Electronic payments have revolutionized the way we handle financial transactions in today's digital world. With the advent of technology, traditional methods of payment such as cash and checks are being replaced by more convenient and efficient methods. Electronic payments encompass a wide range of payment options including credit and debit cards, mobile payments, online banking, and e-commerce transactions.

One of the most prominent electronic payment methods is through credit and debit cards. These cards have become a ubiquitous tool for making payments, both in person and online. With a single swipe or insert, funds are transferred instantly, making them an ideal choice for cashless transactions. Whether it's at a physical point of sale (POS) or in the virtual realm of e-commerce, credit and debit cards offer a hassle-free way to transfer money.

Mobile payments are another popular electronic payment method that is gaining traction. With the widespread use of smartphones, it has become increasingly convenient to make payments on the go. Mobile payment apps allow users to link their bank accounts or credit cards to their devices, enabling instant and secure transactions. Whether it's paying bills, splitting expenses with friends, or making purchases online, mobile payments offer a seamless and efficient way to handle transactions.

In addition to the convenience and instant processing, electronic payments have also made e-commerce flourish. With the rise of online shopping, virtual payments have become an indispensable part of the digital marketplace. Customers can make payments securely and easily without the need for physical cash or checks. This has led to the growth of e-commerce, making it convenient for users to browse and purchase products or services from the comfort of their own homes.

Overall, electronic payments have greatly simplified and expedited the way we handle financial transactions. This comprehensive guide aims to provide an in-depth understanding of the various electronic payment methods available today. From credit and debit cards to mobile payments and online banking, we will explore the intricacies and advantages of each method, empowering individuals and businesses to make informed choices when it comes to handling their money in the digital era.

Types of Electronic Payments

In the modern world, electronic payments have become the preferred method of conducting financial transactions. These digital transactions offer convenience, speed, and security, making them an integral part of the banking and e-commerce industries.

Point of Sale (POS) Payments: This type of electronic payment occurs when a customer uses a debit or credit card to make a purchase at a physical store. The transaction is processed instantly, deducting the money from the customer's account and transferring it to the merchant. POS payments have become increasingly popular due to their convenience and cashless nature.

Online Payments: Online payments refer to transactions made over the internet, typically through a website or mobile app. This method allows customers to make instant payments for goods or services using their credit or debit cards. Online payments leverage secure digital technology, ensuring the safety of sensitive financial information.

Mobile Payments: Mobile payments involve using a mobile device, such as a smartphone or tablet, to make a payment. This can be done through various methods, including using mobile payment apps, scanning QR codes, or tapping the device on a contactless payment terminal. Mobile payments provide a convenient and secure way to make transactions on the go.

Virtual Payments: Virtual payments are electronic transactions made in a virtual environment. This can include virtual currencies, such as cryptocurrencies, or virtual prepaid cards. Virtual payments offer a secure and efficient way to transfer funds digitally, without the need for physical cash or traditional banking methods.

Instant Payments: Instant payments enable real-time transfer of money between two parties. This type of electronic payment is often facilitated through specialized payment systems that use advanced technology to process transactions instantly. Instant payments provide a fast and convenient way to send and receive funds, eliminating the need for delays associated with traditional banking methods.

Credit Card Payments

Credit card payments have revolutionized the way we make transactions, providing a convenient and secure method for electronic payments. With the rise of mobile and online banking, credit cards have become an essential tool for consumers all over the world. Whether it's for virtual shopping or in-store purchases, credit cards offer a seamless and cashless experience.

One of the key advantages of credit card payments is their instant processing. When making a purchase, the transaction is completed within seconds, allowing customers to receive their goods or services without delay. This makes credit cards an ideal choice for e-commerce and digital transactions, where speed and efficiency are crucial.

In addition to their speed, credit cards also provide enhanced security measures. Most credit cards come with built-in chip technology and a unique PIN, ensuring that only the authorized cardholder can make payments. This level of security minimizes the risk of fraud and unauthorized access to sensitive financial information.

