As technology continues to evolve, it has become essential for insurance agencies to leverage cloud-based accounting software to streamline their financial operations. Choosing the right accounting software can help insurance agencies automate bookkeeping, analysis, payroll, taxes, and reporting, providing a comprehensive solution for managing their financial processes.

The best accounting software for insurance agencies should offer integration with insurance company-specific tools and provide support for industry-specific financial requirements. A robust accounting software can simplify the complex task of insurance agency accounting by automating routine financial tasks and generating accurate reports for both internal analysis and external compliance requirements.

One of the key features to consider when selecting accounting software for insurance agencies is the ability to integrate with existing systems and tools. Integration with insurance company-specific software can ensure seamless data transfer and streamline workflows, saving time and minimizing errors. Furthermore, accounting software with automated payroll and tax capabilities can simplify the process of managing employee compensation and ensuring compliance with tax regulations.

In addition to integration and automation, the ideal accounting software for insurance agencies should provide robust reporting and analysis tools. These features enable insurance agencies to gain valuable insights into their financial performance, identify trends, and make data-driven decisions to improve profitability and operational efficiency. With the right accounting software, insurance agencies can stay ahead of the competition and achieve financial success in today's rapidly evolving insurance industry.

Cloud-based Accounting Software

Cloud-based accounting software has revolutionized the way accounting and bookkeeping are done in today's fast-paced business world. With advancements in technology, insurance agencies can now take advantage of cloud-based solutions to streamline their financial processes and improve overall efficiency.

Cloud-based accounting software offers numerous benefits, including easy access to financial data from any location, automated payroll and tax calculations, seamless integration with other company systems and tools, and real-time financial reporting and analysis. It allows insurance agencies to have a comprehensive view of their financial health and make informed decisions.

By leveraging cloud technology, insurance agencies can eliminate the need for on-premise servers and software installations, reducing costs and improving scalability. They can also benefit from the added security measures offered by cloud providers, ensuring that their financial data is protected from potential threats.

Cloud-based accounting software also provides enhanced collaboration and support capabilities. Multiple users can access and work on the same financial data simultaneously, enabling efficient teamwork and reducing the risk of data errors. Furthermore, cloud-based solutions often come with robust customer support, allowing insurance agencies to rapidly resolve any issues or questions that may arise.

Overall, cloud-based accounting software is the best solution for insurance agencies looking to optimize their financial management processes. It provides automated tools, integration capabilities, and real-time reporting to support better decision-making and financial analysis. With its flexibility and accessibility, insurance agencies can focus on their core business functions while having peace of mind knowing their financial data is handled securely and efficiently in the cloud.

Benefits of Cloud-based Accounting Software

Cloud-based accounting software offers numerous benefits for insurance agencies, providing an automated and efficient solution for managing financial tasks. With cloud technology, insurance agencies can streamline their processes and improve overall efficiency.

One of the key benefits of cloud-based accounting software is its integration capabilities. It can easily integrate with other tools and systems used in insurance agencies, such as customer relationship management (CRM) software. This integration allows for seamless data transfer and reduces the need for manual data entry, saving time and minimizing errors.

Another advantage is the accessibility provided by cloud-based accounting software. With this technology, insurance agency employees can access their financial data and perform bookkeeping tasks from anywhere, anytime, as long as they have an internet connection. This flexibility enables remote work and enhances collaboration among team members.

Cloud-based accounting software also offers advanced reporting and analysis features. It provides detailed financial reports and generates real-time insights, allowing insurance agencies to make informed decisions and monitor their financial performance. Additionally, it simplifies tax management by automatically calculating and tracking taxes, ensuring compliance with tax regulations.

Furthermore, cloud-based accounting software offers excellent support and security. Most providers offer customer support services to assist users with any issues or questions they may have. They also implement robust security measures, such as data encryption and regular backups, to protect sensitive financial information and prevent unauthorized access.

In conclusion, cloud-based accounting software is the best choice for insurance agencies seeking a modern and efficient solution for their financial management. With its automated features, integration capabilities, accessibility, reporting tools, and top-notch security, it can greatly streamline financial processes, improve productivity, and support growth in the insurance industry.

Key Features to Look for in Cloud-based Accounting Software

When choosing a cloud-based accounting software for your insurance agency, it is crucial to consider the following key features:

- Tax Management: Look for software that has built-in tax management tools to simplify tax filing and ensure compliance with tax regulations.

- Financial Analysis: The software should provide robust financial analysis capabilities to help you make informed decisions and identify areas for improvement in your agency's financial performance.

- Automated Reporting: Choose a solution that offers automated reporting features, allowing you to easily generate and customize financial reports such as balance sheets, income statements, and cash flow statements.

- Payroll Integration: Look for software that seamlessly integrates with payroll systems to streamline payroll processing and ensure accurate salary calculations.

- Company Management: The software should have features for managing your insurance agency's financial operations, such as expense tracking, invoicing, and billing.

- Cloud Technology: Ensure that the software is cloud-based, allowing you to access your financial data anytime, anywhere, and from any device with an internet connection.

- Support and Training: Choose a software provider that offers comprehensive support and training resources to assist you in getting the most out of the software.

- Bookkeeping Tools: Look for software with advanced bookkeeping tools, such as bank reconciliation, categorization of expenses, and tracking of accounts payable and receivable.

By selecting a cloud-based accounting software with these key features, you can streamline your insurance agency's financial processes, improve efficiency, and have a better understanding of your company's financial health.

Top Cloud-based Accounting Software for Insurance Agencies

In today's digital age, it is essential for insurance agencies to embrace cloud-based accounting software to streamline their bookkeeping and financial processes. Cloud-based accounting software offers numerous benefits to insurance agencies, including easy access to data from anywhere, automated financial tasks, and real-time support.

One of the best cloud-based accounting software solutions for insurance agencies is XYZ Insurance Software. This powerful software provides a comprehensive set of tools for insurance agency management, including payroll, reporting, and tax analysis. With XYZ Insurance Software, insurance agencies can seamlessly integrate their financial data, saving time and reducing the risk of errors.

Another top cloud-based accounting software for insurance agencies is ABC Agency Management System. This software offers an intuitive interface and a wide range of features to help insurance agencies effectively manage their finances. With ABC Agency Management System, insurance agencies can easily track expenses, generate financial reports, and analyze key financial metrics.

For insurance agencies looking for a cloud-based accounting software specifically tailored to their needs, MNO Insurance Solution is an excellent choice. This software provides advanced features for insurance agency accounting, such as policy tracking, premium billing, and claims management. The MNO Insurance Solution also offers integration with external systems, allowing insurance agencies to optimize their workflow and improve efficiency.

In conclusion, cloud-based accounting software is a game-changer for insurance agencies, offering automated financial tasks, real-time support, and seamless data integration. By utilizing the best cloud-based accounting software for their specific needs, insurance agencies can streamline their financial processes, improve accuracy, and drive growth in the digital era.

