Property, Plant, and Equipment (PPE) holds great value in the world of accounting. PPE refers to the tangible assets that a business uses in its operations, such as machinery, buildings, and equipment. These assets are vital for generating revenue and are an essential part of a company's operations.

Operating standards and financial reporting require businesses to accurately report the costs and valuation of their PPE. This is crucial for proper accounting and financial recognition of the assets. The valuation of PPE can be determined through various methods, such as historical cost, fair value, or revaluation model.

Accounting for PPE involves recognizing the costs associated with acquiring and maintaining these assets. Initial costs, such as the purchase price, transportation, and installation, are capitalized and added to the book value of the asset. Ongoing costs, such as repairs and maintenance, are expensed as incurred.

In addition to the accounting treatment of PPE, businesses also need to consider the impact of leases on their financial statements. The new lease accounting standards require lessees to recognize the assets and liabilities arising from operating leases on their balance sheets. This ensures a more accurate representation of a company's financial position.

Depreciation is a key aspect of accounting for PPE. It involves allocating the cost of an asset over its useful life, reflecting the consumption of the asset's economic benefits. Depreciation expenses are recognized in the income statement and reduce the carrying value of PPE on the balance sheet over time.

Understanding the meaning of PPE in accounting is essential for accurately reporting a company's financial position. Proper recognition, valuation, and cost allocation of PPE contribute to a transparent and reliable representation of a business's assets and financial performance.

What is PPE in Accounting?

PPE stands for Property, Plant, and Equipment, and it refers to the tangible assets that a business owns and uses for its operations. In accounting, PPE is recognized according to specific standards and guidelines, such as the International Financial Reporting Standards (IFRS) or the Generally Accepted Accounting Principles (GAAP).

Recognition of PPE in accounting involves determining when an item meets the criteria to be considered a PPE asset. This includes the ability to control the asset, derive economic benefits from it, and the expectation of future use. Once recognized, PPE assets are reported in the financial statements of a business. The reporting includes information on their value, cost, depreciation, and any changes in valuation.

PPE assets can include a variety of business resources, such as buildings, land, machinery, vehicles, and even office furniture. Valuation of these assets is typically based on their historical cost, which includes the purchase price and any related costs to bring them into use, such as installation or transportation expenses.

Depreciation is another important aspect of PPE accounting. As PPE assets are used over time, they experience wear and tear, obsolescence, or other factors that reduce their value. Depreciation is the process of allocating the cost of PPE assets over their useful life, reflecting the reduction in value and spreading the cost over multiple accounting periods.

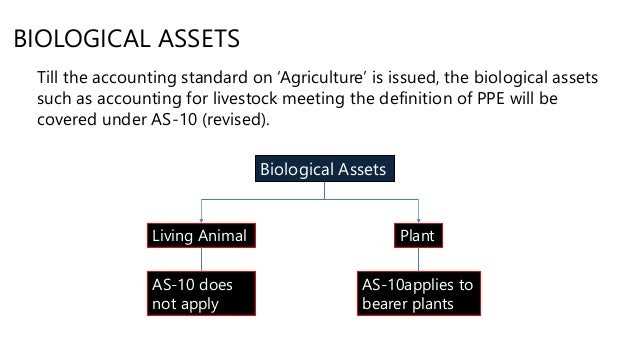

PPE assets can be obtained through various means, including purchase, lease, or even construction. Accounting for leased PPE involves different considerations, such as distinguishing between finance leases and operating leases. Finance leases are treated similarly to purchased assets, while operating leases are typically expensed over the lease term.

In summary, PPE assets are a significant part of a business's balance sheet and play a crucial role in financial reporting. Understanding the accounting principles related to PPE is essential for recording and disclosing the value, cost, and depreciation of these assets accurately.

Definition of PPE in Accounting

PPE stands for Property, Plant, and Equipment. In accounting, PPE refers to the tangible assets used by a business in its operations, including land, buildings, leasehold improvements, machinery, vehicles, and other equipment.

PPE is an essential component of a company's financial statements and is included in the balance sheet as long-term assets. These assets are valued at their original cost, including all necessary expenses to make them operational, such as installation, transportation, and legal fees.

Accounting standards require businesses to record PPE at their historical cost, not their market value. This means that the value of PPE may differ significantly from their current market value. However, PPE is subject to periodic depreciation, which accounts for the gradual wear and tear of these assets over time.

