In the world of accounting, one of the key concepts to understand is Net Property, Plant, and Equipment (Net PPE). Net PPE refers to the value of a company's fixed assets after taking into account depreciation, impairment, and any accumulated amortization.

Depreciation is the systematic allocation of the cost of an asset over its useful life. It is a way for companies to match the expense of using an asset with the revenue it generates. When an asset is depreciated, its value decreases over time on the balance sheet.

Impairment refers to a decrease in the value of an asset that is not related to normal wear and tear. If an asset is impaired, its carrying value on the balance sheet must be reduced to reflect its fair value.

When a company acquires property, plant, and equipment (PPE), it must decide whether to capitalize or expense the cost. Capitalizing means recording the cost of the asset as an asset on the balance sheet, while expensing means recording the cost as an expense on the income statement. The decision to capitalize or expense depends on the company's accounting policies and the nature of the asset.

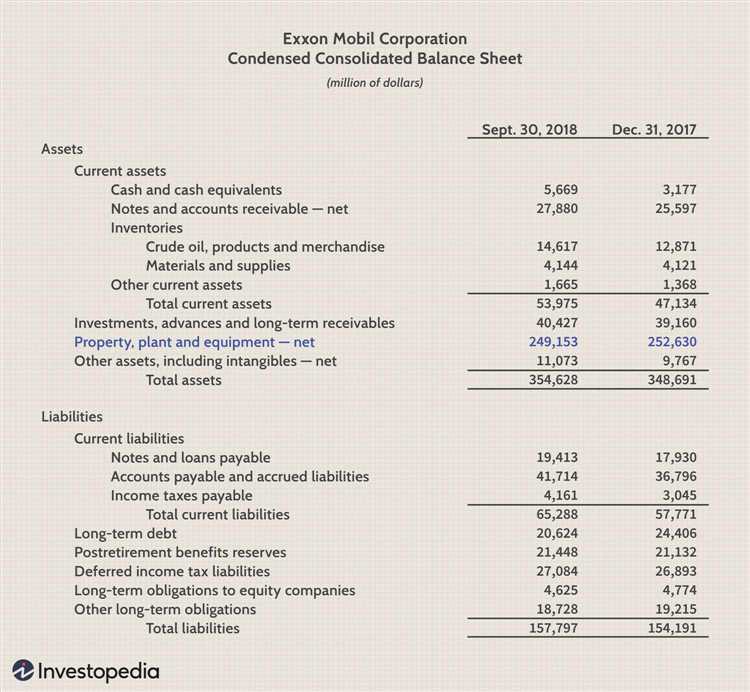

Net PPE is calculated by subtracting the accumulated depreciation, impairment, and amortization from the cost of the assets. It is an important metric for investors and analysts as it provides a snapshot of the value of a company's fixed assets that have not been fully depreciated or impaired.

Examples of property, plant, and equipment include buildings, land, vehicles, machinery, and equipment. These assets are typically long-term and have a useful life of more than one year. The net value of these assets is important for decision-making, as it affects a company's profitability, solvency, and overall financial health.

Understanding and analyzing Net PPE is crucial in assessing a company's financial position and its ability to generate future cash flows. By understanding the depreciation, impairment, and amortization of property, plant, and equipment, investors and analysts can make informed decisions about a company's value and potential risks.

In conclusion, Net PPE is a key concept in accounting that represents the value of a company's fixed assets after taking into account depreciation, impairment, and accumulated amortization. It is an important metric for assessing a company's financial health and future prospects. By understanding Net PPE, investors and analysts can gain valuable insights into a company's asset base and make informed investment decisions.

What is Net PPE?

Net PPE stands for Net Property, Plant, and Equipment. It refers to the value of impaired assets that a company holds on its balance sheet. These assets are categorized under long-term assets and represent the physical assets owned by the company, such as land, buildings, machinery, and vehicles.

Net PPE is calculated by deducting the accumulated depreciation and amortization from the book value of Property, Plant, and Equipment. The book value is the acquisition cost of the assets, which includes the cost of acquiring and capitalizing PPE, minus any residual value or estimated salvage value.

Depreciation is the process of allocating the cost of a PPE over its useful life, while amortization is the same process applied to intangible assets.

Net PPE is an important figure for investors and analysts as it provides insights into a company's long-term asset management. A higher net PPE value indicates greater investment in tangible assets, while a lower value may suggest that the company is relying more on intangible assets or outsourcing certain functions.

