Online payment services offer a convenient way for individuals and businesses to make transactions and transfer funds electronically. It has revolutionized the way we handle financial transactions in the digital age. With just a few clicks, merchants can now accept payments through various methods, including debit and credit cards, online wallets, and even virtual currencies.

One of the key benefits of online payment services is the ease and speed of transactions. Whether it's a purchase from an e-commerce website or a mobile payment at a physical store, online payment services allow for quick and hassle-free transactions. No longer do individuals have to worry about carrying cash or writing checks, as payments can be made with just a swipe of a card or a tap on a mobile device.

Security is also a top priority when it comes to online payment services. Digital wallets and online banking platforms employ advanced encryption and security measures to protect users' personal and financial information. Additionally, payment processors are constantly upgrading their systems to ensure that transactions are safe and secure.

Online payment services have also paved the way for the growth of e-commerce. With the ability to accept payments electronically, businesses can now easily expand their customer base and reach markets beyond their physical location. This has led to the rise of online shopping and the proliferation of online marketplaces, allowing individuals to purchase products and services from virtually anywhere in the world.

In conclusion, online payment services have transformed the way we handle financial transactions. From the convenience and speed of transactions to the enhanced security measures, these services have made it easier than ever to make payments and transfer funds. Whether you're a merchant looking to accept payments or an individual looking to make purchases, online payment services offer a comprehensive solution for all your financial needs.

Overview of online payment services

Online payment services, also known as electronic payment services, are platforms that enable users to make financial transactions over the internet. These services offer a convenient and secure way to transfer money, make purchases, and conduct e-commerce activities.

One popular type of online payment service is a digital wallet, which allows users to securely store their debit and credit card information for easy access during online transactions. Digital wallets often use encryption technology to ensure the security of personal and financial information.

Another form of online payment service is a payment processor, which acts as a middleman between the merchant and the customer. Payment processors facilitate the transfer of funds from the customer's bank account or credit card to the merchant's account, making online transactions seamless and efficient.

Online banking services also play a significant role in online payment services. These services allow users to access their bank accounts, view balances, and perform transactions such as transfers and payments. Mobile banking apps have become increasingly popular, enabling users to make payments and manage their accounts directly from their smartphones or other mobile devices.

In addition to traditional currency, online payment services also support virtual currencies such as Bitcoin. These digital currencies offer a decentralized and secure method of payment, often using blockchain technology to ensure transparency and security.

Security is a paramount concern for online payment services. These platforms employ various security measures such as encryption, tokenization, and multi-factor authentication to protect users' sensitive information and prevent unauthorized access.

Overall, online payment services have revolutionized the way individuals and businesses conduct financial transactions. They provide a convenient, secure, and efficient platform for e-commerce activities and offer a wide range of options for users to make payments online.

Definition of online payment services

Online payment services are digital platforms or systems that facilitate the transfer of money or funds from one party to another over the internet. These services enable individuals and businesses to make payments for goods and services, transfer money to friends or family, or conduct financial transactions in a secure and convenient manner.

One of the most common forms of online payment services is a digital wallet, which allows users to store and manage their financial information, such as credit card details or bank account numbers, in a virtual platform. With a digital wallet, users can make online purchases or payments without having to enter their payment information each time, providing convenience and efficiency.

Online payment services also include merchant services, which enable businesses to accept payments from customers electronically. This can be through various methods, such as debit and credit card payments, bank transfers, or even electronic checks. These services provide businesses with a secure and efficient way to process payments from customers, allowing for faster and more streamlined transactions.

In addition to traditional online payment services, there are also mobile payment services that allow users to make payments using their mobile devices. These services typically utilize mobile banking apps or other dedicated payment apps, allowing users to transfer money, make purchases, or pay bills using their smartphones or tablets.

Security is a crucial aspect of online payment services, as they deal with sensitive financial information. Online payment services employ various security measures, such as encryption and fraud detection systems, to ensure the safety of users' personal and financial data. Additionally, many online payment services offer buyer protection or dispute resolution mechanisms to protect users in case of fraudulent transactions or issues with purchases.

Overall, online payment services have revolutionized the way people make payments and conduct financial transactions. They provide a convenient, secure, and efficient alternative to traditional banking methods, allowing individuals and businesses to manage their finances and make payments in a virtual, digital environment.

Importance of online payment services

Online payment services have become an integral part of the digital economy, providing merchants the ability to securely accept payments and conduct transactions over the internet. With the rise of e-commerce, online payment services have become essential for businesses to expand their customer base and increase sales.

One of the key benefits of online payment services is the enhanced security they provide. Transactions are encrypted and protected from unauthorized access, ensuring that sensitive information such as debit and credit card details are kept safe. This level of security gives customers confidence to make purchases online and lowers the risk of fraud.

