When you receive your paycheck, you may see various deductions and withholdings. One of these deductions is SDI, which stands for State Disability Insurance. SDI is a social insurance program that provides benefits to eligible workers in the event they are unable to work due to a disability.

SDI is a mandatory program in the state of California, and it is funded through employee wages. A percentage of your income is withheld from each paycheck to fund this program. The amount of SDI withholdings depends on your salary and the SDI tax rate set by the government.

The purpose of SDI is to provide a source of income to employees who are unable to work due to a disability, including both physical and mental disabilities. These benefits can be a lifeline for individuals who are unable to earn a income or support themselves due to their disability. SDI benefits can replace a portion of your income while you are disabled and unable to work.

It's important to note that SDI is different from other types of disability insurance, such as private disability insurance or Social Security Disability Insurance (SSDI). SDI is administered by the state government, while private disability insurance is typically purchased through an employer or obtained individually. SSDI is a federal program administered by the Social Security Administration.

What is SDI?

SDI, or State Disability Insurance, is a government program that provides partial wage replacement for workers who are unable to work due to a non-work-related illness, injury, or pregnancy. The program is administered by the Employment Development Department (EDD) in California and provides temporary disability benefits to eligible workers.

SDI is funded through payroll taxes, which are withheld from employees' paychecks. These taxes, known as SDI withholdings, are a percentage of an employee's wages and are used to fund the SDI program. The amount of SDI taxes withheld from an employee's paycheck is based on their income and is subject to certain maximum limits set by the state.

When an eligible worker is unable to work due to a qualifying disability, they can apply for SDI benefits. The benefits provided by SDI are intended to replace a portion of the worker's lost income, helping them to meet their basic needs while they are unable to work. The amount of SDI benefits a worker receives is based on their average weekly wages, up to a certain maximum limit set by the state.

In addition to providing temporary disability benefits, SDI also offers a few other types of benefits, including family leave benefits and paid family care benefits. These benefits are designed to provide financial support to workers who need to take time off work to care for a seriously ill family member or bond with a new child.

Overall, SDI plays an important role in providing income security and financial protection to workers in California. By helping workers replace a portion of their lost wages during times of disability, SDI helps to ensure that workers can still meet their financial obligations and maintain a basic standard of living. It serves as a safety net for workers, providing them with essential financial support during times of need.

Definition and Overview

SDI stands for State Disability Insurance, which is a program established by the government to provide income replacement to eligible workers who are unable to work due to a non-work-related illness or injury. It is a form of insurance that aims to provide financial security to individuals when they are unable to earn their regular wages.

SDI is funded through payroll withholdings, where a portion of an employee's salary is deducted from their paycheck to contribute to the program. These withholdings are similar to taxes deducted for other government benefits, such as social security and Medicare.

When an individual becomes disabled and is unable to work, they can apply for SDI benefits. The amount of benefits received is based on the individual's wages and the length of their disability. These benefits can help cover essential expenses and ensure a source of income while the individual is unable to work.

The SDI program also includes provisions for maternity leave, providing benefits to eligible individuals during pregnancy and childbirth. This helps individuals take time off from employment to focus on their health and the health of their newborn while still receiving a portion of their income.

It is important to understand that SDI is separate from other retirement benefits or insurance programs, such as social security or disability insurance provided by employers. It is a state-level program that operates independently from other forms of employment-based benefits.

Importance and Purpose

The government's Social Security Disability Insurance (SDI) program plays a crucial role in providing financial protection to individuals who are unable to work due to a disability. It ensures that these individuals continue to receive a portion of their salary in the form of insurance benefits, which helps to replace lost wages and maintain a certain level of income.

SDI benefits are an important aspect of employment and income security for workers. By contributing a portion of their wages to the SDI program, employees are able to protect themselves and their families against the financial impact of a disability. In the event that they become disabled and unable to work, SDI benefits can provide a much-needed source of income to cover essential expenses.

One of the key purposes of SDI is to provide protection against the risk of losing income due to a disability. It offers a safety net that helps individuals and their families maintain a stable financial position during challenging times. Without the support of SDI benefits, individuals with disabilities may struggle to meet their basic needs and could face significant financial hardship.

