EBITDA, or earnings before interest, taxes, depreciation, and amortization, is a financial metric that provides insight into a company's profitability. However, it is important to understand the various taxes that are included in EBITDA in order to gain a comprehensive understanding of a company's financial health.

When calculating EBITDA, it is crucial to recognize that taxes are a significant component. Taxes can include both federal and state income taxes, as well as any other taxes that a company may be liable for. These taxes are deducted from a company's gross income to arrive at its net income, which is then used to calculate EBITDA.

In addition to income taxes, other forms of taxes may be included in EBITDA. These can include taxes on profits, gains or losses from the sale of assets, and deductions for certain expenses. It is important to note that not all taxes are included in EBITDA, such as payroll taxes or taxes on dividends paid to shareholders.

Understanding the taxes included in EBITDA is vital for investors and stakeholders who want to evaluate a company's financial performance accurately. By comprehensively analyzing a company's EBITDA, taking into account the various taxes that are included, one can gain valuable insights into its profitability, assets, and liabilities.

The Basics

When it comes to understanding the taxes included in EBITDA, it's important to have a grasp of the basic concepts. EBITDA stands for earnings before interest, taxes, depreciation, and amortization. It is a measure of a company's profitability that looks at its revenue, expenses, and various deductions.

Revenue refers to the money a company earns from its business activities. It can come from the sales of goods or services, as well as any interest income earned on investments. Interest, on the other hand, is the cost of borrowing money and is considered an expense for a company.

Depreciation and amortization are accounting methods used to allocate the cost of an asset over its useful life. Depreciation is used for tangible assets, such as buildings or machinery, while amortization is used for intangible assets, such as patents or trademarks.

Equity represents the ownership interest in a company. It is calculated by subtracting liabilities from assets. Liabilities are the company's financial obligations, such as loans or accounts payable.

EBITDA is a measure of a company's profitability before deducting interest, taxes, and depreciation. It provides a clearer picture of a company's operating performance by excluding these non-operating expenses. It is often used by investors and analysts to evaluate a company's financial health.

Taxes are a mandatory payment imposed by the government on a company's profits. They can include income taxes, payroll taxes, and sales taxes, among others. Profits are the surplus remaining after deducting all expenses, including taxes, from the revenue. Losses, on the other hand, occur when expenses exceed revenue.

Expenses are the costs incurred by a company in its day-to-day operations. They can include salaries, rent, utilities, and other operating expenses. Gross refers to the total revenue generated by a company before deducting any expenses.

Net income, also known as net profit or net earnings, is the amount of money a company has left after deducting all expenses, including taxes, from its revenue. It represents the company's bottom line and is often distributed to shareholders in the form of dividends.

Overall, understanding the taxes included in EBITDA requires a thorough understanding of revenue, interest, depreciation, equity, deductions, income, liabilities, gains, gross, taxes, profits, losses, expenses, net, shareholders, taxable, assets, and amortization.

What is EBITDA?

In financial analysis, EBITDA stands for "Earnings Before Interest, Taxes, Depreciation, and Amortization." It is a measure of a company's profitability and is often used to evaluate a company's operating performance. EBITDA is included in the financial statements of a company to provide a clearer picture of its financial health, as it excludes certain expenses and losses that are not directly related to the core operations of the business.