Integrated Accounting and CRM Software

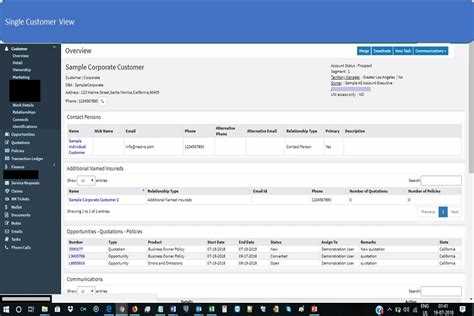

The best accounting software for insurance agencies in 2021 offers integrated accounting and CRM solutions. This cloud-based software allows insurance companies to efficiently manage their financial and customer information in one centralized system.

With integrated accounting and CRM software, insurance agencies can streamline their tax reporting, bookkeeping, and payroll processes. The automated features of the software ensure accurate and efficient financial management, saving time and reducing errors.

This solution also provides comprehensive reporting and analysis tools, allowing insurance agencies to gain insights into their financial performance and make informed decisions. They can track revenue, expenses, and profitability, as well as analyze customer trends and preferences.

The integration of accounting and CRM software enables insurance agencies to provide better customer support and service. They can easily access customer information, manage policy renewals, and track claims. This improves efficiency and customer satisfaction.

In conclusion, integrated accounting and CRM software is the ideal solution for insurance agencies. It combines the best of both worlds by offering robust financial management tools and seamless customer relationship management. This software helps insurance agencies stay organized, save time, and make data-driven decisions for their business success.

Advantages of Integrated Accounting and CRM Software

Integrated accounting and CRM software provides a comprehensive solution for insurance agencies, offering numerous advantages for their financial management and customer relationship management.

Streamlined Reporting: With integrated software, insurance agencies can easily generate financial reports and gain valuable insights into their business performance. This enables them to make informed decisions and adapt their strategies accordingly.

Efficient Payroll Management: Integrated accounting and CRM software automates payroll processes, making it easier for insurance agencies to calculate and manage employee salaries, deductions, and benefits. This saves time and reduces the risk of errors in payroll calculations.

Improved Customer Support: By integrating CRM features into their accounting software, insurance agencies can better serve their customers. They can track customer interactions, manage claims, and provide personalized support, enhancing the overall customer experience.

Better Financial Analysis: With integrated software, insurance agencies can perform in-depth financial analysis, allowing them to identify trends, evaluate profitability, and optimize their operations. This helps agencies stay competitive in the insurance industry.

Easy Insurance Bookkeeping: Integrated accounting software simplifies the complex bookkeeping processes specific to the insurance industry. It enables agencies to track premiums, commissions, policies, and claims, ensuring accurate and up-to-date financial records.

Secure Cloud Technology: Integrated accounting and CRM software often utilizes cloud technology, ensuring that sensitive financial and customer data is securely stored and accessible from anywhere. This eliminates the risk of data loss and provides convenient remote access for agency staff.

All-in-One Solution: By integrating accounting and CRM tools, insurance agencies can consolidate their day-to-day financial and customer management tasks into a single, cohesive platform. This streamlines workflows, reduces manual data entry, and increases overall efficiency.

Tax Compliance: Integrated accounting software helps insurance agencies stay compliant with tax regulations by automating tax calculations, generating accurate tax forms, and keeping track of deductible expenses. This simplifies the tax filing process and reduces the risk of penalties or audits.

In conclusion, integrated accounting and CRM software provides insurance agencies with a comprehensive and efficient solution for their financial management and customer relationship management needs. By leveraging the best of both worlds, agencies can optimize their operations, improve customer satisfaction, and achieve greater success in the competitive insurance industry.

Essential Features of Integrated Accounting and CRM Software

Integrated accounting and CRM software is an essential tool for insurance agencies looking to streamline their financial management processes and improve customer relationships. This type of software combines the best features of accounting and CRM systems to provide a comprehensive solution for insurance agencies.

One of the key features of integrated accounting and CRM software is its ability to support all aspects of financial management. From bookkeeping to payroll and taxes, this software can handle it all. It automates repetitive tasks and eliminates the need for manual data entry, saving time and reducing the risk of errors.

The integration of accounting and CRM technologies allows for seamless data transfer between systems. This means that customer information entered in the CRM system can be automatically synced with the accounting software, eliminating the need for double data entry. This integration also enables real-time reporting and analysis, giving insurance agencies instant access to key financial and customer data.

Another important feature of integrated accounting and CRM software is the ability to generate custom reports and analysis. Insurance agencies can easily create financial statements, balance sheets, and profit and loss reports. They can also analyze customer data to identify trends, preferences, and buying behaviors, which can help them tailor their services and improve customer satisfaction.

Furthermore, integrated accounting and CRM software provides tools for managing and tracking sales and revenue. Insurance agencies can monitor sales performance, track commissions, and generate sales forecasts. This helps them make informed business decisions and optimize their operations.

In conclusion, integrated accounting and CRM software is a must-have for insurance agencies. It combines the best features of accounting and CRM systems, providing a comprehensive solution for financial management and customer relationship management. With automated technology, seamless integration, and powerful reporting and analysis capabilities, this software is a valuable tool for insurance agencies looking to improve efficiency and profitability.

Best Integrated Accounting and CRM Software for Insurance Agencies

In today's technology-driven world, integration is key. When it comes to managing the financial aspects of your insurance agency, having a software solution that combines accounting and customer relationship management (CRM) functionalities is essential. Integrated accounting and CRM software not only streamlines your workflows but also provides accurate and real-time data for better reporting and analysis.

One of the best choices for insurance agencies is a cloud-based software that offers advanced features for both accounting and CRM. This software ensures that all your financial and customer data is securely stored, easily accessible, and updated in real-time. With this integrated solution, you can manage your insurance company's bookkeeping, automate tasks, generate financial reports, and even handle payroll and taxes efficiently.

With the integrated accounting and CRM software, insurance agencies can benefit from various tools and features. These include automated data syncing between accounting and CRM modules, easy tracking of commission payments, comprehensive financial reporting, customizable templates for invoices and quotes, and seamless integration with third-party applications.

Choosing the right software for your insurance agency is important, and it's crucial to consider factors like ease of use, scalability, customer support, and pricing. Look for a software solution that specifically caters to the needs of insurance agencies and provides industry-specific features. Additionally, make sure the software you choose is compliant with insurance regulations and offers enhanced security measures to protect your sensitive data.

In conclusion, the best integrated accounting and CRM software for insurance agencies is a powerful solution that combines the financial and customer relationship management aspects of your business. It provides automation, efficiency, and accuracy in managing your insurance agency's finances while also offering comprehensive features for customer relationship management. By investing in this software, you can streamline your workflows, improve reporting and analysis, and ultimately drive the success of your insurance agency.

Expense Management Software

Expense management software is a crucial tool for insurance agencies to effectively manage their financial transactions and track expenses. It provides automated and cloud-based solutions for insurance agencies to streamline their expense tracking and analysis process.