The depreciation expense associated with PPE is recorded in the income statement as an operating cost. This allows businesses to spread the costs of using PPE over the useful life of these assets, providing a more accurate representation of their financial performance.

PPE is a crucial aspect of financial reporting, as it allows investors and stakeholders to assess the value and financial health of a business. It also plays a role in determining a company's net worth, as the value of PPE is subtracted from its liabilities to calculate its book value.

In summary, PPE in accounting refers to the tangible assets used by a business, including land, buildings, leasehold improvements, machinery, vehicles, and other equipment. These assets are recorded at their historical cost and subject to periodic depreciation to account for their gradual wear and tear. PPE is an important component of financial reporting and provides insights into a company's financial performance and net worth.

Understanding the Concept of PPE

PPE stands for Property, Plant, and Equipment. In the field of accounting, PPE refers to long-term tangible assets that are used in the operations of a business. These assets are recorded in the books of the company and can include land, buildings, machinery, vehicles, and other similar assets.

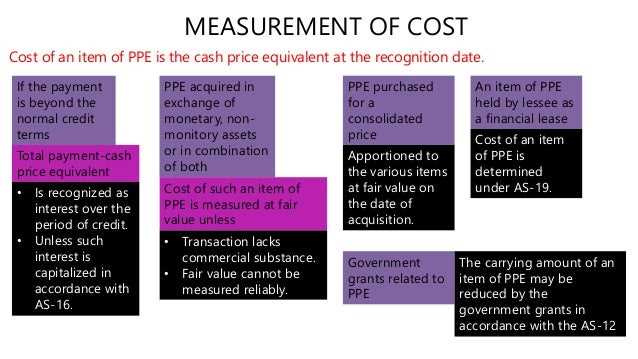

The cost of PPE is initially recognized when the asset is acquired or constructed. The cost includes the purchase price, any additional costs directly attributable to bringing the asset to its working condition, and any leasehold improvements. The valuation of PPE is important for financial reporting purposes, as it determines the carrying value of these assets on the company's balance sheet.

Depreciation is an important concept related to PPE. It refers to the systematic allocation of the cost of PPE over its useful life. Depreciation expense is recorded in the company's financial statements to reflect the gradual wear and tear, obsolescence, or expiration of the asset's useful life. The recognition and calculation of depreciation is governed by accounting standards to ensure consistency in reporting across businesses.

PPE is crucial for businesses as it enables them to operate and generate revenue. It represents a significant portion of a company's assets and can have a significant impact on its financial reporting. Proper PPE management and accurate recording of related costs are essential for a company's financial health and performance evaluation. Businesses must comply with relevant accounting standards to ensure transparency and consistency in reporting PPE.

Types of PPE in Accounting

Property, Plant, and Equipment (PPE) in the field of accounting refers to the tangible assets that a business owns and uses to generate income. These assets include land, buildings, machinery, vehicles, furniture, and fixtures.

Leasehold improvements are also considered as a type of PPE. These are any modifications or improvements made to a leased property to better suit the needs of the lessee. These improvements are typically recorded as assets on the lessee's balance sheet.

Valuation of PPE is an important aspect of accounting. The value of these assets is recorded on the balance sheet at their cost of acquisition, including all costs necessary to bring the assets into their present condition and location. The cost of PPE may include purchase cost, transportation cost, installation cost, and any other costs directly related to the acquisition of the assets.

PPE is classified as an operating asset and is subject to depreciation. Depreciation is the process of allocating the cost of PPE over its useful life. This depreciation expense is recognized in the financial statements and helps reflect the decline in value of the assets as they are used in the business operations.

Financial reporting standards provide guidelines on how to account for PPE. These standards ensure that businesses accurately report the cost, depreciation, and value of their PPE in their financial statements. This helps investors, creditors, and other stakeholders in making informed decisions regarding the business.

Overall, PPE plays a crucial role in the accounting of a business. It represents the long-term tangible assets that are essential for the operations of the business. Accurate recording and reporting of PPE provide transparency and reliability in the financial statements, allowing stakeholders to assess the financial health and performance of the business.

Importance of PPE in Accounting

PPE, or Property, Plant, and Equipment, holds significant importance in financial accounting. PPE refers to the long-term assets owned and used by a business to generate income, such as land, buildings, machinery, vehicles, and equipment.

