Running a manufacturing business involves dealing with complex transactions, managing inventory, and tracking financial records. Having the right accounting software is crucial for efficiently handling all these tasks. By choosing the best option, manufacturing businesses can streamline their accounting processes, gain valuable insights through accurate reports, and improve overall financial management.

When selecting accounting software for a manufacturing business, the vendor must consider several factors. First and foremost, the software should offer robust functionality for tracking sales, expenses, and costs associated with production. This includes features like billing, invoicing, and managing taxes to ensure compliance and accurate financial reporting.

Additionally, the software should have inventory management capabilities, allowing businesses to track their stock levels and analyze inventory cost and profitability. This helps in optimizing inventory levels and reducing carrying costs, ultimately improving profit margins. Furthermore, a good accounting software should have a payroll module to manage employee salaries and benefits efficiently.

An essential feature of accounting software for manufacturing businesses is the ability to generate comprehensive financial reports. These reports provide the necessary insights to make informed business decisions and assess the financial health of the organization. Some examples of key reports include profit and loss statements, balance sheets, and cash flow statements.

In conclusion, selecting the best accounting software for a manufacturing business is crucial for ensuring accurate and efficient financial management. By considering factors like inventory management, robust reporting capabilities, and payroll functionality, businesses can choose software that aligns with their specific needs and maximizes their financial success.

Benefits of Using Accounting Software for Manufacturing Business

Accounting software plays a crucial role in the manufacturing industry by providing various benefits to the business. Here are some key advantages of using accounting software for a manufacturing business:

- Efficient management of financial transactions: Accounting software helps in managing and recording all financial transactions, including sales, invoices, billing, and expenses. It ensures accurate and systematic recording of financial data.

- Real-time reports and analysis: The best accounting software for manufacturing business provides real-time reports and analysis of the financial data, allowing businesses to identify sales trends, analyze costs, measure profit margins, and make informed decisions.

- Inventory management: Manufacturing businesses heavily rely on inventory management, and accounting software can help in streamlining this process. It enables businesses to track inventory levels, monitor stock, and manage procurement efficiently.

- Payroll management: Accounting software simplifies the payroll process by automating calculations, generating payslips, and managing employee information. It ensures accurate and timely payment to employees.

- Compliance with taxes and regulations: The software helps businesses in complying with tax regulations by generating tax reports, calculating taxes, and maintaining tax records. It ensures that the business remains compliant with all tax requirements.

In conclusion, accounting software for manufacturing businesses provides a range of benefits, including efficient financial management, real-time reporting, streamlined inventory management, payroll automation, and tax compliance. Investing in the right accounting software can significantly improve the overall financial health and success of a manufacturing business.

Increased Efficiency and Accuracy of Financial Management

Implementing the best accounting software for manufacturing business can significantly improve the efficiency and accuracy of financial management. By automating various processes, such as expense tracking, payroll management, and generating financial reports, the software helps streamline the business operations.

With accounting software, businesses can easily manage their expenses, reducing the likelihood of errors and ensuring accurate financial records. The software allows for easy tracking of vendor costs, invoices, and sales transactions, providing a clear view of the overall financial status of the manufacturing business.

Furthermore, the software's ledger functionality enables businesses to maintain a complete record of all financial transactions, including billing and inventory management. This helps businesses keep track of their cash flow, monitor profit margins, and make informed decisions regarding pricing and inventory management.

The accounting software also simplifies the process of calculating and managing taxes by automating tax calculations and generating timely tax reports. This ensures compliance with tax regulations and reduces the risk of penalties or fines.

Overall, the implementation of the best accounting software for manufacturing business can significantly increase efficiency and accuracy in financial management. By automating various accounting processes, businesses can save time, reduce errors, and have better control over their financial operations.

Streamlined Inventory Management

When it comes to manufacturing business, efficient inventory management is crucial for maximizing profit and reducing costs. By using the best accounting software for manufacturing, businesses can streamline their inventory management processes to effectively track and control their inventory levels.

