Effective accounting is crucial for travel agents to manage their financial operations efficiently. With the complexity of payroll, reporting, and bookkeeping, it is essential to find the best accounting software that meets the specific needs of travel agents.

Travel agents require accounting software that enables them to streamline their management processes and accurately track their expenses. The software should offer advanced reporting and analytics features that allow agents to analyze their financial data and make informed business decisions.

In addition to tracking expenses, travel agents need software that provides automation for tasks such as invoice generation, reconciliation, and tax calculations. This automation not only saves time but also reduces the risk of errors in financial reports. By automating these processes, travel agents can focus on delivering exceptional service to their clients.

Furthermore, the best accounting software for travel agents should offer efficient tools for payroll management. This includes functionalities that allow agents to calculate and manage payroll for their employees, ensuring compliance with labor laws and accurate distribution of wages.

Choosing the right accounting software is essential for travel agents to optimize their business operations and maintain financial stability. By implementing a reliable and comprehensive accounting solution, travel agents can streamline their financial processes, improve efficiency, and make informed decisions based on accurate analytics.

Whether it's for a small travel agency or a large-scale enterprise, finding the perfect accounting software is crucial for effective financial management. By leveraging the power of automation, analytics, and best accounting practices, travel agents can focus on delivering exceptional service while ensuring the financial health of their business.

The Importance of Accounting Software for Travel Agents

Travel agents play a crucial role in arranging and organizing travel plans for individuals, families, and businesses. In order to effectively manage their financial operations, travel agents require reliable accounting software that is specifically designed to meet their industry needs.

With the right accounting software, travel agents can streamline their financial management practices and ensure accurate reporting and reconciliation of their income and expenses. The software can automate tasks such as invoicing, payroll, and bookkeeping, saving agents valuable time and improving overall efficiency.

One of the key benefits of accounting software for travel agents is its ability to track and manage travel expenses. The software can provide detailed analytics on expenses related to flights, accommodations, transportation, and other travel-related costs. This enables agents to make informed decisions and optimize their budgeting and expenditure strategies.

Furthermore, accounting software for travel agents ensures compliance with tax regulations and simplifies the process of filing taxes. The software can generate accurate reports and statements that facilitate tax preparation, minimizing the risk of errors and penalties. This helps travel agents stay in line with financial regulations and focus on providing exceptional service to their clients.

In conclusion, choosing the best accounting software is crucial for travel agents to effectively manage their financial operations. The software provides automation, efficiency, and accurate reporting for all aspects of financial management, from tracking expenses to filing taxes. With the right accounting software, travel agents can improve their overall productivity and provide better financial services to their clients.

Features to Consider

When searching for the best accounting software for travel agents, there are several features to consider. These features can greatly enhance the efficiency and financial management of your travel agency.

- Invoices: Look for software that allows you to easily create and send invoices to clients, helping you track payments and manage your cash flow.

- Taxes: The software should have built-in tax capabilities, allowing you to easily calculate and report on your travel agency's taxes.

- Travel Automation: Consider software that offers automation features specific to travel agents, such as automated booking and reservation systems.

- Analytics: Look for software with robust analytics capabilities, allowing you to track and analyze key performance indicators for your travel agency.

- Bookkeeping: The software should have comprehensive bookkeeping functionalities, helping you keep track of expenses and income.

- Accounting: Choose software that offers comprehensive accounting features, including financial statements, general ledger, and bank reconciliation.

- Payroll: If you have employees, consider software that offers payroll functionality to easily manage and process employee wages and taxes.

- Reporting: Look for software that offers robust reporting capabilities, allowing you to generate various reports on your travel agency's financials and performance.

- Management: Consider software with features that help you manage your travel agency, such as vendor management and expense tracking.

- Efficiency: Look for software that streamlines your accounting processes and saves you time, allowing you to focus on running your travel agency.

By considering these features, you can find the perfect accounting software for your travel agency, enabling you to better manage your finances and make informed business decisions.

Financial Reporting

Financial reporting is a crucial aspect of any travel agent's business. It involves keeping track of expenses, invoices, and payroll. This ensures accurate accounting and helps in calculating taxes and managing finances efficiently.

A top accounting software for travel agents provides robust reporting features that allow for easy tracking and analysis of financial data. These software solutions offer customizable templates for creating reports and can generate automated reports on a regular basis.

Financial reporting software also helps in reconciling bank statements and bookkeeping. It allows for the seamless integration of financial data from different sources and provides analytics and insights to aid in decision-making.