With expense management software, insurance agencies can easily and accurately record and categorize their expenses. This software enables the automation of tasks such as receipt scanning, expense categorization, and reimbursement calculation, which reduces manual errors and saves time. Moreover, it provides real-time access to financial data and allows for easy integration with other accounting tools.

The best expense management software for insurance agencies offers features like expense reporting and analytics. These tools provide in-depth analysis of expenses and help agencies identify areas for cost reduction and improvement. With detailed expense reports and analytics, insurance agencies can make informed financial decisions and optimize their expenses.

Expense management software also simplifies tax preparation for insurance agencies. It integrates with tax software and automatically captures deductible expenses, ensuring compliance with tax regulations. This integration eliminates the need for manual entry of expenses and reduces the risk of errors in tax reporting.

Additionally, expense management software provides support for payroll and bookkeeping tasks. It automates payroll calculations and expense reimbursements, making the process efficient and accurate. This software also facilitates the integration of financial data with accounting systems, ensuring seamless financial management for insurance agency.

In conclusion, expense management software is an essential technology for insurance agencies to effectively manage their expenses. It automates and streamlines expense tracking, provides detailed reporting and analysis, integrates with accounting systems, and simplifies tax preparation. With the right expense management software, insurance agencies can optimize their financial operations and enhance their overall performance.

Importance of Expense Management Software for Insurance Agencies

Expense management is a crucial aspect of running an insurance agency efficiently. With the constantly changing landscape of bookkeeping and technology, it is essential for insurance companies to have robust expense management software in place to handle their financial operations effectively.

An expense management software provides support to insurance agencies by offering a wide range of features and functionalities. It allows for easy and secure data storage in the cloud, ensuring that the company's financial information is always accessible and protected. The software also provides automated reporting and analysis tools, which can assist in monitoring expenses, identifying areas of improvement, and making informed financial decisions.

Integration with other accounting software and tools is another significant advantage of using expense management software. This integration streamlines the process of collecting data related to expenses, taxes, payroll, and more, eliminating the need for manual data entry and reducing errors. The software can also generate comprehensive reports, making it easier for insurance agencies to comply with regulations and accurately report financial information.

Efficient expense management software can significantly benefit insurance agencies by improving cost control and reducing the risk of financial fraud. By accurately tracking expenses, the software helps in identifying any irregularities or discrepancies in financial transactions. This level of transparency and control can enhance the financial health of the insurance company and increase its profitability.

In conclusion, implementing a reliable expense management software solution is essential for insurance agencies to stay competitive in today's market. The software's features, including cloud storage, automated reporting, and integration with other accounting tools, can streamline financial operations, improve cost control, and ensure compliance with financial regulations. By adopting the best expense management software, insurance agencies can enhance their financial management practices and ultimately drive their success.

Key Features to Consider in Expense Management Software

When choosing expense management software for your insurance agency, it is important to consider several key features that will help streamline your financial processes and ensure accurate and efficient bookkeeping. Here are some essential features to look for:

- Automated Expense Tracking: The best expense management software should have automated tools to track and categorize expenses, minimizing manual data entry and saving time.

- Integration with Accounting Software: Look for software that seamlessly integrates with popular accounting solutions, such as QuickBooks or Xero, to ensure smooth financial management.

- Cloud Technology: Opt for a cloud-based expense management solution that allows you to access your financial data from anywhere, anytime, and collaborate with your team effortlessly.

- Support for Taxes and Reporting: Ensure the software provides features to handle tax calculations and generate reports for your insurance agency. This will help you stay compliant with tax regulations and provide valuable insights for analysis.

- Payroll Management: Look for expense management software that includes payroll management features, allowing you to easily track and process payroll for your employees.

- Financial Analysis: Consider software that offers advanced financial analysis tools, such as customizable dashboards and financial reports, to gain a deeper understanding of your agency's financial performance.

- Insurance Agency-Specific Features: Choose expense management software that caters to the specific needs of insurance agencies, such as support for commission tracking, policy management, and client billing.

- Automated Approval Workflow: Look for software that enables you to set up automated approval workflows for expense reimbursement requests, ensuring timely and efficient processing.

By considering these key features when choosing expense management software, you can find a solution that meets the unique needs of your insurance agency, improves your financial processes, and provides better control and visibility over your expenses.

Top Expense Management Software for Insurance Agencies

Managing expenses is a crucial task for insurance agencies, as it involves tracking and controlling costs related to various aspects of the business. The right expense management software can streamline this process, providing support for efficient financial management.

One of the best expense management software for insurance agencies is a cloud-based solution. This technology allows agencies to access their financial data from anywhere, ensuring convenience and flexibility. It also provides real-time updates, making it easier to track expenses and make informed decisions.

The software should offer tools for automated bookkeeping, enabling agencies to eliminate manual data entry and reduce human errors. These tools can automatically categorize expenses, making it easier to analyze spending patterns and optimize budget allocation. Additionally, it should have features for payroll management, taxes, and financial reporting, ensuring compliance with regulatory requirements.

An ideal expense management software for insurance agencies should also provide comprehensive reporting capabilities. This includes generating financial reports such as profit and loss statements, balance sheets, and cash flow statements. These reports can help agencies gain a clear understanding of their financial performance and make data-driven decisions.

When choosing an expense management software, insurance agencies should consider factors such as the company's reputation, customer reviews, and customer support. It's important to select a software that is user-friendly and can be easily integrated into existing systems. Additionally, the software should have advanced security measures in place to protect sensitive financial data.

In conclusion, utilizing top expense management software is essential for insurance agencies to effectively track, analyze, and manage their expenses. By leveraging the right technology, agencies can optimize their financial operations and stay ahead in the competitive insurance industry.

Payroll Software

Payroll is a crucial aspect of every insurance agency, and having the best payroll software can greatly support the financial management of the company. With the right payroll solution, insurance agencies can automate their payroll processes and save time and effort in bookkeeping and salary calculations.

The best payroll software for insurance agencies is cloud-based, allowing for easy access and integration with other tools. This enables the agency to have a centralized system for all payroll-related tasks, such as employee data management, salary calculation, tax deductions, and reporting.

With automated payroll software, insurance agencies can also benefit from advanced features like analysis and reporting. They can generate detailed reports on employee salary breakdowns, tax calculations, and other financial data, providing valuable insights for better financial decision-making.

In addition to payroll management, some payroll software also offers integration with other accounting systems. This allows for seamless data transfer between different financial processes, such as invoicing, expense tracking, and reconciliation. The integration of payroll software with accounting tools ensures accurate and up-to-date financial records for the insurance agency.

Overall, a robust payroll software solution is essential for insurance agencies to streamline their payroll processes, ensure compliance with tax regulations, and improve financial management. By leveraging technology and automation, insurance agencies can save time, reduce errors, and focus on providing excellent service to their clients.

Benefits of Payroll Software for Insurance Agencies

- Efficiency: Payroll software automates the process of calculating and disbursing payroll for insurance agencies. This technology simplifies the agency's payroll management, saving time and effort.