In addition to its role in providing income replacement, SDI benefits also offer important long-term benefits. Through the program, workers can accumulate credits that count towards their future retirement benefits. This ensures that individuals with disabilities are not excluded from the social security system and can still receive retirement benefits after years of working and paying taxes.

Overall, the importance of SDI cannot be overstated. It provides crucial financial support for individuals with disabilities, allowing them to meet their basic needs and maintain a certain level of income. It offers a sense of security for workers and their families, knowing that they are protected in the event of a disability. Through SDI, the government strives to ensure that individuals with disabilities are not left behind and can still enjoy the benefits of a stable and secure financial future.

Eligibility for SDI

In order to be eligible for State Disability Insurance (SDI), an individual must meet certain criteria. Firstly, they must be employed in a job covered by SDI. This means that the individual must be working for an employer who withholds SDI taxes from their paycheck. These taxes are used to fund the SDI program and provide benefits to eligible individuals.

Secondly, the individual must have paid enough SDI taxes over a specific period of time to be eligible. The amount of taxes paid is determined by the individual's income and the SDI tax rate. Typically, an individual must have earned a certain minimum amount of wages in a year to be eligible for SDI benefits.

Additionally, the individual must meet the definition of disability according to the SDI program. This means that they must have a physical or mental impairment that prevents them from performing their regular or customary work. The disability must be verified by a qualified medical professional.

Furthermore, the individual must be unable to work for at least eight consecutive days due to their disability. This is known as the waiting period and ensures that the individual's disability is of a sufficient duration to qualify for SDI benefits.

It is important to note that SDI benefits are provided by the government and are not based on retirement or salary. The amount of benefits received is calculated using a formula that takes into account the individual's wages and the maximum weekly benefit amount set by the SDI program. The benefits are subject to deductions for taxes and other withholdings as required by law.

Qualifying Criteria

To qualify for SDI on your paycheck, you must meet certain criteria related to your income and employment status. First, you need to have a job, as SDI is a program designed to provide income replacement to workers who are unable to work due to non-work-related illnesses or injuries.

Your wages must be subject to State Disability Insurance (SDI) withholdings to be eligible for SDI benefits. This means that your employer must deduct a specific amount from your paycheck for SDI insurance taxes, which goes towards funding the program.

Additionally, you must have earned a minimum amount of wages during a specific period, known as the base period, to qualify for SDI benefits. The base period is generally the first four out of the last five completed calendar quarters before your disability began. The exact earnings requirements may vary depending on the state you reside in.

It's important to note that SDI benefits are not available to individuals who are receiving unemployment insurance benefits. If you are currently unemployed and receiving unemployment benefits, you are not eligible for SDI on your paycheck.

To apply for SDI benefits, you will need to submit a claim to the government agency responsible for administering the program in your state. The claim will require you to provide detailed information about your employment history, salary, and the nature of your disability.

Overall, qualifying for SDI on your paycheck involves meeting certain income, employment, and disability criteria. Understanding these requirements will help you determine if you are eligible for SDI benefits and ensure you receive the necessary financial support during times of illness or injury.

Employment Requirements

In order to qualify for certain benefits and deductions, individuals are required to meet specific employment requirements. These requirements include having a steady source of income, paying taxes on that income, and making the necessary withholdings. Additionally, individuals must contribute to certain government programs such as Social Security and SDI (State Disability Insurance).

One of the employment requirements is having a valid Social Security number. This number is used by the government to track an individual's earnings and ensure they are paying the appropriate amount of taxes. It is also used to determine eligibility for certain benefits such as retirement income.

Another requirement is making the necessary deductions from each paycheck. This includes withholding federal and state income taxes, as well as any other deductions required by law or agreed upon by the employer and employee. These deductions may include contributions to retirement plans or health insurance premiums.

Employment requirements also include contributing to government programs such as Social Security and SDI. These programs provide financial support to individuals in need, such as those who are disabled or retired. Contributions to these programs are typically based on a percentage of an individual's salary, and they help ensure that individuals have a safety net in case of unforeseen circumstances.

