The term "unapplied credit" refers to an uncredited or unapplied balance that remains in a financial account. It represents a payment or credit that has not been allocated or applied towards a specific balance or transaction. When a payment or credit is not allocated, it is considered unapplied and remains as an unapplied balance.

An unapplied payment or credit can occur in various situations. For example, if a customer makes a payment but does not specify which invoice or account it should be applied to, the payment remains unapplied. Similarly, if a company receives a payment but has not yet allocated it to a specific customer or invoice, it is considered unapplied.

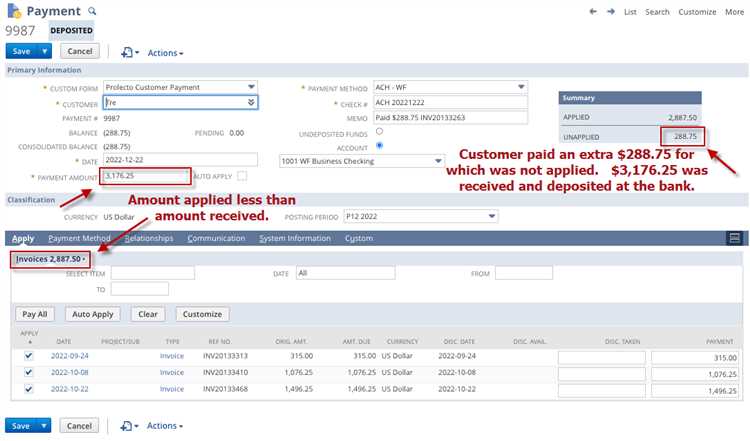

The unapplied amount or unused credit can also arise when a payment is made in excess of the outstanding balance. In this case, the excess amount remains as an unapplied credit until it is applied to future balances or refunded to the customer. Unapplied funds may also occur when there is an unsettled dispute or discrepancy in a transaction, and the payment cannot be applied until the issue is resolved.

In summary, unapplied credit refers to an unallocated or unapplied payment or credit that has not been applied towards a specific balance or transaction. It represents an unused credit or unapplied balance that remains in a financial account until it is applied to a future balance or transaction or resolved in some other manner.

What Does Unapplied Credit Mean?

The term "unapplied credit" refers to an amount of money that has been received by a creditor but has not been credited or applied to a specific account or invoice. It is essentially an unused or unallocated credit that has not been applied to a specific balance or transaction.

When a payment is made by a customer or client, it is typically applied to the outstanding balance on their account. However, in some cases, there may be a discrepancy or error that results in the payment being unapplied or not credited to a specific invoice or account.

The unapplied amount can occur for different reasons. It may be due to a customer making a payment without providing an explanation or instruction on how to allocate the funds. Alternatively, it may be the result of a clerical error or an issue with the payment processing system.

Regardless of the cause, unapplied credit can complicate the accounting process and create confusion. It is important for businesses to regularly review their accounts receivable and identify any unapplied funds or unapplied payments in order to ensure accurate and up-to-date financial records.

To resolve an unapplied balance, businesses typically need to investigate the source of the payment and determine the appropriate account or invoice to allocate the funds. This may involve contacting the customer for clarification or adjusting the payment manually.

In summary, unapplied credit refers to an amount of money that has been received but not applied to a specific balance or invoice. It can arise from various reasons and requires businesses to take proactive steps to allocate the funds and ensure accurate financial records.

Understanding Unapplied Credit in Finance

In finance, unapplied credit refers to a situation in which a payment made by a customer has not been properly credited to their account. It is also referred to as unallocated credit, unapplied amount, or unused credit. Unapplied credit can occur when a payment is received but not applied to a specific invoice or transaction.

When a payment is not credited or allocated, it remains as unapplied credit in the customer's account. The unapplied balance represents the outstanding amount that has not been properly accounted for. The uncredited payment can be a result of various reasons, such as missing payment information, incorrect posting, or human error.

To resolve unapplied credit, the finance department needs to investigate and determine the proper allocation of the payment. This may involve reviewing payment records, contacting the customer for clarification, or working with other departments to identify the appropriate invoice or transaction to apply the credit.

Unapplied credit can have implications for both the customer and the business. For the customer, unapplied credit means that their payment has not been properly recognized, potentially leading to confusion and disputes. For the business, unapplied credit can result in inaccurate financial records and reporting, affecting cash flow and overall financial health.

