When it comes to accounting, understanding the difference between unearned revenue and accounts receivable is essential. Both terms refer to money owed to a company, but they represent different stages in the revenue recognition process.

Unearned revenue is also known as deferred revenue or unearned income. It represents money received from a customer before goods or services have been provided. This means that the customer has paid in advance, creating a balance in the company's books. From an accounting perspective, unearned revenue is classified as a liability on the balance sheet until the goods or services are delivered. At that point, the company can recognize the revenue as earned and move it to the income statement.

Accounts receivable, on the other hand, refers to money owed to a company for goods or services that have already been provided. When a customer purchases goods or services on credit, they create an accounts receivable for the company. Unlike unearned revenue, which is recognized as a liability, accounts receivable is recognized as an asset on the balance sheet. This is because the company has already provided the goods or services and expects to receive payment in the future.

The main difference between unearned revenue and accounts receivable lies in the timing of recognition. Unearned revenue is recognized as a liability before the goods or services are provided, while accounts receivable is recognized as an asset after the goods or services have been provided. Understanding these differences is crucial for accurate financial reporting and analysis.

To summarize, unearned revenue represents money received before goods or services are provided, and is recognized as a liability on the balance sheet. Accounts receivable, on the other hand, represents money owed for goods or services already provided, and is recognized as an asset on the balance sheet. By understanding these distinctions, businesses can ensure accurate financial reporting and make informed decisions based on their current and future cash flow.

Definition of Unearned Revenue

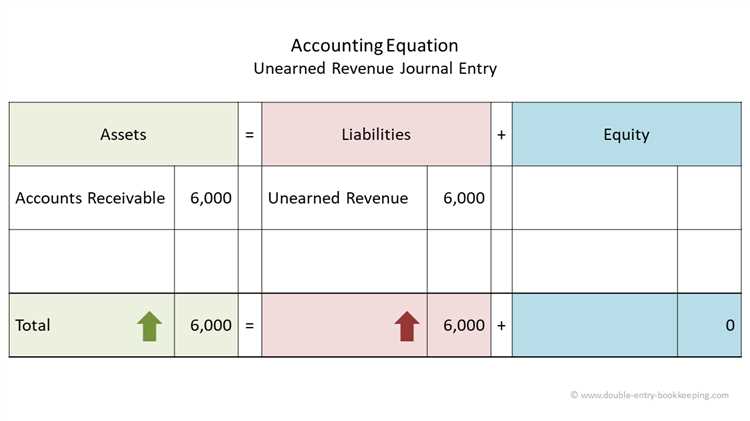

Unearned revenue is a type of accounting contract deferral that occurs when a company receives payment for goods or services before it has fulfilled its obligations. It is also known as unearned income or deferred revenue. This transaction involves the receipt of cash, which is recorded as a liability on the balance sheet.

Unearned revenue is recognized as a liability because the company has an obligation to provide goods or services in the future. The revenue is not considered earned until the goods or services are delivered. Until then, the unearned revenue is reflected as a liability on the balance sheet.

When the company fulfills its obligations and delivers the goods or services, the unearned revenue is no longer deferred and is then recognized as revenue. This recognition of unearned revenue as income is recorded in the income statement. The recognition process involves debiting the unearned revenue account and crediting the revenue account.

Unearned revenue is an important aspect of accrual accounting, as it represents a future inflow of cash. It is classified as a current liability on the balance sheet until it is earned. Once the revenue is earned, it becomes an asset and is no longer considered a liability.

In summary, unearned revenue refers to the recognition and deferment of income until the goods or services are delivered. It is initially recorded as a liability and later recognized as revenue. This accounting process allows for the accurate representation of a company's financial position and performance.

Definition of Accounts Receivable

Accounts receivable refers to the outstanding amounts owed to a company by its customers for goods or services provided on credit. It represents a claim for payment, usually within a specified period of time, which the company expects to receive in the future. Accounts receivable is considered a current asset on the company's balance sheet.

When a company provides goods or services to a customer on credit, it creates an accounts receivable entry in its books. This entry represents the revenue earned from the transaction, which will be recognized as income when the payment is received. Until the cash is received, the revenue is considered unearned or deferred. The recognition of revenue is deferred until the payment is made, but the accounts receivable balance remains as an asset.

Accounts receivable serves as a financial record of all outstanding invoices and is often accompanied by other relevant information, such as the customer's name, contact information, and billing terms. It helps the company keep track of its outstanding receivables and manage its cash flow effectively.