Furthermore, online payment services offer convenience and flexibility to both customers and merchants. Customers can make payments from anywhere, using any device with an internet connection. Whether it is through a desktop computer, mobile phone or tablet, online payment services allow customers to easily complete transactions and choose their preferred payment method, whether it is through a digital wallet, credit card or online banking.

For merchants, online payment services simplify the payment process by providing a platform that integrates with their online store or website. This enables businesses to accept various payment methods and currencies, expanding their reach to a global customer base. In addition, online payment services often offer features such as automatic transaction processing, payment reminders and reporting tools, streamlining business operations and saving valuable time.

In conclusion, online payment services play a crucial role in facilitating electronic transactions and driving the growth of e-commerce. The secure and convenient nature of these services make them a preferred choice for both customers and merchants, enabling seamless and efficient payment processing in the digital age.

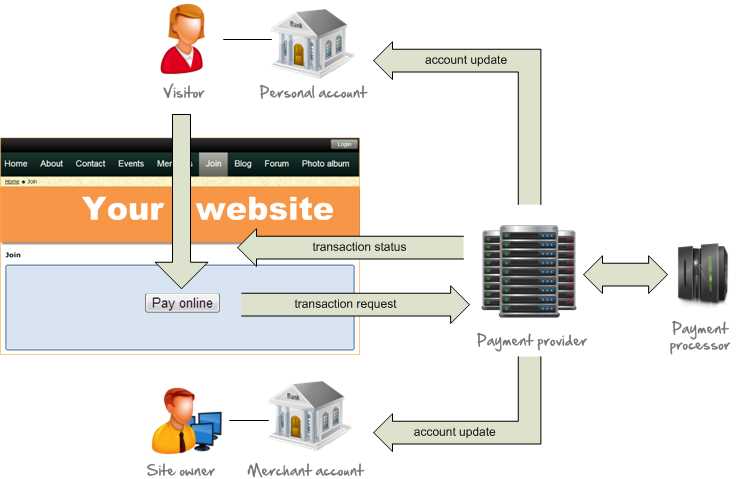

How online payment services work

Online payment services are digital platforms that enable individuals and businesses to make electronic transactions and transfer money over the internet. These platforms provide a convenient and secure way to make payments without the need for physical currency or cards.

When a user wants to make a payment online, they typically have several options. They can use a debit or credit card, link their bank account for direct transfer, or use a mobile payment service. These payment methods are processed by a payment service provider or payment gateway, which acts as the middleman between the user and the merchant.

The payment service provider or gateway securely processes the transaction and ensures that the user's financial information is protected. They use advanced security measures such as encryption and tokenization to safeguard the sensitive data. This helps prevent unauthorized access and fraud.

Once the payment is processed, the merchant receives the funds in their online banking or virtual wallet. They can then use these funds to fulfill the customer's order or provide the requested services. The merchant can choose to keep the funds in their digital wallet or transfer them to their bank account.

Online payment services have revolutionized the e-commerce industry by making it easier and more convenient for businesses and consumers to transact online. They have eliminated the need for physical cash and simplified the payment process. With the rise of mobile payment services, users can now make payments on the go using their smartphones.

In conclusion, online payment services provide a secure and efficient way to make electronic transactions and transfer money online. They enable users to make payments using various methods, such as debit cards, mobile services, and online banking. These services ensure the security of the user's financial information and have greatly facilitated the growth of e-commerce.

Process of making online payments

Making online payments involves several steps to ensure a secure and efficient transaction.

First, the user selects the items or services they wish to purchase on an e-commerce platform. Then, they proceed to the payment page where they can choose their preferred payment method.

There are various payment methods available, such as credit and debit cards, online banking, and mobile wallets. The user can enter their card details, including the card number, expiration date, and CVV, or they can choose to log in to their online banking or mobile wallet account.

Once the payment information is entered, the transaction is processed through a payment processor. The payment processor securely transmits the payment details to the card issuer or bank for verification. This step ensures that the user has sufficient funds or credit limit to make the payment.

If the payment is approved, the transaction is completed, and the user receives a confirmation of their purchase. The merchant also receives the payment and can proceed with fulfilling the order. In case of any issues, the user can contact customer support or initiate a refund or dispute process.

The entire process of making online payments is designed to prioritize security. The payment information is encrypted to protect against unauthorized access, and additional security measures such as two-factor authentication may be implemented to further verify the user's identity.

Online payments can be made in various currencies, and currency conversion may be required if the user's currency differs from the merchant's. Virtual currencies, such as Bitcoin, are also accepted by some merchants.