It is important for businesses to have proper procedures in place to promptly identify and address unapplied credit. This may include regular reconciliation of payments, clear communication with customers regarding payment instructions, and efficient internal processes for allocating credit.

In conclusion, unapplied credit in finance refers to a situation where a payment has not been credited or allocated to a specific invoice or transaction. It represents an unused credit that needs to be properly applied and accounted for. Resolving unapplied credit requires investigation and allocation to ensure accurate financial records for both the customer and the business.

Definition of Unapplied Credit

Unapplied credit refers to an outstanding amount or balance that has not been allocated or applied towards a specific transaction. It is a term commonly used in the field of finance to describe an unapplied or unallocated payment received.

An unapplied payment is a payment that has been made by a customer but has not been allocated to a specific invoice or account. It often occurs when a customer makes a payment without specifying which account or invoice the payment should be applied to.

The unapplied amount or unapplied balance remains unsettled and uncredited until it is properly applied or allocated to the correct account or invoice. It is important for businesses to address unapplied credits promptly and accurately in order to maintain accurate financial records and avoid discrepancies.

An explanation for the presence of unapplied credits could be errors in recording transactions, delays in posting or applying payments, or customer disputes. In some cases, unapplied funds may be the result of overpayments or duplicate payments.

Overall, unapplied credit refers to unused credit or funds that have not been applied or allocated to a specific account or invoice. It is essential for businesses to regularly review and reconcile unapplied credits to ensure accurate financial reporting and prevent potential issues or discrepancies.

Causes of Unapplied Credit

Unapplied credit refers to the uncredited or unapplied amount that, for various reasons, has not been allocated or applied to a specific balance. This term is often used in the context of financial transactions, where an unapplied payment or unused credit may appear on a customer's account. There are several causes that can lead to unapplied credit:

- Errors in processing: One of the most common causes of unapplied credit is errors in the payment processing system. This can occur when a customer makes a payment, but the payment is not properly allocated or credited to the appropriate account. Such errors may arise due to manual input mistakes, technical glitches, or miscommunication between different departments.

- Timing issues: Sometimes, unapplied credit can arise as a result of timing discrepancies. For example, a customer may make a payment toward a balance, but it hasn't been processed or applied yet. This can lead to an unapplied amount or unapplied funds sitting on the customer's account until the payment is officially credited and applied.

- Overpayments: Overpayments can also lead to unapplied credit. For instance, if a customer accidentally pays more than the outstanding balance, the excess amount may remain as unapplied credit until it is either refunded or applied to future transactions.

- Returns or cancellations: When a customer returns a purchased item or cancels a service, the refund amount may initially appear as unapplied credit. This is because the refund needs to be allocated or applied accordingly to the customer's account, and until that happens, it remains unapplied.

- System limitations: In some cases, unapplied credit can be caused by limitations or restrictions within the accounting or billing system. This could be due to technical constraints, insufficient data, or complex transaction scenarios that the system cannot handle automatically. As a result, the credit may be left unapplied until it can be manually resolved or processed.

In conclusion, unapplied credit refers to the unallocated or uncredited amount that has not been applied to a specific balance. It can occur due to errors in processing, timing discrepancies, overpayments, returns or cancellations, and system limitations. Understanding the causes of unapplied credit is important for proper financial management and ensuring accurate account balances.

Impact of Unapplied Credit on Finances

Unapplied credit refers to any funds that have not been credited to an account or applied towards a specific balance. This can occur when a payment is made but not allocated to a specific invoice or when a credit is available but not utilized. The unapplied balance remains outstanding and can have significant implications for an individual or a business's financial situation.

When a credit is not applied or allocated, it means that the unapplied amount is still available for future use. However, this can lead to confusion and inefficiency in managing finances. If unapplied funds are not utilized, it can result in a distorted view of available credit and may lead to missed opportunities for cost savings or financial growth.

Furthermore, having unallocated or unused credit can affect a person or a company's credit score. Creditors and lenders may view unapplied credit as a potential risk, as it suggests that the individual or business may not be effectively managing their financial obligations or taking advantage of available resources.

It is essential to monitor and address unapplied credit to maintain a healthy financial position. This can be achieved by regularly reviewing account balances, reconciling payments, and ensuring that credits are properly applied and allocated. By managing unapplied credit effectively, individuals and businesses can make informed financial decisions and optimize their financial resources.

How to Deal with Unapplied Credit

When it comes to unapplied credit, it refers to the amount of unused credit or unapplied payment that has not yet been credited to a particular account. It means that the funds or balance have not been applied or allocated to a specific term or purpose.