It is important for companies to closely monitor their accounts receivable to ensure timely collection. A high balance of outstanding receivables can indicate potential cash flow issues or customers who may default on payment. To mitigate risks, companies may consider implementing credit policies, establishing clear payment terms, and conducting credit checks on customers before extending credit.

In summary, accounts receivable represents the amount of revenue that a company expects to receive from its customers for goods or services provided on credit. It is an asset on the balance sheet until the payment is received and the revenue is recognized. Managing accounts receivable is crucial for maintaining a healthy cash flow and minimizing the risk of bad debts.

Key Characteristics

Unearned revenue refers to income received in advance, before it is earned. It is recorded as a liability on the balance sheet until the revenue is recognized. When a transaction occurs, such as a customer making a prepayment for goods or services, the unearned revenue is deferred until it is earned.

Accounts receivable is the amount of money owed to a company by its customers for products or services that have been delivered or rendered but have not yet been paid for. It is recorded as an asset on the balance sheet. Accounts receivable represents the right to receive payment in the future, and is recognized as revenue when the transaction occurs.

The key difference between unearned revenue and accounts receivable lies in the timing of revenue recognition. Unearned revenue is recognized when the revenue is earned, while accounts receivable is recognized when the transaction occurs. Unearned revenue involves the deferment of revenue recognition, while accounts receivable involves the recognition of revenue that is yet to be received.

Unearned revenue represents a liability to the company, as it has received payment before providing the goods or services. Accounts receivable, on the other hand, represents an asset to the company, as it signifies the money that is due to be received from customers.

Both unearned revenue and accounts receivable are essential elements of the accrual accounting system. They represent the deferred or yet-to-be-received revenue that will ultimately impact a company's financial statements. Proper classification and management of unearned revenue and accounts receivable are crucial for accurate financial reporting and assessing a company's financial health.

Unearned Revenue Characteristics

Unearned revenue refers to income that a company receives in advance of providing goods or services. It is also known as deferred revenue or unearned income. This type of revenue is generated when a customer pays for a product or service before it is delivered or performed.

The key characteristic of unearned revenue is that it is recorded as a liability on the company's balance sheet. This means that the company has an obligation to provide the goods or services at a later date. The amount paid by the customer is not immediately recognized as income, but rather, it is deferred until the goods or services are delivered.

Unearned revenue is recognized as income once there is a completed performance or delivery of the product or service. This is known as the point of revenue recognition. At this point, the revenue is no longer considered unearned, and is instead recognized as revenue on the income statement.

Unearned revenue can be seen as a contractual obligation between the company and the customer. The company has an obligation to fulfill the terms of the contract, and the customer has the right to receive the goods or services for which they have already paid. Until the goods or services are provided, the unearned revenue serves as a liability on the company's books.

Unearned revenue is different from accounts receivable in that accounts receivable represents money owed to the company for goods or services that have already been provided. Accounts receivable is considered an asset, as it represents future cash inflows. Unearned revenue, on the other hand, represents an obligation to provide goods or services in the future and is recorded as a liability on the company's balance sheet.

Accounts Receivable Characteristics

Accounts receivable refers to the outstanding payments a company is expecting to receive from its customers. It represents a transaction that has already occurred but the payment for it is yet to be received. This means that accounts receivable is recorded on the company's balance sheet as an asset.

Unlike unearned revenue, which is recognized as a liability until the service or product is provided, accounts receivable is an accrual. The revenue is recognized at the time of the sale or completion of the service, but the payment is deferred to a later date. This recognition allows the company to maintain a record of the revenue it expects to receive.

Accounts receivable arises from contractual agreements or sales made on credit, where the customer is given a specific period to make the payment. This deferred payment arrangement allows the company to extend credit to its customers and create a balance of accounts receivable, representing the outstanding payments.

When a customer makes the payment for the goods or services provided, the accounts receivable balance decreases, and the cash account increases. The recognition of the revenue is no longer deferred, and it is recognized as income on the company's financial statements.

Accounts receivable serves as an essential liquidity indicator for a company, as it represents the amount of cash it expects to receive in the near future. Proper management and monitoring of accounts receivable are crucial to maintain a healthy cash flow and mitigate the risk of bad debts or non-payments.

Recognition and Reporting

Recognition and reporting of unearned revenue and accounts receivable play a crucial role in accurately representing a company's financial position. Both unearned revenue and accounts receivable involve the timing of revenue recognition, but there are key differences between the two.