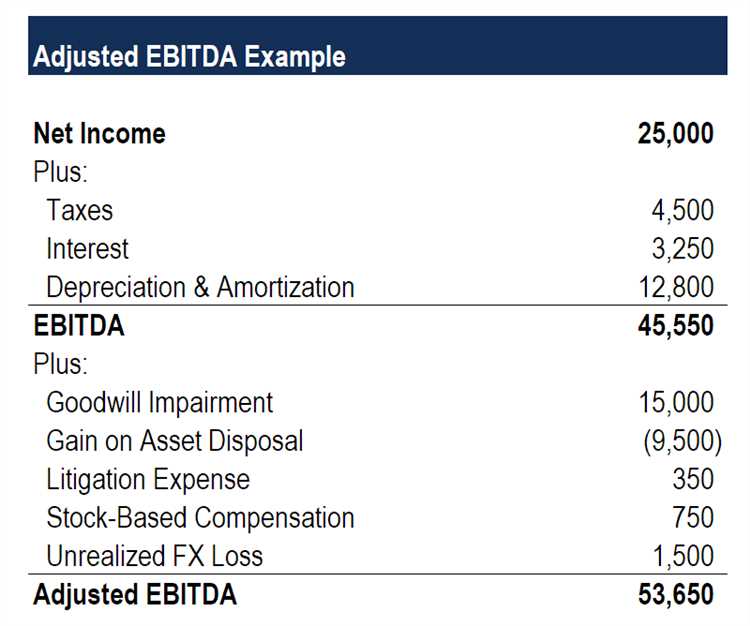

EBITDA is calculated by adding back interest, taxes, depreciation, and amortization to net income. Net income is the profit generated by a company after deducting all expenses, taxes, and interest from its revenue. By excluding interest, taxes, depreciation, and amortization, EBITDA allows investors and analysts to focus solely on the company's operating performance and assess its ability to generate profits from its core business activities.

EBITDA is an important metric for investors and lenders, as it provides a measure of a company's ability to generate cash flow. It helps to determine a company's capacity to repay its debt obligations, as it excludes the impact of interest and taxes. By focusing on the EBITDA, investors can assess a company's performance without considering the effect of its capital structure and tax liabilities.

EBITDA is also an important measure for shareholders, as it provides insight into the company's ability to generate profits and distribute dividends. By excluding non-operating expenses, EBITDA allows shareholders to see the company's true profitability and assess its ability to generate returns on their equity investments.

Why are Taxes Included?

Taxes are a crucial component of any business's financial equation. They represent a significant portion of a company's expenses and can have a significant impact on its profitability and ability to generate revenue for shareholders. Including taxes in the calculation of EBITDA allows for a more comprehensive understanding of a company's financial health and performance.

Tax liabilities can arise from various sources, such as interest income, profits from the sale of assets, and even deductions for certain expenses. Including taxes in the EBITDA calculation ensures that these liabilities are accounted for and provides a clearer picture of the company's true earnings potential.

Moreover, including taxes in EBITDA helps to evaluate a company's ability to generate sustainable cash flow and manage its tax obligations effectively. This is especially important for investors and stakeholders who rely on EBITDA as an indicator of a company's financial strength.

Taxes can also have an impact on the amount of cash available for reinvestment in the business. By including taxes in the EBITDA calculation, companies can better assess their ability to finance investments, pay off debts, and distribute returns to shareholders.

It's important to note that including taxes in EBITDA doesn't mean that the taxable income is being ignored. EBITDA serves as a starting point for financial analysis, and it allows for a more accurate comparison of companies' earnings without the influence of tax rates and other factors specific to particular jurisdictions.

How are Taxes Calculated?

Taxes are calculated based on a variety of factors, including a company's net revenue, profits, and expenses. In general, taxes are calculated as a percentage of taxable income. Taxable income is determined by subtracting deductions and other allowable expenses from gross income.

There are several types of taxes that companies may be subject to, including income taxes, sales taxes, payroll taxes, and property taxes. Each type of tax is calculated differently and may have different rates depending on the jurisdiction.

When calculating income taxes, companies typically start with their earnings before interest, taxes, depreciation, and amortization (EBITDA). EBITDA is a measure of a company's profitability and includes net revenue, losses, depreciation, and amortization. From EBITDA, companies subtract interest expenses to determine their taxable income.

Once taxable income is determined, companies can then apply any available tax credits and deductions to reduce their tax liability. Tax deductions can include expenses such as employee salaries, rent, and interest on loans. These deductions can help lower a company's taxable income and therefore reduce the amount of taxes owed.

It is important for companies to accurately calculate their taxes to ensure compliance with tax laws and regulations. Failure to properly calculate and pay taxes can result in penalties and other legal consequences. Additionally, understanding how taxes are calculated allows companies to plan and strategize their finances to minimize their tax liabilities and maximize their profits for the benefit of their shareholders.