Security measures in online payment services

Encryption: Online payment services use advanced encryption technology to protect sensitive information, such as debit or credit card details, during online transactions. This encoding process converts the data into a secure format that cannot be easily accessed or understood by unauthorized parties. Encryption ensures that the information remains confidential and secure.

Two-factor authentication: Many online payment services employ a two-factor authentication process to verify the identity of the user. This typically involves providing a unique code, sent via SMS or email, in addition to the regular login credentials. By requiring two different forms of identification, this extra layer of security helps prevent unauthorized access to the user's account.

Fraud detection: Online payment services often use sophisticated algorithms to detect and prevent fraudulent activities. These systems analyze various factors, such as the location, time, and amount of the transaction, to identify suspicious patterns. If flagged, the system may automatically halt or delay the transaction and notify the user to verify the transaction's legitimacy.

Secure payment processors: Online payment services partner with trusted payment processors that comply with industry security standards. These processors securely handle the transfer of funds between the user's account and the merchant's account through encrypted channels. By utilizing reputable payment processors, online payment services ensure that customer information remains protected during the payment process.

Secure platforms and mobile apps: Online payment services invest in secure platforms and mobile applications that are regularly updated and patched with the latest security measures. This includes protecting against vulnerabilities and implementing measures to prevent unauthorized access to user accounts and sensitive data.

Secure digital wallets: Many online payment services offer digital wallets that allow users to store their payment information securely. Digital wallets use encryption technology and require additional authentication before accessing stored information. By using digital wallets, users can make online payments without having to repeatedly enter their payment details, reducing the risk of card information being compromised.

E-commerce security certifications: Online payment services undergo rigorous security audits and certifications, such as PCI DSS (Payment Card Industry Data Security Standard), to ensure they meet industry security standards. These certifications demonstrate that the online payment service has implemented the necessary security measures to protect customer data.

Continuous monitoring and fraud prevention: Online payment services employ dedicated teams to continuously monitor transactions and detect any suspicious or fraudulent activities. This proactive approach allows them to quickly respond to potential security threats and take appropriate measures to prevent unauthorized access or fraudulent transactions.

Types of online payment services

There are several types of online payment services available in the market today:

1. Online banking: This is a type of online payment service that allows customers to make payments directly from their bank accounts. It typically involves logging into the customer's online banking platform and initiating a transfer or payment.

2. E-commerce platforms: Many e-commerce platforms offer their own payment processing services. These platforms act as intermediaries between the customer and the merchant, facilitating the payment transaction and ensuring secure transfer of funds.

3. Mobile wallets: Mobile wallet services allow users to store their payment card information digitally on their mobile devices. Users can then make purchases by simply tapping their mobile device at the point of sale.

4. Digital wallets: Similar to mobile wallets, digital wallets also store payment card information electronically. However, they can be accessed not only through mobile devices, but also through computers and other devices with an internet connection.

5. Payment processors: Payment processors are third-party service providers that specialize in processing online payments. They integrate with merchants' websites or platforms and handle the technical aspects of the payment process, such as securely transmitting payment information.

6. Virtual credit cards: Some online payment services offer virtual credit cards, which are temporary card numbers that can be used for online purchases. These cards provide an extra level of security by keeping the customer's actual credit card information private.

7. Peer-to-peer payment services: Peer-to-peer payment services allow individuals to send and receive money directly between each other. These services often require both parties to have an account with the payment service and can be used for various purposes, such as splitting a bill or repaying a friend.

Overall, the wide range of online payment services available today provides consumers and businesses with convenient and secure ways to make transactions in the digital era.

Credit and debit cards

Credit and debit cards are widely used for online transactions in the world of e-commerce. These electronic payment methods have become a popular choice for consumers due to their convenience and ease of use. With online banking services and mobile apps, users can access their virtual wallets and make quick and secure payments from anywhere.

Credit cards provide users with a line of credit from a financial institution, allowing them to make purchases on credit and pay off the balance at a later date. They are accepted by most online merchants and payment processors, making them a versatile option for online shopping. These cards offer a high level of security with features like encryption and fraud protection, providing peace of mind for both consumers and merchants.

Debit cards, on the other hand, allow users to make payments using the funds available in their bank accounts. They are linked directly to the user's bank account and require the entry of a personal identification number (PIN) for authentication. Debit cards are a popular choice for those who want to avoid accumulating credit card debt and prefer using their own funds for online transactions.

Both credit and debit cards support various types of online payment services, enabling users to make secure transactions in different currencies. These digital payment platforms offer features such as virtual wallets, instant transfers, and transaction tracking. They provide a seamless integration between online merchants, payment processors, and the users' financial institutions, ensuring smooth and efficient transactions.