Valuation of PPE is crucial for accurate financial reporting. The cost of acquiring and improving PPE needs to be properly recorded to reflect their true value. Properly valuing PPE helps businesses make informed decisions regarding their assets, investments, and overall financial health.

The standards for recognizing and measuring PPE are outlined by various accounting frameworks and guidelines, such as the International Financial Reporting Standards (IFRS) and Generally Accepted Accounting Principles (GAAP). Compliance with these standards ensures consistency and comparability in financial reporting across different businesses and industries.

Accounting for PPE involves the recognition of the initial cost, subsequent additions and improvements, depreciation, and disposal of these assets. The cost of PPE is initially recorded as an asset on the balance sheet, and then depreciation is calculated to allocate the cost over its useful life. This helps businesses accurately reflect the value of their assets and the corresponding expenses incurred in their day-to-day operations.

In addition, proper accounting for leased PPE is essential to provide an accurate representation of a business's financial position. Leased PPE is accounted for differently depending on whether it is classified as an operating or finance lease. Properly recording these leases ensures that a business's financial statements reflect its true obligations and commitments.

By understanding and appropriately accounting for PPE, businesses can have a comprehensive view of their assets, liabilities, and overall financial performance. This information is vital for decision-making, investment analysis, and assessing the financial health of a business.

Role of PPE in Financial Reporting

PPE (Property, Plant, and Equipment) is a key component in financial reporting for businesses. It refers to the long-term tangible assets that are used in the production or provision of goods and services. These assets include buildings, machinery, vehicles, and equipment that have a useful life of more than one accounting period.

The costs associated with PPE, which include the purchase price, direct costs of bringing the asset to the desired location and condition for its intended use, and any initial estimate of costs that may be incurred in future dismantling or removal of the asset, are initially recognized as an expense when incurred. However, once the asset is recognized and acquired, it is accounted for differently based on the accounting standards and valuation methods employed by the business.

Financial reporting for PPE involves not only recognizing and measuring the cost of acquiring the assets, but also determining the appropriate valuation method and recognition of any subsequent costs. This includes accounting for costs such as repairs and maintenance, enhancements or upgrades, and depreciation.

Depreciation is a particularly important aspect of financial reporting for PPE. It represents the systematic allocation of the cost of an asset over its useful life, reflecting its consumption or wear and tear. Depreciation expense is recognized in the financial statements, reducing the carrying value of the PPE over time.

Lease accounting is another area where PPE plays a significant role in financial reporting. Leases of PPE are classified as either operating leases or finance leases based on the extent of risks and rewards transferred to the lessee. The accounting treatment for each type of lease will differ, impacting the recognition and measurement of PPE in the financial statements.

In conclusion, PPE plays a critical role in financial reporting, as it represents a significant portion of a business's assets. Understanding the accounting principles, standards, and valuation methods related to PPE is essential for accurate and transparent financial reporting, ensuring the proper recognition and measurement of these assets in a business's financial statements.

Impact of PPE on Business Valuation

PPE (Property, Plant, and Equipment) plays a crucial role in business valuation as it represents the long-term assets of a company. Proper recognition and accounting of PPE costs can significantly impact the financial standing and valuation of a business.

Firstly, the valuation of a business heavily relies on the value of its tangible assets, which include PPE. The book value of PPE reflects the historical cost of acquiring these assets, taking into account any depreciation over time. Any changes in the value of PPE can directly affect the overall value of a business.

The accounting standards for PPE recognition and reporting are essential for maintaining accurate financial statements. These standards ensure that PPE assets are appropriately recorded, valued, and reported in accordance with established guidelines. Failure to comply with these standards can result in inaccuracies in financial reporting, leading to incorrect business valuations.

PPE can also impact business valuation through its depreciation. As PPE assets age and wear out, they experience depreciation, which is a decrease in their value over time. The depreciation of PPE assets can result in a reduction in the overall value of a business and should be accounted for accurately in financial statements.

Furthermore, the type of PPE a business owns and its condition can also influence business valuation. Certain types of PPE, such as specialized machinery or equipment, can have a significant impact on a business's operations and profitability. Additionally, well-maintained and functional PPE assets may be valued higher than those in poor condition, further affecting business valuation.