Understanding the net value of PPE is crucial for assessing a company's financial health and its ability to generate future cash flows. It helps investors gauge whether a company is effectively managing its assets and if there is a need for any impairment charges. Therefore, analyzing net PPE is essential for making informed investment decisions.

Definition of Net PPE

Net Property, Plant, and Equipment (Net PPE) is an accounting term that refers to the value of a company's fixed assets after accounting for depreciation, amortization, and any impairments or write-offs. It is the balance of the PPE account reported on the balance sheet, which represents the net worth of the company's tangible assets.

Property, Plant, and Equipment (PPE) are long-term assets that a company acquires to use in its operations and generate revenue. These assets can include land, buildings, machinery, vehicles, furniture, and other tangible items. When a company acquires these assets, they are initially recorded at their cost, which includes the purchase price and any additional costs needed to bring the assets into use.

Over time, these assets are depreciated or amortized to reflect their gradual loss of value due to wear and tear, obsolescence, or technological advancements. This depreciation or amortization expense is recorded on the income statement and reduces the value of the assets on the balance sheet. The accumulated depreciation or amortization is subtracted from the original cost of the assets to arrive at the net book value or net carrying value of the assets.

If an asset becomes impaired or no longer able to generate revenue, it may be written off and removed from the company's books. This impairment loss is also subtracted from the net book value of the assets. The resulting amount is the net PPE, which represents the residual value of the company's fixed assets after accounting for all depreciation, amortization, and impairments.

Net PPE is an important metric for investors and creditors as it provides insights into the company's long-term assets and their value. A higher net PPE indicates that the company has invested more in its fixed assets, which can be a positive sign of growth and operational stability. However, a lower net PPE may indicate that the company's assets are being depreciated or depreciated at a faster rate, which could raise concerns about the company's future profitability.

Importance of Net PPE

The net property, plant, and equipment (PPE) value is a crucial figure on a company's balance sheet. It represents the depreciated value of the assets owned by the company, such as land, buildings, machinery, and equipment.

Depreciation is the systematic allocation of the cost of an asset over its useful life. It is important to depreciate PPE to accurately reflect the decrease in their value due to wear and tear, obsolescence, or technological advancements.

The net PPE value helps investors and stakeholders assess the company's financial health and efficiency in managing its assets. A higher net PPE value indicates that the company has a significant amount of physical assets that can be used in its operations and generate revenue.

Companies can capitalize the cost of acquiring PPE, including any expenses related to installation, transportation, or improvement. By adding these costs to the PPE account, the company can spread out the expense over the useful life of the assets, reducing the impact on its financial statements in a single period.

Accumulated depreciation is the total amount of depreciation expense recognized over the assets' useful lives. It represents the reduction in the carrying value of the assets on the balance sheet. The accumulated depreciation is subtracted from the gross PPE to arrive at the net PPE value.

The net PPE value is also important for assessing the fair value of the assets. If the carrying value of the assets exceeds their estimated fair value, it indicates that the assets may be impaired. In such cases, companies need to recognize an impairment loss to bring the carrying value down to the estimated fair value.

In summary, the net PPE value is a key indicator of a company's asset base, financial health, and efficiency in managing its assets. It provides valuable insights to investors, creditors, and other stakeholders in evaluating the company's performance and potential risks associated with its property, plant, and equipment.

How to Calculate Net PPE?

Net PPE, or Net Property, Plant, and Equipment, is an important metric used by businesses to determine the value of their long-term assets after accounting for depreciation and impairment. Calculating Net PPE involves subtracting the accumulated depreciation and impairment from the gross value of PPE.

To calculate Net PPE, first, determine the gross value of PPE. This includes the initial cost of acquiring the assets, such as land, buildings, equipment, and vehicles. It also includes any additional costs incurred to bring the assets into use, such as installation or transportation expenses.

Next, depreciation should be taken into account. Depreciation is the systematic allocation of the cost of an asset over its useful life. It reflects the wear and tear or obsolescence that occurs over time. Accumulated depreciation represents the cumulative amount of depreciation expense recognized since the acquisition of the asset.

Depending on the accounting method used, depreciation can be calculated using various methods, such as straight-line depreciation, declining balance depreciation, or units of production depreciation. The depreciation expense is allocated to each accounting period, reducing the value of the asset on the balance sheet.