The Different Types of Taxes

When it comes to taxes, there are several different types that businesses may be subject to. These taxes can impact a company's taxable net income, liabilities, and ultimately its profits and losses. Understanding the various types of taxes can help businesses effectively manage their financial health and plan for future expenses.

One type of tax that businesses must consider is income tax. Income tax is imposed on a company's revenue or gross income, and it can be levied at both the federal and state levels. This tax is calculated based on the company's net income, which is its revenue minus deductions for expenses, interest, and any losses incurred.

Another type of tax that businesses may face is payroll tax. Payroll tax is assessed on the wages and salaries paid to employees. It includes taxes for Social Security and Medicare, as well as any state-specific taxes. Payroll tax is typically the responsibility of the employer and is withheld from employees' paychecks.

Property tax is another important tax that businesses must consider. Property tax is assessed on the value of a company's tangible assets, such as land, buildings, and equipment. The tax rate is determined by the local government and can vary depending on the jurisdiction. Property tax is an ongoing expense for businesses, as it is typically paid annually.

In addition to these direct taxes, businesses may also be subject to indirect taxes such as sales tax or value-added tax (VAT). Sales tax is imposed on the sale of goods and services and is collected by the retailer at the point of sale. VAT, on the other hand, is levied at each stage of production and distribution and is ultimately paid by the end consumer. These taxes can add to a company's expenses and may impact its pricing strategy.

Overall, understanding the different types of taxes is crucial for businesses to effectively manage their finances. By considering the various tax liabilities, businesses can accurately calculate their Earnings Before Interest, Taxes, Depreciation, and Amortization (EBITDA) and make informed decisions about their operations and investments.

Income Taxes

Income taxes are a type of taxable expense that corporations and individuals must pay on their net income. It is calculated based on the revenue generated minus deductions, such as depreciation, amortization, and other allowable expenses. Income taxes include both federal and state taxes, and they are an essential part of the overall tax liability of a company or an individual.

When calculating earnings before interest, taxes, depreciation, and amortization (EBITDA), income taxes are excluded from the equation. This is because EBITDA is used to assess the operating performance of a company without the influence of non-operating items such as taxes and interest expenses.

However, income taxes play a crucial role in determining the net income and profitability of a company. They directly impact the amount of income a business has available for distribution to shareholders in the form of dividends or retained earnings. The higher the income taxes, the lower the net income and thus the lower the profits available for distribution.

Income taxes are reflected as a liability on a company's balance sheet, representing the amount of taxes payable to the government. The company must also account for any deferred tax assets or liabilities, which arise from temporary differences between the book value and tax value of certain assets and liabilities.

Income taxes can also have an impact on the valuation of a company. Higher tax rates tend to decrease the value of a company's assets and equity, as they reduce the amount of income generated after taxes. This is an important consideration for investors and shareholders when assessing the financial health and potential returns of a company.

Sales Taxes

In the context of EBITDA, sales taxes refer to the taxes that are incurred on the revenue generated from the sale of goods or services. These taxes are included in the calculation of EBITDA as they are a part of the cost of doing business.

Sales taxes are typically calculated as a percentage of the selling price or value of the goods or services. They are imposed by the government and collected by businesses on behalf of the government. The collected sales taxes are then remitted to the government on a regular basis.

When calculating EBITDA, sales taxes are treated as an operating expense and are deducted from the gross revenue. This deduction helps in determining the net revenue or income before taxes. By including sales taxes in the calculation of EBITDA, the impact of these taxes on the profitability of the business is taken into account.

It is important to note that not all goods or services are subject to sales taxes. The imposition of sales taxes varies by jurisdiction and there may be exemptions or reduced rates for certain categories of goods or services. The specific regulations and rates for sales taxes can vary between countries and even within different states or regions.

In summary, sales taxes are an important component of the expenses included in the calculation of EBITDA. They represent the taxes incurred on the revenue generated from the sale of goods or services and are considered as operating expenses. Including sales taxes in the calculation of EBITDA provides a comprehensive view of the profitability of a business by accounting for the impact of these taxes on its financial performance.

Property Taxes

Property taxes are one of the taxes that are included in EBITDA. They are taxes levied on the value of real estate properties owned by a company. These taxes are typically assessed by local government authorities and are based on the assessed value of the property.

