In the world of billing and accounting, the management of billable expenses is a crucial aspect that can have a direct impact on a company's income and financial health. Billable expenses refer to the costs incurred by a business that can be passed on to clients or customers. These expenses need to be carefully analyzed, tracked, and reported for a proper understanding of the company's financial situation.

One of the major challenges in managing billable expenses is ensuring accuracy and transparency. With the increasing complexity of business transactions and the need for thorough audits, it becomes essential to have a robust system in place for tracking and categorizing expenses. This requires a diligent process of budgeting, invoicing, and analyzing each expense to ensure that it aligns with the company's revenue and project goals.

To effectively manage billable expenses, it is crucial to establish clear guidelines and policies for both internal teams and clients. This includes defining what expenses are billable, how to record and report them, and how they will be reimbursed or billed. By establishing these guidelines, companies can streamline their billing process, ensure compliance with tax regulations, and avoid any issues related to miscommunication or disputes with clients.

Effective management of billable expenses goes beyond just tracking and reporting. It also involves frequent analysis and evaluation of expenses to identify areas for cost reduction and optimize revenue. This can be done through effective budgeting and forecasting techniques that help in identifying potential cost-saving opportunities. By conducting regular expense analysis and implementing measures to control costs, companies can improve their bottom line and enhance their overall financial stability.

Overall, understanding and managing billable expenses is crucial for the financial success of any business. By implementing effective systems and processes for tracking, reporting, and analyzing expenses, businesses can ensure accurate invoicing, proper tax compliance, and improved profitability. It also enables companies to better serve their clients by providing transparent and accountable billing practices, ultimately strengthening their relationships and reputation in the market.

The Importance of Tracking Billable Expenses

Tracking billable expenses is crucial for effective accounting and financial management. It allows businesses to accurately account for their transactions and income, especially when they involve projects or services that need to be billed to clients.

Proper tracking of billable expenses ensures accurate invoicing and contributes to the overall financial health of a company. By monitoring expenses related to specific projects or clients, businesses can generate detailed invoices that reflect the actual costs incurred. This not only helps in budgeting and managing cash flow, but also aids in maintaining transparency and accountability with clients.

Moreover, tracking billable expenses is essential for tax purposes. By properly categorizing and recording expenses, businesses can improve the accuracy of their tax filings and potentially reduce their tax liabilities. Additionally, tracking expenses allows for better cost analysis and management, as it enables businesses to identify areas where costs can be reduced or optimized.

Furthermore, tracking billable expenses is crucial for audit purposes. Businesses may undergo financial audits, either internally or externally, and having well-documented and organized records of billable expenses facilitates the auditing process. It demonstrates compliance with accounting standards and provides a clear trail of financial transactions, promoting credibility and trust in the financial reporting of a company.

Overall, tracking billable expenses is paramount in effectively managing revenue and expenses, which directly impacts a company's profitability. It not only aids in accurate billing and invoicing, but also contributes to better budgeting, tax planning, and financial analysis. Therefore, businesses should implement robust systems and processes for tracking billable expenses to ensure financial success and optimal management of their resources.

Why Tracking Billable Expenses is Essential for Businesses

Tracking billable expenses is an essential task for businesses as it plays a crucial role in the overall profit and management of the company. By accurately recording and monitoring expenses, businesses can effectively assess their financial health and make informed decisions regarding accounting, budgeting, and payroll processes.

Proper expense tracking enables businesses to accurately calculate the costs associated with specific projects or clients. This information is valuable for project analysis and helps ensure that accurate invoicing and revenue recognition take place. Additionally, tracking expenses allows businesses to identify areas of unnecessary expenditure and make appropriate adjustments to reduce costs and increase profitability.

Furthermore, accurate expense tracking is crucial for financial management and regulatory compliance. Tracking expenses ensures proper reporting of financial information, which is necessary for filing taxes correctly and avoiding any penalties or legal issues. It also supports the billing process by providing a detailed breakdown of expenses to clients, enhancing transparency and trust in business operations.

In addition, tracking billable expenses facilitates audit readiness and simplifies the process of reconciling transactions with business records. By diligently recording and categorizing expenses, businesses can easily provide accurate documentation to auditors, reducing the risk of an audit failure or delay.

Moreover, tracking billable expenses provides businesses with valuable insights into the financial performance of different projects and clients. By comparing expenses to income generated, businesses can identify which projects or clients are more profitable and focus their resources accordingly. This analysis helps businesses identify areas for improvement and make strategic decisions to maximize profit.