Credit card payments also offer a wide range of benefits, such as reward programs and cashback incentives. These perks add value to each transaction and encourage customers to use their credit cards for everyday purchases. Additionally, credit cards allow for easy tracking of expenses through detailed statements, making it simpler to manage personal finances.

Overall, credit card payments have transformed the way we handle money and conduct transactions. Their convenience, security, and versatility have made them an integral part of the modern financial landscape. As technology continues to advance, credit card payments will likely remain a dominant force in the world of electronic payments.

Debit Card Payments

A debit card is a type of payment card that allows individuals to access funds directly from their bank account, eliminating the need for cash transactions. This electronic payment method has become increasingly popular in recent years, especially with the rise of mobile and online banking.

Debit card payments offer a convenient and secure way for individuals to make purchases without the need to carry cash. With the advent of technology, these payments can now be made instantly, allowing for a seamless and efficient shopping experience.

In the world of e-commerce, debit card payments have become an essential method for transactions. They are commonly used for online shopping, providing individuals with a secure and digital way to make purchases. With the growth of the digital economy, debit card payments have played a significant role in enabling cashless transactions and fostering the growth of online businesses.

Debit card payments are widely accepted, both in physical stores and online. They can be used at point-of-sale (POS) systems, where individuals can simply swipe their card or use contactless payment methods to complete a transaction. This method of payment has become a standard in the retail industry, allowing for quick and convenient transactions.

Overall, debit card payments have revolutionized the way we handle money, providing a secure, instant, and convenient method for conducting transactions. Whether it's in a physical store or in the online realm of e-commerce, debit cards have become an essential tool in our modern banking and payment systems.

Mobile Wallet Payments

Mobile wallet payments are a cashless and secure method of conducting transactions through a virtual platform. Using a mobile device, such as a smartphone or tablet, individuals can make payments using various methods, including credit, debit, or online banking. This innovative technology allows customers to make instant and convenient electronic payments, eliminating the need for physical cash or cards.

Mobile wallet payments leverage digital banking and e-commerce platforms to enable users to securely store their payment information. By linking their bank accounts or credit cards to their mobile wallet, individuals can easily make purchases online or in-person at point of sale (POS) terminals. The mobile wallet securely stores the user's information, including card details, eliminating the need to carry physical cards or enter payment information for each transaction.

The convenience of mobile wallet payments extends beyond just making purchases. Consumers can also use their mobile wallets for other transactions, such as transferring money to friends or family, paying bills, or even making donations to charitable organizations. The digital nature of mobile wallet payments makes it easy to manage and track transactions, providing users with a comprehensive overview of their spending habits.

Security is a top priority for mobile wallet payments. To ensure the protection of user's information, mobile wallets use advanced encryption and authentication measures. Additionally, many mobile wallet providers offer additional security features, such as biometric authentication through fingerprint or facial recognition, adding an extra layer of protection to the payment process.

Overall, mobile wallet payments are revolutionizing the way we make transactions. With their convenience, security, and versatility, they provide a seamless and efficient payment solution for individuals in an increasingly digital world.

Benefits of Electronic Payments

Electronic payments offer numerous advantages compared to traditional cash-based transactions. The rise of online and digital banking has made it easier than ever to make payments and conduct financial transactions. One of the key benefits of electronic payments is their convenience. With electronic payments, you can make transactions instantly from anywhere using your mobile device or computer, eliminating the need to carry cash or visit a physical branch.

Electronic payments also provide a more secure method of money transfer. By using encrypted technology, your personal and financial information is protected, reducing the risk of fraud and identity theft. Additionally, electronic payment methods such as debit and credit cards offer built-in protections and dispute resolution processes, giving you peace of mind when making purchases.

Another advantage of electronic payments is their ability to track and manage financial transactions. Online banking platforms and mobile apps provide easy access to your transaction history, allowing you to keep track of your spending and manage your budget effectively. This feature is particularly helpful for businesses, as it simplifies bookkeeping and reduces the need for manual data entry.