When using credit or debit cards for online payments, it is important to prioritize security. Users should ensure that they are using a secure website or payment gateway, look out for SSL encryption, and regularly monitor their account for any unauthorized transactions. By taking these precautions, consumers can confidently make online purchases using credit and debit cards.

Digital wallets

A digital wallet, also known as an e-wallet or virtual wallet, is a software-based platform that securely stores a user's payment information, allowing them to make online transactions. It acts as a virtual version of a physical wallet, where users can store their debit or credit card information, electronic currency, and other payment details.

With a digital wallet, users can easily make payments for goods and services in e-commerce platforms. They can also transfer money to other users, make online banking transactions, and perform various financial activities. Digital wallets often support multiple currencies, providing users with flexibility in making international transactions.

One of the key advantages of digital wallets is their convenience. Users can easily access their payment information with just a few clicks. They don't have to manually enter their card details for each online transaction, as the wallet securely stores their information and automatically fills in the payment forms on merchant websites.

Security is also a crucial aspect of digital wallets. These platforms use advanced encryption and authentication techniques to safeguard user information and prevent unauthorized access. Additionally, most digital wallets employ tokenization, a process that replaces sensitive card data with a unique token, offering an extra layer of security during online transactions.

Many digital wallets also offer mobile apps, allowing users to make payments on the go. These apps often come with additional features such as loyalty programs, integration with other payment services, and the ability to scan QR codes for quick payments.

Overall, digital wallets are transforming the way people make online payments. With their ease of use, security measures, and diverse range of features, they provide a convenient and efficient payment solution for individuals and businesses alike.

Payment gateways

A payment gateway is a key component of online payment services. It acts as a mediator between the merchant and the customer by securely transferring the customer's payment information to the merchant's virtual platform. This ensures that transactions can be carried out smoothly and securely in e-commerce.

Payment gateways enable various payment methods, including credit cards, debit cards, online banking, and digital wallets. They handle the processing of these payments, ensuring that sensitive information is encrypted and protected. This allows customers to confidently make purchases online, knowing that their personal and financial details are secure.

One of the main functions of a payment gateway is to authorize and validate digital transactions. It verifies the customer's payment details, such as credit card information and available funds, before approving the transaction. This helps prevent fraudulent activities and ensures that merchants receive payment for the products or services they sell.

Payment gateways often support multiple currencies, allowing merchants to accept payments from customers around the world. They convert the customer's currency into the merchant's preferred currency at the current exchange rate. This simplifies international transactions and expands the merchant's customer base.

With the rise of mobile devices, payment gateways have also adapted to accommodate mobile payments. They can securely process transactions made through mobile apps or mobile websites, providing convenience and flexibility to both merchants and customers.

In summary, payment gateways play a crucial role in enabling secure and efficient online payment services. They ensure that transactions are processed smoothly, customer information is protected, and merchants can receive payment for their products or services.

Advantages and disadvantages of online payment services

Online payment services, such as digital wallets and online banking, offer several advantages for both consumers and merchants. One of the main advantages is convenience. Online payment services allow users to make transactions from anywhere, at any time, using their mobile devices or computers. This eliminates the need for physical cash or card payments, making shopping and bill payments quick and easy.

Another advantage of online payment services is enhanced security. These platforms employ advanced encryption and authentication methods to protect users' personal and financial information. This reduces the risk of fraud and identity theft, providing users with peace of mind when making online transactions.

Online payment services also offer flexibility in terms of payment methods. Users can choose to link their credit or debit cards to their online accounts, or they can use digital currencies such as Bitcoin. This allows for seamless transactions across various currencies and eliminates the need for physical currency exchange.

For merchants, online payment services can simplify the payment process and reduce transaction costs. These platforms act as intermediaries between the buyer and seller, processing the payment and facilitating the transfer of funds. This eliminates the need for manual payment processing and reduces the risk of errors or delays.

However, there are also some disadvantages associated with online payment services. One of the main concerns is the potential for security breaches and hacking. Despite the security measures implemented by these platforms, there is always a risk of unauthorized access to users' accounts and data. It is therefore important for users to choose reputable online payment service providers and regularly monitor their accounts for any suspicious activity.

Another disadvantage is the dependency on technology. Online payment services rely on stable internet connections and functioning devices. If there are any technical issues or outages, users may not be able to access their accounts or make payments. This can be inconvenient and may disrupt e-commerce operations for both consumers and merchants.

In conclusion, online payment services offer numerous advantages, including convenience, security, and flexibility. However, users should be aware of the potential risks and take necessary precautions to protect their personal and financial information.

Advantages of online payment services

Online payment services offer a range of advantages that make them an attractive option for both consumers and merchants. One of the key benefits is the convenience they provide. With an online payment service, users can securely store their payment information in a virtual wallet, eliminating the need to enter their card details for every transaction. This not only saves time but also helps streamline the checkout process, making online shopping faster and more efficient.