In conclusion, tracking billable expenses is an essential practice for businesses. It provides accurate information for financial decision-making, supports regulatory compliance, enhances billing processes, aids in audit readiness, and offers valuable insights for business profitability and growth. By implementing effective expense tracking mechanisms, businesses can optimize their financial operations and ensure long-term success.

Impact of Untracked Expenses on Accounting and Financial Reporting

Untracked expenses can have a significant impact on accounting and financial reporting for businesses. When expenses are not properly tracked and recorded, it becomes difficult to accurately calculate income, billing, and profit. This lack of visibility into expenses can lead to inaccurate budgeting and forecasting, making it challenging for businesses to effectively manage their financial resources.

In accounting, tracking expenses is crucial for ensuring that transactions are properly classified and recorded. Without accurate expense tracking, it becomes difficult to allocate costs to specific projects or clients. This can result in billing errors, as expenses might not be properly attributed to the appropriate clients or projects. It can also make it difficult to analyze the profitability of different projects and identify areas where costs can be reduced.

Additionally, untracked expenses can have implications for financial reporting and audit processes. Without proper expense tracking, businesses may struggle to meet reporting requirements and provide accurate financial statements. This can lead to compliance issues and potential penalties. It can also make it challenging for auditors to assess the financial health of the business and ensure that proper accounting practices are being followed.

Furthermore, untracked expenses can affect the overall management and decision-making process within a business. Without accurate expense data, it becomes difficult to make informed decisions about resource allocation, budget adjustments, and cost-saving measures. This lack of visibility into expenses can hinder effective financial management and limit the ability to optimize revenue and profit.

In conclusion, the impact of untracked expenses on accounting and financial reporting cannot be underestimated. It is essential for businesses to implement robust expense tracking systems and processes to ensure accurate financial management, reporting, and decision-making. By properly tracking and recording expenses, businesses can improve billing accuracy, analyze profitability, meet reporting requirements, and make informed decisions to drive success.

Benefits of Accurate Billable Expense Tracking

Accurate billable expense tracking is crucial for businesses as it offers several benefits. One of the primary advantages is the ability to accurately calculate taxes. By tracking billable expenses, businesses can include them in their tax reporting, ensuring compliance with tax regulations and potentially reducing their tax liability.

Another benefit is improved profitability. Accurate tracking of billable expenses allows businesses to better understand the costs associated with different projects and clients. This insight enables effective cost management, helping businesses to identify areas where expenses can be reduced or controlled, ultimately leading to increased profit.

Accurate billable expense tracking also facilitates efficient project management. By tracking expenses related to specific projects, businesses can accurately assess the financial impact of each project. This information can help them make informed decisions on resource allocation, budgeting, and tracking project progress, resulting in more successful and profitable projects.

In addition, accurate billable expense tracking plays a crucial role in audit and accounting processes. In the event of an audit, businesses need to provide detailed records of all billable transactions and expenses. Accurate tracking ensures that businesses can easily retrieve this information and provide the necessary documentation to auditors or accountants.

Furthermore, accurate billable expense tracking supports streamlined invoicing and billing processes. Businesses can easily identify and include all billable expenses in client invoices, ensuring accurate and transparent billing. This helps maintain a positive client relationship and enhances the credibility of the business.

Accurate billable expense tracking also enables effective analysis and budgeting. By analyzing billable expenses, businesses can gain insights into spending patterns, identify areas of overspending or inefficiency, and make informed budgeting decisions. This proactive approach to expense management can help businesses optimize their budget allocation and improve overall financial stability.

Finally, accurate billable expense tracking contributes to accurate payroll calculations and revenue forecasting. By tracking billable expenses, businesses can ensure that employee reimbursements and contractor payments accurately reflect the expenses incurred. Additionally, accurate tracking allows businesses to forecast revenue more effectively by including all billable expenses in revenue calculations, providing a clear picture of the business's income and expenses.

Classifying Billable Expenses: A Closer Look

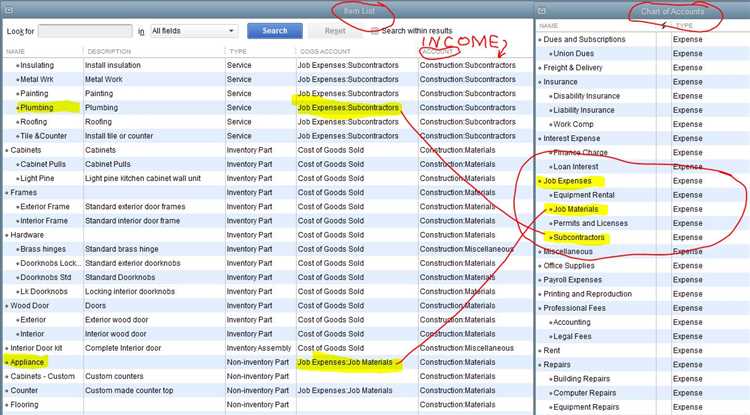

When it comes to managing billable expenses, it is essential for accounting professionals to have a clear understanding of how to classify these expenses. Proper classification ensures accurate invoicing and revenue recognition.