- Accuracy: By using the best payroll software, insurance agencies can ensure accurate calculations of salaries, taxes, and deductions. This helps eliminate errors in payroll processing and ensures that employees are paid correctly.

- Integration: Payroll software can be integrated with other accounting software used by insurance agencies. This integration allows for seamless transfer of financial data, reducing the need for manual data entry and streamlining the overall bookkeeping process.

- Reporting: Payroll software provides detailed and customizable reports on various aspects of payroll, such as salary breakdowns, taxes, and employee benefits. This reporting feature helps insurance agencies gain better insight into their financials and make informed decisions.

- Tax Compliance: Payroll software keeps insurance agencies up-to-date with the latest tax regulations and automatically calculates and deducts the appropriate taxes from employee salaries. This helps ensure that the agency remains compliant with tax laws and avoids penalties.

- Cloud-based Access: Many payroll software solutions offer cloud-based access, allowing insurance agencies to access payroll data anytime, anywhere, and from any device with an internet connection. This feature provides flexibility and convenience in managing payroll remotely.

- Payroll Analysis: Payroll software provides tools and analytics that enable insurance agencies to analyze payroll data and identify trends or patterns. This analysis can help agencies make data-driven decisions and optimize their payroll management strategies.

In conclusion, payroll software is a valuable tool for insurance agencies, providing them with automated and accurate payroll processing, seamless integration with other accounting software, comprehensive reporting capabilities, compliance with tax regulations, cloud-based access, and payroll analysis. By utilizing payroll software, insurance agencies can streamline their financial processes and focus on core business operations.

Essential Features of Payroll Software

Payroll software is an essential tool for any insurance agency that wants to streamline its payroll management process. With automated payroll processing, the software eliminates the need for manual calculations and saves time for both the company and its employees.

One of the key features of payroll software is its integration capabilities. The software should be able to integrate seamlessly with the company's accounting and bookkeeping systems to ensure accurate and efficient processing of payroll information. This integration also allows for easy tracking of wages, deductions, and taxes, simplifying the payroll management process.

Another essential feature of payroll software is its cloud support. A cloud-based payroll solution ensures that all payroll data is securely stored and accessible from anywhere, allowing for remote payroll management. This feature is particularly important for insurance agencies that operate in multiple locations or have employees working remotely.

Payroll software should also provide robust reporting and analysis tools. It should be able to generate various reports related to payroll, such as payroll summary, tax reports, and wage analysis. These reports help the insurance agency in financial analysis and ensure compliance with tax regulations.

Moreover, payroll software should have built-in support for managing taxes. It should be able to calculate and withhold the correct amount of taxes from employee wages, including income tax, social security, and Medicare taxes. The software should also generate tax forms, such as W-2 and 1099, to facilitate tax filing.

In conclusion, the best payroll software for insurance agencies should offer automated payroll processing, integration with accounting systems, cloud support, robust reporting and analysis tools, and comprehensive tax management. With these essential features, insurance agencies can efficiently manage their payroll process and ensure accurate and timely payment of wages to their employees.

Best Payroll Software for Insurance Agencies

When it comes to managing financial processes for insurance agencies, having the best payroll software is essential. The right software can provide automated support for accounting and payroll needs, helping to streamline operations and improve efficiency.

One of the top payroll software options for insurance agencies is XYZ Payroll. This software offers seamless integration with accounting tools, making it easy to track income, expenses, and taxes. It also provides robust reporting and analysis features, allowing insurance agencies to gain valuable insights into their financial performance.

XYZ Payroll is designed specifically for insurance agencies, offering industry-specific features such as commission calculations and policy management. This specialized solution ensures that all payroll processes are in line with insurance regulations and requirements.

In addition to its comprehensive payroll functionalities, XYZ Payroll also offers cloud-based technology. This means that insurance agencies can securely access their payroll data from anywhere, at any time. The software also provides automatic backups and data synchronization, ensuring that information is always up to date and protected.

Overall, XYZ Payroll is the best payroll software for insurance agencies due to its tailored features, intuitive interface, and advanced reporting capabilities. By implementing this solution, insurance agencies can streamline their payroll and bookkeeping processes, save time and resources, and focus on core business management activities.

Tax Management Software

Tax management software is a crucial tool for any accounting agency in the insurance industry. With the best technology and software, insurance agencies can streamline their tax processes, ensuring accuracy and efficiency. This software is specifically designed to handle the unique tax needs of insurance companies, providing the necessary tools for analysis, financial reporting, and compliance.

One of the key features of tax management software is its integration with accounting and bookkeeping systems. This allows agencies to automate the calculation and reporting of taxes, eliminating the need for manual data entry and reducing the risk of errors. With this automated solution, insurance agencies can save time and resources, while also ensuring compliance with tax regulations.

In addition to tax calculation and reporting, tax management software offers support for payroll tax management. This includes automating the calculation and withholding of employee taxes, as well as generating the necessary forms and reports for tax filing. This feature ensures that insurance agencies are accurately managing their payroll taxes, minimizing the risk of penalties and audits.

Furthermore, tax management software provides comprehensive tools for tax analysis. This includes the ability to generate detailed reports and forecasts, allowing agencies to make informed decisions regarding their tax strategies. The software also supports tax planning, helping insurance companies identify potential tax savings and minimize their overall tax liability.

In conclusion, tax management software is an essential solution for insurance agencies looking to streamline their tax processes. With its automated features, integration capabilities, and comprehensive support, this software provides the best tools for efficient tax management. By using this technology, insurance agencies can ensure accuracy, compliance, and financial success in their tax operations.

Why Tax Management Software is Important for Insurance Agencies

Insurance agencies, like any other business, have to manage their financial transactions and comply with tax regulations. To simplify this process and ensure accuracy, insurance agencies need the best tax management software available.

One of the main advantages of tax management software is its ability to automate payroll and accounting tasks. These software solutions integrate with the company's financial systems, making it easy to calculate and process taxes, deductions, and employee payroll. The automated process reduces the risk of errors and saves time and effort for insurance agencies.

In addition to payroll and accounting, tax management software provides comprehensive tax reporting tools. It enables insurance agencies to generate accurate and detailed tax reports, necessary for filing taxes and for financial analysis. With these reporting capabilities, agencies can easily track their tax liabilities, deductions, and other financial metrics.

Insurance agencies deal with complex tax regulations specific to the insurance industry. Tax management software understands these regulations and ensures compliance. It keeps up with the latest tax laws and helps agencies stay updated, preventing any potential penalties or issues with the tax authorities.

Another benefit of tax management software is its support for bookkeeping and financial analysis. It organizes and categorizes financial data, making it easier for insurance agencies to analyze their financial performance. These software solutions provide insightful reports and analysis, helping agencies make informed decisions about their financial strategies.

Cloud-based tax management software is also available, offering additional flexibility for insurance agencies. The cloud-based solution allows agencies to access their financial data, tax reports, and analysis from anywhere, at any time. This feature is particularly useful for agencies with multiple locations or remote employees.