Another advantage of online payment services is their versatility. They support a wide range of payment methods, including debit and credit cards, electronic transfers, and even digital currencies. This allows consumers to choose the method that is most convenient for them, whether they prefer using their credit card or transferring funds directly from their bank account. For merchants, this means being able to accept payments from customers all over the world, regardless of their preferred currency or payment method.

Security is another key advantage of online payment services. These platforms employ advanced encryption and security measures to protect users' personal and financial information. This helps reduce the risk of fraud and identity theft, giving users peace of mind when making online transactions. Additionally, online payment services often provide additional security features, such as two-factor authentication, to further protect users' accounts.

Online payment services also offer flexibility and mobility. Users can easily access their accounts and make payments from any device with an internet connection, whether it's a computer, smartphone, or tablet. This allows for seamless cross-platform integration and ensures that users can make payments on-the-go, making online shopping and payment even more convenient.

Furthermore, online payment services provide merchants with access to valuable transaction data. These platforms often offer detailed reporting and analytics tools, allowing businesses to gain insights into their customer's purchasing behaviors and preferences. This information can be used to optimize marketing strategies and improve customer experiences, ultimately leading to increased sales and customer satisfaction.

Disadvantages of online payment services

While online payment services offer convenience and efficiency, there are several disadvantages that users and merchants should be aware of:

1. Security concerns: Online payment services are susceptible to security breaches and fraudulent activities. Hackers can gain unauthorized access to users' accounts and steal their personal information or financial data. It is important to choose a reputable online payment platform that provides robust security measures to safeguard transactions.

2. Limited acceptance: Not all merchants accept online payment services, especially smaller businesses or those in certain industries. This can limit the options for customers and force them to use alternative methods of payment.

3. Transaction fees: Online payment services often charge transaction fees for every payment made. These fees can add up, especially for businesses that process a large number of transactions. Merchants should consider these fees when calculating their costs and pricing.

4. Dependency on internet connection: Online payment services require a stable internet connection for transactions to be processed. Any interruption in the internet connection can disrupt the payment process and cause delays or failures. This can be a problem in areas with poor internet connectivity or during technical issues.

5. Risk of currency fluctuation: If users or merchants are operating in multiple countries or dealing with different currencies, online payment services may be subject to currency fluctuations. This can result in additional costs or losses if the exchange rate is not favorable.

6. Lack of buyer protection: Online payment services may not offer the same level of buyer protection as traditional payment methods, such as credit or debit cards. In case of disputes or fraudulent transactions, users may face difficulties in getting their money back or resolving the issue.

7. Dependency on third-party providers: Online payment services rely on third-party providers, such as payment processors or online banking platforms. Any issues or downtime with these providers can affect the functionality and availability of the online payment services.

In conclusion, while online payment services offer convenience and speed for e-commerce transactions, it is important to consider the potential disadvantages and choose a reliable and secure platform. Users and merchants should weigh the benefits against the risks and make informed decisions when it comes to online payment services.

Popular online payment service providers

When it comes to online payment services, there are several popular providers that offer convenient and secure options for processing digital transactions:

- PayPal: One of the most well-known online payment processors, PayPal allows users to link their bank account or credit card to make payments online. It offers a secure platform and is widely accepted by merchants around the world.

- Stripe: A digital payment platform that provides easy integration with e-commerce websites, Stripe offers a range of features including recurring billing and customized payment forms. It is popular among developers and businesses looking for flexible payment solutions.

- Square: Known for its point-of-sale devices, Square also offers online payment services for businesses. It provides a virtual terminal that allows merchants to process payments from their computer or mobile device, as well as a range of other features such as invoicing and inventory management.

- Google Wallet: Google's mobile payment service, Google Wallet, allows users to make payments using their mobile devices. It offers a virtual card that can be linked to a user's existing debit or credit card, and provides a convenient and secure way to make payments both online and in-store.

- Apple Pay: Apple's mobile wallet, Apple Pay, allows users to make purchases using their iPhone, Apple Watch, or iPad. It securely stores a user's credit and debit card information and utilizes near field communication (NFC) technology to enable contactless payments in stores.

- Venmo: Venmo is a popular peer-to-peer payment app that allows users to send and receive money from their friends and family. It provides a social feed where users can see and interact with their friends' transactions, adding a social element to the payment experience.

These online payment service providers offer a range of features and options to meet the needs of merchants and consumers alike. Whether it's for online banking, e-commerce, or other electronic transactions, these services provide convenient and secure ways to transfer money and make payments in the online world.