The software provides real-time visibility into inventory data, allowing businesses to accurately monitor and analyze their stock levels. It enables businesses to easily track inventory movements, such as goods received from vendors, products sold to customers, and items used in the manufacturing process.

With streamlined inventory management, businesses can generate detailed reports on inventory turnover, stock valuation, and sales trends. These reports help businesses make informed decisions about pricing, purchasing, and production. They can identify slow-moving or obsolete inventory and take necessary actions to optimize their inventory levels.

In addition to inventory management, the software also integrates with other accounting functions, such as sales, payroll, billing, and financial reporting. It automates various accounting tasks, such as updating the general ledger, recording expenses, and generating invoices. This integration ensures accurate financial data and reduces the risk of errors in financial records.

Moreover, the software helps businesses comply with tax regulations by automatically calculating and recording taxes on transactions. It provides a clear audit trail, which is essential for tax compliance and financial transparency. By streamlining inventory management and accounting processes, businesses can improve efficiency, reduce costs, and ultimately enhance their profitability in the competitive manufacturing industry.

Improved Cost Control and Profitability Analysis

In manufacturing business, it is crucial to manage costs effectively to ensure profitability. Using the best accounting software specifically designed for manufacturing can help you achieve improved cost control and profitability analysis.

The software allows you to track and manage various expenses, including payroll, inventory, billing, taxes, and vendor transactions. With detailed financial reports and analysis, you can gain insights into your costs and identify areas where you can reduce expenses or optimize spending.

By accurately tracking your sales, invoices, and expenses, the software enables you to analyze your profit margins and identify opportunities for growth. You can easily determine the profitability of different products or projects, making informed decisions to maximize your revenue.

With the help of the software's comprehensive ledger and financial reporting capabilities, you can monitor your cash flow and ensure that your manufacturing operations are financially stable. The software provides real-time updates on your financial performance, allowing you to make timely adjustments and take proactive measures to maintain profitability.

In addition, the software's cost control features enable you to set budgets and monitor your expenditure against the budgeted amounts. By analyzing the variance between actual costs and budgeted costs, you can identify areas of inefficiency and implement cost-saving measures.

Overall, the best accounting software for manufacturing business provides you with the tools and insights necessary to effectively manage costs, analyze profitability, and make informed financial decisions to drive the success of your manufacturing operations.

Key Features to Look for in Accounting Software for Manufacturing Business

When selecting accounting software for a manufacturing business, there are several key features that you should look for to effectively manage your financial processes. These features will help streamline your operations, improve accuracy, and provide you with valuable insights into your business performance.

- Inventory management: A good accounting software for manufacturing should have robust inventory management features. It should allow you to track your inventory levels, manage costs, and accurately calculate the value of your stock.

- Cost tracking: Proper cost tracking is essential for manufacturing businesses. Look for software that enables you to track and allocate costs to different production processes and accurately calculate the cost of goods sold.

- Invoicing and billing: Your accounting software should have features for generating invoices and managing billing processes. It should allow you to easily create and send invoices to customers, track payment status, and automate recurring billing.

- Financial reporting: Robust financial reporting capabilities are crucial for a manufacturing business. Look for software that can generate various financial reports, such as profit and loss statements, balance sheets, and cash flow statements. These reports will provide you with an overview of your business's financial health.

- Vendor management: Effective vendor management is important in manufacturing. Your accounting software should allow you to easily manage vendor information, track purchase orders, and reconcile vendor payments.

- Transaction and expense tracking: Look for software that enables you to track all your business transactions and expenses. This will help you accurately record and categorize expenses, and keep track of all financial activities.

In conclusion, the best accounting software for manufacturing businesses should have features for managing inventory, tracking costs, generating invoices, providing comprehensive financial reports, managing vendors, and tracking transactions and expenses. These key features will help you effectively manage your business's finances and make informed decisions for growth and profitability.

Integration with Inventory and Supply Chain Management

The best accounting software for manufacturing businesses should have seamless integration with inventory and supply chain management systems. This integration is crucial for businesses to effectively manage their sales and inventory levels, which directly impact their profit.