Property taxes are an important consideration for companies, as they can have a significant impact on their profits and EBITDA. The expenses incurred from property taxes are deducted from a company's net income to arrive at its EBITDA. Therefore, property taxes can reduce a company's EBITDA and overall profitability.

Gains or losses from the sale of properties are also taken into account when calculating EBITDA. If a company sells a property at a profit, the gains are added to the EBITDA, while if a property is sold at a loss, the losses are deducted from the EBITDA.

Property taxes are considered an operating expense and are listed under the "taxes" category in the income statement. They are not included in the calculation of EBITDA, as EBITDA is a measure of a company's operating performance before taxes and interest expenses.

It is important for shareholders and investors to understand the impact of property taxes on a company's EBITDA and overall financial performance. Property taxes can affect a company's bottom line and its ability to generate profits, which in turn affects the value of the company's equity and its ability to pay dividends to shareholders.

Important Considerations

When analyzing the taxes included in EBITDA, it is important to consider various factors that can impact the equity of shareholders.

Depreciation and amortization, which are non-cash expenses, are added back to EBITDA because they do not affect the net income of a company. However, it is crucial to take into account the impact these expenses have on the overall financial health of the organization.

Interest expenses, on the other hand, are not included in EBITDA as they represent the cost of borrowing. These expenses are deducted from the gross income to calculate the net income.

Furthermore, gains and losses from the sale of assets and investments are not included in EBITDA but are relevant for calculating taxable income. It is vital to consider the tax implications of these gains and losses when assessing the profitability of a company.

Additionally, it is important to keep in mind that not all expenses are tax-deductible. Certain deductions, such as research and development expenses, can reduce taxable income. However, other expenses, like fines and penalties, are not tax-deductible and should not be included in the calculation of EBITDA.

Lastly, it is crucial to consider the impact of taxes on the overall financial performance of a company. By understanding the taxes included in EBITDA, investors and analysts can gain a clearer picture of a company's true profits and liabilities.

Tax Rates

Understanding tax rates is an important aspect of calculating EBITDA (Earnings Before Interest, Taxes, Depreciation, and Amortization) for a company. Tax rates determine the amount of taxable income that a company must report to the government.

The taxable income is calculated by subtracting the losses, interest expenses, and other allowable deductions from the revenue generated by a company. This taxable income is then subjected to the tax rate set by the government, which is a percentage of the taxable income.

Tax rates can vary depending on the jurisdiction and the type of income being taxed. For example, capital gains may be taxed at a different rate than ordinary income. Additionally, some countries may apply different tax rates to individuals and corporations.

It is important to note that tax rates can have a significant impact on a company's EBITDA and overall profitability. Higher tax rates can reduce a company's net income and EBITDA, while lower tax rates can increase them.

Companies must also consider the impact of taxes on their shareholders and equity. Taxes on dividends and capital gains can affect the return on investment for shareholders and the value of equity in a company.

Overall, understanding tax rates is crucial for accurately calculating EBITDA and assessing a company's financial performance. It helps companies determine their tax liabilities and evaluate the impact of taxes on their net profits and EBITDA. By staying informed about tax rates and their implications, companies can make informed decisions to optimize their tax planning and maximize their profitability.

Tax Deductions and Credits

Tax deductions and credits play a significant role in determining the taxable income of a company. These deductions and credits help reduce the company's tax liability and can have a substantial impact on its financial performance. By taking advantage of eligible deductions and credits, a company can lower its taxable income and ultimately decrease the amount it owes in taxes.

There are various deductions and credits available to businesses that can be applied to different expenses and financial activities. One commonly utilized deduction is depreciation, which allows a company to deduct the cost of its assets over their useful lives. This deduction helps offset the expenses incurred when acquiring and maintaining assets such as equipment, vehicles, and buildings.

Another important deduction is interest expense. Companies can deduct the interest they pay on loans and credit facilities used to finance their operations. This deduction can significantly reduce a company's taxable income, as interest expenses can be substantial, especially for companies with significant debt obligations.