If any impairment is identified, it should also be considered in the calculation of Net PPE. Impairment occurs when the carrying value of an asset exceeds its recoverable amount. The recoverable amount is the higher of an asset's fair value less costs to sell or its value in use. Impairment is recognized as a loss and reduces the value of the asset in the balance sheet.

Finally, to calculate Net PPE, subtract the accumulated depreciation and impairment from the gross value of PPE. The resulting amount represents the net value of the long-term assets that the business owns. Net PPE is an important indicator of a company's financial health and stability, as it shows the value of its long-term assets after accounting for wear and tear, obsolescence, and impairments.

Depreciation and Accumulated Depreciation

Depreciation is a method used to gradually allocate the cost of an asset over its useful life. It represents the reduction in the value of an asset due to wear and tear, obsolescence, or any other factor that causes a decrease in its market value. Depreciation allows businesses to match the cost of an asset with the revenue it generates over time.

Accumulated depreciation is the total amount of depreciation recorded for an asset since its acquisition. It is a contra account that is subtracted from the asset's original cost to determine its net book value. Accumulated depreciation is presented on the balance sheet as a negative value to reflect the accumulated reduction in the value of the asset.

When an asset is acquired, its cost is initially capitalized as property, plant, and equipment (PPE) on the balance sheet. Over time, the asset is depreciated, which reduces its value on the balance sheet, and the corresponding amount is recorded as accumulated depreciation. The net book value of the asset is obtained by subtracting the accumulated depreciation from its original cost.

The rate at which an asset is depreciated depends on factors such as its useful life, salvage value, and depreciation method chosen by the company. Some assets may be subject to impairment if their fair market value falls below their carrying value. In such cases, the impairment loss is recorded, and the asset's net book value is adjusted accordingly.

Depreciation is an important concept in accounting as it allows companies to accurately reflect the decrease in value of their assets over time. It helps in determining the true cost of using assets for business operations and provides a more accurate representation of a company's financial position.

Net PPE Calculation Example

Net PPE, or Net Property, Plant, and Equipment, is an important financial metric used to determine the value of a company's fixed assets. It is calculated by subtracting the accumulated depreciation and impairment charges from the total cost of acquisition of the assets.

Let's consider an example to better understand the calculation of Net PPE. Suppose a company has acquired various assets such as buildings, machinery, and vehicles. The total cost of acquisition of these assets is $1,000,000. Over time, these assets have depreciated and accumulated total depreciation of $200,000. Additionally, some assets have been impaired, resulting in impairment charges of $50,000.

To calculate the Net PPE, we subtract the accumulated depreciation and impairment charges from the total cost of acquisition. In this case, Net PPE can be calculated as follows: $1,000,000 (total cost) - $200,000 (accumulated depreciation) - $50,000 (impairment charges) = $750,000.

The Net PPE value of $750,000 represents the net book value of the company's property, plant, and equipment. It indicates the remaining value of the assets after accounting for depreciation and impairment. This value is reported on the company's balance sheet as a long-term asset.

Net PPE is an important metric for investors and creditors as it provides insight into the value of a company's fixed assets. It helps assess the financial health of the company and its ability to generate future cash flows. Additionally, tracking Net PPE over time can indicate the company's investment in new assets and the effectiveness of its asset management.

Why is Net PPE Important for Businesses?

Net Property, Plant, and Equipment (PPE) is an essential financial metric that businesses use to determine the residual value of their assets. It represents the net value of a company's property, plant, and equipment after accounting for accumulated depreciation and any impairments.

Understanding net PPE is important for businesses because it allows them to assess the value of their long-term tangible assets. By subtracting the accumulated depreciation from the initial cost of the assets, businesses can determine the actual value of their property, plant, and equipment.

Net PPE is particularly crucial when it comes to important financial decisions, such as asset acquisition or disposal. It provides a clear picture of the current value of the assets, helping businesses make informed decisions about their capital investments.

In addition, net PPE is an important figure for financial reporting purposes. Companies are required to report their net PPE on their balance sheet, providing stakeholders with information about the company's tangible assets and their value. This can be especially relevant for creditors, investors, and potential buyers who want to assess a company's financial health and stability.

Furthermore, net PPE helps businesses in calculating important financial ratios, such as return on assets (ROA) and return on invested capital (ROIC). These ratios measure a company's efficiency in utilizing its assets to generate profits. By having an accurate net PPE value, businesses can assess their performance against industry benchmarks and identify areas for improvement.