To deal with unapplied credit, it is important to take several steps. Firstly, it is crucial to identify the unapplied payment or unallocated funds. This can be done by reviewing bank statements, payment receipts, or transaction records. By doing so, you can determine the amount of unapplied credit and the outstanding unapplied balance.

Once the unapplied amount is identified, the next step is to contact the relevant financial institution or service provider to address the issue. You can reach out to the customer support or account management team to inquire about the unapplied funds and seek clarification on why they have not been credited or applied to the account.

During this process, it is important to provide any supporting documents or evidence of the unapplied payment or unused credit. This can include payment receipts, bank statements, or any other relevant documentation that proves the existence of the unapplied amount.

After contacting the financial institution or service provider, it is advisable to keep track of the communication and any updates regarding the unapplied credit. This can be done by maintaining a record of the conversations, emails, or any other form of communication related to the unapplied funds.

In some cases, it may be necessary to escalate the issue to a higher level of authority or seek legal advice if the unapplied credit remains unresolved or unsettled. It is important to stay persistent and proactive in resolving the unapplied credit to ensure that it is properly credited or allocated to the intended account or purpose.

Identifying Unapplied Credit

Unapplied credit refers to a term used in finance to describe an unallocated or outstanding payment. It is an unapplied amount that has not been credited or applied towards a specific balance. Unapplied credit can be defined as unused credit or unapplied funds that have not been allocated to a particular account.

Identifying unapplied credit is important in financial management as it helps to monitor and track uncredited payments. It is essential for businesses to be aware of any unapplied amounts to ensure that all payments are properly allocated and credited towards the correct balances.

An unapplied balance can occur for various reasons, such as a customer making a payment without specifying the account or invoice it should be applied to. In some cases, a payment may be received but not applied due to administrative errors or delays in processing.

By identifying unapplied credit, businesses can take appropriate actions to allocate the funds or contact the customer for further clarification. Tracking unapplied credit can also help in reconciling accounts and maintaining accurate financial records.

In conclusion, unapplied credit is a term used to describe unused or unapplied funds that have not been credited or applied towards a specific balance. Identifying and addressing unapplied credit is essential in financial management to ensure accurate allocation of payments and maintain proper accounting records.

Resolving Unapplied Credit Issues

Unapplied credit refers to unused credit or unallocated funds that have not been applied or allocated to a specific account or balance. It is a term commonly used in finance to describe payments or credits that have not been properly credited or applied to an outstanding balance or invoice. When a payment is made but not credited, it results in an unapplied payment or unapplied amount.

To resolve unapplied credit issues, it is important to first identify the unapplied balance or unapplied funds. This can be done by reviewing payment records and transaction history. Once the unapplied amount is identified, steps can be taken to allocate or apply the funds to the appropriate account or balance.

There are several possible reasons for unapplied credit, such as errors in data entry, delays in processing payments, or discrepancies between payment records and invoicing. To resolve these issues, it may be necessary to contact the relevant parties, such as the customer or the financial institution, to ensure that the unapplied funds are properly credited.

One way to resolve unapplied credit issues is to create a clear and organized system for tracking and recording payments. This can include implementing a standardized payment process, using unique identifiers for each payment, and regularly reconciling payment records with invoicing. By doing so, it becomes easier to identify and allocate unapplied funds.

In some cases, it may be necessary to seek professional assistance, such as consulting with an accountant or financial advisor, to resolve complex unapplied credit issues. They can provide expert guidance and help navigate the process of identifying and allocating unapplied funds, ensuring that the books are properly balanced and all transactions are accounted for.

In conclusion, unapplied credit refers to unused or not allocated credit that has not been applied to a specific balance or account. Resolving unapplied credit issues requires identifying the unapplied balance and taking steps to allocate or apply the funds. Creating a clear and organized payment tracking system can help prevent unapplied credit issues in the future and seeking professional assistance may be necessary in complex cases.

Preventing Unapplied Credit

In finance, unapplied credit refers to the portion of a payment that has not been allocated to a specific account or transaction. This usually occurs when a customer makes a payment but does not provide enough information for the payment to be matched to an outstanding balance. Unapplied credit can also occur when a customer overpays an invoice or makes a payment without specifying how it should be applied.