By automating financial reporting, travel agents can save time and effort. They can focus more on their core business activities and rely on accurate and up-to-date financial information for strategic planning and growth.

Adopting best practices in financial reporting is essential for travel agents. This includes maintaining proper documentation, implementing internal controls, and regularly reviewing and analyzing financial reports to identify trends and areas for improvement.

In summary, financial reporting is a critical function for travel agents. Choosing the best accounting software that offers comprehensive reporting and analytics capabilities can greatly enhance efficiency and management of finances in the travel agency industry.

Expense Tracking

Effective expense tracking is crucial for travel agents to maintain accurate financial records and ensure profitability. With the help of accounting software, agents can easily track their expenses and implement efficient reporting practices.

Expense tracking allows travel agents to monitor and control their spending, identify areas where costs can be reduced, and improve overall financial management. By categorizing expenses and analyzing spending patterns, agents can make informed decisions to streamline their operations and increase efficiency.

With automated expense tracking software, travel agents can easily reconcile their expenses with receipts and invoices. The software automatically matches expenses to the appropriate categories and provides real-time updates on financial transactions. This eliminates the need for manual data entry and reduces errors, saving agents valuable time and effort.

Expense tracking software also helps travel agents stay compliant with tax regulations. By accurately documenting expenses and categorizing them appropriately, agents can ensure they claim the right deductions and minimize their tax liability. Additionally, the software provides detailed analytics to assist in financial planning and forecasting.

In conclusion, efficient expense tracking is essential for travel agents to manage their business finances effectively. By utilizing accounting software, agents can automate expense management, simplify reconciliation, and improve overall financial management. With accurate tracking and reporting, travel agents can make informed decisions and optimize their operations for better profitability.

Invoicing and Billing

Invoicing and billing are crucial aspects of financial management in travel agencies. With the right accounting software, travel agents can streamline their invoicing and billing processes, ensuring accuracy and efficiency in the financial operations of their business.

The best accounting software for travel agents offers a range of features to support invoicing and billing needs. It provides tools for creating, sending, and tracking invoices, as well as generating quotes and estimates for clients. Such software also enables agents to customize invoices with their own branding and logo, adding a professional touch to their financial transactions.

Automation is a key feature of accounting software for travel agents when it comes to invoicing and billing. It automates the generation of invoices and sends reminders for overdue payments, saving agents valuable time and effort. Additionally, the software can integrate with payment gateways, allowing clients to pay invoices electronically, further accelerating the payment process.

Effective expense management is another important aspect of invoicing and billing for travel agents. Accounting software enables agents to track and categorize expenses related to their business operations, ensuring accurate bookkeeping and financial reporting. It also facilitates the reconciliation of invoices with payments received, providing an overview of outstanding payments and helping agents manage their cash flow effectively.

Moreover, accounting software for travel agents provides robust reporting and analytics capabilities. Agents can generate financial reports to gain insights into their business performance, such as revenue, expenses, profit margins, and outstanding payments. This enables agents to make informed decisions and optimize their financial strategies for long-term growth and success.

Furthermore, integration with payroll systems simplifies the process of managing employee salaries and benefits. Accounting software can calculate and generate payroll, automatically deducting taxes and other withholdings. This ensures compliance with tax regulations and reduces the burden of payroll administration for travel agents.

In conclusion, accounting software plays a crucial role in facilitating invoicing and billing for travel agents. Its features and functionalities automate and streamline financial processes, ensuring efficiency and accuracy in managing expenses, invoices, and payments. By choosing the right accounting software, travel agents can improve their financial management practices and focus on providing exceptional services to their clients.

Top Accounting Software for Travel Agents

When it comes to managing the finances of a travel agency, having reliable accounting software is essential. Travel agents deal with a variety of financial tasks, including tracking expenses, managing payroll, generating invoices, and reconciling accounts. The right software can automate these processes and provide valuable analytics and reporting to help agents streamline their business operations and ensure financial efficiency.

One of the best practices for travel agents is to choose accounting software that is specifically designed for the travel industry. These tools understand the unique needs of travel agencies and provide features tailored to their requirements. They can handle complex tax calculations, manage multiple currencies, and track commissions from vendors.