PayPal

PayPal is a popular online payment platform that allows users to send and receive payments securely. It serves as an intermediary between the payer and the recipient, making it easier for individuals and businesses to engage in digital transactions.

Merchants can integrate PayPal into their websites or use it as a processor for their online payments. Customers can link their credit or debit cards, bank accounts, or even use PayPal's own digital wallet to make transactions. PayPal supports various currency options, making it convenient for international e-commerce.

One of PayPal's key features is its commitment to security. It uses advanced encryption technology and fraud detection systems to protect users' financial information. Additionally, PayPal offers buyer protection and dispute resolution services, which further enhance its security measures.

PayPal is not limited to online transactions; it also offers a mobile payment solution. Users can download the PayPal app and make payments using their smartphones, making it convenient for on-the-go transactions.

Aside from its payment services, PayPal also provides online banking functionalities. Users can transfer funds from their PayPal account to their linked bank accounts or vice versa. This makes it easier to manage finances and track transactions.

In summary, PayPal is a leading electronic payment platform that offers a range of services for individuals and businesses. Its secure and convenient payment options, along with its commitment to customer protection, make it a popular choice in the online payment industry.

Stripe

Stripe is an online payment services platform that allows merchants to accept credit and debit card payments on their websites or mobile applications. It provides a secure and easy-to-use electronic payment solution for businesses of all sizes.

With Stripe, merchants can securely process transactions using various payment methods, including credit cards, online banking, and digital wallets. It supports multiple currencies, making it an ideal choice for global e-commerce businesses.

One of the key features of Stripe is its focus on security. It employs advanced encryption and authentication technologies to protect sensitive customer data and ensure the safe handling of online transactions. Merchants can rely on Stripe's robust security measures to build trust with their customers and minimize the risk of fraud.

In addition to its payment processing capabilities, Stripe offers a range of additional services to help merchants grow their businesses. These include tools for managing subscriptions, handling recurring payments, and analyzing transaction data. Stripe's platform is highly customizable, allowing merchants to integrate it seamlessly into their existing systems and workflows.

Overall, Stripe is a versatile and user-friendly online payment services platform that provides merchants with the tools they need to accept and manage payments in a secure and efficient manner. Its flexible features and strong emphasis on security make it an ideal choice for businesses operating in the digital economy.

Square

Square is an online payment processor that offers a variety of services to facilitate digital transactions. It provides a secure platform for individuals, businesses, and e-commerce websites to accept payments using debit and credit cards.

One of the key features of Square is its ability to process both online and in-person payments. It allows users to accept payments through its virtual wallet, which can be accessed through a mobile app or a website.

Square ensures the security of all transactions by encrypting the payment data and employing industry-standard security measures. This ensures that customers' financial information is protected from unauthorized access and fraudulent activities.

In addition to payment processing, Square offers other services such as instant transfer of funds to the user's bank account, inventory management, and analytics tools. These features enable businesses to effectively manage their finances and track sales performance.

With Square, users can also create and send invoices, set up recurring payments, and integrate their online store with other e-commerce platforms. This makes it a versatile tool for businesses of all sizes.

Square also supports various payment methods, including contactless payments using NFC technology, QR code scanning, and online banking transfers. Its flexibility in accepting different forms of payment makes it convenient for customers and increases the chances of completing a sale.

In summary, Square is a comprehensive online payment service that offers secure and efficient payment processing solutions for businesses and individuals. With its wide range of features and compatibility with different payment methods, it has become a popular choice in the digital payment industry.

Tips for using online payment services securely

1. Use trusted and secure online payment services: When making online payments, make sure to choose reputable and secure payment platforms. Look for well-known and established platforms that have a good track record of protecting customer information.

2. Protect your login credentials: Create strong and unique passwords for your online payment accounts and regularly update them. Enable multi-factor authentication when available, and never share your login details with anyone.

3. Be cautious with mobile payments: If using a mobile payment app or mobile wallet, make sure to secure your device with a passcode or biometric authentication. Be cautious when using public Wi-Fi networks and avoid entering sensitive payment information while connected to insecure networks.

4. Monitor your transactions: Regularly review your online payment transactions and statements to detect any unauthorized activity. Set up alerts for any unusual activity to be notified immediately and report any suspicious transactions to your payment service provider.

5. Shop on secure websites: When making online purchases, look for websites that have SSL encryption to protect your payment information. Look for the padlock symbol in the address bar and make sure the website starts with "https://" instead of "http://".

6. Be cautious with email and phishing scams: Be wary of emails or messages asking for your payment information or login details. Avoid clicking on suspicious links and always verify the authenticity of any requests before providing any information.

7. Keep your devices and software up to date: Regularly update your mobile devices, computer operating systems, and payment apps to ensure you have the latest security patches. This helps protect against known vulnerabilities that could be exploited by hackers.