By integrating the accounting software with inventory management, businesses can track their stock levels in real-time. They can easily see which products are selling well and which ones are not, allowing them to make informed decisions about their production and purchasing plans.

Furthermore, integration with supply chain management enables businesses to effectively manage their vendor relationships. They can easily track their purchases, manage vendor invoices, and ensure timely payments. This integration also allows for efficient tracking of shipping and delivery schedules, ensuring that manufacturing processes are not interrupted due to supply chain issues.

With the integration of financial and inventory data, businesses can generate comprehensive reports that provide insights into their costs and profitability. They can analyze their inventory turnover ratios, identify slow-moving or obsolete items, and make necessary adjustments to optimize their inventory management.

Additionally, the integration of accounting software with payroll systems enables businesses to efficiently manage employee salaries, taxes, and benefits. This integration ensures accurate and timely payment of employee wages, while also facilitating the calculation and reporting of payroll taxes.

In summary, the integration of accounting software with inventory and supply chain management systems is essential for manufacturing businesses to effectively manage their financial transactions, inventory, and supply chain processes. It allows for streamlined operations, improved decision-making, and better control over costs, ensuring the overall success of the business.

Costing and Pricing Analysis Tools

Costing and pricing analysis tools are essential for manufacturing businesses to effectively manage their financial operations and optimize profitability. These software solutions allow businesses to track and analyze expenses, transactions, and financial data in real time, enabling them to make informed decisions about pricing strategies.

One of the best costing and pricing analysis tools for manufacturing businesses is accounting software. This software helps businesses manage their accounts payable and receivable, vendor payments, payroll, and taxes. It provides a comprehensive view of the financial health of the business and enables businesses to accurately calculate costs and determine pricing strategies.

In addition to accounting software, manufacturing businesses can also benefit from inventory management software. This software helps businesses keep track of their inventory levels, perform inventory valuation, and analyze the cost of goods sold. By accurately tracking and managing inventory, businesses can identify cost-saving opportunities and optimize their pricing strategies.

Another important tool for costing and pricing analysis is sales software. This software helps businesses analyze sales data, track customer orders, and generate sales reports. By analyzing sales data, businesses can identify their most profitable products or services and adjust pricing accordingly to maximize profit.

Billing and invoicing software is another useful tool for costing and pricing analysis. This software enables businesses to create and send invoices to customers, keep track of outstanding payments, and generate financial reports. By efficiently managing the billing process, businesses can ensure timely payment and optimize cash flow.

Overall, costing and pricing analysis tools are crucial for manufacturing businesses to effectively manage their costs, determine optimal pricing strategies, and maximize profit. Whether it is accounting software, inventory management software, sales software, or billing and invoicing software, businesses should carefully choose the best tools that meet their specific needs and requirements.

Job Costing and Project Management

In the manufacturing industry, job costing and project management are crucial aspects of running a successful business. With the right accounting software, manufacturers can efficiently track costs associated with each job or project, helping them make informed decisions and maximize profitability.

Job costing involves assigning and tracking costs to specific jobs or projects. This allows manufacturers to accurately determine the direct and indirect costs associated with each job, including labor, materials, overhead expenses, and taxes. By analyzing these costs, businesses can calculate the total expenses incurred and assess the profitability of each job.

Effective project management is also essential for manufacturing businesses. With the help of accounting software, manufacturers can manage and track various project-related activities, such as inventory management, vendor management, payroll processing, and sales transactions. This enables businesses to streamline their operations, ensure timely completion of projects, and maintain customer satisfaction.

Accounting software designed for manufacturing businesses provides features like job costing and project management modules. These modules allow manufacturers to create detailed job cost estimates, track actual costs, generate invoices, and manage billing. Manufacturers can also monitor project progress, generate financial reports, and analyze profitability using such software.