One key aspect of classifying billable expenses is determining whether they are direct or indirect expenses. Direct expenses are costs directly related to a specific project or client, such as materials or subcontractor fees. Indirect expenses, on the other hand, are costs that are not directly tied to a specific project or client, but are still necessary for the overall operation of the business, such as payroll or taxes.

Furthermore, it is important to distinguish between billable expenses and non-billable expenses. Billable expenses are costs that can be passed on to clients, either through direct reimbursement or as part of a project's billing. Non-billable expenses, on the other hand, are costs that cannot be charged to clients, such as internal administrative costs.

Classifying billable expenses is crucial for accurate profit analysis and cost reporting. By properly categorizing expenses, accounting professionals can track the profitability of different projects or clients and make informed decisions regarding budgeting and resource allocation.

In addition to classification, proper tracking and documentation of billable expenses is essential for audit and compliance purposes. By maintaining clear records of all billable expenses, accounting professionals can ensure transparency and accuracy in financial reporting.

Overall, understanding how to classify billable expenses is a fundamental aspect of effective expense management in accounting. By accurately categorizing these expenses, accounting professionals can streamline billing processes, enhance profitability analysis, and ensure compliance with financial regulations.

Different Types of Billable Expenses

In the world of accounting and financial management, billable expenses refer to costs that can be passed on to clients or customers. These expenses are typically incurred during the course of a project or engagement and are directly related to providing a product or service. Properly understanding and managing billable expenses is crucial for businesses to effectively budget, bill, and track revenue, as well as to ensure accurate invoicing and profit analysis.

There are several types of billable expenses that organizations may encounter:

- Direct Costs: These are expenses that are directly attributable to a specific project or client. Examples include materials, labor, and equipment costs. Tracking and properly allocating direct costs is essential in order to accurately bill clients and calculate project profitability.

- Indirect Costs: These are expenses that cannot be directly traced to a specific project or client, but are still necessary for business operations. Examples include rent, utilities, and office supplies. While not directly billable, they can be allocated to projects or clients based on predetermined cost allocation methods.

- Travel Expenses: For businesses that require employees to travel for work, travel expenses such as transportation, meals, and accommodation can be billable to clients if they are incurred while working on a specific project. Effective tracking and documentation of travel expenses is crucial for accurate invoicing and reimbursement.

- Professional Fees: In certain industries, organizations may need to hire outside professionals or consultants to provide specialized services. These professional fees, such as legal or accounting fees, can be directly billed to clients as billable expenses.

- Other Billable Expenses: There may be other types of billable expenses that are specific to a particular industry or business. For example, advertising expenses, software licensing fees, or insurance costs incurred for a specific client or project. It is important to identify and properly track these unique billable expenses.

Properly identifying, tracking, and managing billable expenses is essential for accurate accounting, financial analysis, and tax reporting. It allows businesses to calculate project profitability, allocate costs, invoice clients correctly, and ensure compliance with auditing and tax requirements. By effectively managing billable expenses, organizations can optimize their revenue and improve overall financial management.

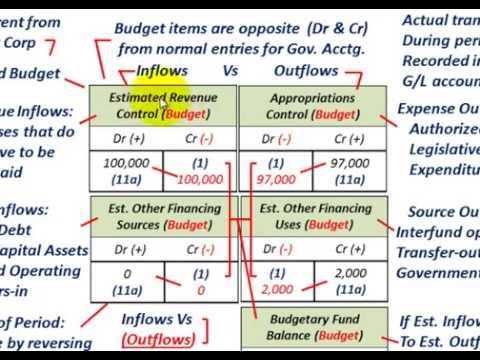

Understanding Expense Classification and Allocation

Expense classification and allocation is a crucial aspect of financial management and accounting. It involves the analysis and management of various expenses incurred by a company or organization.

Expense classification is the process of categorizing expenses into different categories based on their nature and purpose. This helps in better tracking and reporting of expenses, as well as in budgeting and forecasting future costs. Common expense categories include payroll expenses, billable expenses, overhead costs, and direct project expenses.

