security measures to safeguard the financial data of small and medium-sized businesses, making it a reliable accounting software for efficient bookkeeping, management of invoices, inventory, payroll, and financial reports.

Mobile and Remote Access

Both Peachtree Accounting and QuickBooks offer mobile and remote access solutions for small and medium-sized businesses. These features allow users to access their financial data, manage invoices, track expenses, and run reports from any location using their mobile devices or computers.

Peachtree Accounting provides a cloud-based solution that enables users to access their accounting data from any device with an internet connection. This allows business owners or accountants to stay connected and manage their company's finances on the go. They can easily view and edit invoices, monitor payroll, generate financial reports, and track inventory.

On the other hand, QuickBooks also offers mobile and remote access capabilities through its mobile app and web-based platform. Users can access their financial data, manage invoices, and track expenses from their smartphones, tablets, or computers. This flexibility is especially valuable for businesses with remote employees or multiple locations.

Both software solutions provide a secure and convenient way to handle bookkeeping, taxes, and financial management while on the move. Small business owners can confidently manage their transactions and access important data whenever and wherever they need it, ensuring the smooth operation of their business.

Mobile access capabilities of Peachtree Accounting

Peachtree Accounting software, a popular choice for small and medium-sized businesses, offers mobile access capabilities that can greatly enhance your company's financial management and bookkeeping processes.

With Peachtree Accounting's mobile app, you can access your company's financial data anytime, anywhere, using your smartphone or tablet. This convenient feature allows you to stay connected and informed, even when you are on the go.

The mobile app provides a range of functionalities, including the ability to view and edit financial records, create and send invoices, track expenses, and manage payroll. This means that you can efficiently handle all your financial tasks, whether it's managing cash flow, processing payments, or tracking expenses, all from the convenience of your mobile device.

In addition to providing access to your financial data, Peachtree Accounting's mobile app also allows you to generate various reports, such as profit and loss statements, balance sheets, and tax summaries. These reports provide valuable insights into your company's financial health, enabling you to make informed business decisions.

Peachtree Accounting's mobile access capabilities offer a versatile and flexible solution for small businesses, as it allows you to manage your finances on the go and maintain accurate and up-to-date records. By using the mobile app, you can streamline your accounting processes, reduce the risk of errors, and improve overall efficiency.

Furthermore, Peachtree Accounting's mobile app provides secure access to your data, ensuring that your financial information is protected. With the option to store your data in the cloud, you can also benefit from automatic backups, reducing the risk of data loss.

Overall, Peachtree Accounting's mobile access capabilities make it an excellent choice for small and medium-sized businesses looking for a comprehensive and user-friendly accounting solution that can be accessed anytime, anywhere.

Mobile access capabilities of QuickBooks

QuickBooks, a popular small business accounting software, offers impressive mobile access capabilities that provide medium-sized companies with a convenient solution for managing their financial data on the go.

With QuickBooks, users can access important financial reports, manage inventory, and even process payroll from their mobile devices. This allows small businesses to stay connected and keep track of their finances no matter where they are.

In addition to accessing financial data, QuickBooks also allows users to create and send invoices, track expenses, and manage taxes with ease. This makes it an all-in-one solution for small business bookkeeping and accounting needs.

One of the key advantages of QuickBooks' mobile access capabilities is its integration with the cloud. Users can securely store their data in the cloud, ensuring that it is easily accessible and backed up. This eliminates the need for physical storage and reduces the risk of data loss.

Overall, QuickBooks' mobile access capabilities make it an ideal choice for small businesses that require flexible and convenient management of their financial data. Its user-friendly interface and comprehensive features set it apart from other accounting software options like Peachtree, making it a top choice for small business owners.

Reporting and Analytics

Both Peachtree and QuickBooks offer robust reporting and analytics features, allowing businesses to effectively analyze their financial data and make informed decisions.

Peachtree Accounting provides a wide range of management reports that can be customized to suit the needs of a small or medium-sized business. These reports include financial statements, profit and loss statements, balance sheets, cash flow statements, and more. The software also offers advanced analytics tools, such as trend analysis and variance reporting, which provide valuable insights into the company's financial performance.