To prevent unapplied credit, it is important for businesses to clearly communicate their payment requirements to customers. This includes providing detailed invoices or statements that clearly state the outstanding balance and any specific instructions for payment. By providing this information upfront, customers are more likely to send payments that can be easily allocated to their account.

Another way to prevent unapplied credit is by using an automated payment system that allows customers to make electronic payments and automatically applies the payment to their account. This reduces the chances of errors or missing information that could lead to unapplied credit. Additionally, businesses can implement a system that verifies and matches payment information with outstanding balances to ensure proper allocation.

Regularly monitoring and reconciling accounts receivable can also help prevent unapplied credit. This involves regularly reviewing payment records and identifying any unapplied or unallocated funds. By promptly investigating and resolving these discrepancies, businesses can ensure that all payments are properly credited and applied to the appropriate account.

In conclusion, preventing unapplied credit requires clear communication with customers, the use of automated payment systems, and regular account reconciliation. By taking these steps, businesses can avoid the issues and complications that unapplied credit can cause, ensuring that all payments are accurately allocated and credited to the correct accounts.

Importance of Managing Unapplied Credit

Managing unapplied credit is crucial for financial organizations and individuals alike. Unapplied credit refers to the funds that have been received but not credited to a specific account or allocated to a particular payment or outstanding balance. This unapplied payment, also known as unapplied balance, creates confusion and can lead to financial discrepancies if not properly managed.

When a payment received is not allocated to a specific account, it remains unapplied, and the unapplied funds can create problems in reconciling accounts and determining the correct balance. If these unapplied amounts are left unsettled, they can result in misrepresentation of financial statements and inaccurate reporting.

Managing unapplied credit involves careful tracking and analysis of payments to ensure they are properly allocated. It is essential to have clear documentation and an explanation for any unapplied funds or unallocated payments. This allows for transparency and accuracy in financial records and helps avoid any confusion or disputes regarding the unapplied amounts.

By actively managing unapplied credit, organizations can maintain accurate financial records, prevent errors and discrepancies, and ensure that all payments are properly applied and credited to the correct accounts. This not only helps in maintaining financial stability but also builds trust and credibility among stakeholders and customers.

Financial Stability

Financial stability refers to the ability of an individual or organization to maintain a solid and secure financial position. It involves effectively managing finances, minimizing debt, and ensuring a steady income stream to meet financial obligations.

One aspect of financial stability is the management of unused credit. This refers to credit that has been granted but not yet utilized or allocated. Unused credit is typically considered as outstanding and available for future use.

When credit remains unapplied, it means that it has not been allocated to a specific transaction or account. This unapplied credit may be a result of a payment not being credited to the correct account or an unapplied amount that has not been properly reconciled.

Financial stability also involves managing unapplied payments and funds. An unapplied payment is a payment that has not been matched to a specific invoice or transaction. Likewise, unapplied funds are funds that have been received but not yet allocated or applied to a specific purpose.

It is important to resolve any unapplied credit, unapplied payments, or unallocated funds to maintain financial stability. This may require contacting the relevant financial institution or company to provide an explanation and ensure that the unapplied amounts are properly credited or allocated.

In summary, financial stability involves effectively managing credit, payments, and funds to ensure a solid financial position. Unused credit, unapplied payments, and unallocated funds can pose challenges to financial stability and should be addressed to prevent potential financial issues.

Credit Score and Lending

When it comes to credit score and lending, understanding the concept of unapplied credit is crucial. Unapplied credit refers to an unallocated or unused credit amount that has not been applied to a specific balance or outstanding payment. It can also be referred to as an uncredited or unapplied payment.

Due to its unapplied nature, this credit amount does not contribute to improving your credit score in the short term. In order for it to be considered as part of your credit score, it needs to be allocated or applied towards a specific payment or balance. Until then, it remains as an unapplied balance or unused credit.

It is important to note that unapplied credit can occur for various reasons. One common explanation is when a payment has been made but is not credited to the appropriate account or balance. This can happen if the payment is not allocated correctly or if there is a delay in processing the payment.

Unapplied credit can also occur when there is a discrepancy in the amount paid versus the outstanding balance. For example, if a payment is made for an amount that is less than the full amount owed, the remaining balance may be considered as unapplied until it is settled or allocated towards the outstanding debt.

In summary, unapplied credit refers to an unused or unallocated credit amount that has not been applied to a specific balance or outstanding payment. It is important to keep track of your payments and ensure that they are properly credited and allocated to avoid having unapplied credits that can potentially impact your credit score and lending opportunities.