Expense allocation, on the other hand, refers to the distribution of expenses across various revenue-generating activities or projects. This ensures that each project or activity bears its fair share of expenses and helps in determining the true profitability of each project. Expense allocation is also important for tax purposes, as it helps in accurately calculating taxable income.

Proper expense classification and allocation are crucial for accurate accounting and financial reporting. They ensure that all expenses are recorded properly, and that there is transparency and accountability in financial management. This is particularly important when dealing with clients and billing them for the services rendered.

Expense classification and allocation also play a key role in audits and compliance. By properly classifying and allocating expenses, companies can provide auditors and regulatory bodies with accurate and reliable financial information. This helps in maintaining compliance with accounting standards and regulations, and in avoiding penalties or fines.

In conclusion, understanding expense classification and allocation is essential for effective financial management. It helps in tracking expenses, managing projects, and determining the profitability of various activities. By properly classifying and allocating expenses, companies can ensure accurate accounting, tax compliance, and efficient financial reporting.

Importance of Accurate Expense Classification for Financial Analysis

In the field of accounting, accurate expense classification is crucial for effective financial analysis. Properly categorizing expenses allows businesses to gain a comprehensive understanding of their financial health and make informed decisions.

Accurate expense classification plays a significant role in budgeting and payroll management. By properly classifying expenses, businesses can track and analyze their spending patterns, identify areas of overspending, and make necessary adjustments to their budget. Moreover, accurate classification ensures that payroll expenses are accurately accounted for, allowing businesses to calculate their labor costs and make appropriate staffing decisions.

Accurate expense classification is also essential for reporting and auditing purposes. By correctly categorizing expenses, businesses can generate accurate financial reports that comply with relevant accounting standards and regulations. This is particularly important during audits, as accurate expense classification allows auditors to assess the financial health and compliance of a business.

Furthermore, accurate expense classification enables businesses to analyze their profitability. By categorizing expenses into different revenue-generating activities, businesses can determine the cost of each activity and evaluate its contribution to overall profit. This analysis helps businesses identify the most profitable areas of their operations and allocate resources accordingly.

Accurate expense classification is also crucial for billing clients and tracking revenue. By properly categorizing billable expenses, businesses can ensure that clients are accurately invoiced for the services or products provided. Additionally, this classification allows businesses to track and analyze revenue streams, helping them identify sources of income and make informed decisions to optimize profitability.

Lastly, accurate expense classification is necessary for tax purposes. By properly categorizing expenses, businesses can determine which expenses are deductible for tax purposes and ensure compliance with tax regulations. Proper classification also enables businesses to track and report their tax-related expenses accurately, avoiding potential penalties or audits.

In conclusion, accurate expense classification is vital for financial analysis and management. It helps businesses with budgeting, reporting, audit, profit analysis, client billing, revenue tracking, tax compliance, and more. By ensuring expenses are recorded and categorized accurately, businesses can gain valuable insights into their financial health and make informed decisions to drive success

Billing Methods for Billable Expenses

When it comes to managing billable expenses in accounting, choosing the right billing method is crucial. The billing method determines how expenses are tracked, invoiced, and ultimately accounted for in terms of revenue and profit. Here are some common billing methods used by businesses:

- Hourly Billing: This method involves charging clients based on the number of hours spent on a project or task. It requires accurate time tracking and analysis of employee's payroll records. Hourly billing is commonly used in professional services industries such as law firms and consulting firms.

- Fixed Fee: With this method, a predefined amount is charged for a specific project or service, regardless of the time or expenses incurred. Fixed fee billing provides certainty to both the client and the business, but careful budgeting and cost analysis should be done to ensure profitability.

- Expense Reimbursement: In some cases, businesses may bill clients for actual expenses incurred on their behalf. This method requires meticulous tracking and reporting of expenses and can include items such as travel, equipment, or supplies. Transparent reporting and proper documentation are essential to avoid disputes or audit issues.

- Retainer: A retainer is a prepayment made by a client for a set number of hours or services. It provides a predictable income stream for the business and allows clients to have priority access to services. Retainers are often used in ongoing consulting or legal engagements.

- Value-based Pricing: This method ties the billing to the value delivered to the client rather than the time spent or expenses incurred. It requires a deep understanding of the client's needs and the ability to quantify the impact of the services provided. Value-based pricing is commonly used in creative industries such as marketing and advertising.