The cashless nature of electronic payments also contributes to a more efficient and streamlined payment process. Point-of-sale (POS) systems and virtual payment terminals enable businesses to process payments quickly and accurately, reducing wait times for customers. For consumers, electronic payments eliminate the need to count or carry cash, making the payment process smoother and more efficient.

In summary, electronic payments offer a wide range of benefits including convenience, security, efficient tracking, and streamlined payment processes. As technology continues to evolve, the use of electronic payments is only expected to increase, further transforming the way we handle transactions and conduct business.

Convenience and Accessibility

With the rapid advancement in technology, electronic payments have become the preferred method for transferring money. Whether it's processing online transactions or making virtual cashless payments at a physical store, electronic payments have revolutionized the way we handle our finances.

One of the main advantages of electronic payments is their convenience. Instead of having to carry physical cash or checks, you can simply use your banking card, credit or debit, to make instant payments. This is especially useful in e-commerce, where you can make purchases with just a few clicks, without the hassle of entering your payment details each time.

In addition to convenience, electronic payments also offer greater accessibility. With the rise of mobile banking, you can now make transactions and manage your finances from anywhere, at any time. This has made it easier for many people to access banking services, especially those who live in remote areas or have limited access to physical banks.

Moreover, electronic payments ensure a high level of security. With encryption and other security measures in place, your financial information is well-protected during the payment process. This gives you peace of mind knowing that your transactions are safe and secure.

Overall, digital payment methods such as electronic payments, digital wallets, and POS systems have made financial transactions more convenient, accessible, and secure. By embracing these technologies, we can enjoy a more efficient and streamlined approach to managing our money.

Enhanced Security

The advancement of technology has revolutionized the way we handle financial transactions. With the rise of mobile and online banking, the need for secure payment methods has become paramount. Electronic payments provide a convenient and cashless way to make transactions, whether it's for purchasing goods or transferring money.

One of the key benefits of electronic payments is the enhanced security measures that have been implemented to protect sensitive financial information. With the use of encryption technology, the risk of unauthorized access to personal data is significantly reduced. This ensures that your credit or debit card information is securely transmitted during online transactions, making it virtually impossible for hackers to intercept and misuse your information.

In addition to encryption, another secure method of electronic payment processing is the use of tokenization. This involves the substitution of sensitive card data with a unique identifier, or token, which is then used for the transaction. This means that even if the token is intercepted, it is useless to hackers, as it cannot be used to make any fraudulent transactions.

Moreover, electronic payments also offer instant fraud detection mechanisms. Advanced algorithms and artificial intelligence are used to analyze transactions in real-time, looking for any suspicious activity. In case of any unusual patterns or potential fraud, the system can immediately flag the transaction, halting it before any harm is done.

With the increasing popularity of e-commerce and online shopping, secure payment methods have become essential. Electronic payments provide a seamless and secure way to make online transactions, eliminating the need for physical cash or checks. The use of secure payment gateways and various authentication methods, such as two-factor authentication, further enhance the security of these transactions.

Faster Transaction Processing

In today's digital age, faster transaction processing has become a key aspect of electronic payments. With the advent of mobile and online payments, transactions can now be completed instantaneously, eliminating the need for lengthy processing times.

One of the main advantages of electronic payments is that they allow for almost instant processing. Whether it's a credit or debit card transaction at a point-of-sale (POS) terminal, a cashless payment in an e-commerce transaction, or a virtual banking transaction, the technology allows for quick and efficient processing.

The use of secure digital payment methods has made it convenient for consumers to complete transactions without the hassle of carrying cash. Additionally, the secure nature of electronic payments ensures that sensitive financial information is protected, providing peace of mind for both consumers and merchants.

With faster transaction processing, businesses can streamline their operations and improve customer satisfaction. The ability to process payments quickly and efficiently allows for a smoother checkout experience, reducing waiting times and increasing overall customer convenience.

Overall, the advancements in electronic payment technology have revolutionized the way transactions are processed. The speed and efficiency of these methods have made electronic payments the preferred choice for many consumers and businesses alike, paving the way for a cashless future.