QuickBooks, on the other hand, offers a comprehensive suite of reporting tools that cover various aspects of a business's financial operations. Users can generate reports on sales, expenses, invoices, inventory, payroll, taxes, and more. The software also includes customizable templates and a drag-and-drop report builder, making it easy to create personalized reports. Additionally, QuickBooks offers powerful analytics features that help businesses track key performance indicators and identify areas for improvement.

Both Peachtree and QuickBooks have the ability to generate reports in different formats, including PDF, Excel, and HTML, allowing users to easily share and distribute financial data. Furthermore, both software solutions offer cloud-based options, which enable users to access their reports and analytics data from anywhere, at any time, on any device.

In conclusion, when it comes to reporting and analytics, both Peachtree Accounting and QuickBooks offer comprehensive solutions that can meet the needs of small and medium-sized businesses. The choice between the two would ultimately depend on the specific requirements and preferences of the company.

Reporting features of Peachtree Accounting

Peachtree Accounting provides a comprehensive set of reporting features that are essential for small and medium-sized businesses. With its advanced reporting capabilities, Peachtree Accounting allows businesses to generate detailed reports on various aspects of their financial management.

One of the key reporting features of Peachtree Accounting is its ability to generate reports on company's financial performance. These reports provide a clear overview of the business's revenue, expenses, and profits, allowing owners to make informed decisions about their company's financial health.

In addition to financial performance reports, Peachtree Accounting also offers reporting features for managing invoices and payroll. Businesses can easily generate reports that track outstanding invoices, payment history, and payroll expenses. These reports help businesses maintain accurate records and ensure timely payments to vendors and employees.

Another important reporting feature of Peachtree Accounting is its inventory management reports. These reports provide businesses with detailed information about the status of their inventory, including stock levels, sales trends, and reorder points. This enables businesses to optimize their inventory management and avoid stockouts or overstock situations.

Peachtree Accounting also offers reporting features for tax management. The software allows businesses to generate reports that summarize tax liabilities and provide relevant information for tax filing purposes. These reports simplify the process of preparing and filing taxes, saving businesses valuable time and effort.

Furthermore, Peachtree Accounting provides the option to store and access data in the cloud. This means that businesses can generate and access reports anytime, anywhere, as long as they have an internet connection. This cloud-based solution enhances the flexibility and convenience of using Peachtree Accounting for financial management.

In summary, the reporting features of Peachtree Accounting make it a robust and comprehensive software solution for small and medium-sized businesses. With its ability to generate various types of reports, including financial performance reports, invoice and payroll reports, inventory management reports, and tax management reports, Peachtree Accounting enables businesses to effectively manage their financial data and make informed decisions for their company's growth and success.

Reporting features of QuickBooks

QuickBooks is a comprehensive accounting software solution that offers a wide range of reporting features to help small and medium-sized businesses effectively manage their financial data. With QuickBooks, businesses can generate detailed reports on various aspects of their finances, allowing them to make informed decisions and keep track of their expenses.

One of the key reporting features of QuickBooks is its ability to generate detailed reports on a company's financial performance. This includes reports on income and expenses, balance sheets, and cash flow statements. These reports provide businesses with a clear picture of their financial health, allowing them to identify areas of improvement and make more informed decisions.

In addition to financial reports, QuickBooks also offers reporting features that allow businesses to keep track of their inventory. With QuickBooks, businesses can generate reports on their current inventory levels, track sales and purchases, and even set up automatic reorder points to ensure they never run out of stock.

QuickBooks also offers robust reporting features for payroll management. Businesses can generate reports on employee wages, deductions, and taxes, making it easy to calculate and file payroll taxes accurately. These reports help businesses ensure compliance with tax regulations and maintain accurate and up-to-date payroll records.

Furthermore, QuickBooks provides reporting features specifically designed for the needs of small businesses. Businesses can generate reports on customer invoices, allowing them to keep track of outstanding payments and manage their cash flow effectively. QuickBooks also offers reports on sales and expenses by customer, allowing businesses to analyze their customer base and identify which customers are contributing the most to their bottom line.

With QuickBooks cloud accounting, businesses can access these reporting features anytime, anywhere, from any device. This makes it easy for business owners and accountants to stay on top of their finances and make informed decisions on the go.

In conclusion, QuickBooks offers a powerful and comprehensive reporting solution for small and medium-sized businesses. With its wide range of reporting features, businesses can effectively manage their financial data, track expenses, and make informed decisions to drive growth and success.