Choosing the right billing method for billable expenses depends on various factors such as the nature of the business, client preferences, and industry standards. It is important for businesses to carefully evaluate their options and select a method that aligns with their financial goals, accounting system, and client relationships. Proper tracking, reporting, and invoicing of billable expenses are essential to ensure accurate accounting, meet tax obligations, and maintain a healthy profit margin.

Time and Materials Billing: Pros and Cons

Time and Materials billing is a popular method used by many businesses to track and invoice for their billable expenses. This type of billing allows companies to charge clients for the actual time spent on a project, as well as any materials or additional expenses incurred.

One advantage of Time and Materials billing is the ability to accurately track and bill for all expenses related to a project. This can help ensure that the company is not losing money on any specific project, and that all costs are properly accounted for. Additionally, Time and Materials billing provides transparency to clients, as they can see exactly where their money is being spent and what expenses are being billed.

Another benefit of Time and Materials billing is that it allows for more flexibility when it comes to budgeting and planning. Since expenses are billed as they are incurred, companies can better predict and manage their cash flow. This can be especially useful for projects that have fluctuating costs or require unexpected expenditures.

However, there are also some disadvantages to Time and Materials billing. One disadvantage is the potential for disputes or disagreements with clients over the accuracy of the billing. Clients may question the amount of time spent on a project or the necessity of certain expenses, which can lead to tension and potential conflicts.

Additionally, Time and Materials billing may require more administrative work and paperwork compared to other billing methods. Companies need to carefully document and track all expenses in order to provide accurate and transparent billing to clients. This can be time-consuming and may require additional resources, such as accounting software or staff dedicated to expense tracking and invoicing.

In conclusion, Time and Materials billing has its pros and cons. It can provide accurate and transparent billing for clients, as well as flexibility in budgeting and planning. However, it may also lead to disputes and require more administrative work. It is important for companies to carefully consider the advantages and disadvantages before deciding to use this billing method.

Fixed Fee Billing: Advantages and Considerations

Fixed fee billing is a method of charging clients a predetermined amount for services rendered, regardless of the actual time or expenses incurred. This approach offers several advantages for both accounting firms and their clients.

- Simplicity: One of the main advantages of fixed fee billing is its simplicity. With this approach, clients know exactly how much they will be charged upfront, which can help them budget and plan their finances more effectively.

- Predictability: Fixed fee billing provides predictability for both the accounting firm and the client. The firm can forecast its income and revenue more accurately, while the client can budget for the expense without worrying about unexpected fluctuations.

- Efficiency: Fixed fee billing can also lead to increased efficiency. Since the billing is based on a fixed amount rather than tracking individual transactions or expenses, the accounting firm can streamline its processes and allocate resources more efficiently.

However, there are also considerations to keep in mind when implementing fixed fee billing.

- Scope of Work: It is crucial to clearly define the scope of work included in the fixed fee. Any additional services requested by the client should be accounted for separately and billed accordingly.

- Project Management: Proper project management is crucial when using fixed fee billing. The firm needs to carefully track the time and resources spent on each project to ensure that the fixed fee accurately reflects the effort and costs involved.

- Profit Margins: Accounting firms must carefully consider their profit margins when setting fixed fees. It is important to strike a balance between offering competitive prices and ensuring that the firm's profitability is not compromised.

In conclusion, fixed fee billing can offer simplicity, predictability, and efficiency for both accounting firms and their clients. However, careful consideration should be given to the scope of work, project management, and profit margins to ensure that this billing method is implemented effectively.

Milestone Billing: Managing Billable Expenses over a Project's Lifespan

When it comes to managing billable expenses in accounting, milestone billing is a crucial aspect. This approach allows businesses to track and bill clients for specific stages or milestones achieved throughout a project's lifespan, ensuring accurate revenue recognition.

By implementing milestone billing, businesses can effectively monitor and manage their billable expenses, ensuring that costs are properly allocated and accounted for. This helps in budgeting and forecasting, allowing businesses to stay on top of their financials and make informed decisions about project profitability.

With milestone billing, businesses can break down a project into various stages or milestones, each with its own set of deliverables and associated costs. By clearly defining these milestones, businesses can accurately track and record billable expenses, ensuring that the client is invoiced correctly for the work completed.

This approach also helps in identifying any cost overruns or inefficiencies that may arise during various stages of the project. By analyzing the billable expenses at each milestone, businesses can identify areas where costs can be reduced and find opportunities to improve profitability.

In addition, milestone billing aids in streamlining the payroll process, as it provides a clear structure for tracking and calculating employee compensation based on milestone completion. This ensures that employees are paid accurately and on time, while also providing transparency and accountability.