Unearned revenue refers to the cash received in advance from a customer for goods or services that have not yet been provided. It is considered a liability on the balance sheet, as the company has an obligation to deliver the goods or services at a later date. The revenue is recognized and reported on the income statement as the goods or services are provided, and the unearned revenue account is then reduced.

On the other hand, accounts receivable represents amounts owed to the company by customers for goods or services already delivered. It is recorded as an asset on the balance sheet and as revenue on the income statement when the transaction occurs. If the company allows customers to defer payment, the amount is still recognized as revenue and reported on the income statement, but it is classified as a deferred receivable on the balance sheet until the cash is received.

The recognition and reporting of unearned revenue and accounts receivable require careful accounting practices. In the case of unearned revenue, companies must ensure that the revenue is only recognized when the goods or services are provided to avoid misleading financial statements. Likewise, for accounts receivable, companies need to closely monitor the aging of receivables to identify any potential bad debts that could impact the accuracy of the financial statements.

In conclusion, recognition and reporting of unearned revenue and accounts receivable involve different concepts and treatments. Unearned revenue is a liability that is recognized and reported as revenue when the goods or services are provided, while accounts receivable represent amounts owed by customers and are recognized as revenue when the transaction occurs. Both are integral to accurately presenting a company's financial position.

Recognition of Unearned Revenue

Recognition of unearned revenue refers to the process of accounting for the money received by a company in advance for goods or services that have not yet been provided. This occurs when a company receives cash from a customer before the revenue can be recognized as earned income.

Unearned revenue is a liability on a company's balance sheet because the company has an obligation to provide the goods or services to the customer at a later date. The amount of unearned revenue is recorded as a liability and represents the company's obligation to satisfy the contract terms.

When a company receives cash for unearned revenue, it initially defers the recognition of income and records the cash as a liability. This deferral occurs in accordance with the accrual accounting principle, which states that revenue should be recognized when it is earned, rather than when cash is received.

Once the goods or services are provided to the customer, the company can then recognize the revenue as earned income and reduce the liability of unearned revenue on the balance sheet. This recognition of revenue is typically done through an adjusting entry that credits the unearned revenue account and debits the appropriate income account.

In summary, the recognition of unearned revenue involves the deferral of income recognition when cash is received in advance for goods or services. It is recorded as a liability on the balance sheet until the revenue is earned, at which point it is recognized as income.

Recognition of Accounts Receivable

Accounts receivable refers to the amount of money that a business is owed by its customers for goods or services that have been delivered but not yet paid for. The recognition of accounts receivable occurs when a customer is invoiced for a transaction and an account is created to record the amount owed. This recognition is based on the accrual accounting method, which records revenue when it is earned, regardless of when the cash is received.

When a transaction takes place, the revenue from the sale is recognized and recorded as accounts receivable on the balance sheet. This means that the business has earned income from the sale and has a right to receive payment in the future. The amount of the sale is then added to the accounts receivable balance, increasing the asset side of the balance sheet.

Accounts receivable recognition can occur in various situations, such as when a business enters into a contract with a customer for future delivery of goods or services. In this case, the business may recognize a portion of the revenue as accounts receivable at the time the contract is signed, even though the goods or services have not yet been delivered. This deferred recognition reflects the expectation that the revenue will be earned in the future, and the amount recognized is recorded as a liability on the balance sheet.

Once the goods or services are delivered, the deferred revenue is no longer applicable, and the revenue is then fully recognized as accounts receivable. The balance on the accounts receivable account represents the total amount of revenue that the business has recognized but has not yet been received in cash.

The recognition of accounts receivable is an important aspect of a business's financial management. It allows the business to track its expected cash flow from sales and ensures that the revenue is properly recorded and reflected on the balance sheet. It also provides an indication of the business's ability to collect payments from its customers and manage its overall financial health.

Importance in Financial Statements

Unearned revenue and accounts receivable are both important components of a company's financial statements. They represent different types of transactions and have different implications for financial reporting and analysis.

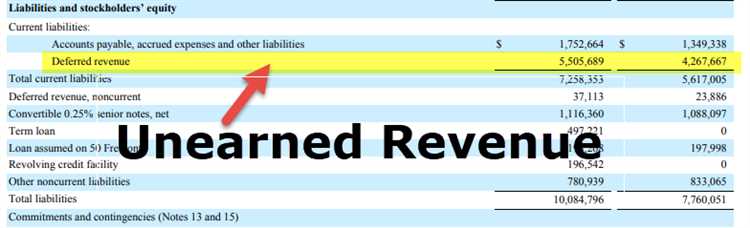

Unearned revenue is a liability that arises when a company receives payment from a customer for goods or services that have not yet been delivered. It is recorded as a liability on the balance sheet and represents an obligation to perform a future service or deliver a product. The recognition of unearned revenue is an important part of the accrual basis of accounting, which aims to match revenue with the expenses incurred to generate that revenue.