In conclusion, job costing and project management are crucial components of running a successful manufacturing business. Using accounting software with job costing and project management modules can help businesses effectively manage costs, improve project execution, and maximize profit. By leveraging such software, manufacturers can gain better control over their financials and make informed business decisions.

Top Accounting Software Options for Manufacturing Business

Accounting software plays a crucial role in managing the financial aspects of a manufacturing business. It helps streamline various processes, such as invoices, inventory management, taxes, payroll, vendor transactions, and more.

One of the best accounting software options for manufacturing businesses is ABC Manufacturing Accounting Software. This software provides comprehensive features to efficiently manage all financial aspects of a business. With ABC Manufacturing Accounting Software, you can easily track invoices, manage inventory, calculate taxes, process payroll, and handle vendor transactions.

Another popular accounting software for manufacturing businesses is XYZ Manufacturing Financial Suite. This software offers robust capabilities for profit and loss management, ledger maintenance, and financial reporting. It also provides tools for tracking sales, billing, and expenses, ensuring accurate financial calculations and reporting.

For manufacturing businesses looking for a cloud-based accounting solution, DEF Manufacturing Cloud Accounting Software is an excellent choice. This software allows you to access your financial data anytime, anywhere, and provides real-time insights into the financial health of your business. It includes features such as inventory management, invoice tracking, and customizable reports.

In conclusion, choosing the right accounting software is crucial for managing the financial aspects of a manufacturing business. Whether you prefer a traditional on-premises solution or a cloud-based option, there are various software options available to suit your business needs. Make sure to consider factors such as invoicing, inventory management, taxes, payroll, vendor transactions, and financial reporting capabilities when selecting the best accounting software for your manufacturing business.

QuickBooks Desktop Enterprise

QuickBooks Desktop Enterprise is a powerful accounting software designed specifically for manufacturing businesses. It offers a comprehensive set of features that help businesses manage their financial transactions, inventory, and payroll efficiently.

With QuickBooks Desktop Enterprise, manufacturing businesses can easily track their sales, expenses, and profit. The software allows you to create and send professional-looking invoices to your customers, helping you streamline your billing process.

One of the key highlights of QuickBooks Desktop Enterprise is its robust inventory management capabilities. It allows you to keep track of your inventory levels, monitor costs, and manage your vendors effectively. You can easily track the movement of your inventory and ensure that you always have the right amount of stock on hand.

In addition, QuickBooks Desktop Enterprise simplifies the process of managing payroll. It offers advanced payroll features that enable you to calculate paychecks, deduct taxes, and generate payroll reports with ease. This helps save time and ensures accurate payroll processing.

QuickBooks Desktop Enterprise also provides a comprehensive financial reporting system. You can easily generate balance sheets, income statements, and cash flow statements to gain insight into your business's financial health. The software also allows you to create custom reports, tailor-made to suit your specific reporting needs.

Overall, QuickBooks Desktop Enterprise is an excellent choice for manufacturing businesses looking for a reliable and efficient accounting software. Its wide range of features, including inventory management, payroll processing, and financial reporting, make it one of the best options available on the market.

Sage Intacct

Sage Intacct is a top accounting software for manufacturing businesses. It is specially designed to handle the complex transactions and financial needs of manufacturing companies. With Sage Intacct, you can easily manage your vendor and customer transactions, track inventory, and generate detailed financial reports.

The software provides a comprehensive ledger system that allows you to record and track all your accounting transactions. It also offers advanced features for managing manufacturing costs, including overhead expenses, labor costs, and materials costs. This helps you keep track of your expenses and ensure that your manufacturing operations are running efficiently.

Sage Intacct is the best choice for manufacturing businesses because it provides a complete solution for managing your financials. It allows you to easily track your sales, manage your payroll, handle billing, and calculate taxes. With Sage Intacct, you can generate accurate financial reports and invoices, giving you a clear picture of your business's profit and loss.

One of the key features of Sage Intacct is its inventory management capabilities. It allows you to track your inventory levels, manage stock movements, and monitor product costs. This helps you optimize your inventory and reduce the risk of overstocking or stockouts, ensuring that you have the right amount of inventory at all times.