Furthermore, milestone billing offers benefits when it comes to audit and reporting requirements. By having clear records of billable expenses associated with each milestone, businesses can easily provide supporting documentation and answer any questions that may arise during an audit.

Lastly, milestone billing plays a crucial role in tax planning and compliance. By accurately tracking and recording billable expenses, businesses can ensure that they are claiming the appropriate deductions and credits, minimizing their tax liability while remaining compliant with tax regulations.

In conclusion, milestone billing is an essential tool for managing billable expenses over a project's lifespan. It helps in accurate revenue recognition, budgeting, cost analysis, payroll management, audit readiness, and tax compliance. By implementing milestone billing, businesses can effectively track and manage their billable expenses, ensuring profitability and success on their projects.

Strategies for Managing Billable Expenses

Managing billable expenses is a crucial aspect of effective financial management for any business. By implementing strategic strategies, businesses can efficiently track, manage, and report on their billable expenses, ensuring that they are accurately invoiced to clients and maximizing profitability.

One important strategy is payroll budgeting. By carefully budgeting for payroll expenses, businesses can ensure that employee salaries are accurately accounted for and billed to clients as billable expenses. This allows for better tracking and management of labor costs, and helps to ensure that businesses are accurately invoicing clients for the labor hours spent on their projects.

Another strategy is effective expense tracking. By implementing a comprehensive system for tracking billable expenses, businesses can ensure that all relevant transactions are documented and accounted for. This includes tracking expenses such as travel costs, supplies, and any other costs related to client projects. This not only helps with accurate invoicing, but also aids in ensuring that businesses can properly analyze their expenses and make informed decisions about cost management.

In addition to expense tracking, regular auditing and reporting is essential for effective billable expense management. By conducting regular audits of billable expenses, businesses can identify any discrepancies or errors, ensuring that accurate billing is maintained. Regular reporting on billable expenses also allows for better analysis of profitability and revenue, helping businesses to identify areas for improvement and potential cost-saving measures.

Finally, leveraging technology and automation can greatly enhance billable expense management. By utilizing invoicing and billing software, businesses can streamline the process of tracking, managing, and reporting on billable expenses. This not only saves time and improves accuracy, but also allows businesses to more easily generate and send invoices to clients, ensuring timely payment and minimizing the risk of lost revenue.

In conclusion, effective management of billable expenses is essential for businesses to maximize profitability and ensure accurate billing to clients. By implementing strategies such as payroll budgeting, expense tracking, auditing and reporting, and leveraging technology, businesses can optimize their billable expense management and drive financial success.

Establishing Clear Expense Reporting Policies and Procedures

Effective expense management is crucial for any organization to track and control its costs. By establishing clear expense reporting policies and procedures, businesses can ensure that all expenses are accurately recorded, tracked, and accounted for. Such policies and procedures provide guidelines for employees on how to report their expenses, ensuring consistent and accurate reporting across the organization.

Expense reporting policies and procedures should outline the types of costs that need to be reported, such as travel expenses, office supplies, or professional services. It is important to define the specific criteria for billable expenses, which can vary depending on the nature of the business. This clarity helps prevent misunderstandings and ensures that only eligible expenses are included in client invoicing.

Clear reporting policies also establish guidelines for the frequency and format of expense reporting. This ensures that expenses are reported in a timely manner and allows for efficient invoicing and revenue tracking. Organizations should specify the required documentation for expense reporting, such as receipts or invoices, to ensure accurate record-keeping and compliance with accounting standards and tax regulations.

In addition to managing expenses for clients and billing purposes, establishing clear expense reporting policies and procedures also benefits internal budgeting and financial management. By tracking and analyzing expenses, businesses gain insights into their spending patterns, allowing for more informed budgeting decisions and improved cost management. Regular expense reporting also facilitates accurate income and profit calculations and aids in tax preparation and audit processes.

In summary, clear expense reporting policies and procedures are essential for accurate cost tracking, effective client billing, and efficient financial management. By establishing these guidelines, organizations can ensure that expenses are properly recorded, tracked, and accounted for, ultimately contributing to their overall financial success.

Implementing Technology Solutions for More Efficient Expense Management

Implementing technology solutions for expense management can greatly improve the efficiency and accuracy of invoicing and income tracking. By using automated systems, businesses can streamline their processes and reduce the likelihood of errors in financial management.

One of the key benefits of implementing technology solutions is the ability to better track and analyze expenses. With advanced reporting and analysis tools, businesses can gain valuable insights into their spending patterns, allowing for more informed budgeting and decision-making.