How Electronic Payments Work

In today's cashless society, electronic payments have become the norm for most transactions. With the advancement of technology and the widespread use of the internet, making payments online has become incredibly convenient and efficient.

When you make an electronic payment, whether it's for an item purchased online or a bill payment, the transaction is processed digitally. This means that instead of using physical cash or checks, the payment is made using a virtual method.

One of the most common electronic payment methods is through credit or debit cards. When you make a payment using your card, the payment processing technology verifies your card information and checks if you have enough funds to cover the transaction. If everything is in order, the payment is instantly processed, and the funds are transferred from your account to the recipient's account.

Another popular method of electronic payment is through online banking. With online banking, you can transfer money from one account to another electronically. This can be done instantly or within a few business days, depending on the banking institution's policies.

In addition to credit cards and online banking, there are also other electronic payment options available, such as mobile payment apps and POS (point of sale) systems. These methods allow you to make payments using your smartphone or tablet, making it even more convenient and accessible.

Security is a crucial aspect of electronic payments. To ensure the security of your transactions, payment processors use encryption technology to protect your card information and personal details. This helps to prevent fraudulent activities and unauthorized access to your account.

Overall, electronic payments have revolutionized the way we handle our finances. With their speed, convenience, and secure nature, they have become the preferred method of making transactions in today's digital world.

Authorization and Authentication

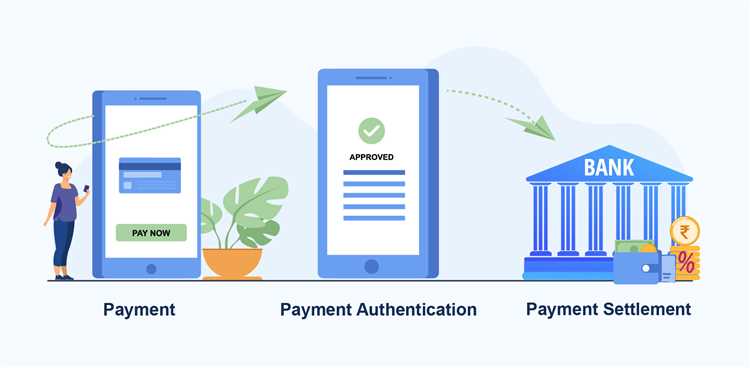

In the world of electronic payments, authorization and authentication play a crucial role in ensuring the security and legitimacy of transactions. When a customer makes a purchase using a point-of-sale (POS) terminal or online platform, the transaction must go through a series of steps to be authorized and verified.

First, the customer's payment information, whether it be a credit or debit card, is validated to ensure that it belongs to the rightful owner. This can be done through various means, such as entering a PIN, providing a signature, or using biometric authentication.

Once the customer's identity is confirmed, the authorization process begins. This involves obtaining approval from the customer's bank or card issuer to proceed with the transaction. The bank evaluates the available funds or credit limit, and if sufficient, provides an authorization code to the merchant or service provider.

Authentication is a crucial step in electronic payments, especially in the realm of e-commerce and mobile banking. With increasing instances of fraud and identity theft, it is important to verify the customer's identity before completing a transaction. This can be done through various methods, such as two-factor authentication, where the customer must provide something they know (such as a password) and something they have (such as a unique code sent to their mobile device).

The use of technology has greatly improved the speed and accuracy of authorization and authentication processes. With instant data processing and online connectivity, transactions can be authorized within seconds, providing a seamless and convenient experience for customers.

In conclusion, authorization and authentication are essential components of electronic payments. They ensure that transactions are secure, legitimate, and protected against fraud. With the advancements in technology, these processes have become more efficient and convenient, allowing for fast and reliable digital transactions in the cashless era.

Payment Gateway and Processor

A payment gateway is a virtual banking system that allows electronic transactions to be conducted securely over the internet. It serves as a link between the merchant, the customer, and the bank, ensuring that money is transferred from the customer's account to the merchant's account in a fast and secure manner.