Accounts receivable, on the other hand, represent an asset on the balance sheet that arises from credit sales to customers. When the company extends credit to customers, it records the sale as revenue and creates an account receivable. The recognition of accounts receivable reflects the income earned by the company from credit sales.

The importance of properly recognizing unearned revenue and accounts receivable lies in their impact on the company's financial statements. Unearned revenue represents a liability that needs to be taken into account when assessing the company's financial health and overall financial position. It indicates that the company has received cash in advance for goods or services that it has not yet provided, and the liability must be deferred until the performance obligation is fulfilled.

Accounts receivable, on the other hand, represent the company's right to receive future cash payments from customers. It is an asset and reflects the money owed to the company by its clients. The balance of accounts receivable is crucial for determining the company's cash flow and liquidity, as it indicates the level of sales made on credit and the timing of cash inflows.

In summary, both unearned revenue and accounts receivable play important roles in a company's financial statements. The proper recognition and deferral of these items ensure that a company's financial statements accurately reflect its financial position, performance, and cash flow. They provide valuable information for stakeholders and analysts to assess the company's overall financial health and make informed investment decisions.

Impact of Unearned Revenue on Financial Statements

Unearned revenue refers to the amount of money received by a company in advance for goods or services that have not yet been delivered or performed. It represents a liability for the company because it owes the delivery or performance of those goods or services to the customer.

On the financial statements, unearned revenue is reported as a liability on the balance sheet. This is because the company has an obligation to deliver the goods or services in the future, and until that obligation is met, the revenue cannot be recognized as income.

When a customer pays for goods or services in advance, the transaction is recorded as an increase in cash and an increase in unearned revenue. This means that the company has received cash, but it has not yet earned the revenue. The revenue is only recognized as income once the goods or services are delivered or performed.

The deferral of recognizing the revenue is necessary to accurately match the revenue with the expenses incurred to generate that revenue. By deferring the recognition of revenue, the company ensures that its financial statements reflect the actual economic activity and performance of the business.

When the goods or services are delivered or performed, the unearned revenue is then recognized as revenue on the income statement. The amount of revenue recognized is equal to the amount of unearned revenue that has been earned. This results in a decrease in the unearned revenue balance and an increase in the revenue balance.

In summary, unearned revenue has a significant impact on a company's financial statements. It is reported as a liability on the balance sheet until the revenue is earned. By deferring the recognition of revenue, the company ensures accurate matching of revenue and expenses. Once the goods or services are delivered or performed, the unearned revenue is recognized as income on the income statement.

Impact of Accounts Receivable on Financial Statements

Accounts receivable refers to the money owed to a company by its customers for the goods or services that have been sold on credit. It is an asset on the balance sheet and represents the amount of cash that the company expects to receive in the future. The recognition of accounts receivable has a significant impact on the financial statements.

When a company enters into a contract or makes a sale, it recognizes the revenue associated with that transaction. However, if the customer is not able to pay immediately, the company may choose to defer the recognition of the revenue and instead record it as accounts receivable. This allows the company to show the revenue on its income statement and the corresponding increase in assets on its balance sheet.

The recognition of accounts receivable affects both the income statement and the balance sheet. On the income statement, it increases the company's revenue, which in turn increases its net income. On the balance sheet, it increases the company's assets. However, it is important to note that the recognition of accounts receivable does not immediately result in an increase in cash. The company still needs to collect the cash from its customers in the future.

Accounts receivable are considered a current asset as they are expected to be converted into cash within a year. They represent money that the company is entitled to receive and are classified as a short-term asset on the balance sheet. If accounts receivable are not collected within a year, they may be classified as long-term assets.

The recognition of accounts receivable follows the accrual method of accounting, which recognizes revenue when it is earned, regardless of when the cash is received. This method provides a more accurate representation of a company's financial performance and position. However, it also introduces the risk of bad debts, where customers are unable to pay their outstanding balances.

In summary, the recognition of accounts receivable has a significant impact on a company's financial statements. It increases the company's revenue and assets on the balance sheet, but does not immediately result in an increase in cash. Accounts receivable are considered a current asset and follow the accrual method of accounting.