Automated expense management systems also offer an efficient way to track billable expenses. This can be particularly useful for businesses that work on projects for clients, as it ensures that all reimbursable expenses are accurately recorded and billed.

In addition to tracking expenses, technology solutions can also streamline other financial processes such as payroll and tax calculations. By automating these tasks, businesses can save time and reduce the likelihood of errors, ultimately resulting in more accurate and timely financial reporting.

Furthermore, implementing technology solutions for expense management can help businesses improve their profitability. By gaining a better understanding of their costs and expenses, businesses can identify areas where expenses can be reduced or better managed, ultimately increasing their profit margins.

In conclusion, implementing technology solutions for expense management offers numerous benefits to businesses. From better tracking and analysis of expenses to streamlined billing and financial processes, the use of technology can greatly improve efficiency and accuracy in accounting. By leveraging these tools, businesses can optimize their revenue and ensure the smooth financial operations of their organization.

Monitoring and Controlling Billable Expenses: Best Practices

1. Implementing a Robust Accounting System: To effectively monitor and control billable expenses, it is essential for companies to have a solid accounting system in place. This system should be able to accurately record and track all billing and invoicing activities, payroll details, revenue and expenses, and other financial transactions.

2. Budgeting and Forecasting: A key aspect of managing billable expenses is to establish a comprehensive budget and regularly update it based on the actual costs incurred. By doing so, companies can set clear financial goals, allocate resources efficiently, and make informed decisions about their billing and accounting practices.

3. Reporting and Analysis: Regularly generating detailed financial reports can provide valuable insights into billable expenses, allowing companies to identify trends, areas of improvement, and potential cost-cutting measures. Analyzing these reports can help in optimizing billable expenses and maximizing profit margins.

4. Client and Project-Based Tracking: To effectively manage billable expenses, it is important to track expenses on a client and project basis. This allows companies to accurately allocate costs to specific clients and projects, ensuring that all billable expenses are accounted for and properly invoiced.

5. Expense Management Tools: Utilizing expense management tools can streamline the process of tracking and controlling billable expenses. These tools often provide features such as automated expense tracking, categorization, and approval workflows, making it easier to monitor and control expenses within the company.

6. Regular Review of Tax Regulations: Staying up-to-date with tax regulations is crucial for monitoring and controlling billable expenses. Changes in tax laws can impact costs and deductibility, so it is important to regularly review and adjust financial practices to ensure compliance and minimize tax liabilities.

7. Cost Control Measures: Implementing cost control measures such as negotiating better vendor contracts, streamlining internal processes, and encouraging employees to be mindful of expenses can help in effectively managing and controlling billable expenses. Regularly reviewing and adjusting these measures can further optimize expenses and improve overall financial performance.

In conclusion, effective monitoring and controlling of billable expenses in accounting require a combination of robust systems, budgeting and forecasting, reporting and analysis, client and project-based tracking, expense management tools, regular review of tax regulations, and cost control measures. By implementing these best practices, businesses can optimize their billing and accounting practices, maximize revenue, and ensure financial success.

Communicating Billable Expenses to Clients

When working on projects, it is important for accounting professionals to accurately track and manage expenses to ensure that projects stay within budget. In order to maintain transparency and build trust with clients, it is necessary to effectively communicate the billable expenses incurred during the project.

Effective communication of billable expenses starts with clear and detailed invoicing. Clients should be provided with itemized invoices that clearly outline all the expenses incurred during the project. This includes not only direct costs such as materials and labor, but also indirect costs such as administrative fees and overhead expenses. By providing a breakdown of each expense category, clients can have a clear understanding of where their money is being allocated.

In addition to itemized invoices, it can also be helpful to provide regular reports or summaries that detail the overall financial status of the project. This can include information on the total expenses incurred, the percentage of budget used, and any remaining funds. By providing this information in a clear and concise manner, clients can easily assess the financial health of the project and make informed decisions regarding its future.

Furthermore, it is important to communicate any unexpected or significant expenses to clients in a timely manner. If additional costs arise during the course of the project, it is essential to inform clients as soon as possible. This allows them to adjust their own budgeting and planning accordingly. By proactively communicating any changes to billable expenses, accounting professionals can avoid surprises and maintain open lines of communication with clients.

Overall, effective communication of billable expenses to clients is crucial for maintaining transparency and building trust. By providing detailed and itemized invoices, regular reports on project finances, and timely updates on any unexpected expenses, accounting professionals can ensure that clients have a clear understanding of all costs associated with the project. This not only helps with effective budgeting and expense management, but also fosters strong client relationships and ensures long-term success.