With the rise of e-commerce and online shopping, payment gateways have become an essential part of the digital economy. They enable businesses to accept credit and debit card payments, providing a convenient and efficient method of payment for customers.

Payment processors, on the other hand, are the technology behind the scenes that facilitates the secure processing of electronic transactions. They handle the authorization and settlement of payments, ensuring that the funds are transferred from the customer's account to the merchant's account in a seamless and secure manner.

Payment processors employ advanced encryption technology to protect sensitive customer information and ensure the security of transactions. They can be integrated into various platforms, including e-commerce websites, mobile apps, and point-of-sale (POS) systems.

Payment processors also enable instant transactions, allowing customers to make payments in real-time and merchants to receive funds immediately. This is particularly beneficial in the fast-paced world of online shopping, where speed and convenience are highly valued.

Overall, payment gateways and processors play a crucial role in enabling secure and efficient electronic payments in the digital age. They provide a seamless experience for customers, allowing them to make secure payments online or in-store, while also improving the efficiency and speed of transactions for businesses.

Settlement and Funding

Settlement and funding are crucial processes in the world of electronic payments. When a transaction is made using an electronic payment method, such as a debit or credit card, it goes through a series of processing steps before the funds are settled and transferred to the merchant's account.

The settlement process involves the transfer of funds from the customer's bank account to the merchant's account. This can be done through various methods, such as batch processing or online settlement. With the advancement of technology, settlement has become much faster and more secure. Instant settlement allows for quick and convenient transfer of funds, ensuring that merchants receive their money in a timely manner.

Electronic payments have revolutionized the way we handle money, making cashless transactions more efficient and convenient. With the rise of online and mobile banking, customers can make payments anytime, anywhere. This digital payment technology has also introduced new ways of making transactions, such as virtual POS systems, where customers can simply tap their mobile devices to pay for goods and services.

Security is a top priority in electronic payments. With the use of secure encryption methods and authentication protocols, electronic payment systems ensure that customer's financial information is protected. This makes electronic payments a safe and reliable alternative to traditional cash transactions.

In conclusion, settlement and funding play a vital role in the world of electronic payments. The convenience, speed, and security offered by electronic payment methods have revolutionized the way we conduct transactions. With the continuous advancement of technology, electronic payments are expected to become even more prevalent in the future.

Popular Electronic Payment Providers

Electronic payments have revolutionized the way we handle transactions in today's digital age. Several popular payment providers have emerged to meet the increasing demand for secure, fast, and convenient electronic payment methods.

One of the most well-known payment providers is PayPal, which offers online payment solutions for both individuals and businesses. With PayPal, users can link their bank accounts or credit cards to make transactions, and the platform provides secure processing for both buyers and sellers.

Another popular provider is Stripe, which focuses on enabling businesses to accept online payments. Stripe offers a seamless integration with e-commerce platforms, allowing businesses to easily set up their online stores and accept a wide range of payment methods, including credit and debit cards.

For those who prefer mobile payments, Apple Pay and Google Pay have become go-to choices. These mobile payment platforms allow users to make contactless payments using their smartphones or smartwatches. Both Apple Pay and Google Pay use secure technology to encrypt and protect users' payment information.

When it comes to virtual currency, one of the largest providers is cryptocurrency exchange Coinbase. Coinbase allows users to buy, sell, and store various cryptocurrencies such as Bitcoin and Ethereum. This digital payment method has gained popularity due to its decentralized and instant nature.

Moreover, Square is a popular electronic payment provider that offers a comprehensive suite of payment solutions. From mobile card readers for small businesses to point-of-sale (POS) systems for larger establishments, Square provides a range of tools to accept payments both offline and online.

- PayPal: Online payment solutions for individuals and businesses.

- Stripe: Enables businesses to accept online payments.

- Apple Pay and Google Pay: Mobile payment platforms for contactless payments.

- Coinbase: Cryptocurrency exchange for buying, selling, and storing digital currencies.

- Square: Provides a suite of payment solutions for offline and online transactions.