In conclusion, employment requirements play a crucial role in determining an individual's eligibility for various benefits and deductions. By meeting these requirements, individuals can ensure that they are contributing to their future financial security and taking advantage of government programs that are designed to support them in times of need.

Exclusions and Limitations

When it comes to Social Security Disability Insurance (SSDI), there are certain exclusions and limitations that you should be aware of.

Firstly, not all types of employment are covered under SDI. Self-employment and certain government positions, such as elected officials, are excluded from SDI coverage.

Secondly, not all wages and withholdings are taken into account when calculating SDI benefits. For example, bonuses, severance pay, and certain insurance benefits are excluded from the calculation of SDI benefits.

Additionally, there are limitations on the amount of income that can be received while receiving SDI benefits. If you earn more than a certain threshold, your SDI benefits may be reduced or even eliminated.

Furthermore, SDI benefits are only available for a limited period of time. Once you reach retirement age, you will transition from receiving SDI benefits to receiving retirement benefits.

Lastly, it is important to note that SDI benefits are only available to individuals who have a qualifying disability. Therefore, if your disability does not meet the criteria set by the government, you may not be eligible for SDI benefits.

How SDI Benefits are Calculated

SDI (State Disability Insurance) benefits are calculated based on an employee's wages. When calculating SDI benefits, the employee's income is taken into account. This includes their salary, wages, and any other sources of income that are subject to social security and Medicare taxes.

To calculate SDI benefits, the government considers a specific time period known as the base period. The base period is typically the first four of the last five calendar quarters before the first day of the disability. During this period, the employee's wages are reported by their employer and the government uses this information to determine their eligibility and benefit amount.

The benefit amount is calculated by taking a percentage of the employee's average weekly wages during the base period. The percentage varies depending on the employee's income, but it generally ranges from 60% to 70%. However, there is a maximum weekly benefit amount set by the government, which is reviewed annually and adjusted for inflation.

It's important to note that SDI benefits are subject to certain deductions. These deductions may include federal and state income tax withholdings, as well as any other applicable withholdings such as child support or unpaid taxes. These deductions are subtracted from the employee's gross benefit amount to determine their net benefit amount.

SDI benefits are designed to provide temporary financial assistance to employees who are unable to work due to a disability. It's a form of insurance that is funded through payroll taxes and administered by the government. By understanding how SDI benefits are calculated, employees can better understand and plan for any potential income loss in the event of a disability.