In conclusion, tax management software is essential for insurance agencies to manage their taxes and comply with regulations. It automates payroll and accounting tasks, provides comprehensive tax reporting, ensures compliance with industry-specific tax regulations, supports bookkeeping and financial analysis, and offers the flexibility of cloud technology. With all these features, it's clear that tax management software is a valuable tool for insurance agencies.

Key Features to Look for in Tax Management Software

When it comes to managing taxes, insurance agencies require a reliable and efficient software solution. Here are some key features to look for in tax management software:

- Financial Integration: The best tax management software should seamlessly integrate with your insurance agency's financial systems. This integration allows for accurate and real-time reporting of tax liabilities and payments.

- Automated Payroll: Look for software that offers automated payroll processing. This feature eliminates the need for manual calculations and ensures accurate tax deductions for your employees.

- Cloud-based Technology: Opt for a cloud-based tax management software as it provides flexibility and accessibility. You can securely access your tax information from anywhere and at any time.

- Automated Bookkeeping: The software should have automated bookkeeping tools that streamline the recording and tracking of financial transactions. This eliminates manual errors and saves time.

- Tax Law Compliance: Ensure that the software is up-to-date with the latest tax laws and regulations. It should automatically calculate taxes based on the current tax codes, helping you avoid penalties and fines.

- Tax Analysis and Reporting: Look for software that offers detailed tax analysis and reporting capabilities. This allows you to gain insights into your company's tax performance and make informed financial decisions.

- Support and Training: Choose a software provider that offers excellent support and training resources. This ensures that you can effectively use the software and resolve any issues that may arise.

Overall, finding the right tax management software for your insurance agency is crucial for accurate tax calculations, seamless financial integration, and efficient reporting. Consider these key features when making your decision and choose a software solution that meets your agency's unique needs.

Top Tax Management Software for Insurance Agencies

Managing taxes is a crucial task for insurance agencies, and having the right software solution can greatly streamline this process. The top tax management software for insurance agencies offers a range of features and tools to ensure efficient tax management and compliance with regulatory requirements.

One of the best tax management software options for insurance agencies is XYZ Tax Solution. This cloud-based software provides comprehensive tax management tools, including automated bookkeeping, financial analysis, and reporting. With XYZ Tax Solution, insurance agencies can easily track and manage their tax liabilities, deductions, and credits.

Another top tax management software option is ABC Tax Support. This software provides robust tax planning and preparation tools specifically designed for insurance agencies. It offers integration with accounting software, allowing for seamless data transfer and analysis. Insurance agencies using ABC Tax Support can also benefit from advanced reporting capabilities for accurate tax filing.

For insurance agencies that prioritize payroll tax management, DEF Tax Technology is an ideal choice. This software specializes in automating payroll tax calculations and filings. It offers built-in compliance features and supports complex payroll tax requirements specific to insurance agencies, ensuring accurate and timely tax reporting.

In summary, the top tax management software solutions for insurance agencies provide comprehensive tools and support for efficient tax management. Whether an insurance agency needs general tax management features, advanced reporting capabilities, or specialized payroll tax tools, there is a software solution available to meet their specific needs.

Reporting and Analytics Software

When it comes to managing financial data in an insurance agency, accurate accounting and analysis are essential. That's where reporting and analytics software comes in. These specialized tools integrate with your existing bookkeeping software to provide robust reporting capabilities and in-depth analysis of your agency's financial performance.

The best reporting and analytics software for insurance agencies offers automated data collection and reporting features. With just a few clicks, you can generate comprehensive reports on key financial metrics such as revenue, expenses, and profit margins. This not only saves you time but also ensures accuracy in your financial reporting.

One of the key advantages of using reporting and analytics software is the ability to integrate with other accounting tools. This allows for seamless data flow and consolidation of financial information from various sources. The integration capabilities enable you to track different aspects of your agency's finances, including payroll, taxes, and insurance premiums, all in one centralized system.

With the advancement of technology, many reporting and analytics software solutions are now cloud-based. This means you can access your financial data and reports anytime, anywhere, as long as you have an internet connection. The cloud-based nature of these tools also ensures data security and provides backup and recovery options in case of any unforeseen events.

Additionally, reporting and analytics software often comes with built-in support and training resources. This ensures that you and your team can make the most out of the software's capabilities and effectively analyze and interpret the financial data. Having access to a reliable support network can also help resolve any technical issues or questions that may arise during the implementation and ongoing management of the software.

Overall, reporting and analytics software is a crucial component of financial management in an insurance agency. It provides the necessary insights and tools to effectively analyze and track your agency's financial performance, make informed decisions, and ensure compliance with industry regulations. Investing in a reputable reporting and analytics software can significantly enhance your agency's financial management capabilities and drive overall success.

Benefits of Reporting and Analytics Software for Insurance Agencies

Reporting and analytics software can provide numerous benefits to insurance agencies, helping them to streamline their operations and make informed business decisions. These tools enable agencies to generate comprehensive reports, analyze financial data, and gain valuable insights into their performance and profitability.

One of the key benefits of reporting and analytics software is the ability to automate the generation of financial reports. This eliminates the need for manual data entry and reduces the risk of errors. With the best reporting software, agencies can generate accurate and detailed reports with just a few clicks, saving time and effort.

Another advantage is enhanced analysis capabilities. Reporting and analytics software offer advanced features such as data visualization and dashboards, allowing agencies to analyze their financial data from different perspectives. This enables them to identify trends, patterns, and anomalies, helping them to make data-driven decisions for their company.

Integration with other software systems is also a major advantage of reporting and analytics software. These tools can seamlessly integrate with other accounting and bookkeeping software, payroll systems, and even insurance-specific platforms. This integration ensures the flow of data between different systems, providing a holistic view of the agency's financial performance.

Cloud-based reporting and analytics software offer additional benefits. With cloud technology, agencies can access their financial data anytime, anywhere, as long as they have an internet connection. This flexibility allows managers and decision-makers to stay updated on their agency's performance, even when they are on the go.

Finally, reporting and analytics software offer support for tax-related tasks. These solutions often come with tax features, allowing agencies to streamline the tax preparation process. They can track deductible expenses, calculate taxes owed, and generate the necessary reports, simplifying the agency's tax filing obligations.

In conclusion, reporting and analytics software provide insurance agencies with the tools they need to analyze their financial data, generate reports, and make informed business decisions. With automated reporting, enhanced analysis capabilities, integration with other software systems, cloud accessibility, and tax support, these solutions offer a comprehensive financial management solution for insurance agencies.

Essential Features of Reporting and Analytics Software

In the insurance industry, accurate and timely reporting is crucial for the success of any agency. Reporting and analytics software provides the necessary tools and functionality to gather, analyze, and present essential financial data. These solutions offer a wide range of features that support insurance companies in their bookkeeping, tax compliance, and financial analysis.

One of the key features of reporting and analytics software is the integration with other systems and technologies. This allows for seamless data flow and eliminates the need for manual data entry or reconciliation. With this integration, insurance agencies can automate their reporting process and save valuable time and resources.