With these popular electronic payment providers, individuals and businesses can enjoy the benefits of a cashless society, making transactions faster and more convenient than ever before.

PayPal

PayPal is a leading cashless payment platform that facilitates virtual and mobile electronic payments. It allows users to make secure transactions and is widely used in e-commerce and online banking. PayPal offers both credit and debit card processing options, making it a convenient method for conducting online transactions.

One of the advantages of PayPal is its user-friendly interface and easy integration with various e-commerce platforms. It simplifies the payment process for customers, allowing them to make purchases with just a few clicks. Additionally, PayPal's advanced banking technology ensures the security of transactions, protecting users' personal and financial information.

With PayPal, users can securely send and receive money from individuals or businesses worldwide. It supports digital transactions in multiple currencies, making it a versatile payment solution for international commerce. PayPal is accepted by millions of online merchants, providing customers with a trusted and reliable payment option.

Furthermore, PayPal offers a Point of Sale (POS) system, allowing businesses to accept payments in-store or on the go. The PayPal Here solution includes a mobile card reader that can be connected to a smartphone or tablet, enabling merchants to process payments anytime and anywhere.

In conclusion, PayPal revolutionized the way we make electronic payments by providing a secure, convenient, and efficient method for online transactions. Its advanced technology and widespread acceptance make it a popular choice among individuals and businesses alike.

Stripe

Stripe is a technology company that provides a cashless payment solution for businesses and individuals. It offers a virtual and secure platform for processing electronic payments, making transactions quick and convenient.

With Stripe, businesses can accept payments through various methods, including credit and debit cards, as well as mobile and digital wallets. The platform integrates seamlessly with e-commerce websites, allowing for easy online transactions.

One of the key features of Stripe is its focus on security. The company uses advanced encryption and anti-fraud measures to ensure that sensitive banking and personal information is protected. This makes it a trusted and reliable payment method for both businesses and consumers.

Stripe also offers an instant payment feature, enabling businesses to receive funds in their account immediately after a transaction is completed. This eliminates the need for manual processing and reduces payment delays.

Furthermore, Stripe provides businesses with a range of tools and analytics to manage their payments more efficiently. This includes a point-of-sale (POS) system for in-person transactions, as well as reporting and reconciliation features for easy tracking of money flow.

Overall, Stripe is a comprehensive and user-friendly payment solution that empowers businesses to accept and process electronic payments securely and conveniently.

Square

Square is an online payment platform that offers convenient and secure electronic payment processing for businesses and individuals. It is a popular choice for e-commerce and mobile payments, allowing users to accept instant, cashless transactions using their mobile devices or through a virtual terminal.

With Square, users can easily accept credit card payments and process transactions using the latest technology and digital banking methods. The platform provides a secure and reliable way to handle money transfers, eliminating the need for traditional POS systems and physical cash.

One of the key features of Square is its ability to provide secure transactions through its advanced encryption and fraud detection technology. This ensures that the financial information of both the buyer and the seller is protected during online transactions.

Square also offers a range of additional features and services to enhance the payment experience. For example, users can create and send digital invoices, set up recurring payments, and manage their finances with detailed reports and analytics. The platform is also compatible with other popular business tools and software, making it easy to integrate into existing systems.

Future Trends in Electronic Payments

As online transactions continue to grow, the future of electronic payments is expected to be even more convenient and instant. With the rapid advancements in digital technology, the payment industry is constantly evolving to provide secure and efficient methods for transferring money.

One of the future trends in electronic payments is the increased use of mobile banking. With the rise of smartphones, people are relying more on their mobile devices for various tasks, including banking. Mobile payments enable users to make transactions on the go, providing a convenient and seamless experience.

Another trend is the emergence of virtual currencies, such as Bitcoin. These digital currencies allow for decentralized, peer-to-peer transactions without the need for traditional banking systems. While still in the early stages, virtual currencies have the potential to revolutionize the way we make payments online.