Overall, Sage Intacct is the best accounting software for manufacturing businesses. It offers a wide range of features and functionalities to help you effectively manage your financials and streamline your operations. Whether you are a small manufacturer or a large-scale enterprise, Sage Intacct can help you make better financial decisions and drive profitability.

Oracle NetSuite

Oracle NetSuite is considered one of the best accounting software options for manufacturing businesses. It offers a wide range of features that help manage the financial aspect of the business efficiently.

With Oracle NetSuite, businesses can easily track costs, generate detailed reports, and analyze transactions to make informed decisions. The software provides comprehensive accounting capabilities, including invoicing, billing, and managing expenses.

Manufacturing businesses can also benefit from NetSuite's inventory management features. It allows businesses to track vendor and customer relationships, manage sales orders, and optimize inventory levels. This helps ensure that the financial aspect of the manufacturing process is smooth and profitable.

In addition to accounting and inventory management, Oracle NetSuite also provides payroll and tax functionalities. It simplifies the process of managing employee payroll, calculating taxes, and generating accurate reports for tax filing purposes.

Overall, Oracle NetSuite offers a robust and comprehensive solution for manufacturing businesses, helping them streamline their financial processes, manage costs, and maximize profitability. Its user-friendly interface and extensive features make it an ideal choice for businesses of all sizes in the manufacturing industry.

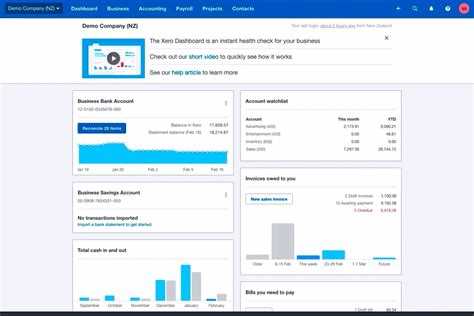

Xero

Xero is a powerful and user-friendly accounting software that is ideal for manufacturing businesses. It allows you to manage your costs, transactions, expenses, and billing all in one place. This makes it easier to keep track of your business's financial health and make informed decisions.

With Xero, you can easily create and send professional invoices to your customers, helping you streamline your sales process. The software also has a payroll feature, which makes it easy to manage your employees' salaries and track their hours worked.

Xero also offers robust inventory management capabilities, allowing you to track your manufacturing materials and finished products. This can help you ensure that you always have the right amount of inventory on hand and avoid costly stockouts or overstock situations.

In addition, Xero makes it easy to stay on top of your tax obligations. The software can automatically calculate and file your taxes, saving you time and reducing the risk of errors. Xero also provides detailed financial reports, such as profit and loss statements and balance sheets, which can help you gain insights into your business's financial performance.

Xero integrates seamlessly with other business software and allows you to connect with your vendors and suppliers. This makes it easy to manage your accounts payable and stay on top of your financial obligations. The software also has a robust ledger feature, which allows you to track and analyze your transactions in detail.

In summary, Xero is an excellent accounting software for manufacturing businesses. Its features such as inventory management, payroll, billing, and financial reporting make it a comprehensive solution for managing your business's finances. With Xero, you can focus on growing your manufacturing business while having peace of mind knowing that your accounting and financial needs are being taken care of.

Factors to Consider When Choosing Accounting Software for Manufacturing Business

Choosing the right accounting software for a manufacturing business is crucial for managing and optimizing financial processes. There are several factors that should be considered when making this decision:

- Specific manufacturing features: The software should have features tailored to the unique needs of a manufacturing business, such as inventory management, sales order processing, bill of materials, and production planning. These features are essential for effectively managing the manufacturing process and tracking costs.

- Scalability: It's important to choose accounting software that can grow with the business. As the manufacturing business expands, the software should be able to accommodate increasing volumes of transactions and data without compromising performance.