Another important feature is the ability to generate comprehensive and customizable reports. Reporting software should offer a variety of built-in templates and tools that enable agencies to create reports tailored to their specific needs. These reports should provide detailed insights into the company's financial performance, including revenue, expenses, and profitability.

Additionally, reporting and analytics software should support advanced financial analysis capabilities. This includes features such as forecasting, budgeting, and variance analysis. By providing these tools, the software enables insurance agencies to make informed financial decisions and better manage their resources.

Cloud-based solutions are also becoming increasingly popular in the insurance industry. Cloud-based reporting software offers the advantage of accessibility, allowing users to access their financial data from anywhere, at any time. It also ensures data security and easy backup and recovery.

Furthermore, reporting and analytics software should provide support for payroll management. This includes features like calculating salaries, tax deductions, and generating pay slips. Integration with payroll systems can streamline the payroll process and ensure accuracy and compliance.

In conclusion, reporting and analytics software is an essential tool for insurance agencies. It provides the necessary support for efficient bookkeeping, tax compliance, and financial analysis. With its integration capabilities, customizable reports, advanced financial analysis tools, cloud-based accessibility, and payroll management features, this software offers a comprehensive solution for insurance agencies' reporting needs.

Best Reporting and Analytics Software for Insurance Agencies

When it comes to managing the financial aspects of an insurance agency, having access to the best reporting and analytics software is crucial. With the ever-increasing complexity of the insurance industry, insurance agencies need powerful tools to help them make informed decisions and optimize their operations. This is where cloud-based accounting software comes into play.

Cloud-based accounting software offers insurance agencies the support they need to effectively manage their finances, taxes, and bookkeeping. By automating many of the tedious tasks associated with financial management, this software frees up valuable time for insurance agencies to focus on other critical aspects of their business.

One of the key benefits of using the best reporting and analytics software for insurance agencies is the ability to gain insights from comprehensive financial data. These software solutions provide advanced analysis and reporting tools that enable insurance agency owners to evaluate their financial performance and make data-driven decisions. With integrated reporting features, insurance agencies can easily monitor key performance indicators and track their progress towards financial goals.

Moreover, the best reporting and analytics software for insurance agencies offers seamless integration with other business management tools. This integration allows insurance agencies to centralize their financial data and streamline their reporting processes. By integrating their accounting software with other technology solutions used in their agency, insurance agencies can ensure data accuracy and improve overall operational efficiency.

In conclusion, investing in the best reporting and analytics software is essential for insurance agencies looking to stay ahead in today's competitive market. With the right software solution in place, insurance agencies can benefit from automated financial management, advanced analysis tools, and seamless integration. By leveraging the power of technology, insurance agencies can make informed decisions and drive their business forward.

Budgeting and Forecasting Software

One of the key challenges for insurance agencies is effectively managing their financial resources. This is where budgeting and forecasting software comes into play. This software helps agencies plan and allocate their budget, as well as predict future financial outcomes.

With the advancement of cloud technology, budgeting and forecasting software has become more accessible and user-friendly. Insurance agencies can now leverage the benefits of cloud-based tools to streamline their financial processes.

The best budgeting and forecasting software offers powerful features that enable insurance agencies to effectively manage their finances. These features include automated bookkeeping, payroll integration, and tax management. By automating these tasks, agencies can save time and reduce the risk of errors.

Furthermore, budgeting and forecasting software provides in-depth financial analysis and reporting. Insurance agencies can generate detailed reports and gain insights into their financial performance. This allows them to make informed decisions and identify areas for improvement.

In conclusion, budgeting and forecasting software is an essential tool for insurance agencies. It helps them effectively manage their finances, streamline their processes, and make data-driven decisions. By leveraging the power of technology and automation, insurance agencies can optimize their financial management and drive success.

Why Budgeting and Forecasting Software is Important for Insurance Agencies

Insurance agencies deal with complex financial transactions on a daily basis, making it crucial for them to have effective budgeting and forecasting software. This type of software provides valuable tools and features that help insurance agencies effectively manage their finances and make informed business decisions.

One of the key advantages of budgeting and forecasting software for insurance agencies is its ability to streamline financial analysis. With this software, agencies can track and analyze key financial data, such as revenue, expenses, and cash flow, in real time. They can easily generate reports that provide a comprehensive overview of their financial performance, helping them identify areas of improvement and make necessary adjustments.

Another important aspect of budgeting and forecasting software is its support for financial planning and goal setting. Insurance agencies can use this software to create budgets and forecasts based on their specific business objectives and financial targets. By setting realistic goals and monitoring their progress, agencies can better allocate their resources and ensure that they are on track to achieve their desired financial outcomes.

The integration capabilities of budgeting and forecasting software are also crucial for insurance agencies. This software can be seamlessly integrated with various other tools and systems that agencies use for their financial operations, such as bookkeeping, payroll, and tax software. This integration eliminates the need for manual data entry and ensures accurate and up-to-date financial information, saving time and reducing errors.

Furthermore, budgeting and forecasting software is often cloud-based, allowing insurance agencies to access their financial data from anywhere and at any time. This flexibility and accessibility is especially beneficial for agencies with multiple locations or remote employees. It also provides secure and reliable data storage, protecting sensitive financial information and ensuring compliance with data privacy regulations.

In conclusion, budgeting and forecasting software is a vital solution for insurance agencies, enabling them to efficiently manage their finances, analyze financial data, plan for the future, integrate with other tools, and securely store their financial information. By leveraging the power of technology, insurance agencies can optimize their financial operations and make informed decisions that drive growth and success.

Key Features to Consider in Budgeting and Forecasting Software

When it comes to budgeting and forecasting in the insurance industry, having the right software is essential. The best software solutions provide a range of key features that can help insurance agencies with their financial management and analysis. Here are some important features to consider:

- Integrated Reporting: A good budgeting and forecasting software should offer integration with accounting and bookkeeping systems. This allows for seamless data transfer and consolidated financial reporting.

- Built-in Tax Tools: Since taxes are an integral part of financial planning, it is important to choose a software that offers built-in tax calculation and reporting features. This can help insurance agencies ensure compliance with tax regulations.

- Automated Budgeting: Manual budgeting can be time-consuming and prone to errors. Look for a software solution that offers automated budgeting capabilities, allowing for efficient and accurate budget creation and tracking.

- Forecasting Capabilities: In the insurance industry, accurate financial forecasting is crucial for effective planning. Choose a software that offers robust forecasting tools, including predictive modeling and what-if analysis.

- Cloud-based Solution: Cloud technology provides several advantages, including remote access, scalability, and data security. Opt for a budgeting and forecasting software that is cloud-based for greater flexibility and convenience.

- Payroll Integration: Payroll is an important aspect of financial management for insurance agencies. Look for software that integrates with payroll systems, allowing for seamless payroll processing and accurate financial reporting.

- Support and Training: When adopting new software, adequate support and training are crucial. Ensure that the software provider offers comprehensive support options, including training resources and a dedicated support team.