Understanding the Formula

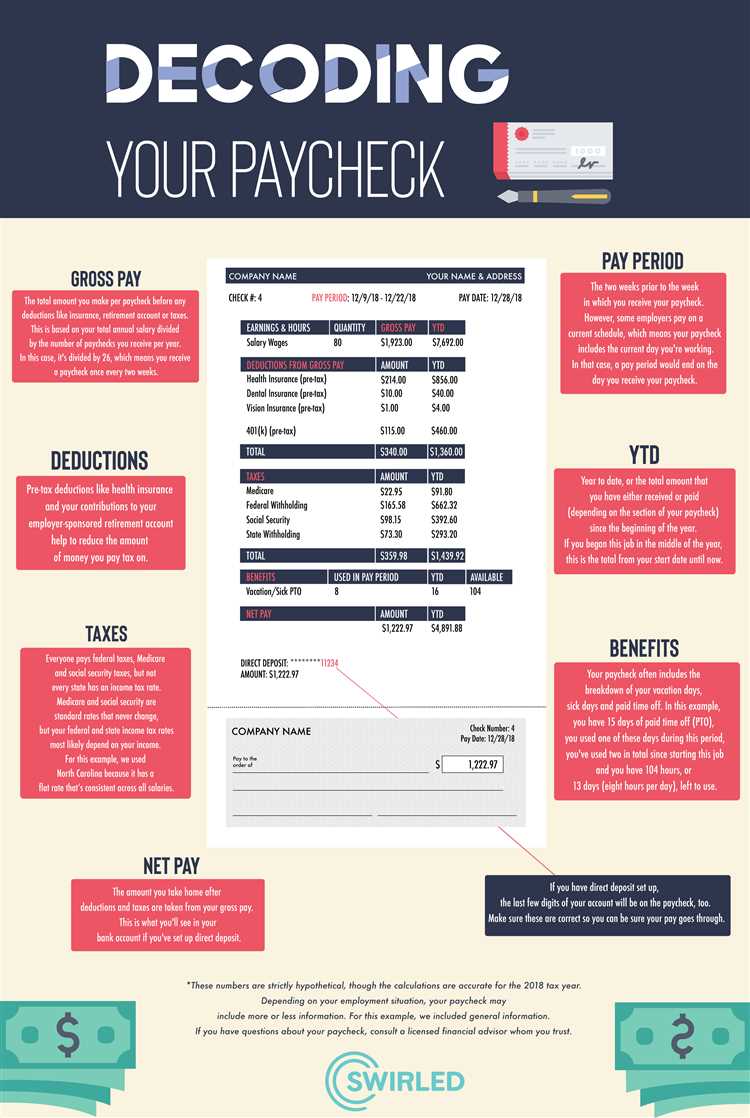

When it comes to understanding SDI on your paycheck, it's important to first understand the formula that determines how much is deducted. SDI, or State Disability Insurance, is a program that provides income replacement to eligible workers who experience a loss of wages due to a disability. The amount of SDI that is withheld from your paycheck is based on your earnings and the current SDI tax rate.

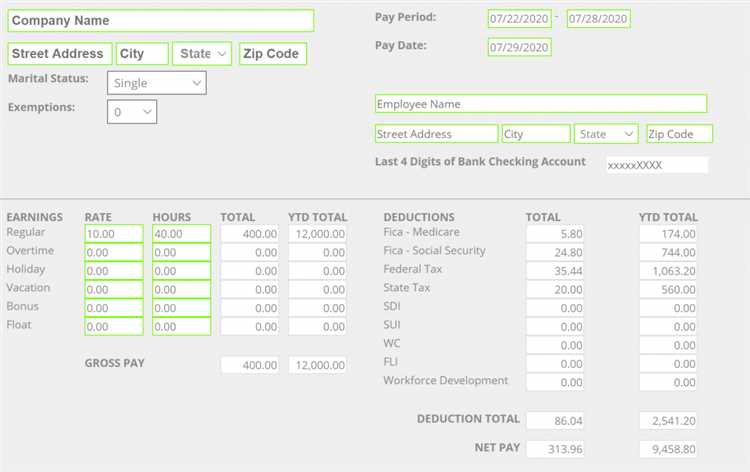

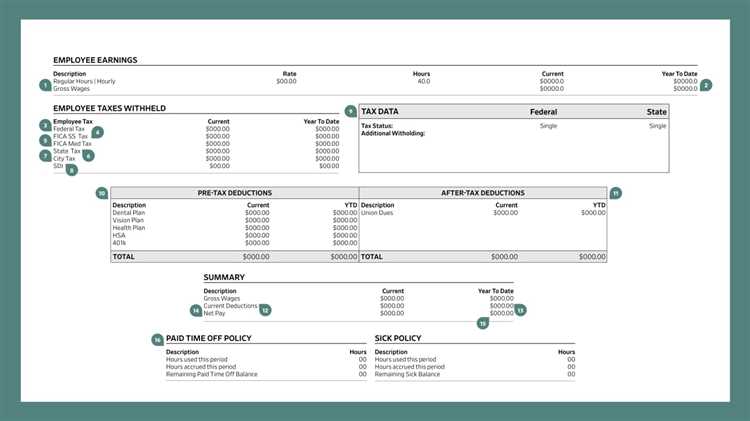

To calculate the amount of SDI that is deducted from your paycheck, your employer will first determine your taxable wages. This includes your gross salary, as well as any other taxable income, such as bonuses or commissions. Once your taxable wages are determined, your employer will apply the current SDI tax rate to calculate the amount of SDI that will be deducted.