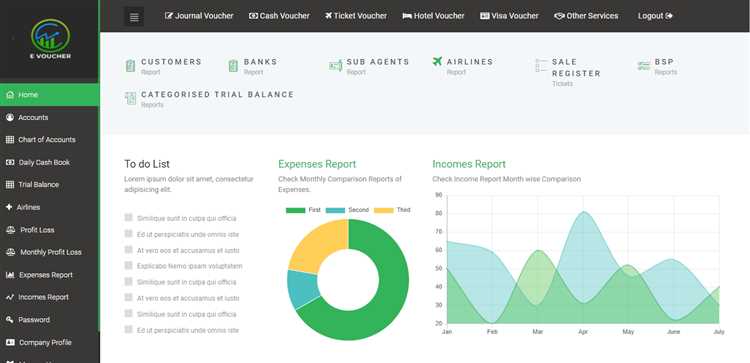

In addition to basic accounting functions, top accounting software for travel agents may also include advanced features such as automated expense reconciliation, built-in travel industry analytics, and integration with other management systems for seamless data flow. This can save agents time and effort by eliminating manual data entry and providing real-time insights into the financial health of their business.

By using the best accounting software for travel agents, businesses can improve their financial management, reduce errors, and ensure compliance with tax regulations. It can also help agents focus on their core business activities, such as designing travel itineraries and providing excellent customer service, knowing that their finances are being taken care of efficiently and accurately.

Option 1: Software A

When it comes to accounting software for travel agents, Software A is one of the best options available. It offers a comprehensive suite of features designed specifically for travel agencies to help them track their finances effectively.

With Software A, travel agents can easily manage their expenses, invoices, and financial transactions. The software provides robust tracking capabilities, allowing agents to keep a close eye on their income and expenses. This ensures accurate record-keeping and simplifies the tax filing process.

In addition to basic bookkeeping functions, Software A also offers advanced features such as payroll management and financial analytics. These tools help travel agents gain a better understanding of their business performance, allowing them to make informed decisions and identify areas for improvement.

Software A also streamlines the reconciliation process by automating tasks that would otherwise be time-consuming and prone to error. With its efficient automation capabilities, travel agents can save valuable time and focus on delivering excellent customer service.

Overall, Software A provides travel agents with a highly efficient and user-friendly accounting solution. Its comprehensive features, including expense tracking, tax management, and financial analytics, make it the ideal choice for travel agencies looking to streamline their accounting practices and boost their efficiency.

Option 2: Software B

Software B is a top accounting solution specifically designed for travel agents. With its robust financial features, this software helps travel agents streamline their bookkeeping and manage their financials with ease.

One of the key features of Software B is its powerful reconciliation capabilities. It allows travel agents to quickly match their bank statements with their recorded transactions, ensuring accurate and up-to-date financial data.

In addition, Software B offers comprehensive invoicing features, allowing travel agents to easily create and send professional invoices to their clients. It also provides a seamless integration with tax software, making it easy for agents to calculate and track their taxes.

Managing expenses and tracking payroll is made simple with Software B. It offers a user-friendly interface where agents can easily record and categorize their expenses, as well as manage their payroll for employees.

Software B also provides advanced reporting and analytics tools, allowing travel agents to gain valuable insights into their business performance. With customizable reports and real-time data, agents can make informed decisions and implement best accounting practices for their travel business.

Furthermore, Software B offers automation capabilities, reducing manual data entry tasks and saving time for travel agents. It automatically imports data from various sources, such as bank statements and credit card transactions, and categorizes them accordingly.

In conclusion, Software B is the best accounting software for travel agents, offering a range of features for easy financial management. From bookkeeping and reconciliation to invoicing, expenses tracking, and payroll management, this software provides all the necessary tools for travel agents to effectively run their business and comply with accounting regulations.

Option 3: Software C

Software C is a top accounting solution for travel agents that offers an extensive range of features to help streamline and automate financial management processes.

With Software C, travel agents can easily manage their bookkeeping and accounting tasks, including invoicing, tracking expenses, and payroll management. The software provides efficient tools for expense tracking, ensuring that all expenses are accurately recorded and tracked for better financial management.

One of the best features of Software C is its robust reporting and analytics capabilities. Travel agents can generate detailed financial reports, analyze their business's financial performance, and make data-driven decisions to improve efficiency and profitability. The software also offers comprehensive tax management features, making it easy to calculate and file taxes in compliance with the latest tax regulations.

Additionally, Software C provides seamless integration with other travel management systems, allowing agents to easily reconcile their financial data with bookings and reservations. This integration helps ensure that all financial transactions are accurately recorded and accounted for.

In summary, Software C is a powerful accounting software option for travel agents, offering automation, bookkeeping, analytics, efficiency, financial management, invoicing, tracking expenses, payroll management, taxes, reporting, and reconciliation features. It provides travel agents with the tools they need to effectively manage their finances and make informed business decisions.