Additionally, tax deductions can be claimed for certain business expenses, such as employee salaries, rent, utilities, and advertising costs. These deductions help reduce a company's overall expenses and, in turn, its taxable income. By carefully tracking and documenting these expenses, companies can take advantage of available deductions and optimize their tax position.

Tax credits, on the other hand, directly reduce a company's tax liability on a dollar-for-dollar basis. These credits are often offered as incentives by the government to promote specific activities or industries. For example, a company that invests in research and development may be eligible for a research and development tax credit, which can help offset the costs incurred during the research and development process.

It is important for businesses to understand and utilize the various tax deductions and credits available to them in order to optimize their tax position and maximize their profits. By carefully managing these deductions and credits, companies can minimize their tax liabilities and allocate more revenue towards growth, equity, and shareholder dividends.

State and Local Taxes

State and local taxes are taxes imposed by individual states and local jurisdictions on various taxable activities, including income, sales, property, and payroll. These taxes are separate from federal taxes and can have a significant impact on a company's financial performance, including its EBITDA.

State and local taxes can affect a company's EBITDA in several ways. First, they directly reduce a company's taxable income, thereby reducing its EBITDA. These taxes are typically based on a percentage of a company's revenue or income, and the rates vary by state and municipality.

Additionally, state and local taxes can impact a company's expenses and gross profits. For example, certain states may impose higher taxes on specific industries, such as hospitality or retail, which can increase the cost of doing business and reduce profitability.

In some cases, state and local taxes may also affect a company's liabilities and assets. For instance, property taxes can increase the cost of owning or leasing real estate, while sales taxes can impact the pricing and demand for products. These taxes can directly impact a company's net income and EBITDA.

It's important for companies to carefully consider the impact of state and local taxes on their financial performance and EBITDA. This includes understanding the various tax rates and regulations in different jurisdictions, as well as any potential deductions or losses that may be available.

Companies can also engage in tax planning strategies to minimize their state and local tax liabilities. This may involve structuring operations or transactions in a way that takes advantage of favorable tax rates or incentives offered by certain states or local jurisdictions.

In summary, state and local taxes can have a significant impact on a company's financial performance, including its EBITDA. These taxes can reduce taxable income, increase expenses, and affect liabilities and assets. Understanding and managing these taxes is crucial for companies to optimize profitability and maximize shareholder value.

The Impact on EBITDA

Understanding the taxes included in EBITDA is crucial for determining the true financial performance of a company. EBITDA, which stands for earnings before interest, taxes, depreciation, and amortization, is a measure commonly used to evaluate a company's operational profitability.

Taxes have a significant impact on EBITDA. While EBITDA represents the earnings before taxes, it does not exclude the taxable income that a company generates. Taxes on income are a significant liability for businesses and reduce their EBITDA.

Interest expenses also affect EBITDA. Interest is the cost of borrowing money and is usually tax-deductible. However, excluding interest expenses from EBITDA provides a clearer picture of a company's operational profitability, as it focuses solely on the company's ability to generate revenue from its core business activities.

Depreciation and amortization are non-cash expenses that are included in EBITDA. Depreciation represents the decrease in value of physical assets over time, while amortization refers to the gradual recognition of intangible assets. Both expenses reduce EBITDA and reflect the wear and tear of assets used to generate revenue.

Gross equity gains or losses from the sale of assets are also excluded from EBITDA calculations. While these gains or losses can have a significant impact on a company's net income, they are not reflective of the operational profitability and therefore not considered in EBITDA.

By understanding the impact of taxes, assets, liabilities, and other deductions on EBITDA, investors and shareholders gain a clearer understanding of a company's financial performance. EBITDA provides a useful measure for comparing the operational profitability of different companies in the same industry, as it removes the effects of taxes and other non-operating expenses.

How Taxes Affect EBITDA

Earnings Before Interest, Taxes, Depreciation, and Amortization (EBITDA) is a financial metric widely used to measure a company's profitability before the impact of taxes and non-operating expenses. Taxes play a crucial role in determining a company's net income and, consequently, its EBITDA. Understanding how taxes affect EBITDA is vital for companies and shareholders in assessing a company's financial health and performance.