In summary, PPE has a significant impact on business valuation. Proper recognition, accounting, and reporting of PPE assets are crucial for accurately estimating the value of a business. Moreover, the type and condition of PPE assets, as well as their depreciation, also play a role in determining the overall valuation of a business.

Recognition and Measurement of PPE in Accounting

In accounting, the recognition and measurement of property, plant, and equipment (PPE) is a crucial aspect of financial reporting. PPE refers to tangible assets that are owned or leased by a business for its operating activities. These assets include land, buildings, machinery, vehicles, and equipment.

Valuation of PPE is important to determine the fair value of these assets for accounting purposes. The historical cost method is commonly used, which involves recording the initial cost of acquiring or constructing the PPE. This cost includes all the necessary costs to bring the asset into its intended use, such as purchase price, transportation fees, and installation costs.

Operating leases also play a role in the recognition and measurement of PPE. Under accounting standards, if a lease meets certain criteria, the leased asset must be recognized as an owned asset and recorded on the balance sheet. This ensures that the economic substance of the lease is accurately reflected in the financial statements.

Depreciation is another key component in the measurement of PPE. It is the systematic allocation of the cost of an asset over its useful life. Depreciation expenses are recorded in the income statement and reduce the book value of PPE over time. Different depreciation methods, such as straight-line or accelerated depreciation, may be used based on the estimated pattern of asset usage and expected future benefits.

In summary, the recognition and measurement of PPE in accounting involve valuing, recording, and depreciating these assets to provide an accurate representation of a business's financial position. This allows stakeholders to assess the value and performance of a company and make informed decisions based on its reported financial information.

Criteria for Recognizing PPE

To be recognized in accounting, Property, Plant, and Equipment (PPE) must meet certain criteria. These criteria are set by financial reporting standards to ensure consistent and accurate valuation of these assets.

One of the main criteria for recognizing PPE is that it must have a useful life that extends beyond one accounting period. This means that the property, plant, or equipment should be expected to be used in the business's operations for a significant period of time, typically more than one year.

PPE must also meet the cost recognition criterion. This means that the cost of acquiring or constructing the asset can be reliably measured. The cost of PPE includes not only the purchase price but also any directly attributable costs, such as transportation and installation expenses.

Another criterion for recognizing PPE is that it must be probable that the future economic benefits associated with the asset will flow to the business. In other words, there should be a reasonable expectation that the asset will generate revenue or reduce costs in the future.

Leased property must be recognized as PPE if it meets certain criteria, such as a lease term that is a significant portion of the asset's remaining economic life or if it includes a purchase option that is reasonably certain to be exercised.

Once recognized, PPE is typically depreciated over its useful life to allocate its cost over time. Depreciation is the systematic allocation of the asset's cost as an expense in the financial statements. This allows the business to reflect the declining value of the asset as it is used in the operations.

In summary, the recognition criteria for PPE in accounting include a useful life extending beyond one accounting period, measurable cost, future economic benefits, and meeting specific lease criteria. These criteria help ensure accurate valuation and reporting of these important assets in a business's financial statements.

Methods for Measuring PPE

When it comes to measuring Property, Plant, and Equipment (PPE) in accounting, businesses have several methods at their disposal. These methods are crucial for accurately capturing and reporting the value of PPE assets, which are a significant part of a company's financial statements.

One common method for measuring PPE is the cost method. Under this approach, PPE assets are initially recorded at their historical cost, which includes the purchase price and any directly attributable costs to bring the asset into its working condition. The cost method is widely used for measuring PPE as it provides a reliable and verifiable value for these assets.

Another method for measuring PPE is the fair value method. In this approach, PPE assets are valued based on their fair market value at the time of acquisition. Fair market value is the price at which the assets would be exchanged between willing buyers and sellers in an orderly transaction. This method is often used when PPE assets are acquired through a business combination or a noncash exchange.

Additionally, the revaluation method can be used to measure PPE. Under this approach, PPE assets are periodically revalued to their current fair value. This method is often employed when an asset's value has significantly changed over time. Revaluation helps businesses reflect the true economic value of their PPE assets on their financial statements.

Lastly, the depreciation method is crucial for measuring PPE. Depreciation is the systematic allocation of the cost of PPE assets over their useful lives. It aims to match the consumption of an asset's economic benefits with the corresponding recognition of expenses. Depreciation helps businesses accurately reflect the decrease in the value of their PPE assets over time and ensures proper financial reporting.