It's important to note that SDI is just one of several taxes and deductions that may be withheld from your paycheck. Other common deductions include federal and state income taxes, Medicare, and Social Security. These deductions help fund various government programs, such as retirement benefits and healthcare. The exact amount that is withheld for each deduction will depend on your income and the applicable tax rates.

In addition to SDI and other taxes, your paycheck may also include withholdings for other types of insurance, such as health insurance or life insurance. These withholdings are typically a percentage of your income and help cover the cost of providing these insurance benefits to employees.

Understanding the formula for calculating SDI and other deductions on your paycheck is crucial for managing your finances and planning for the future. By knowing how much will be withheld from your income, you can better budget for your expenses and ensure that you have enough funds to cover your needs.

Maximum and Minimum Benefits

In the United States, the government provides a social safety net to help individuals who are unable to work due to a disability or injury. One such program is the State Disability Insurance (SDI) program, which provides benefits to eligible employees who have a loss of wages due to a non-work-related disability or injury.

The amount of SDI benefits an individual can receive is based on their income and the maximum and minimum benefit amounts set by the government. The maximum benefit amount is the highest amount of SDI benefits that an individual can receive, while the minimum benefit amount is the lowest amount that an individual can receive.

The maximum and minimum benefit amounts are determined by the individual's salary, as well as other factors such as withholdings for taxes and retirement and health insurance deductions. These factors are taken into account when calculating the individual's SDI benefits, ensuring that the benefits are fair and reasonable.

It is important to note that the maximum and minimum benefit amounts may change from year to year, as they are adjusted by the government to keep up with changes in the cost of living and other economic factors. Therefore, it is important for individuals who may be eligible for SDI benefits to stay informed about any changes to these amounts.

In conclusion, the maximum and minimum benefit amounts of SDI are important factors to consider when understanding the benefits available through the program. By understanding how these amounts are calculated and how they can impact an individual's income, individuals can make informed decisions about their financial future and take advantage of the support provided by the SDI program.

Implications for Different Employment Types

SDI, or State Disability Insurance, has different implications for various employment types. Whether you are a full-time employee, part-time worker, or self-employed individual, the way SDI affects your paycheck and benefits can vary.

For full-time employees, SDI is deducted from their paycheck as a percentage of their salary. This deduction ensures that they are contributing to the state disability fund, which provides income replacement for eligible workers who are unable to work due to a non-work-related illness or injury. Full-time employees can rely on SDI as a form of financial security in the event of disability.

Part-time workers also have SDI deductions taken from their paycheck, but the amount may be proportionately lower than that of full-time employees. However, part-time workers can still qualify for SDI benefits if they meet the eligibility requirements set by the state. SDI can provide them with a partial income replacement during their disability, giving them some financial stability during this time.

Self-employed individuals have to handle their SDI contributions differently. Since they do not have an employer who withholds SDI taxes from their paycheck, they are responsible for making their own SDI contributions. This means they need to set aside a portion of their income to pay into the state disability fund. Self-employed individuals can benefit from SDI coverage by ensuring they have income protection in case they are unable to work due to a disability.

In addition to SDI, different types of employment also have implications for other government benefits. For example, full-time employees may have employer-sponsored retirement plans, in which a portion of their salary is contributed towards their retirement savings. Part-timers and self-employed individuals may need to make their own retirement arrangements, such as contributing to an individual retirement account (IRA).

Overall, understanding the implications of SDI and other government benefits on different employment types is essential for individuals to plan their finances and ensure financial security. Whether it's income protection through SDI, retirement savings, or other forms of insurance or deductions, considering these factors can help individuals make informed decisions and effectively manage their paycheck and financial well-being.

Applying for SDI

When it comes to applying for SDI (State Disability Insurance), it is important to understand the process and requirements. SDI is a government program that provides income replacement benefits to workers who are unable to work due to a disability. To apply for SDI, you need to complete an application form and submit it to the Employment Development Department (EDD).

First, you will need to gather some important documents and information, such as your Social Security number, employment history, and medical records related to your disability. It is important to provide accurate and detailed information to ensure the processing of your application.