- Integration: Compatibility with other business systems, such as enterprise resource planning (ERP) software and customer relationship management (CRM) software, is crucial for seamless data flow and streamlined operations. The accounting software should integrate with these systems to ensure efficient collaboration between different departments.

- Reporting capabilities: The software should provide comprehensive reporting capabilities, allowing businesses to track financial performance and generate various financial reports, such as profit and loss statements, balance sheets, and cash flow statements. These reports are essential for making informed business decisions and meeting regulatory requirements.

- Security: The accounting software should have robust security measures in place to protect sensitive financial data. This includes features like user access controls, data encryption, and regular backups. Adequate security measures are necessary to safeguard against potential threats and maintain the integrity of financial information.

- User-friendly interface: The software should have an intuitive and user-friendly interface that makes it easy for users to navigate and perform tasks. A well-designed interface can greatly enhance productivity and reduce the learning curve for employees.

By carefully considering these factors, manufacturing businesses can choose the best accounting software to effectively manage their financial processes and drive growth.

Scalability and Customization Options

When choosing the best accounting software for your manufacturing business, it is crucial to consider its scalability and customization options. As your business grows, you need a software that can effectively manage your financial transactions, expenses, and costs.

Scalable accounting software allows you to easily add new features and functionalities as your needs evolve. This flexibility ensures that the software can adapt to the changing requirements of your business. For example, if you expand your product line or enter new markets, a scalable software can handle the increased billing and inventory management needs.

Customization options are also important for manufacturing businesses. Each business has its unique accounting processes and requirements. A software that provides customizable features allows you to tailor it to your specific needs. For instance, you can customize the chart of accounts, vendor ledger, and sales reports to match your manufacturing operations.

Furthermore, customization options enable you to automate repetitive tasks and streamline your accounting processes. You can create custom invoices and billing templates that align with your branding and reflect your manufacturing business. This not only saves time but also ensures consistency and professionalism in your communications with customers and vendors.

Moreover, a customizable accounting software allows you to integrate other business software and tools that you use in your manufacturing operations. For example, you can integrate the payroll system to automatically calculate and process payroll expenses. You can also integrate tax management software to accurately calculate and report taxes.

In summary, scalability and customization options are crucial factors to consider when choosing accounting software for your manufacturing business. Look for a software that can efficiently manage your financial transactions, expenses, costs, billing, vendor ledger, and sales. Customization options will enable you to tailor the software to your specific manufacturing needs and integrate other tools for seamless operations. With the right accounting software, you can accurately track your profit, generate reports, and streamline your manufacturing business.

User-Friendly Interface and Ease of Use

When it comes to accounting software for manufacturing businesses, having a user-friendly interface is crucial. This ensures that business owners and employees can easily navigate the software and perform their tasks efficiently. A user-friendly interface helps to simplify the complex process of managing transactions and expenses, making it easier for users to track costs and analyze financial data.

With the best accounting software for manufacturing businesses, users can easily manage their inventory, track sales, and generate invoices. The software allows for seamless integration with other systems and applications, making it simple to import and export data. This means that users can easily manage their vendor and customer information, as well as track their financial transactions and monitor their profit and loss statements.

In addition to a user-friendly interface, ease of use is also important in accounting software for manufacturing businesses. The software should have a simple and intuitive design, allowing users to easily find the information they need and perform tasks such as managing payroll, billing, and generating financial reports. This simplifies the process of managing financial transactions and helps businesses stay organized.

Furthermore, a user-friendly interface and ease of use help businesses save time and reduce errors. By automating repetitive tasks and providing users with clear instructions, the best accounting software for manufacturing businesses helps to minimize the risk of human error and increase efficiency. This allows business owners and employees to focus on other important aspects of their business, such as product development and customer satisfaction.

In conclusion, having a user-friendly interface and ease of use are crucial factors to consider when choosing the best accounting software for manufacturing businesses. The software should provide easy navigation, simplify complex processes, and help businesses save time and reduce errors. By investing in a reliable and user-friendly accounting software, manufacturing businesses can effectively manage their financial transactions and stay on top of their financial health.