8. Use secure payment options: When possible, use payment options that offer additional security, such as virtual credit cards or online wallets. These can provide an extra layer of protection for your payment information.

9. Be vigilant for scams: Be aware of common online payment scams, such as fake websites or auction fraud. Research the merchant or platform before making a payment and be cautious of deals that seem too good to be true.

10. Regularly review your online payment accounts: Take the time to review and update your online payment accounts regularly. Remove any saved payment methods or revoke access for apps or services that you no longer use. This reduces the risk of unauthorized transactions.

Choose reputable service providers

When it comes to online payment services, it is crucial to choose reputable service providers. These providers offer secure and reliable platforms for processing online transactions and managing electronic wallets.

Reputable service providers often have a strong presence in the industry and are trusted by a large number of users. They provide a wide range of online payment services, including online banking, mobile wallets, and virtual currency platforms.

One important factor to consider when choosing a service provider is the level of security they offer. Reputable service providers implement robust security measures to protect users' personal and financial information. They use encryption technology to ensure that sensitive data is securely transmitted during transactions.

Another important aspect to consider is the range of payment options a service provider offers. Reputable providers typically support a variety of payment methods, including credit and debit cards, electronic transfers, and online banking. This ensures that users have flexibility in choosing the most convenient payment option for their needs.

In addition to providing payment processing services for individual users, reputable service providers also cater to merchants. They offer merchant accounts that allow businesses to accept payments from customers online. These providers ensure that merchants receive their funds in a secure and timely manner.

By choosing reputable service providers for online payment services, users can have peace of mind knowing that their transactions are secure and their funds are handled professionally. It is essential to research and compare different service providers to find the one that best meets your specific needs and requirements.

Keep your payment information secure

When it comes to e-commerce and online payment services, keeping your payment information secure is of utmost importance. With the increasing popularity of virtual transactions and online shopping, it is essential to take steps to protect your sensitive data.

Firstly, choose a reputable payment service provider or merchant platform that offers robust security features. Look for services that use encryption to protect your data during the payment process. Encryption ensures that your financial details, such as credit card numbers and personal information, are converted into an unreadable format before being transmitted over the internet.

Additionally, consider using a digital wallet or mobile payment app for your online transactions. These platforms provide an extra layer of security by allowing you to make payments without directly sharing your credit card information with the merchant. Virtual wallets can securely store your payment details and facilitate transactions without exposing your sensitive information to potential hackers.

Regularly monitor your online banking and payment accounts for any suspicious activity. Set up notifications, if available, to receive alerts about any unusual transactions or changes to your account. Promptly report any unauthorized charges or suspicious behavior to your bank or payment processor to mitigate potential risks.

When making online payments, always ensure that the website or payment gateway you are using is secure. Look for the padlock symbol in the browser's address bar, indicating that the website has a valid SSL (Secure Sockets Layer) certificate. This certificate encrypts the data transmitted between your device and the website, protecting it from interception by unauthorized parties.

Lastly, be cautious when sharing your payment information online. Avoid entering sensitive details on public or unsecured Wi-Fi networks, as these can be easily accessed by hackers. Always double-check the website's URL and verify the security measures in place before entering any payment details.

By following these precautions and staying informed about the latest security practices, you can help protect your payment information and enjoy a secure online shopping experience.

Monitor your transactions regularly

Monitoring your online transactions regularly is essential in ensuring the security and accuracy of your financial activities. By keeping a close eye on your credit, debit, or digital wallet transactions, you can identify any suspicious or unauthorized activities promptly and take appropriate action.

With the rise of e-commerce and online banking platforms, it has become easier than ever to access and manage your financial transactions electronically. However, this convenience also makes it more important to be vigilant and proactive regarding your financial security.

By regularly reviewing your online transactions, you can check for any unauthorized charges, errors, or unexpected transfers. This step is particularly crucial if you frequently use online payment services for shopping, bill payments, or money transfers.

While most online payment services have robust security measures in place, it is still possible for hackers or scammers to gain access to your account information or perform unauthorized transactions. By monitoring your transactions regularly, you can detect any suspicious activities and report them to your bank or service provider immediately.

In addition to monitoring transactions through your online banking platform or the service provider's website, you can also set up alerts or notifications for any significant transactions. This way, you will receive real-time updates on your mobile or email, providing an extra layer of security and ensuring that you are aware of all financial activities happening on your account.

To summarize, monitoring your online transactions regularly is a crucial step in ensuring the security and accuracy of your financial activities. By being vigilant and proactive, you can detect and address any unauthorized or suspicious activities promptly, protecting your financial information and maintaining control over your online transactions.