Once you have gathered all the necessary documents, you can then fill out the SDI application form. The application will require you to provide information about your wages, taxes, and withholdings, as well as details about your disability and the date it began. Make sure to answer all the questions accurately and provide any additional documentation or evidence if required.

After submitting your application, the EDD will review your information and determine if you are eligible for SDI benefits. This process may take some time, and it is important to be patient. If you are approved, you will receive a notice of the benefit amount you will receive on your paycheck. SDI benefits are generally a percentage of your average weekly wage, up to a maximum amount set by the state.

It is important to note that SDI benefits are subject to income taxes and other withholdings, just like your regular salary. However, they are not subject to employment taxes, such as Social Security and Medicare. Understanding how SDI affects your paycheck and taxes is important for financial planning and budgeting. It is advisable to consult with a tax professional or financial advisor for guidance.

Application Process

When applying for SDI benefits, it is important to understand the application process. This process involves gathering necessary documentation, completing the application forms, and submitting them to the appropriate government agency.

Firstly, you will need to provide information about your employment history, including your wages and deductions from your paycheck. This information is crucial for calculating your SDI benefits.

Additionally, you will need to provide documentation that proves your disability and the impact it has on your ability to work. This can include medical records, doctor's notes, and other relevant documents. Proving the severity of your disability is essential in determining your eligibility for SDI benefits.

Once you have gathered all the necessary documents, you can begin filling out the application forms. These forms will ask for personal information, such as your social security number, contact details, and employment history. It is important to provide accurate and up-to-date information to ensure a smooth application process.

After completing the forms, you will need to submit them to the appropriate government agency responsible for administering SDI benefits. Be sure to follow the instructions provided on the application forms and include all required documents.

Once your application has been submitted, it will be reviewed by the government agency. This review process can take some time, so it is important to be patient. If your application is approved, you will begin receiving SDI benefits, which can provide financial security during a period of disability.

Required Documents and Information

When it comes to understanding SDI (State Disability Insurance) on your paycheck, there are certain documents and information you need to provide. These documents and information are vital for calculating your social security income tax, insurance deductions, and other benefits.

Firstly, you will need to provide your wage information. This includes details about your salary, taxes withheld, and any other income received. Your paycheck will typically include this information, listing your gross wages, as well as any deductions for taxes or retirement contributions.

Additionally, you will need to provide personal information, such as your full name, social security number, and contact details. This information is essential for the government to accurately track and calculate your SDI benefits.

In some cases, you may also need to submit supporting documents, such as medical reports or statements, to prove your eligibility for SDI benefits. These documents can help determine the length and amount of benefits you may be entitled to if you become disabled and unable to work.

Finally, it is important to keep track of any changes in your employment status or income throughout the year. This can include changes in job title, salary, or hours worked. Providing accurate and up-to-date information ensures that your SDI benefits are calculated correctly and that any necessary adjustments are made.

Receiving SDI Benefits

When you are unable to work due to disability, the State Disability Insurance (SDI) program provides benefits that can help you replace a portion of your salary. These benefits are designed to support individuals who are unable to work for a temporary period of time due to a non-work-related illness or injury.

SDI benefits are calculated based on your wages and employment history. The amount you receive is a percentage of your average weekly wages, up to a maximum set by the government. The duration of your benefits depends on the severity of your disability and your ability to return to work.

It is important to note that SDI benefits are subject to taxes and deductions, just like regular wages. Your paycheck will include withholdings for federal and state taxes, as well as contributions to Social Security and Medicare. These deductions ensure that you continue to receive the necessary benefits and insurance coverage while on disability.

During your time on SDI benefits, it is also important to keep track of any changes in your employment and income. If you earn wages or receive other disability benefits while on SDI, you must report them to the state government. Failure to do so may result in overpayment or loss of benefits.

If you have questions about your eligibility or the application process for SDI benefits, it is recommended to contact your state's Employment Development Department. They can provide you with the necessary information and guide you through the process of receiving SDI benefits.