Management and Control

Management and control of unearned revenue and accounts receivable are important aspects of financial management. Unearned revenue refers to the recognition of cash received for goods or services that have not yet been provided. It represents a liability on the balance sheet and is recognized as revenue only when the transaction has been completed. This type of recognition is known as deferred revenue or deferred income.

On the other hand, accounts receivable refers to the recognition of cash that is owed to a company for goods or services that have already been provided. It represents an asset on the balance sheet and is recognized as revenue at the time of the transaction. This type of recognition is known as accrual accounting.

Proper management and control of unearned revenue and accounts receivable involve keeping track and monitoring the inflow and outflow of cash related to these transactions. Companies need to ensure that unearned revenue is properly deferred until the performance obligation is satisfied and revenue can be recognized. Similarly, companies need to actively manage and collect accounts receivable to ensure timely cash flow.

To effectively manage unearned revenue, companies need to have clear and well-defined contracts or agreements with their customers. These contracts should outline the terms and conditions for the provision of goods or services, as well as the deferral and recognition of revenue. Companies should also regularly review and reassess their unearned revenue balances to ensure accurate recognition and proper financial reporting.

For accounts receivable management, companies need to have well-established credit and collection policies. These policies should include procedures for credit checks, invoicing, and follow-up on overdue payments. Effective communication and coordination between sales, marketing, and finance departments are crucial to ensure timely collection and minimize the risk of bad debts. Regular monitoring and analysis of accounts receivable aging reports can also help identify potential issues and implement appropriate actions.

In summary, management and control of unearned revenue and accounts receivable are essential for proper financial management. By effectively managing these assets and liabilities, companies can ensure accurate financial reporting and maintain a healthy cash flow.

Managing Unearned Revenue

Unearned revenue refers to the cash received by a company in advance for products or services that have not yet been delivered or performed. It is a liability on the balance sheet because the company owes the customer the products or services they have prepaid for. Managing unearned revenue requires careful accrual and recognition to ensure accurate financial reporting.

One approach to managing unearned revenue is to defer its recognition until the products or services are delivered or performed. This is known as deferring the revenue. By deferring the recognition of unearned revenue, the company can avoid overstating its income and instead reflect the revenue in the period when it is earned.

When a customer makes a prepayment, the company records the cash as a liability on its balance sheet, typically under the category of unearned revenue. This creates a contractual obligation for the company to deliver the products or services in the future. The company should then defer the recognition of this revenue until the products or services are provided.

Managing unearned revenue involves monitoring the deferral period and ensuring that the revenue is recognized in the appropriate accounting period. The company must keep track of the deferred revenue and update its records as the products or services are delivered or performed. This requires accurate and timely documentation of each transaction and its respective deferral period.

By managing unearned revenue effectively, companies can ensure accurate financial reporting and maintain the trust of their customers. Proper recognition of unearned revenue allows for a more accurate representation of a company's financial health and performance. It also ensures that customers receive the products or services they have prepaid for in a timely manner.

Managing Accounts Receivable

Accounts receivable refers to the money owed to a company by its customers for products or services that have been provided on credit. Effective management of accounts receivable is crucial for maintaining healthy cash flow and ensuring that the company receives the funds it is owed in a timely manner.

One important aspect of managing accounts receivable is the recognition of revenue. Revenue should only be recognized when it is earned, which means that the product or service has been delivered to the customer and the payment is reasonably assured. This recognition should be done in accordance with generally accepted accounting principles (GAAP) to ensure accurate financial reporting.

To properly manage accounts receivable, the company should also consider deferral of revenue when necessary. This occurs when payment is received in advance of goods or services being provided. In such cases, the payment is initially recorded as a liability called unearned revenue or deferred income. The revenue is deferred until the goods or services are delivered, at which point it can be recognized as revenue and recorded as an asset on the balance sheet.

Additionally, it is important to keep track of accounts receivable aging, which refers to the amount of time that invoices have been outstanding. Regularly reviewing the aging report allows the company to identify overdue payments and take appropriate actions to collect the payment. This may include sending reminders, making collection calls, or even pursuing legal action if necessary.

Another way to manage accounts receivable is by implementing clear payment terms and policies. This includes specifying the due date for payment, offering different payment options, and establishing penalties for late payments. Clear communication with customers regarding payment expectations can help prevent misunderstandings and improve overall collection efforts.

In summary, managing accounts receivable involves the proper deferment and recognition of revenue, monitoring the aging of accounts, and establishing clear payment terms. By effectively managing accounts receivable, a company can ensure a healthy cash flow and maintain strong financial performance.