Cost and Pricing Structures

In the manufacturing business, managing costs is crucial for the success and profitability of a company. Effective accounting software can help businesses maintain accurate financial records and track expenses.

One of the key features of accounting software for manufacturing businesses is its ability to manage transactions and maintain a ledger. This allows businesses to keep track of all their financial activities, including invoicing, billing, and inventory management.

Additionally, accounting software can assist in managing payroll expenses. It can calculate employee wages, benefits, and taxes, ensuring accurate and timely payment. This feature helps businesses streamline their payroll process and reduce the risk of errors.

Furthermore, the software can generate various financial reports, such as profit and loss statements, balance sheets, and cash flow statements. These reports provide businesses with valuable insights into their financial performance and help them make informed decisions.

When choosing the best accounting software for a manufacturing business, it is important to consider the cost and pricing structure. Different vendors offer different pricing models, such as monthly subscriptions, per user licenses, or one-time purchases. Businesses should evaluate their budget and needs to determine the most cost-effective option.

In conclusion, accounting software is essential for manufacturing businesses to effectively manage their finances, track expenses, and generate accurate financial reports. Considering the cost and pricing structure is important to ensure that the chosen software meets the needs of the business while being within budget.

Case Studies: How Manufacturing Businesses Benefit from Accounting Software

Accounting software has become an essential tool for manufacturing businesses, offering a wide range of benefits. Let's take a look at some case studies to see how these businesses have leveraged accounting software for improved productivity and financial management.

1. Streamlining Transactions and Expenses: A manufacturing company implemented an accounting software solution that automated the process of recording and categorizing transactions and expenses. This eliminated the need for manual data entry, saving time and reducing errors. The software also generated reports that provided a clear overview of all financial activities.

2. Efficient Sales Management: Another manufacturing business used accounting software to manage its sales process more effectively. The software allowed them to track leads, manage customer information, and generate professional invoices with ease. By streamlining these tasks, the company could focus more on the core aspects of its business and improve sales productivity.

3. Accurate Financial Reports: A manufacturing company implemented an accounting software solution that offered comprehensive reporting features. This allowed them to generate detailed financial reports such as profit and loss statements, balance sheets, and cash flow statements. Access to accurate and up-to-date financial information enabled the business to make informed decisions for cost control and future planning.

4. Enhanced Inventory Management: An accounting software solution helped a manufacturing business optimize its inventory management. The software provided real-time tracking of inventory levels, automated reordering processes, and alerted the business when stock levels were running low. This prevented stockouts and improved overall efficiency in the production process.

5. Effective Payroll and Tax Management: A manufacturing company simplified its payroll and tax management processes by using accounting software. The software automated payroll calculations, tax deductions, and generated accurate payslips for employees. It also helped the business stay compliant with tax regulations by automatically calculating and filing taxes.

In conclusion, accounting software offers various benefits for manufacturing businesses, including streamlined transactions and expenses, efficient sales management, accurate financial reports, enhanced inventory management, and effective payroll and tax management. By leveraging the best accounting software, manufacturing businesses can improve their financial processes and make informed decisions for profitability and growth.

Case Study 1: Company A Saves Time and Improves Efficiency with QuickBooks

Company A, a manufacturing business, was facing challenges in effectively managing their financial transactions and accounting processes. Their manual system was time-consuming and prone to errors, which affected their billing, expenses, and overall profitability. They needed the best accounting software to streamline their operations and improve efficiency.

After researching various options, Company A decided to implement QuickBooks as their financial management software. QuickBooks provided them with a comprehensive set of tools to handle their manufacturing-specific needs, such as inventory management, vendor management, and payroll processing.

With QuickBooks, Company A was able to automate many of their manual tasks, saving significant time and reducing the chances of errors. The software allowed them to track their expenses, create and send invoices, and manage their overall financial health in a more efficient manner.