Payment Schedule and Duration

When it comes to understanding SDI on your paycheck, it is important to know the payment schedule and duration of the benefits. SDI stands for State Disability Insurance, which is a government-provided program that offers partial wage replacement to eligible employees who are unable to work due to a disability, illness, or injury.

The payment schedule for SDI benefits is typically based on a weekly basis. This means that you will receive payments on a weekly basis, covering a specific period of time. The specific duration of your SDI benefits will depend on several factors, including the nature of your disability or injury and your ability to return to work.

It is important to note that SDI benefits are subject to certain deductions and withholdings, similar to regular wages. These deductions may include taxes, insurance premiums, and other withholdings. The amount of your SDI benefits will be based on a percentage of your average weekly wages, up to a certain maximum amount set by the government.

In addition to SDI benefits, some employers may offer additional benefits such as employer-sponsored disability insurance, retirement benefits, and social security benefits. It is important to review your paycheck and understand how these benefits may affect your overall income and financial situation.

Overall, understanding the payment schedule and duration of SDI benefits is essential for managing your finances during a period of disability or unemployment. By knowing when and how much you will be receiving in SDI benefits, you can better plan your budget and ensure that your essential expenses are covered.

Income Tax Considerations

When it comes to understanding SDI on your paycheck, it's important to consider the income tax implications. SDI, or State Disability Insurance, is a government benefit that provides income replacement for individuals who are unable to work due to a disability. While SDI benefits are not subject to federal income tax, they may be subject to state income tax.

When you receive SDI benefits, they are considered taxable wages, similar to regular wages earned through employment. This means that they will be included in your total income for the year and may be subject to state income taxes. It's important to understand your state's specific tax laws and regulations regarding SDI benefits to determine the impact on your overall tax liability.

In addition to income taxes, SDI benefits may also have an impact on other government benefits, such as Social Security retirement benefits. SDI benefits are not considered earned income and therefore do not count towards your Social Security earnings record. This means that receiving SDI benefits may not impact the amount of Social Security retirement benefits you receive in the future.

It's also important to note that SDI benefits are subject to certain deductions and withholdings, just like regular wages. These deductions may include state income tax withholdings, as well as deductions for employment-related expenses or disability insurance premiums. Be sure to review your paycheck or pay stub to understand the specific deductions and withholdings that apply to your SDI benefits.

In summary, when it comes to SDI on your paycheck, it's important to consider the income tax implications. SDI benefits may be subject to state income taxes, so it's important to understand your state's tax laws. Additionally, SDI benefits may not impact your Social Security retirement benefits, as they are not considered earned income. Lastly, be sure to review your paycheck to understand the specific deductions and withholdings that apply to your SDI benefits.

Continuing Employment and SDI

When it comes to continuing employment and SDI (State Disability Insurance), there are several key factors to consider. One of the main things to keep in mind is how SDI affects your paycheck. SDI is a mandatory program that provides partial wage replacement to eligible workers who experience a disability and are unable to work. As an employee, a portion of your wages is deducted on each paycheck to fund SDI, similar to how taxes and insurance withholdings are deducted.

While SDI deductions may reduce your take-home pay, it is important to remember that SDI provides a vital form of financial security. In the unfortunate event that you are unable to work due to a disability, SDI can help replace a portion of your income and ensure that you still receive some financial support during your time away from employment.

In addition to providing income replacement, SDI also offers certain benefits that can help support you and your family. These benefits include coverage for medical expenses related to your disability, as well as access to job protection and accommodation services. SDI can also provide assistance in navigating the complexities of the government's social security and retirement systems.

It is important to understand that SDI is separate from other forms of disability insurance, such as employer-sponsored disability insurance or private disability insurance. While these additional forms of coverage may offer more comprehensive benefits, SDI ensures that all eligible employees have access to at least some level of disability income protection.

Overall, continuing employment and SDI go hand in hand, as SDI serves as a safety net for workers in the event of a disability. It is important to review your paycheck and understand the specific deductions for SDI, as well as the benefits and protections that SDI offers. By being informed and prepared, you can ensure that you have the necessary financial support and resources in place in the event of a disability.