Future trends in online payment services

The future of online payment services is expected to bring significant advancements in technology and security. Merchants will have access to more streamlined and efficient payment processors, allowing for easier and faster transactions. Online wallets will become even more popular, offering users a convenient and secure method for storing and accessing their digital currency.

One of the main focuses of future trends in online payment services will be enhancing security measures. With the increasing number of cyber threats, it is essential to implement robust security protocols to protect users' sensitive information. This may include biometric authentication, such as fingerprint or facial recognition, to ensure only authorized individuals can access payment platforms.

Another trend is the integration of online payment services with e-commerce platforms. Merchants will be able to seamlessly accept credit and debit card payments directly on their websites, eliminating the need for customers to navigate to a separate payment gateway. This integration will simplify the purchasing process and enhance the overall user experience.

Mobile payment options will continue to grow in popularity as more people rely on their smartphones for everyday tasks. Online payment services will offer mobile apps that allow users to make secure transactions on the go. With advancements in technology, mobile payments will become even more seamless and convenient, transforming smartphones into digital wallets.

The future of online payment services may also involve the adoption of new payment methods, such as cryptocurrency. As digital currencies gain more mainstream acceptance, online payment platforms will adapt to accommodate transactions in virtual currencies. This will open up new possibilities for global commerce and eliminate the need for traditional banking systems.

In conclusion, the future of online payment services holds exciting possibilities for merchants and consumers alike. With advancements in technology, enhanced security measures, and the integration of various payment methods, online transactions will become more efficient, convenient, and secure.

Mobile payments

Mobile payments refer to the ability to make payments using a mobile device, such as a smartphone or tablet. With the increasing popularity of smartphones, mobile payments have become a convenient and secure way for consumers to make transactions.

Mobile payment services allow users to link their credit or debit card information to their mobile device, creating a virtual wallet. This allows users to make purchases online or in physical stores using their mobile device, without the need to carry cash or a physical card.

There are different methods of making mobile payments, including NFC (Near Field Communication) technology, which allows users to simply tap their mobile device on a payment terminal to complete a transaction. Another method is through the use of mobile payment apps, which act as a digital wallet and allow users to make payments by scanning a QR code or entering their payment information.

Mobile payment processors and platforms, such as Apple Pay, Google Pay, and Samsung Pay, have emerged to facilitate and secure mobile payments. These platforms often require users to authenticate their payment with a fingerprint, facial recognition, or a passcode, adding an extra layer of security to the transaction.

The use of mobile payments has been particularly beneficial for e-commerce businesses, as it allows customers to easily and securely make online purchases using their mobile device. Additionally, mobile payments have also made it easier for users to send money electronically to friends and family, through services like Venmo or PayPal.

In conclusion, mobile payments have revolutionized the way people make transactions, providing a convenient, secure, and efficient alternative to traditional payment methods. As technology continues to advance, mobile payments are likely to become an even more integral part of the digital economy.

Cryptocurrencies

Cryptocurrencies are digital or virtual currencies that utilize cryptography for secure online transactions. They are decentralized and operate on a technology called blockchain, which is a distributed ledger that records all transactions across a network of computers. This technology ensures the security and transparency of cryptocurrency transactions.

One of the most well-known cryptocurrencies is Bitcoin, which was created in 2009. Since then, numerous other cryptocurrencies, such as Ethereum, Litecoin, and Ripple, have emerged. These cryptocurrencies offer various features and capabilities beyond traditional online payment services.

Using cryptocurrencies for online transactions offers several advantages. Firstly, it eliminates the need for intermediaries such as banks or payment processors. Transactions can be made directly between individuals or merchants, reducing transaction fees and processing time. Additionally, cryptocurrencies provide a high level of security due to their cryptographic nature, making it difficult for fraudsters to manipulate or counterfeit transactions.

Wallets are used to store and manage cryptocurrencies. These online platforms enable users to securely store their digital currency and facilitate transactions. Wallets can be accessed through a web browser or through mobile applications, providing convenience for users to make payments on the go.

Cryptocurrencies also have the potential to revolutionize e-commerce. They enable more efficient cross-border transactions by eliminating currency conversion fees and reducing transfer times. Furthermore, cryptocurrencies allow users to maintain greater control over their funds without the need for traditional banking services. This can be particularly valuable for individuals who lack access to banking services or have privacy concerns.

As cryptocurrencies continue to gain popularity, more merchants are accepting them as a form of payment. Integrating cryptocurrency payment options allows merchants to expand their customer base and tap into a growing market. Additionally, with the development of stablecoins, which are cryptocurrencies pegged to traditional currencies, the volatility associated with cryptocurrencies can be mitigated, making them more suitable for everyday transactions.