Depreciation and Impairment of PPE in Accounting

Depreciation and impairment play crucial roles in the accounting treatment of Property, Plant, and Equipment (PPE). These concepts are important for accurately reflecting the financial position and performance of an organization.

Depreciation: Depreciation refers to the systematic allocation of the cost of PPE over its useful life. It recognizes that these assets gradually lose value due to wear and tear, obsolescence, or other factors. By spreading the cost of PPE over multiple accounting periods, depreciation helps to match the expenses with the revenue generated from the use of these assets.

Cost and recognition: The cost of PPE includes not only the purchase price but also any direct costs incurred to get the assets ready for use. These costs are initially recognized as part of the asset's value. However, subsequent expenditures to enhance or extend the useful life of PPE are typically capitalized as well. It's important to carefully evaluate and allocate costs to ensure accurate reporting.

Impairment: Impairment occurs when the carrying value of PPE exceeds its recoverable amount. Recoverable amount is the higher of an asset's fair value less selling costs and its value in use. If an asset is impaired, its carrying value needs to be reduced to reflect its new lower value. Impairment losses are recognized in the financial statements when they occur, helping to ensure that the asset's value is not overstated in the books.

In summary, depreciation and impairment are key components of the accounting treatment for PPE. Depreciation helps to allocate the costs of these long-lived assets over time, while impairment ensures that the assets are appropriately valued on the books. These concepts are essential for accurate financial reporting and adherence to accounting standards.

Depreciation Methods for PPE

When it comes to accounting for property, plant, and equipment (PPE), one important aspect to consider is the depreciation method for these assets. Depreciation is the allocation of the cost of PPE over its useful life, reflecting the wear and tear, obsolescence, and decline in value over time.

There are various depreciation methods available in financial accounting to handle the recognition of depreciation for PPE. One commonly used method is the straight-line method, where the cost of the asset is divided equally over its estimated useful life. This method provides a systematic and consistent approach for spreading the cost of PPE throughout its useful life.

Another depreciation method is the declining balance method, which allows for higher depreciation expenses in the earlier years and lower expenses in the later years of an asset's life. This method recognizes that PPE may experience higher wear and tear in its early years, resulting in a higher depreciation expense during that period.

Additionally, there is also the units of production method, which considers the actual usage or output of the PPE as the basis for determining depreciation. This method is particularly useful for assets such as vehicles or equipment that are used in a production process, as it directly ties the depreciation expense to the level of production or usage.

The choice of depreciation method depends on various factors such as the nature of the asset, its expected useful life, and the accounting standards or regulations applicable to the business. It is important for companies to carefully consider these factors and select an appropriate depreciation method for accurate financial reporting of their PPE.

Impairment of PPE: Causes and Consequences

Impairment of property, plant, and equipment (PPE) can have significant impacts on a company's financial reporting and overall business operations. PPE refers to long-term tangible assets, such as buildings, machinery, and vehicles, that are used in the production or delivery of goods and services. These assets are initially recorded in a company's books at their cost, including any directly attributable costs of acquisition or construction.

The recognition of impairment occurs when the carrying amount of a PPE asset exceeds its recoverable amount. The recoverable amount is the higher of the asset's fair value less costs to sell or its value in use. Causes of impairment can include factors such as technological advancements rendering equipment obsolete, changes in market demand, physical damage, or legal restrictions. It is important for companies to regularly assess the carrying value of their PPE assets and recognize any impairment losses.

When impairment is recognized, it has consequences for financial reporting and business operations. Impairment losses are recorded as expenses on the income statement, reducing the net income of the company. Additionally, the carrying value of the impaired asset is reduced on the balance sheet, leading to a decrease in the company's total assets. This can affect key financial ratios, such as return on assets and debt-to-equity ratio, which can impact a company's ability to secure financing or attract investors.

To determine the amount of impairment, companies must estimate the recoverable amount of the asset. This requires a detailed valuation process, which may involve external appraisers or internal experts. The impairment loss is then calculated as the difference between the carrying value of the asset and its recoverable amount. The impairment loss is typically recognized in the income statement under operating costs or as a separate line item.

Overall, impairment of PPE can have significant impacts on a company's financial position, performance, and ability to generate future cash flows. It is essential for businesses to understand and properly account for impairment losses to ensure accurate financial reporting and make informed business decisions regarding the repair, replacement, or disposal of impaired assets.