Comparison of Accounting Software

When it comes to accounting for travel agents, finding the right software can greatly improve efficiency and productivity. There are several accounting software options available that cater specifically to the needs of the travel industry. These software solutions offer various features for tracking financial transactions, automating bookkeeping processes, generating invoices, and managing expenses.

One key feature to consider when comparing accounting software options is the ability to provide detailed financial analytics and reporting. A good software solution should offer robust reporting capabilities that allow travel agents to analyze their financial data and make informed business decisions. This can include tracking revenue, expenses, and taxes, as well as generating reports for reconciliation and financial management.

Another important factor to consider is automation. The best accounting software for travel agents should automate repetitive tasks, such as generating payroll and managing invoices. This can save time and improve accuracy, allowing agents to focus on other aspects of their business.

Additionally, integration with other tools and platforms commonly used by travel agents, such as customer relationship management (CRM) systems and online booking platforms, can further streamline processes and improve efficiency. The ability to sync data between different systems can eliminate the need for manual data entry and reduce the risk of errors.

Ultimately, the choice of accounting software will depend on the specific needs and preferences of each travel agent. Some may prioritize user-friendly interfaces, while others may prioritize advanced features and customization options. It is important to carefully evaluate the available options and choose the one that best aligns with the business practices and goals of the travel agency.

Comparison Metric 1: Price

When it comes to choosing accounting software for travel agents, price is an important factor to consider. The cost of the software can vary widely depending on the features and functionality it offers. For small travel agencies or freelancers, finding an affordable option that still provides essential accounting capabilities is crucial.

Many accounting software solutions for travel agents offer different pricing plans to accommodate businesses of all sizes. Some software providers offer tiered pricing, where the cost is based on the number of users or the volume of transactions processed. Others may offer a flat monthly or annual fee regardless of the agency's size.

It's important to evaluate what features are included in each pricing plan to find the best fit for your travel agency's needs. Look for features such as reporting, financial reconciliation, bookkeeping, tax management, payroll, and invoice generation. Additionally, consider whether the software includes analytics capabilities to track and analyze business expenses and performance.

While price is a significant consideration, it's also important to keep in mind that investing in accounting software can ultimately lead to increased efficiency and better financial management practices for travel agents. By automating tasks and streamlining processes, accounting software can save time and reduce the risk of errors, ultimately benefiting the bottom line of the business.

Comparison Metric 2: User Interface

The user interface is an important aspect to consider when choosing accounting software for travel agents. A user-friendly interface allows agents to easily navigate the software and access the necessary tools and features. It should provide a clear and intuitive layout, making it easy for agents with limited accounting knowledge to manage their financial tasks.

Good accounting software should offer a range of features for financial management, including expense tracking, reporting, and bookkeeping. The user interface should provide easy access to these features, allowing agents to efficiently track their expenses and generate accurate financial reports.

Automation is another key feature that contributes to the user-friendliness of accounting software. With automated processes such as payroll and tax calculations, agents can save time and ensure accuracy in their financial management tasks. The user interface should provide easy access to these automation features, making it simple for agents to set up and manage automated processes.

In addition to these features, the user interface should also support efficient data entry and reconciliation. The software should provide clear and organized forms for entering financial data, making it easy for agents to input and review their financial information. The user interface should also include tools for reconciling accounts and resolving any discrepancies, ensuring accurate financial records.

The best accounting software for travel agents will have a user interface that incorporates best practices in design and functionality. It should be visually appealing, with well-organized menus and tabs for easy navigation. The user interface should also be customizable, allowing agents to personalize their dashboard and prioritize the features they use most frequently.

Comparison Metric 3: Integration

When evaluating accounting software for travel agents, one important metric to consider is integration. The best accounting software should seamlessly integrate with other systems and software that travel agents use on a daily basis.

Integration allows for efficient reporting and analysis of financial data. By integrating accounting software with other systems such as expense tracking, bookkeeping, and payroll management, travel agents can easily reconcile their expenses and track their financial performance.

In addition, integration with travel management software enables agents to generate invoices and track payments directly from their accounting software. This eliminates the need for manual data entry and reduces the risk of errors. Integrated accounting software also simplifies tax reporting by automating the calculation and tracking of taxes.

Furthermore, integration with analytics tools allows travel agents to gain insights into their business performance and make informed decisions. By analyzing data from various systems, agents can identify trends, optimize their pricing strategies, and improve overall business management practices.

Therefore, travel agents should look for accounting software that offers seamless integration with other systems and software, providing a unified platform for efficient financial management and reporting.