By considering these key features, insurance agencies can choose the best budgeting and forecasting software that suits their specific needs. Integration with existing systems, automated processes, and strong forecasting capabilities will enhance financial management and help drive the success of the agency.

Top Budgeting and Forecasting Software for Insurance Agencies

When it comes to managing the financial aspects of an insurance agency, having a reliable budgeting and forecasting software is essential. Such software can provide insurance agencies with the tools they need to effectively plan, track, and analyze their financial activities.

One of the best budgeting and forecasting solutions for insurance agencies is Company A. This software provides seamless integration with other key systems used by insurance agencies, such as payroll and bookkeeping software. By automating these processes, Company A eliminates the need for manual data entry and ensures accuracy.

In addition to streamlining financial processes, Company A offers robust budgeting and forecasting capabilities. The software allows insurance agencies to create detailed budgets, track expenses, and generate accurate financial forecasts. With real-time data and automated reporting, insurance agencies can make informed decisions and adjust their strategies as needed.

Another top budgeting and forecasting software for insurance agencies is Company B. This cloud-based solution provides a user-friendly interface and advanced financial analysis tools. Agency managers can easily access and analyze financial data, identify trends, and make data-driven decisions to optimize their operations.

Furthermore, Company B offers comprehensive support for insurance-specific requirements, such as managing policy premiums and claims expenses. The software also includes features for tax reporting and compliance, ensuring insurance agencies stay on top of their financial obligations.

In conclusion, the top budgeting and forecasting software for insurance agencies offers a combination of powerful financial management tools and advanced analytical capabilities. Companies A and B are prime examples of solutions that can help insurance agencies streamline their financial processes, improve decision-making, and achieve long-term success in a rapidly evolving industry.

Invoicing and Billing Software

Invoicing and billing software is a crucial tool for insurance agencies as it provides support for efficient financial management. With this software, insurance agencies can streamline their invoicing processes, ensuring accurate and timely payment collection from clients. This software automates the billing process, reducing the chances of errors and ensuring compliance with tax regulations.

One of the key features of invoicing and billing software is the ability to generate detailed reports and analysis. This enables insurance agencies to gain insights into their financial performance, track revenue, and identify areas for improvement. With advanced reporting tools, agencies can monitor outstanding payments, track client payment history, and analyze overall cash flow.

In addition to its bookkeeping and accounting capabilities, invoicing and billing software also offers integration with other financial management tools. This allows insurance agencies to seamlessly connect their billing system with payroll and expense management solutions, creating a comprehensive financial management solution.

Cloud technology plays a vital role in modern invoicing and billing software, as it enables agencies to securely store and access their financial data from anywhere, at any time. The cloud-based approach eliminates the need for manual backups and ensures data integrity and security.

In conclusion, choosing the best invoicing and billing software is essential for insurance agencies to streamline their financial processes, ensure accurate invoice generation, manage taxes, and automate payment collection. The right software solution will offer advanced reporting and analysis tools, seamless integration with other financial management tools, and the benefits of cloud technology.

Advantages of Invoicing and Billing Software for Insurance Agencies

Managing the financial aspects of an insurance agency can be a complex task, but with the right software solution, it becomes much easier. Invoicing and billing software offers numerous advantages for insurance agencies, allowing them to streamline their operations, improve accuracy, and save time and effort.

One of the key advantages of using invoicing and billing software is the automation it provides. With automated accounting and billing processes, insurance agencies can reduce manual errors and ensure accurate and timely invoicing. This means that policyholders receive their invoices promptly, which improves customer satisfaction and cash flow for the agency.

Another advantage is the integration that invoicing and billing software offers. Many top accounting software for insurance agencies have integration capabilities with other essential tools, such as payroll systems or tax management software. This integration allows for seamless data transfer and eliminates the need for manual data entry, saving time and reducing the risk of errors.

Cloud-based solutions are becoming increasingly popular in the insurance industry, and invoicing and billing software is no exception. Cloud-based software offers numerous advantages, such as easy accessibility from anywhere with an internet connection, real-time updates, and automatic backups. Insurance agencies can benefit from increased flexibility and scalability, as well as enhanced data security.

Furthermore, invoicing and billing software often provides robust reporting and financial management functionalities. Insurance agencies can generate comprehensive financial reports, track revenue and expenses, and gain valuable insights into their business performance. This data-driven approach enables better decision-making, strategic planning, and improved profitability.

In conclusion, the advantages of using invoicing and billing software for insurance agencies are numerous. From automation and integration to cloud technology and advanced financial management tools, these software solutions provide the best support for efficient invoicing, billing, and overall financial management for insurance agencies.

Essential Features of Invoicing and Billing Software

When it comes to invoicing and billing in the insurance industry, having efficient and reliable software is crucial. Here are some essential features to look for:

1. Automation: An invoicing and billing software should have automated features that streamline the process, reducing manual errors and saving time. This includes automatically generating and sending invoices, as well as reminders for overdue payments.

2. Integration: The software should be able to integrate seamlessly with other accounting and management tools, such as payroll systems and reporting software. This allows for better synchronization of data and reduces the need for manual data entry.

3. Reporting and Analysis: A good invoicing and billing software should offer robust reporting and analysis tools. This enables insurance agencies to track invoices, monitor payment trends, and identify potential issues or areas for improvement.

4. Tax Support: The software should have built-in tax support, allowing for accurate and easy calculation of taxes. This ensures compliance with local tax regulations and saves the company from potential penalties or audits.

5. Cloud Technology: Cloud-based software offers the advantage of accessibility from anywhere and at any time. It also ensures that data is securely stored and backed up, preventing loss of important financial information.

6. Bookkeeping and Accounting: An ideal invoicing and billing software should have basic bookkeeping and accounting features. This includes the ability to track income and expenses, generate financial reports, and manage financial transactions.

7. Customer Support: Good customer support is essential when using any software. Look for a software provider that offers prompt and reliable customer support, as well as regular updates and bug fixes.

Overall, the best invoicing and billing software for insurance agencies should provide a comprehensive solution that integrates seamlessly with other tools, offers automation, supports tax calculations, and provides robust reporting and analysis features. Investing in such software can greatly improve the efficiency and accuracy of billing processes within an insurance agency.

Best Invoicing and Billing Software for Insurance Agencies

Insurance agencies require efficient financial management and streamlined bookkeeping processes to effectively handle the financial aspects of their business. With the advancements in technology, the best invoicing and billing software for insurance agencies provide the necessary tools to simplify and automate these tasks.

One of the key features to look for in invoicing and billing software is cloud integration. This allows insurance agencies to access their financial data anytime and anywhere, enabling real-time analysis and reporting. Cloud-based software also ensures data security and backup, providing peace of mind to the company.

The best software for insurance agencies should also provide support for automated invoicing and billing processes. With automated features, agencies can save time and effort by setting up recurring invoices and scheduled payments, eliminating manual data entry. This enables faster payments and reduces the risk of errors.