In summary, net PPE is a vital financial metric for businesses as it provides an accurate representation of the value of their tangible assets. It assists in making informed decisions about capital investments, reporting financial information, and evaluating performanc

Financial Reporting and Decision Making

Financial reporting plays a crucial role in the decision-making process of businesses. It provides information about the company's financial performance and position, enabling stakeholders to make informed decisions.

One important aspect of financial reporting is the treatment of assets, specifically property, plant, and equipment (PPE). PPE includes tangible assets such as land, buildings, machinery, and vehicles that a company acquires to support its operations.

When a company acquires PPE, it is initially recorded at cost on the balance sheet. This purchase cost includes not only the acquisition price but also any costs directly related to bringing the asset into use, such as transportation and installation expenses.

Over time, as the PPE is used and its value decreases, it is depreciated or amortized. Depreciation is the systematic allocation of the asset's cost over its estimated useful life, while amortization applies to intangible assets. The amount of depreciation recorded each period is determined by the chosen depreciation method and the estimated useful life of the asset.

It is important for businesses to accurately reflect the value of their PPE on the balance sheet. This is done through capitalizing costs, such as improvements or additions, that increase the asset's future economic benefits. Capitalizing means adding the costs to the asset's carrying value instead of expensing them immediately.

Another factor that affects the value of PPE is impairment. Impairment occurs when the carrying value of an asset exceeds its recoverable amount. The recoverable amount is the higher of an asset's net selling price and its value in use. In case of impairment, the asset's carrying value is adjusted downwards, reflecting its reduced value.

Net PPE is the difference between the gross value of the PPE and its accumulated depreciation or amortization. It represents the net book value of PPE and indicates the amount that a company has invested in these long-term assets.

In conclusion, understanding net PPE and its importance in financial reporting is essential for decision making. It helps stakeholders assess the value and condition of a company's assets and make informed choices about its future prospects.

Investment and Creditworthiness

Understanding the net PPE (Property, Plant, and Equipment) is crucial for evaluating the investment and creditworthiness of a company.

When making an investment decision, it is important to consider the cost and value of the net PPE. The net PPE account is where the costs associated with acquiring, capitalizing, and depreciating property, plant, and equipment are recorded.

A company's net PPE assets are accumulated over time and can be found on the balance sheet. These assets include buildings, machinery, vehicles, and other tangible assets.

To determine the net PPE value, the accumulated depreciation and impairment losses are subtracted from the original cost of the assets. Depreciation represents the decrease in value of the net PPE over time, while impairment losses are recognized when the net PPE's recoverable value is lower than its book value.

The net PPE value provides insights into a company's ability to generate future cash flows and its long-term asset management. A higher net PPE value indicates that a company has invested significantly in its property, plant, and equipment, which may enhance its creditworthiness.

Investors and creditors also consider the residual value of the net PPE. The residual value represents the estimated worth of the assets at the end of their useful lives. A higher residual value indicates that the assets can potentially be sold or used for a longer period, which may increase the creditworthiness of the company.

Overall, a thorough understanding of the net PPE helps investors and creditors assess a company's investment and creditworthiness by analyzing the value, depreciation, and residual value of the property, plant, and equipment.

Examples of Net PPE

Net PPE, or Net Property, Plant, and Equipment, is a measure that represents the value of a company's fixed assets after accounting for accumulated depreciation and any impairment. It is an important indicator of the company's long-term investment in tangible assets.

One example of Net PPE is the value of a company's machinery and equipment. These assets are capitalized on the balance sheet at their cost and are then depreciated over time. The net value of the machinery and equipment can be calculated by subtracting the accumulated depreciation from the initial cost.

Another example of Net PPE is buildings and land. When a company acquires a building, the cost of the acquisition is recorded as an asset on the balance sheet. Over time, the building is depreciated to reflect its declining value. The net value of the building can be calculated by subtracting the accumulated depreciation from the initial cost.

Intangible assets such as patents and copyrights can also be included in Net PPE. These assets are amortized over their useful lives, and the net value is calculated by subtracting the accumulated amortization from the initial cost.

In some cases, a company may have impaired assets, which means that their value has decreased substantially. Impaired assets are written down to their fair value, and the net value is calculated by subtracting the impairment loss from the initial cost.

Overall, Net PPE provides valuable information about a company's investment in fixed assets and how they are being depreciated or amortized over time. It is an important aspect of financial reporting and helps investors and stakeholders understand the true value of a company's assets.