Furthermore, the integration of electronic payment methods into e-commerce platforms is becoming more prevalent. Online retailers are offering a wide range of payment options, including credit and debit cards, digital wallets, and instant payment platforms. This variety of payment methods gives customers more flexibility and enhances their overall shopping experience.

In addition, advancements in point-of-sale (POS) technology are also shaping the future of electronic payments. Contactless payment methods, such as NFC (Near Field Communication) and QR codes, are gaining popularity as they offer a quick and secure way to complete transactions. With just a tap or a scan, customers can make payments without the need for physical cards or cash.

Overall, the future of electronic payments is headed towards a more streamlined and secure system. As technology continues to advance, we can expect to see more innovative methods and solutions in the payment industry, ultimately making transactions easier and more efficient for consumers and businesses alike.

Contactless Payments

Contactless payments refer to virtual, cashless transactions that are made using digital technology. This method of payment allows for seamless and instant processing of credit and debit card transactions, without the need for physical contact between the card and the point of sale (POS) terminal.

One of the key advantages of contactless payments is the convenience it offers. With just a tap or wave of a card or mobile device, customers can quickly and securely make payments at various locations, including retail stores, restaurants, and other businesses. This technology has also been widely adopted in the e-commerce industry, allowing for fast and easy online transactions.

Contactless payments have become increasingly popular due to their speed and ease of use. Customers no longer have to carry around cash or worry about entering their card details for every purchase. Instead, they can simply tap their card or mobile device on the contactless payment terminal to complete the transaction.

In addition to its convenience, contactless payment technology also provides enhanced security. Despite the speed of the transaction, contactless payments use encryption and tokenization methods to protect sensitive information and prevent unauthorized access. This makes it a secure method for making payments both in-person and online.

The adoption of contactless payment methods has also been driven by the rise of mobile banking apps and digital wallets. Many banks and financial institutions now offer mobile payment solutions that allow customers to link their credit or debit cards to their smartphones. This enables them to make contactless payments using their mobile devices, further adding to the convenience and versatility of this payment method.

Blockchain Technology

Blockchain technology is revolutionizing the way electronic payments are processed and secured. It is a decentralized system that allows for secure and transparent transactions without the need for intermediaries.

One of the key features of blockchain technology is its ability to securely store and validate transactions. Each transaction is recorded in a block, which is then linked to the previous blocks, forming a chain of transactions. This makes it virtually impossible to alter or tamper with the transaction history, ensuring the integrity of the payment process.

Blockchain technology is particularly beneficial for debit and online payments. With blockchain, payments can be processed and verified instantly, reducing the time and friction associated with traditional banking methods. This makes it a convenient and efficient option for both businesses and consumers.

In addition to being secure and convenient, blockchain technology has the potential to revolutionize other areas of electronic payments, including e-commerce and mobile payments. With blockchain, users can make instant and secure virtual transactions, eliminating the need for cash and physical payment methods.

Overall, blockchain technology is a game-changer in the electronic payments industry. Its secure, efficient, and transparent nature makes it a promising method for processing payments in the digital era.

Biometric Authentication

Biometric authentication is an instant and secure method of verifying a person's identity by using their unique biological traits. This technology has revolutionized the way payments are processed, both in-person at point-of-sale (POS) terminals and online.

Biometric authentication allows individuals to make cashless and virtual transactions without the need for physical credit or debit cards. Instead, their electronic devices, such as smartphones or tablets, use biometric data, such as fingerprints or facial features, to confirm their identity and authorize the transaction.

The use of biometric authentication in electronic payments provides a higher level of security compared to traditional methods. As biometric data is unique for each individual, it becomes virtually impossible for imposters to access someone's device or banking information.

Furthermore, biometric authentication makes banking and other financial transactions more convenient. Users no longer need to remember multiple passwords or carry physical cards. Instead, they can simply use their registered biometric data to verify their identity and complete transactions with ease.

Overall, biometric authentication has transformed the way electronic payments are conducted. It offers a secure, efficient, and convenient method for individuals to make transactions, whether they are in-person or online. As technology continues to advance, we can expect biometric authentication to become an even more integral part of our digital lives.