The Importance of Transparent Communication

Transparent communication plays a vital role in the success of any business, especially when it comes to understanding and managing billable expenses in accounting. Clear and open communication between team members, clients, and management is crucial for ensuring accurate financial reporting and maintaining accountability.

By fostering transparent communication, businesses can effectively track and report their expenses, which directly impacts their profit and loss. Transparent communication enables businesses to identify and analyze costs associated with various projects, allowing for better budgeting and decision-making.

Transparent communication also ensures that clients are aware of the expenses incurred on their projects, avoiding any misunderstandings or disputes. By providing detailed invoices and accurate billing information, businesses can build trust with their clients and maintain strong relationships.

Moreover, transparent communication facilitates the auditing process. With clear and well-documented communication, businesses can easily provide relevant information and evidence to auditors, ensuring compliance with financial regulations and standards.

In addition, transparent communication plays a crucial role in internal management. It allows for effective tracking and reporting of expenses, simplifying tasks such as payroll management and tax reporting. This level of transparency helps businesses make informed decisions about their revenue and expenses, ultimately contributing to their overall financial health.

In conclusion, transparent communication is essential for understanding and managing billable expenses in accounting. It enables accurate analysis, effective budgeting, and proper reporting of expenses. By fostering transparent communication, businesses can enhance their financial management processes and build trust with clients and stakeholders.

Presenting Billable Expenses in a Clear and Understandable Format

When it comes to payroll and accounting, it is crucial to have a system in place for tracking billable expenses. This ensures that all transactions are properly recorded and can be easily referenced in the future. Additionally, clear and organized presentation of these expenses is essential for audit purposes.

One way to present billable expenses is by categorizing them according to revenue streams or projects. This allows for easy budgeting and analysis, as well as providing a clear overview of how expenses relate to specific sources of income. By presenting this information in a clear and understandable format, businesses can easily identify areas where costs can be minimized and profits maximized.

Invoicing is another crucial aspect of presenting billable expenses. Clear and detailed invoices that specify the services provided and the corresponding expenses incurred can help both clients and the business understand the billing process. Moreover, proper management of invoicing ensures that all billable expenses are accurately recorded and can be easily referenced for tax purposes.

Presenting billable expenses in a clear and understandable format also involves reporting and analysis. By regularly generating reports that summarize and categorize expenses, businesses can gain valuable insights into their spending habits and make informed decisions regarding their financial strategies. These reports can also be useful for discussing expenses with clients, ensuring transparency and maintaining a healthy client relationship.

Overall, presenting billable expenses in a clear and understandable format is essential for effective accounting and financial management. It allows businesses to accurately track expenses, maximize revenue, and make informed decisions regarding budgeting and profitability. By implementing proper systems and processes for managing billable expenses, businesses can ensure their financial success and maintain a strong position in the market.

Addressing Client Concerns and Questions regarding Billable Expenses

As a client, it is important to understand the analysis and management of billable expenses within the accounting process. These expenses play a significant role in determining the overall profit and revenue of a project or business. It is essential to address any concerns or questions that may arise regarding these expenses to ensure transparency and accurate billing.

One common concern is the tracking and reporting of billable expenses. Clients often want to know how these expenses are recorded and monitored throughout the project or accounting period. By implementing effective tracking systems and utilizing appropriate software, accounting professionals can ensure accurate reporting and provide clients with detailed breakdowns of each transaction.

Another concern clients may have is the impact of billable expenses on their budgeting and billing processes. It is important to explain how these expenses are integrated into the overall budget and how they can affect the final billing amount. By providing clear explanations and examples, clients can better understand the necessity of including billable expenses in their project's financial plan.

Additionally, clients may have concerns about the allocation of billable expenses to specific projects or tasks. It is crucial to address these concerns by explaining the process of categorizing expenses and how it aligns with project management. This ensures that expenses are correctly allocated and accounted for, providing clients with accurate and transparent information.

Moreover, clients may question the necessity of billable expenses and how they contribute to the overall income and profit of their project or business. It is important to emphasize that billable expenses are essential for maintaining accurate financial records and ensuring a comprehensive audit trail. These expenses directly contribute to the overall analysis of costs and profitability, allowing for informed decision-making and successful financial management.

In conclusion, addressing client concerns and questions regarding billable expenses is crucial for maintaining transparency, reliability, and trust in the accounting process. By providing clear explanations, accurate reporting, and effective tracking systems, clients can better understand the role of billable expenses and their impact on project management, budgeting, and overall profitability.