Real Estate and Construction

Real estate and construction companies often deal with a range of assets, including equipment used for various purposes. These assets need to be properly accounted for in the financial statements. One way to do this is by capitalizing the cost of the equipment and recording it in the net property, plant, and equipment (PPE) account.

When a real estate or construction company acquires equipment, the cost of the acquisition is recorded as an asset on the balance sheet. This is done by debiting the PPE account and crediting the cash or accounts payable account, depending on how the equipment was acquired. The net PPE balance represents the cost of the equipment that has not yet been depreciated or amortized.

Over time, the value of the equipment depreciates due to wear and tear, obsolescence, or other factors. This depreciation is recorded as an expense, reducing the value of the equipment on the balance sheet and increasing the accumulated depreciation account. The net balance between the cost of the equipment and its accumulated depreciation represents the net book value of the asset.

It is important for real estate and construction companies to accurately calculate and track the depreciation of their equipment. This information is essential for financial reporting purposes, as it affects the company's profitability and the value of its assets. Additionally, understanding the net book value of the equipment allows companies to make informed decisions regarding repairs, upgrades, or replacements.

In conclusion, equipment plays a crucial role in the real estate and construction industry. By properly capitalizing and accounting for the cost of equipment in the net PPE account, companies can ensure accurate financial reporting and make informed decisions about their assets.

Manufacturing and Production

In the manufacturing and production industry, net property, plant, and equipment (PPE) play a crucial role. Net PPE refers to the value of the company's tangible assets used in the production process, after deducting the accumulated depreciation and impairment losses. These assets include buildings, machinery, equipment, and vehicles that are essential for manufacturing operations.

When a company acquires property, plant, and equipment, it initially records the cost of acquisition as the net value of the asset on its balance sheet. This cost includes the purchase price, transportation expenses, installation costs, and any other necessary expenditures to make the asset ready for its intended use. Net PPE reflects the value of these assets after considering any depreciation or impairment charges.

Depreciation is the process of allocating the cost of an asset over its useful life. Companies use different methods, such as straight-line depreciation or accelerated depreciation, to determine the amount of depreciation expense recorded each accounting period. This helps in reflecting the gradual decrease in the value of the asset over time due to wear and tear, obsolescence, or technological advancements.

Accumulated depreciation is the total amount of depreciation expense recorded since the acquisition of the asset. It is subtracted from the original cost to calculate the net book value or net PPE. Impairment occurs when the carrying amount of an asset exceeds its recoverable amount. If an asset is impaired, the company needs to reduce its value and recognize an impairment loss on its financial statements.

Manufacturing and production companies heavily rely on property, plant, and equipment to carry out their operations efficiently. These assets enable them to produce goods, manage logistics, and meet customer demands. Properly managing, maintaining, and upgrading these assets is crucial for ensuring smooth production processes and maximizing productivity. Companies often allocate significant resources to capitalize on the value of their net PPE and ensure their assets remain in good condition.

Transportation and Logistics

In the transportation and logistics industry, the need for specialized equipment is crucial to ensure the smooth flow of goods and services. This industry heavily relies on various types of vehicles, such as trucks, airplanes, ships, and trains, to transport goods from one location to another.

These vehicles are considered fixed assets and fall under the category of property, plant, and equipment (PPE) on a company's balance sheet. The cost of acquiring these vehicles, including purchase price, installation fees, and any other directly attributable costs, is capitalized as part of the net PPE value.

Over time, the value of these vehicles depreciates due to wear and tear, obsolescence, and other factors. The depreciation expense is recorded in the company's financial statements and helps to reflect the decrease in the value of the transportation equipment. Accumulated depreciation is shown as a contra account to the PPE value on the balance sheet.

When the vehicles in the transportation and logistics industry are impaired or no longer suitable for their intended use, they are written off and removed from the books. The remaining value of these vehicles, called the residual value, is deducted from the net PPE value.

Understanding the net PPE value in the transportation and logistics industry is essential for accurately assessing a company's financial position. It provides insight into the total value of the assets it holds and helps stakeholders evaluate the company's capital investment in transportation equipment.

In conclusion, the transportation and logistics industry heavily relies on specialized equipment for the efficient movement of goods. This equipment, considered as property, plant, and equipment (PPE), has a depreciating value over time. Accurately accounting for the net PPE value is crucial for evaluating a company's financial performance in this industry.