Integration with other financial and accounting tools is another important consideration. The software should integrate seamlessly with payroll systems, tax software, and other accounting platforms, allowing for efficient data transfer and reducing the need for manual reconciliation.

Insurance agencies also need robust reporting and analysis capabilities to gain insights into their financial performance. The software should provide detailed financial reports, such as income statements and balance sheets, as well as customizable dashboards for real-time monitoring. This helps agencies make informed business decisions and identify areas for improvement.

In conclusion, the best invoicing and billing software for insurance agencies should offer cloud integration, automation of invoicing and billing processes, seamless integration with other financial tools, and robust reporting and analysis capabilities. By choosing the right software, insurance agencies can streamline their financial management and focus on growing their business.

Asset Management Software

Asset management software is a crucial tool for insurance agencies that want to efficiently manage their financial resources and streamline their operations. This software provides a cloud-based solution that allows agencies to easily track and monitor their assets, including property, equipment, and investments. By using asset management software, insurance agencies can ensure accurate reporting and accounting, as well as seamless integration with other financial systems.

One of the best features of asset management software is its ability to provide detailed analysis and reporting. This technology allows agencies to generate comprehensive financial reports and performance metrics, which can be used for strategic decision-making and planning. This includes tracking income and expenses, managing taxes, and conducting thorough bookkeeping.

Another key benefit of asset management software is its support for payroll management. With this software, insurance agencies can easily calculate and process employee salaries, benefits, and deductions. This eliminates the need for manual calculations and reduces the risk of errors. Additionally, the software can generate payroll reports and provide real-time access to important payroll data.

When choosing asset management software for an insurance agency, it is important to consider the level of customer support provided by the software company. The software should come with reliable technical support and regular updates to ensure its functionality and security. The best asset management software providers offer 24/7 customer support and have a reputation for excellent service.

In conclusion, asset management software is a vital tool for insurance agencies that want to efficiently manage their financial resources. This software provides a cloud-based solution that allows for accurate reporting, seamless integration, payroll support, and overall management of assets. With the right asset management software, insurance agencies can improve their financial operations and make informed decisions for the success of their company.

Importance of Asset Management Software for Insurance Agencies

Insurance agencies are heavily reliant on technology to streamline their operations and provide efficient solutions to clients. One crucial aspect of this technology integration is asset management software. This software enables insurance agencies to effectively manage their assets, such as properties, vehicles, and equipment, ensuring seamless operations and accurate accounting.

The best asset management software for insurance agencies offers integrated features that go beyond basic accounting and bookkeeping. It enables automation of processes such as inventory management, payroll, and tax calculations. By automating these tasks, insurance agencies can save time and reduce the likelihood of errors, ensuring accurate financial reporting and analysis.

Furthermore, asset management software allows insurance agencies to track the depreciation of their assets and make informed decisions regarding repairs, replacements, or upgrades. This helps in optimizing resources and improving the overall efficiency of the agency. With cloud-based asset management software, agencies can access their asset information anytime, anywhere, enabling remote collaboration and real-time updates.

Another significant benefit of asset management software is its ability to generate comprehensive reports and provide valuable insights into the financial health of the agency. These reporting tools offer detailed analytics, enabling insurance agencies to identify trends, assess risks, and make informed business decisions. Additionally, insurance agencies can leverage the software to ensure compliance with industry regulations and internal policies.

In conclusion, asset management software plays a vital role in the success of insurance agencies. It offers a comprehensive solution for managing assets, integrating accounting processes, and providing automated reporting and financial analysis tools. By leveraging this software, insurance agencies can streamline their operations, optimize resources, and make informed decisions to drive growth and profitability.

Key Features to Look for in Asset Management Software

When choosing asset management software for your company, it is important to consider the key features that will best suit your needs. These features can help you effectively manage your company's financial resources and maximize profitability. Here are some key features to look for in asset management software:

- Integration: Look for software that integrates seamlessly with your existing systems, such as accounting and payroll software. This will streamline your processes and eliminate the need for manual data entry.

- Automated Accounting: Choose a software solution that automates your accounting processes, such as tracking assets, calculating depreciation, and generating financial reports. This will save you time and reduce the risk of errors.

- Financial Analysis: Look for software that provides robust financial analysis tools, such as profitability analysis, return on investment (ROI) calculations, and cost tracking. These tools will help you make informed decisions and identify areas for improvement.

- Management Solution: Choose a software solution that offers comprehensive asset management capabilities, such as asset tracking, maintenance scheduling, and contract management. This will help you effectively manage your assets throughout their lifecycle.

- Cloud Technology: Consider software that is cloud-based, allowing you to access your asset information from anywhere, at any time. This flexibility is especially important for companies with multiple locations or remote teams.

- Bookkeeping and Reporting: Look for software that offers robust bookkeeping features, such as general ledger management, accounts payable and receivable, and bank reconciliation. Additionally, customizable reporting capabilities will allow you to generate meaningful reports tailored to your specific needs.

- Insurance Support: If your company deals with insurance policies or claims, consider asset management software that integrates with insurance systems. This integration will streamline the process, ensuring accurate asset valuations and insurance coverage.

- Support and Training: Choose a software provider that offers comprehensive support and training to ensure that you and your team can effectively use the software. This will help maximize the benefits of the software and minimize downtime.

- Best in Class Software: Prioritize software providers that have a proven track record in the asset management industry. Look for reviews and testimonials from other companies in your industry to ensure you are selecting the best software for your needs.

By considering these key features, you can choose asset management software that best fits your company's requirements and helps you effectively manage your assets for maximum financial success.

Top Asset Management Software for Insurance Agencies

Insurance agencies require robust software solutions to manage their assets efficiently. With the increasing complexity of the insurance industry, it is essential for agencies to have access to advanced tools that can support their financial management needs. Here is a list of the top asset management software for insurance agencies in 2021:

- Cloud-based Solutions: Cloud technology allows insurance agencies to access their asset management software from anywhere, at any time. This flexibility is crucial for remote work and promotes collaboration among team members.

- Financial Analysis Tools: The best asset management software for insurance agencies offer powerful financial analysis tools. These tools allow agencies to assess the performance of their assets and make data-driven decisions to optimize their investment strategies.

- Integration with Accounting Software: Integration with accounting software is essential for insurance agencies to streamline their financial processes. This integration ensures accurate bookkeeping, simplifies tax preparation, and provides a comprehensive view of the company's financial health.

- Payroll Support: Efficient payroll management is crucial for insurance agencies, especially those with a large workforce. Asset management software with built-in payroll support automates salary calculations, tax deductions, and employee benefits, saving time and reducing the risk of error.

- Reporting and Analysis: Reporting and analysis features enable insurance agencies to generate customizable reports and dashboards. These reports provide valuable insights into the agency's asset performance, helping them identify trends and opportunities for growth.

Choosing the right asset management software for your insurance agency can significantly impact your financial management capabilities. Consider the specific needs of your agency and evaluate the features offered by different software solutions before making a decision. The best asset management software provides a comprehensive solution that combines cutting-edge technology with efficient and user-friendly tools.

Security and Compliance Software