Taxes are a mandatory expense imposed by the government on a company's profits, income, or revenue. They are calculated based on the company's taxable income, which is the difference between its gross income and deductible expenses. Taxes, including both corporate income taxes and other taxes like sales tax or property tax, are not included in the EBITDA calculation.

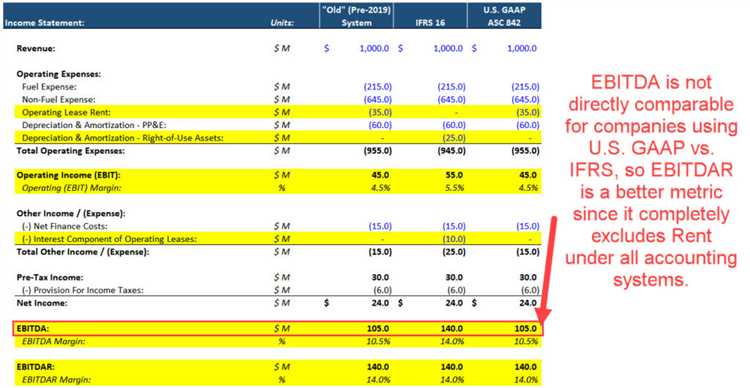

By excluding taxes from the EBITDA metric, companies can focus on the core operating profitability, disregarding the impact of tax regulations and rates. This allows for easier comparison between companies operating in different tax environments and jurisdictions.

Taxes also affect a company's EBITDA indirectly through their impact on net income. A higher tax rate reduces a company's net income, which, in turn, reduces its EBITDA. Additionally, certain tax deductions and credits can lower a company's taxable income, increasing its net income and, consequently, its EBITDA.

It is important to note that while taxes are not included in the EBITDA calculation, they are still a significant factor in a company's financial health. Taxes paid or owed are recorded as a liability on the company's balance sheet. A company's tax liability can impact its overall equity and debt-to-equity ratio, affecting its ability to attract investors and lenders.

In conclusion, understanding how taxes affect EBITDA is crucial for evaluating a company's financial performance. While taxes are not included in the EBITDA calculation, they indirectly impact EBITDA through their influence on net income. Companies and shareholders should consider both the direct and indirect effects of taxes on profitability and financial health.

Strategies to Minimize Tax Impact on EBITDA

Taxes are an essential component of a business's financial landscape, and minimizing their impact on EBITDA (Earnings Before Interest, Taxes, Depreciation, and Amortization) is crucial for maintaining healthy profits. Here are some strategies that businesses can employ to minimize the tax impact on their EBITDA.

- Utilizing tax deductions: Businesses can take advantage of various tax deductions available to them, such as those related to operating expenses, employee benefits, R&D investments, and depreciation of assets. By carefully tracking and claiming these deductions, businesses can reduce their taxable income and ultimately minimize the tax impact on their EBITDA.

- Choosing the right legal structure: The legal structure of a business can significantly affect its tax liability. For example, forming a corporation instead of operating as a sole proprietorship or partnership can provide opportunities for reducing the tax burden. Corporations often have more flexibility in managing income and expenses, allowing them to optimize their EBITDA.

- Implementing tax-efficient investment strategies: Investing in tax-efficient assets can help minimize the tax impact on EBITDA. For example, investing in tax-exempt municipal bonds or tax-advantaged retirement accounts can reduce the amount of taxable income. By strategically allocating investments, businesses can optimize their EBITDA and preserve more of their profits.

- Managing losses and gains: Businesses can offset taxable profits by utilizing losses from previous years. By carrying forward losses, businesses can reduce their taxable income and, consequently, the tax impact on their EBITDA. Additionally, carefully timing the realization of capital gains and losses can help minimize the overall tax liability on EBITDA.

- Implementing employee stock incentive plans: Offering employee stock options or equity grants can provide tax advantages for both the business and its employees. By incentivizing employees with ownership in the company, businesses can align their interests and potentially reduce the tax impact on EBITDA through deductions related to stock compensation expenses.

By employing these strategies, businesses can minimize the tax impact on their EBITDA and maximize their profits. It is important to consult with tax professionals to ensure compliance with applicable laws and regulations while optimizing tax efficiency.