The inventory management feature of QuickBooks proved to be highly beneficial for Company A. They could easily track their inventory levels, monitor costs, and generate reports to make well-informed decisions. This helped them optimize their inventory and reduce unnecessary expenses, resulting in improved profits.

In addition to inventory management, QuickBooks provided Company A with comprehensive reporting capabilities. They could generate financial statements, profit and loss reports, and balance sheets with just a few clicks. These reports allowed them to gain insights into their business performance, identify trends, and make informed decisions for the future.

Furthermore, QuickBooks made it easier for Company A to handle their payroll and taxes. The software streamlined the payroll process, allowing them to calculate wages, manage employee information, and generate paystubs effortlessly. It also helped them handle tax filings and ensure compliance with tax regulations.

Overall, QuickBooks proved to be the best accounting software for Company A's manufacturing business. By automating their financial processes, they were able to save time, improve efficiency, and make more informed decisions. With features like inventory management, vendor management, and payroll processing, QuickBooks provided them with all the tools they needed to effectively manage their business's finances.

Case Study 2: Company B Achieves Better Cost Control with Sage Intacct

Company B, a manufacturing business, was struggling to manage its costs and achieve better financial control. The company had a complex manufacturing process with multiple expenses and transactions, making it difficult to track costs and optimize profitability. Additionally, its accounting system was outdated and unable to provide timely and accurate financial reports.

Recognizing the need for a modern and efficient solution, Company B decided to implement Sage Intacct, one of the best accounting software options for manufacturing businesses. With Sage Intacct, Company B was able to streamline its financial processes and gain better control over its costs.

The software allowed Company B to track its manufacturing expenses and analyze them in detail. It provided comprehensive reports on costs, sales, and profit margins, giving Company B valuable insights into its financial performance. With this information, the company could make informed decisions to optimize its manufacturing process and reduce unnecessary expenses.

In addition to cost control, Sage Intacct also helped Company B manage other financial aspects such as payroll, taxes, and vendor invoices. The software automated these processes, saving time and minimizing errors. It also provided a centralized ledger for all financial transactions, making it easier for Company B to track and reconcile its accounts.

Furthermore, Sage Intacct offered advanced inventory management features, allowing Company B to track its inventory levels and manage purchasing and billing. The software provided real-time visibility into inventory levels, ensuring that the company had the right amount of materials without excess stock. This helped optimize production and reduce carrying costs.

In conclusion, by implementing Sage Intacct, Company B was able to achieve better cost control and financial management. The software provided comprehensive reports, automated processes, and advanced inventory management features, empowering the company to optimize its manufacturing process and improve profitability.

Case Study 3: Company C Streamlines Operations with Oracle NetSuite

Company C, a leading manufacturing business, was facing challenges in managing its accounting processes efficiently. They were struggling with manual invoicing and financial reporting, which resulted in delays and errors. Additionally, their inventory costs were difficult to track, and they were finding it hard to manage payroll and vendor expenses.

To overcome these challenges, Company C decided to implement Oracle NetSuite, one of the best accounting software for manufacturing businesses. This cloud-based solution offered a comprehensive set of features that helped streamline their operations and improve overall efficiency.

With Oracle NetSuite, Company C was able to automate their invoicing process, eliminating the need for manual entry and reducing the risk of errors. The software provided them with real-time financial reports, allowing them to make informed decisions based on accurate data.

The inventory management capabilities of Oracle NetSuite proved to be invaluable for Company C. They were able to track inventory levels, monitor costs, and optimize their procurement process. This helped them minimize excess inventory and reduce wastage, resulting in significant cost savings.

Managing payroll and vendor expenses became much simpler for Company C with Oracle NetSuite. The software offered built-in payroll and billing functionalities, ensuring accurate and timely payments to employees and vendors. They could also easily track tax obligations and generate tax reports.

In conclusion, Oracle NetSuite proved to be the best accounting software for Company C. It helped them streamline their operations, reduce manual work, and improve the accuracy and efficiency of their accounting processes. With the ability to manage their finances effectively, Company C was able to focus on growing their business and increasing their profit margins.